AI is disrupting Customer Support. Salesforce is feeling the pinch.

As enterprises invest in AI proof-of-concepts for customer support, software companies are getting squeezed with acquisition costs rising. Will these once glorious companies ever get their glam back?

«The 2-minute version»

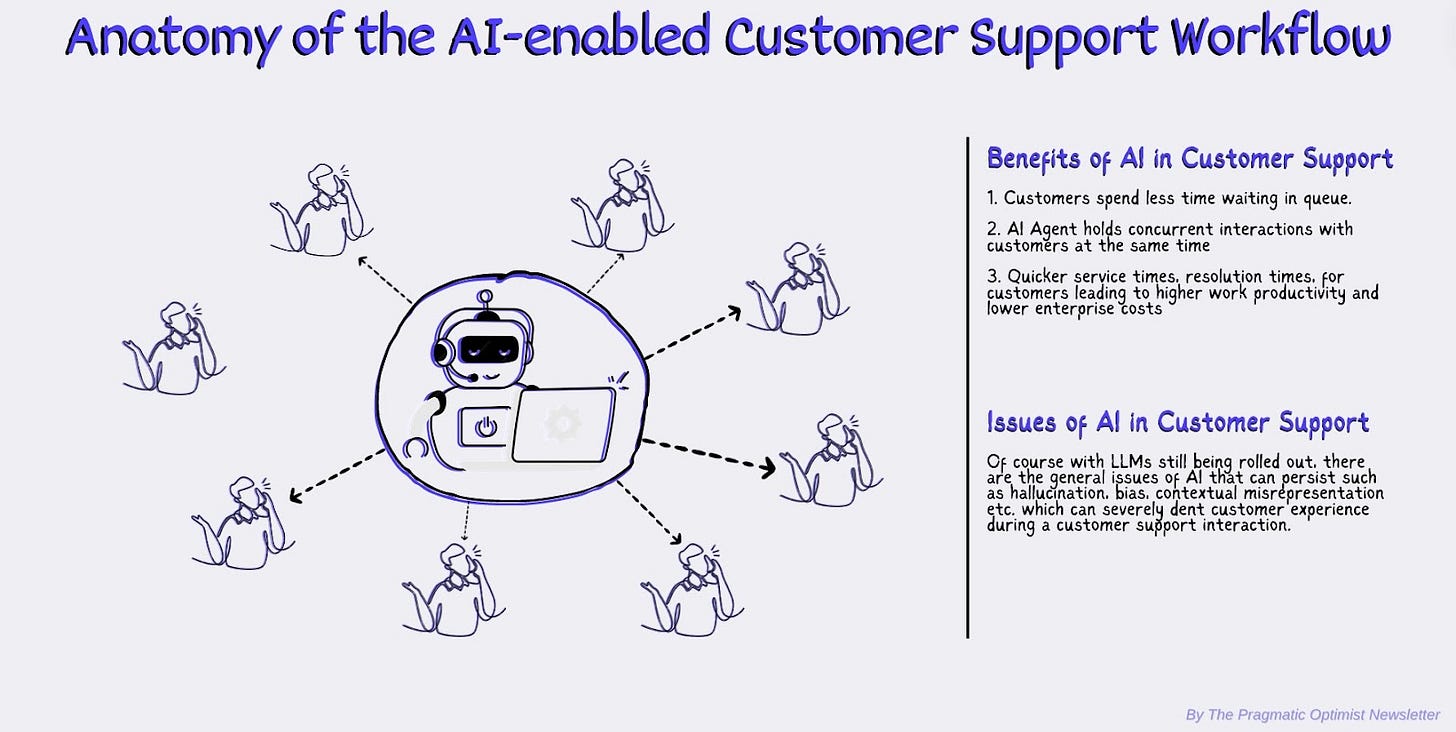

Ever wondered what the behind-the-scenes operation of a customer service call looks like? Turns out that it is quite a complex operation where a customer has to be routed through the phone queues to the next available agent. The agent has to then verify the customer’s identity and subsequently match the customer’s queries with the most up-to-date information on products and services in the Knowledge Base to resolve the issue(s). After the call ends, the agent proceeds to add the required notes to the database.

