AI may take longer to monetize than most expect. How long will investor optimism last?

As the market cap of the top 10 mega-cap stocks reaches an all time high, coupled with 45% YoY increase in AI capex spend from the Big 4, when will investors start demanding a return on AI investment?

«The 2-minute version»

The concentration of the top 10-mega cap stocks relative to the total US stock market reaches an all time high. Meanwhile, the four tech giants pledged to spend a total of $200B on AI-related infrastructure in 2024, exceeding the total capital investments and expenses of the other 90 Technology & Communications companies in the S&P 500. At what point will investors start demanding a clear path to AI monetization?

The incentive to move quickly on AI is clear: For many of the largest tech firms, AI creates both, the risk that their existing businesses will be rendered obsolete and the unique opportunity to leverage their client relationships to outcompete others by providing AI tools and services as well as “compute” that businesses need to develop and use AI. On top of that, they are sitting on one of the highest cash piles in history that can be used to fund their AI-related investments.

Plus the AI trade is broadening out: Although semiconductor companies and hyperscalers have been the largest beneficiaries from the first order wave of GenAI related to “compute”, we have seen companies across the entire GenAI infrastructure ecosystem outperform the S&P 500 YTD, while sales is yet to pick up. Meanwhile valuations do not resemble an asset price bubble, like it did during the dot-com era with prices rising roughly in line with short-term earnings expectations.

Beware of “overbuild”: Big Tech’s capex splurge may be reaching irrationally exuberant levels with the risk of runaway spending while model commodification looms in the background. Not to mention, the “law of diminishing returns”, where newer training techniques and custom built hardware is required to yield further progress on LLM’s.

We’re still in the early innings of AI adoption: Although the four tech giants are spending 45% more on AI capex, it is still less than 1% of US GDP. As AI investment cycle picks up to build out the physical infrastructure as well as funding startups in the AI application space, its highly uncertain as to whether these investments will pay off.

But first, show me the money: Recently, investors have turned against the software sector after revenue and earnings projections came in softer than expected. While the general sentiment of tech CEOs is to continue investing in building AI capabilities to position for success, the resulting slower than expected growth has squeezed valuation premiums. Plus, in the current macroeconomic environment where vendor consolidation will likely continue, along with the possibility that GenAI may disrupt the business models of software vendors, we will see clear distinction between winners (and losers) in the coming years.

🎥Let’s set the stage…

Did you know that the combined capital expenditure (capex) from Amazon AMZN 0.00%↑, Meta META 0.00%↑, Google GOOG 0.00%↑ and Microsoft MSFT 0.00%↑ is expected to exceed the total capital expenditure of the other 90 Technology and Communications companies within the S&P 500 in 2024? 🤯

In recent weeks, the four tech giants have pledged to spend close to a total of $200B in 2024, mostly on data centers, chips and other gear for building, training and deploying generative AI (GenAI) models. That is 45% more than last year’s capex figures.

Since the release of ChatGPT in the fall of 2022, GenAI has captured the imagination of society. While its ultimate impact on the economy remains uncertain in the short term, it is widely believed that it may boost productivity across many industries in truly staggering ways over time. Bill McDermott, CEO of ServiceNow NOW 0.00%↑ boldly stated that “a tsunami of change is coming” in a recent Dell World Conference in Las Vegas, where AI will re-engineer every organizational workflow in every industry within the next 24 months.

Simultaneously, Jensen Huang, CEO of Nvidia NVDA 0.00%↑ , the largest beneficiary in the AI arms race with a market cap that is closing in on Apple AAPL 0.00%↑ and Microsoft claimed that the next industrial revolution has begun, where Nvidia will play a pivotal role in partnering with companies and countries to shift the trillion-dollar installed base of traditional data centers (run on general purpose computing) to accelerated computing and build a new type of data center called “AI factories” to produce “artificial intelligence” as a commodity.

On the other hand, legendary investor Stanley Druckenmiller took a more pragmatic approach in his recent appearance on CNBC, where he believes that AI may be a “little overhyped in the short term” while remaining bullish on the technology’s long-term prospects.

Here's what he had to say: 👇🏼

"If we were all sitting here in 1999 talking about the internet, I don't think anybody would have estimated it would be as big as it got in 20 yrs. We didn't have the iPhone, we didn't have Uber, we didn't have FB, etc.