Why it matters? While customer support plays an integral role in determining long-term brand value and customer loyalty, enterprises are primarily focused on these two metrics to assess the ROI of their customer support center. That is 1) the Cost per Support case, and 2) the Average Handle Time needed to interact with a customer and resolve their queries. In this whole process, companies like Salesforce, Zendesk, Five9, and others provide the tools and solutions to help companies streamline their customer support spend and improve overall efficiencies.

The pandemic changed the status quo: With customer support costs growing during the pandemic, many enterprises resorted to “chat with agents," where customer care agents could interact with many customers at once rather than on the phone. A growing number of companies also resorted to Apple’s AppleCare model, where they started charging customers a premium for each customer segment.

Enter ChatGPT into the scene: When ChatGPT was launched in late 2022, it immediately found appeal in the customer support industry, as it could be used as a chat agent to troubleshoot queries, not to mention that the latest live demonstration of ChatGPT acting as an assistant to talk to customer care agents on your behalf was pretty spectacular to watch.

The SaaS economics are squeezing software companies: As more companies invest in AI proof-of-concepts, as demonstrated by OpenAI, Sienna AI, and Microsoft Copilot, customer support software companies have to fight tooth and nail for a zero-sum IT budget. As a result, these companies are seeing their sales cycles elongate under greater budget scrutiny, thus pushing up their CAC Payback Period to an astonishing 50 months.

Is there an investment opportunities after all? While the entire consumer support software sector is in the midst of a de-rating, we believe that it will continue to remain under pressure over the next twelve months or so. So far, organizations are increasingly allocating budgets towards AI that start as a proof-of-concept before expanding it to fully fleshed-out deployments. Whether we see a return in spending on customer support software depends on the level of innovation at these companies, pricing power, and the state of the macroeconomic environment.

🎥Let’s set the stage…

Of all the businesses that got affected by the pandemic lockdowns, two industries in particular were severely impacted by the stay-at-home restrictions and have since followed different paths to recovery.

The first was the travel and tourism industry, which inevitably suffered from overnight shutdowns, mass cancellations, and a mad dash for refunds/returns demand. The second was the CS (customer support) & CRM (Customer Relationship Management) industries, which ironically had to deal with all those refunds & cancellations not only by customers in travel and tourism but across any kind of business that dealt with customer bookings.

Since then, the customer support industry has found it hard to recover, and the proliferation of AI has just made it worse for the makers of customer support tools and solutions such as Salesforce CRM 0.00%↑ , Five9 FIVN 0.00%↑, Zoom ZM 0.00%↑ , etc.

A growing number of firms, like buy-now-pay-later heavyweight, Klarna, replaced their entire customer support team with an AI chatbot agent powered by ChatGPT. This has caused immense pressure on Salesforce, Five9, Zoom & others, with the future of these large firms looking uncertain.

Customer Support was always ripe for disruption

To understand why customer support was one of the prime targets for disruption, we will briefly expand a little bit about how the customer support industry used to work and what made this industry a disruption target.

Let’s take the example of a customer who calls customer support to fix an issue with a product they purchased. The sketch below is a high-level illustration of the behind-the-scenes operations of a customer who calls in and moves through the phone queue to eventually talk to the customer care agent. As can be seen, this is still quite a complex operation where the agent has to do their best to address the customer issues to resolution, and more importantly, within a specified period of time.

In this process, companies like Salesforce, Zendesk, & Freshworks FRSH 0.00%↑ help with providing tools and solutions for the Customer Files and Records as well as the Knowledge Base system for the agent to look up the most up-to-date information on products and services, while others such as Five9 and Zoom help in handling the phone conversation and routing customers to the next available agent. Others, like Twilio TWLO 0.00%↑ provided software tools & infrastructure for automating and uplifting the different channels of communication with the customer.

The important thing to note in all of this is that enterprises are ultimately focused on two main metrics, or KPIs, when it comes to customer support: 1) the cost per support case, and 2) the average handle time needed to interact with a customer and resolve their queries. Up until the pandemic, most of the CS software providers were able to successfully help enterprises streamline their customer support costs, thus leading to a rise in demand for their solutions and the subsequent outperformance in their stock prices.

But post-pandemic, everything changed; customer support costs skyrocketed, handle times increased, and the promised 'streamlining’ in customer support departments took a massive hit.

Many enterprises resorted to pushing customers to chat with agents online rather than call in because customer care agents could interact with many customers at the same time via chat rather than the phone, thus reducing support costs. Others resorted to pulling the plug on customer support entirely, because the costs were too high and employee productivity was too low to justify the cost of buying more software from Salesforce, Five9, and others. A growing number of companies also resorted to Apple’s AppleCare model, where they charged customers a premium for customer support.

AI disrupts IT budgets, especially for customer support software

When ChatGPT was globally launched in 2022, the broader fear was whether AI would take our jobs. So far, we have seen that AI has started to threaten IT budgets that were usually allocated to software companies.

One of the areas that ChatGPT found immediate appeal in was the enterprise’s customer support groups. This CEO infamously fired his entire customer support team in one swell and replaced them with solutions built on top of ChatGPT. Klarna did something similar and then went on record to say, “more jobs can be done by AI in the future,” in an interview with the Telegraph last year.

That comment from Klarna’s CEO was a thinly-veiled reference to the enterprise productivity that their ChatGPT-enabled AI chatbot was reportedly providing. Klarna had managed to build an entire end-to-end customer support tool that could engage with customers via chat and was built using ChatGPT. According to the company, every 2 of 3 customers who reach out to Klarna’s chat support team talk to a Klarna AI Agent. This is expected to reportedly deliver an additional $40 million in savings for the company.

The pace of these conversations picked up after ChatGPT’s maker, OpenAI, demonstrated how ChatGPT could be used as a chat customer support agent to troubleshoot for queries such as helping someone fix a bicycle issue.

Imagine how that pressure on software companies further intensified after OpenAI followed it up with a live demonstration of ChatGPT acting as an assistant to talk to customer care agents on your behalf.

In the 15 months since ChatGPT, the focus has moved from streamlining customer support and customer relationship management operations aided by software to adding more productivity in these departments, now aided by AI.

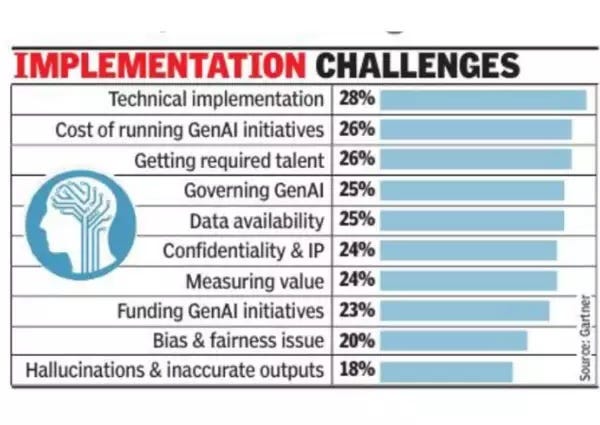

Intercom’s 2023 State of Customer Support showed that almost three-quarters of organizations worldwide planned to invest more in AI in the year ahead. In the process, software companies like Salesforce, Five9, and Zoom are now left fighting tooth-and-nail for budgets as more enterprises invest in the proof-of-concepts demonstrated by OpenAI as well as others such as Sienna AI and even Microsoft’s Copilot.

CS Software companies seeing higher customer acquisition costs

As a result, software companies, especially those involving CS software, have experienced issues in their sales pipelines as they lose out to AI in competing for enterprise IT budgets.

While Zoom had other fundamental issues, such as rapidly fading pandemic tailwinds, both Salesforce and Zoom have reported that their sales cycles are getting extended, with heightened levels of budget scrutiny impeding them from acquiring customers at the pace that they originally expected.