And yet if you bought the NASDAQ in 1999, it went down 80% before that all came to fruition.

That's not gonna happen with AI. But it could rhyme. AI could rhyme with the internet as we go through all this capital spending we need to do. The payoff, while it's incrementally coming in by the day, the big payoff might be 4 to 5 yrs from now. So AI might be a little overhyped now, but underhyped long term."

With the concentration of top 10-mega cap stocks relative to the total US stock market reaching an all time-high, there is a rising chatter about whether we are in an AI bubble. Nvidia contributes about 39% of the S&P 500’s market cap year-to-date.

The way that I see it is that while semiconductor companies and hyperscalers have benefitted from the first order wave of genAI that are largely related to “compute”, the path to broader AI monetization for companies outside of the Mag 7 is still unclear. Therefore, it begs the question, at what point will investors start demanding an ROI (return on investment) on the AI capex?

Let’s find out.

….But before that, if you want to support my Substack publication by buying me a coffee ☕ and a muffin 🧁, that would really help with my ROI. So, consider upgrading to paid for $8/month or $80 annually to unlock a quarterly 30 minute chat with me over Google Meet…

The incentive to move quickly on AI is clear. Capex is just one side of the story.

“At some points in history, we experience a technological breakthrough big enough to change the way that we go about our day-to-day lives. In most cases, it takes many years for society to adapt to the new technology and to figure out how to reap its benefits.

However, the combination of excitement around its potential benefits and fears of becoming obsolete can spark intense competition to get ahead. That competition can pull forward the expected future growth associated with the technology by creating a surge in investment in the near term.”

- Bridgewater Associates.

Today, the ingredients are in place for an arms race to build capacity in AI, even if productivity gains for the average company are years in the future. Take a look at the diagram below that illustrates a simplified version of the AI infrastructure that is required to support widespread AI adoption and how some of the notable companies fit in the supply chain.

For many of the largest tech firms, AI creates both, the risk that their existing core businesses will be rendered obsolete and the unique opportunity to leverage their client relationships and resources to outcompete others by providing AI tools and services as well as “compute” that businesses need to develop and use AI.

Therefore, not only do these firms have a strong incentive to take advantage of this perceived “once in a generation” opportunity, they also have significant resources at their disposal, with massive war chests of cash and highly profitable core businesses that can fund AI-related investments, without needing to secure the equity and debt financing that is typical of such investment booms.

In the latest podcast,

correctly outlined how the current macroeconomic environment of “higher for longer” interest rate environment is actually helping these mega cap companies earn more on their cash piles and further boost their earnings.“Higher for longer interest rates are actually helping these mega cap companies because it gives them a 5% or more interest return on their very, very large cash balances. And this helps them to boost their earnings quarter over quarter as long as we have these higher interest rates in place.”

But, even though AI capex is expected to grow a whopping 45% YoY to $200B in 2024, it is still a small share of the economy at approximately 0.9-1% of GDP. However, both equity pricing and analyst forecasts reflect expectations for a material rise in AI-related investment from here, especially as we evolve from the early innings of model development to building and deploying applications that can add value across a wide range of industries and translate into economic output.

Meanwhile, companies across the AI infrastructure ecosystem have outperformed the S&P 500 by a wide margin over the past year or so, even where revenues are yet to pick up. The greatest increase in valuations are among the most direct near-term beneficiaries of AI-related investment (chip suppliers) and a more recent and modest increase among less direct beneficiaries, like those exposed to AI-related power demand.

However, I don’t believe that the increase in valuations resemble an asset price bubble like it did during the dot-com bubble, where prices rose well above short-term earnings expectations. In fact, when you look carefully at the chart above, you will see that prices have risen roughly in line with short-term earnings expectations. Having said that, the earnings growth expected for these firms in the short term is a product of investment that would fade if AI does not live up to its potential.

How concerned should we be about “overbuild”?

A recent Economist article outlined that big tech’s capex splurge may be reaching a point of irrational exuberance. In the article, the author pointed to runaway spending being the biggest risk, where companies may end up spending more than it earns in revenue. After all, investing in AI is not cheap, and includes juicy salaries for brilliant engineers and mammoth electricity bills for data centers that can handle the heavy demands of GenAI.