, a partner at Altimeter Capital, reported that the median Customer Acquisition Cost Payback Period or CAC Payback, for software companies was now at 50 months. This implies that it takes an average software company approximately 4 years to start making money on their enterprise customers after they have acquired them.This metric becomes alarmingly irrelevant in Salesforce, Zoom, & even Twilio’s TWLO 0.00%↑ case because these companies have a negative CAC Payback Period metric, i.e., they are currently losing money to acquire customers on a gross margin-adjusted CAC Payback Period basis. Others, like Five9, have payback periods of 56 months, which is over the median payback period for software companies.

Let’s take a deeper look at Salesforce. The company has been seeing the pace of its revenue growth in two of its primary revenue segments, Service and Sales platforms, slow considerably compared to the overall pace of revenue growth. The company’s Sales and Service platforms provide tools such as CRM, Knowledge Base etc. that help their enterprises' customer support and other teams work better with their customers.

As can be seen, the five year compounded growth rates of the Sales and Service segments slowed down to the low teens. These are important segments that, at one point in time, contributed well over 50% of Salesforce’s total revenue. Today, Salesforce’s Sales and Service segments are responsible for slightly under half of the company’s total revenue.

***Enjoying the content so far? If yes, please consider supporting our work by buying us a coffee ☕ and a muffin 🧁 for $8/month or $80 annually and unlock 30 minutes of zoom call time to discuss a range of topics surrounding macroeconomics, technology and investing. Also, your support goes a long way to help us keep up the quality of our work and continue to delight you all.***

Valuation for CS Software companies still in disarray

Naturally, with the current set of headwinds from AI putting downward pressure on CS & CRM software companies, this entire complex of stocks is currently in the midst of a de-rating environment. This can be seen in the peer regression analysis conducted below based on the projected 12M revenue growth versus the forward revenue multiple.

However, when it comes to the investability of these companies, we have to be aware of the threats that most of these companies currently face, as IT budgets are still shrinking when it comes to CS & CRM software. As a result, we believe that the valuation for most of the CS & CRM software companies will likely continue to remain depressed until the CIOs and CFOs of enterprises decide to re-allocate budgets back to software firms.

In fact, Salesforce appears fully valued given that it is trading at 5.7x the revenue expected in the next twelve months, which is supposed to grow 8% y/y. In contrast to that, companies in the S&P 500 generally grow their revenues on average by 4.8% over a 5-year period, with a revenue multiple of 2.2. However, what is unique to Salesforce is the volume of free cash that the company generates from its software business, which could likely support the valuation multiple relative to its CS peers.

Looking ahead, a crucial twelve months in AI & Software

Salesforce and its peers will have one of the most important twelve months ahead as they revamp their offerings and aggressively push the deployment, development, and sales of their AI-enabled offerings to entice enterprise customers to tie them down to new contracts.

Since ChatGPT’s launch, most enterprises have allocated budgets towards deploying AI in their organizations that start as proof-of-concepts, and based on the ROI and efficiency gains, they may expand it to fully fleshed-out deployments.

In Klarna’s case, the company started in a similar way before fully transitioning towards a comprehensive AI-centric customer support solution later last year. Most proof-of-concepts last ~2 years for mid-sized enterprises and ~4 years for large enterprises. By next year, the growth of these AI-concept deployments in enterprises is expected to slow, as 90% of enterprises will assess the ROI from these AI-concept projects to evaluate the benefit of long-term, full-scale deployment versus the cost of implementation.

Hence, in our opinion, CS-software stocks can face some challenging periods over the next 12 months unless these companies create compelling AI products that can compete with the features most LLMs provide today. Another possibility is that enterprises may shift their spending back towards cloud software later this year, especially if global macroeconomic conditions improve and the Fed eases monetary policy.

Until then, it's cloudy times for all customer support-focused cloud software companies.

After chatting with GPT-4o, I am quite certain that most customer support jobs are on the way out.

Who wouldn’t want an AI agent, available 24/7, who is helpful, friendly, and best yet….no need to navigate the dreaded phone tree?

Companies will find AI agents, not only a great deal cheaper, but better than human. The biggest challenge will probably be integrating the technology in existing software.

Another masterful edification!! We as readers should be truly appreciative, for your talent is rare and is most luminous in the present moment.