In the recent quarterly earnings, we saw mixed reactions where investors applauded Google’s capex plans right after throwing cold water on Meta’s. It could be related to the uncertainty around Llama’s monetization trajectory, where its CEO Mark Zuckerberg has admitted that it may be years before this investment generates returns.

At the same time, there is a risk of model commodification, especially with open-source alternatives such as Hugging Face that lists more than 650,000 models, where it can take market share from large proprietary models built by hyperscalers, which will likely lower the returns on investment on capex.

Meanwhile, as these models become bigger with higher computing power and data, we should not simply assume that they will get proportionally better as more money is thrown at them.

of wrote this post where he highlighted his conversation with Swami Sivasubramaniam, VP of AI and Data at Amazon Web Services on the need for newer techniques, more efficient training and custom built hardware that should eventually yield further progress on large language models (LLMs).The path of continued scale probably starts with better methods to train and run LLMs, some of which are already in motion. “We are starting to see new kinds of architectures that are going to change how these models scale in the future,” Swami Sivasubramanian, VP of AI and Data at Amazon Web Services, told me in an interview Thursday night. Sivasubramanian said researchers within Stanford and elsewhere are getting models to learn faster, with the same amount of data, and ten times cheaper inference. “I'm actually very optimistic about the future when it comes to novel model architectures, which has the potential to disrupt the space.”

However, Sivasubramaniam also mentioned that lack of progress in developing these LLMs efficiently would put the world in a position where we may be reaching the top bound for data, compute and energy. LLM progress also depends on building better chips that can train and run these models faster and more efficiently than traditional chips, along with finding better models.

While NVIDIA current lineup of GPUs are exceptionally useful for training LLMs, they aren’t completely purpose-built for them. Therefore, a big question for investors is whether Nvidia can keep up the momentum, especially as the AI market gradually shifts from training GenAI models to the deployment phase, also known as “inference”, where Nvidia’s current lineup of expensive GPUs are less critical. While Nvidia has always managed to be in the right place at the right time, it is already positioning itself with its next generation of Blackwell chips and Rubin chips, companies like Amazon, Google, Meta Platforms and Microsoft are also building “accelerators” or custom chips that can run AI processes fast.

As AI companies increasingly look for ways to build and deploy smaller models that can be effective for specific tasks, as they strive to build a business model that can recoup the massive investment in hardware the technology requires, AI developers may find it easier to run their models on cheaper servers.

FYI: Sequoia Capital estimated in March that AI startups have put $50B in Nvidia’s chips to train LLMs, but so far they have only made $3B in revenue.

The path to AI monetization is somewhat unknown. How long will investor optimism last?

While Gartner placed GenAI in the “Peak of Inflated Expectations” segment of its Hype Cycle for Emerging Technologies Report last year, we are still in the early innings of AI adoption, where core models have limited utility on their own, and people need to figure out and build effective applications of the technology before it can add value across a wide range of industries.

Here is an image by

that demonstrates that we are indeed in the early days when it comes to AI.According to The Census Bureau’s Business Trends and Outlook Survey, only 5% of companies use AI regularly to produce goods and services, with less than 0.4% of companies reporting that a “moderate” number of labor tasks have been automated by AI.

However, the expectations about the future benefits of AI don’t need to be universally held to induce sizable capital investment, as long as the key actors believe them. In the near term, those key actors are likely to be large corporations (particularly in tech) and some of the world’s large pools of capital. Some of those investments will go directly to firms building out the physical infrastructure associated with AI, while the remaining will go towards startups in the AI application space, thereby creating intermediate demand for cloud-service providers (for instance, over 60% of funded genAI startups are Google Cloud customers).

In fact, just 2 weeks ago, we saw the largest AI fundraising since Microsoft poured $10B into OpenAI last January. Starting with infrastructure, CoreWeave raised $7.5B in debt to rent more AI chips from Nvidia in a deal led by Blackstone, while enterprise tools, such as ScaleAI that helps companies organize and label their data for AI models just bagged a cool billion dollars. Investments also flooded in industry-specific enterprise tools such as PolyAI, a builder of AI voice assistants for call centers, GraspAI, an AI assistant for investment bankers and Leya, an AI legal assistant that accurately cites public legal sources, as well as in consumer AI tools (for you and me) that includes Suno, an AI music generator for anyone to make music and Gamma, which is an AI presentation helper.

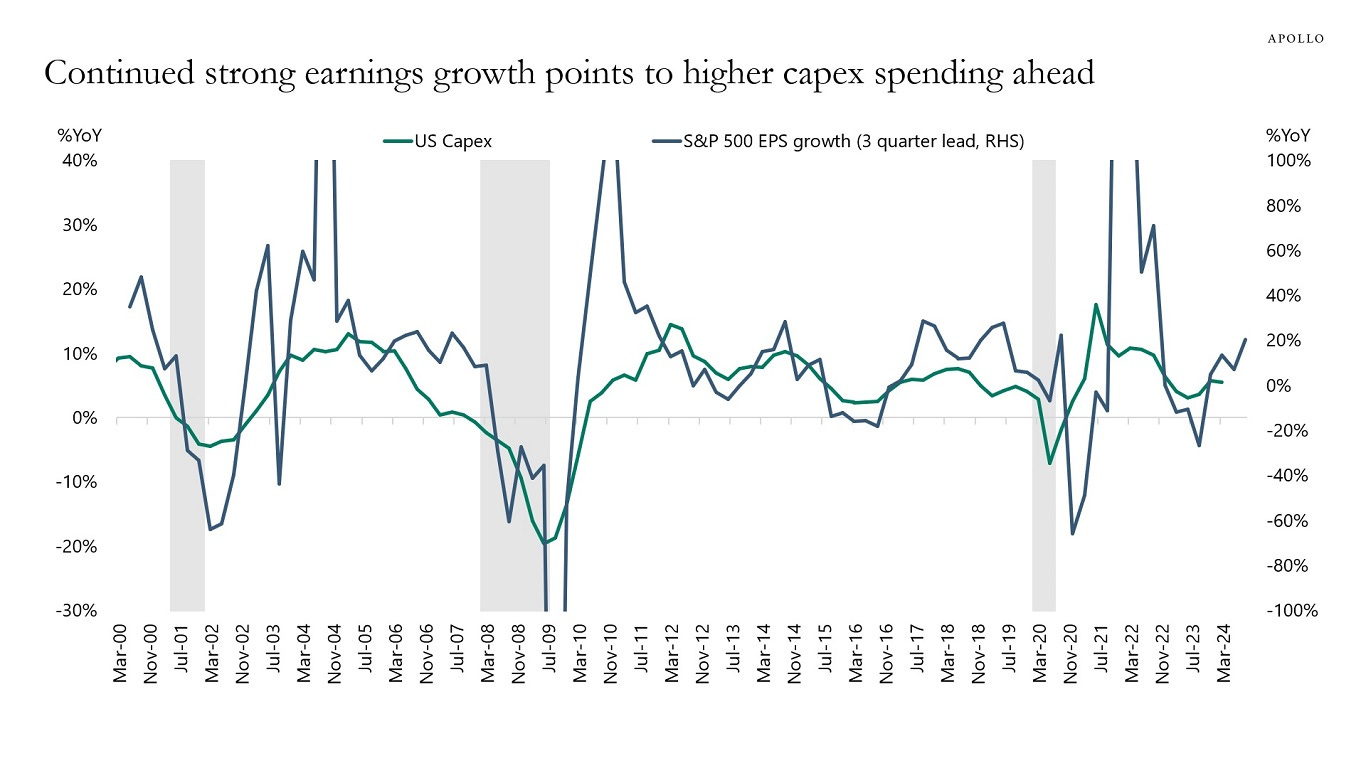

On the macroeconomic front, Torsten Sløk, Chief Economist at Apollo released his research note where he expects a strong rebound in business fixed investment over the coming quarters to fuel economic growth, as earnings in public companies continue to come in stronger than projected.

At the same time, he also points to the $6T in money market funds (MMFs) that are sitting on the sidelines that can be deployed to purchase public and private credit and equity, especially when the Fed starts cutting interest rates.

So far in 2024, we have also seen the AI trade has been broadening in the public markets outside of semiconductors and hyperscalers, with the utility sector XLU 0.00%↑ and Global X U.S. Infrastructure Development ETF PAVE 0.00%↑ outpacing the S&P 500. But, investors are now slowly starting to pay attention to whether these AI-related spending will ultimately be paying off.

The truth is that outside of the semiconductor and hyperscalers, AI revenue hasn’t yet shown up. Especially over the last week or so, we have seen carnage in the software space, where companies such as Salesforce CRM 0.00%↑, MongoDB MDB 0.00%↑ , ServiceNow NOW 0.00%↑ and others have been investing in R&D (Research and Development) to build AI capabilities to drive superior business outcomes for their customers in the form of efficiency and productivity gains, improving their client relations by driving personalization efforts and enabling them to build genAI applications seamlessly. The iShares Expanded Tech-Software Sector ETF IGV 0.00%↑ is now down 3% for the year, severely underperforming the overall indices.

Both Marc Benioff and Dev Ittycheria, CEO of Salesforce and MongoDB respectively, hinted that they are facing pressures from broader macroeconomic challenges that is dampening their sales cycle and platform usage growth.

also hints that one of the factors that is possibly slowing down revenue growth can be attributed to customers who are scaling back their software purchases to fund rising investment, which is very interesting in my opinion. However, despite the slowdown, the management at both these companies emphasized their commitment to GenAI and its potential to drive future growth, as they continue to drive R&D spend to fuel their AI-led product innovation. shared this table below in his latest post that demonstrates that most software companies missed next quarter’s revenue guidance, with UiPath PATH 0.00%↑ missing by a massive 11.7%.While there are hopes of revenue reacceleration in the future, I believe it will be more tricky. With macroeconomic pressures sustaining and the ZIRP (zero interest rate policy) likely behind us, businesses will continue to consolidate their software vendors towards the ones that offer fully integrated platform solutions in order to gain pricing and efficiency advantages.

This is what

said in his latest post that I fully resonate with:The “power of the bundle / platform” is very real. Those aren’t likely to go away any time soon, which means we most likely won’t see a sharp change in software spend, but rather a more gradual increase more in line with typical budget growth. It’s never been harder for point solutions to find incremental customers. There are more companies than I ever remember with net retention <100% right now.

This can lead to further valuation pressures down the line for the software sector, especially if revenue fails to show up as expected. In that case, investors will shift their valuation models away from revenue multiples towards earnings or free cash flow multiples, which can further deflate stock prices. Plus, genAI can also disrupt the current business model of many software companies, especially as it takes the cost of software generation to essentially zero, thus wiping out the valuation premium software stocks generally command. Ultimately there will be clear winners (and losers) that will emerge in the coming years as the AI investment picks up pace.

Back to you…

That’s all for today. Hope you enjoyed the post. What are some of the companies that you believe will be winners (or losers) in the coming years. Do you think the current dip in software is a long-term buying opportunity to ride the deployment phase of genAI applications? Let me know in the comments section below.

Amrita 👋🏼👋🏼

🚨P.S. My Substack account has been under numerous identity attacks in the past 72 hour or so. Please know that I will never ever reach out to you via any medium asking you to contact me personally or send me money on my Telegram, WhatsApp or other accounts. So, if you see such a suspicious comment from someone pretending (and looking ) like me, please block and report them right away.

We tend to over invest and overbuild when the next game changing technology shows up. Railroads are a good example. Also we had the exact same monetization questions about the internet. Early on the only ones monetizing were porn outfits. If I were to guess we see the same dynamics. We will overbuild leading to a capex pause, but will eventually figure out generalized monetization. Longer term the biggest winners will be on the software/data side as infrastructure is a smaller market and cyclical. Right now I think they need to solve the data accuracy problems to make it more commercially useful. People will look at googles put glue in pizza sauce fiasco, and question whether I want to run my enterprise on this stuff. AI is more than LLM’s of course, but that’s what can replace humans so I’d bet that’s where the really big money is once it’s solved. Good piece as always.

Interesting thoughts!

Personally I don’t think we can even comprehend how fast the AI space is going to move though.

We’re heading to the point where we can accomplish things in 1 month that once took us 1 year.

Industries will change quicker than we’ve ever witnessed before in human history.

100 years ago it was easy to project what the world would look like in 5-10 years. These days that is getting much harder to “see.”