CoreWeave & Nebius Bet On Nvidia’s GPUs & Won Big

But costs for AI Neoclouds are also sky-rocketing.

At The Pragmatic Optimist, we help investors navigate the evolving AI innovation landscape, identify rock-solid businesses with strong growth trajectories and operational grit, and make long-term investments in the space with a high probability of success.

Become a paid subscriber today

«The 2-minute version»

🛠️ GPU Airbnb - Meet the Neoclouds: A new breed of cloud companies has emerged by renting GPUs like digital real estate, sort of like Airbnb. Neoclouds like CoreWeave & Nebius are flipping the script with their GPUs-as-a-Service model. These young companies are scaling fast, quadrupling revenues and giving hyperscalers another reason to think about their capex efficiency goals.

🤔Hyperscalers As Customers? Even hyperscalers like Microsoft and Google are warming up to the idea of renting GPUs from neoclouds. Counterintuitive, isn’t it? Because traditional hyperscalers like Microsoft are actually peers of neoclouds. But the irony in that observation is that hyperscalers are increasingly renting GPU cloud services from neoclouds to scale up/down capacity to meet stronger-than-anticipated demand. Proof? Microsoft accounted for 72% of CoreWeave's revenues last quarter.

💪Neocloud Battles Just Getting Started: CoreWeave and Nebius are both gunning for market share differently. One of them wants to Grow At All Costs with revenues expected to grow 3x in CY25 to ~$5.4B, but it comes with a side of a $12B debt bill. The other company is a Lean, Clean, and Euro-Printing Machine expected to post $1B in ARR this year with a cash hoard of over $1.4B and debt under $200M.

We have added updated price targets and respective ratings on both CoreWeave and Nebius on our AI Stock Tracker that all premium members have access to.

🎥Let’s Set The Stage

In H2 of 2023, Microsoft MSFT 0.00%↑ and Meta Platforms META 0.00%↑ led their hyperscaler counterparts in significantly raising their capex and allocating it into building data centers specifically geared for one task—processing AI workloads.

Markets loved it, their stocks surged, and other hyperscaler peers started to follow in lockstep. By 2024, the top four hyperscalers racked up huge capex bills cumulatively exceeding $217B and growing 55% since 2023.

Then came the hard part.

How to justify another year of near 50% growth in AI capex in 2025 to shareholders when expected revenue growth is nowhere near capex growth rates of ~50%?

As capex estimates kept rising through the last twelve months, the conversation around capex dollars moved from the volume of dollars spent to the efficiency of capital investments being made for AI. Could hyperscalers increase the rack life of Nvidia’s GPUs NVDA 0.00%↑ which are still the gold standard for compute resources needed to process AI workloads? Or was there an alternative to buying up Nvidia’s pricey AI GPUs?

Enter Neoclouds: Young hyperscalers that answered most of the questions above by buying up Nvidia GPUs and offering to rent them via the cloud compute business model. Revenues for neoclouds have been quadrupling for the two leading publicly listed neocloud companies, CoreWeave CRWV 0.00%↑ and Nebius NBIS 0.00%↑ making this new breed of AI cloud companies a hot commodity.

In this post we break down the neocloud market and how investors should think about CoreWeave and Nebius along with our respective price targets.

The Economics & Viability of the AI Neocloud Market

A good place to start is the overall cloud compute market, of which neoclouds are a part.

We had covered this in our Q1 update on Hyperscalers earlier this month, but to reiterate, one of our key takeaways from that post was that the overall cloud market enjoyed an AI boost in Q1, growing 25% y/y, with first-quarter revenues for the overall cloud market standing at $94B worldwide.

(Remember these market share numbers because we will use them to project revenues for CoreWeave/Nebius and arrive at our respective price targets at the end of the post.)

We noted that Microsoft enjoyed the strongest traction of all hyperscalers which saw their share in the cloud market sequentially jump by 100 bp to 22%.

But the other revelation was the 100bp gain in market share that was recorded in the “Others” category that neocloud companies such as CoreWeave are a part of.

In fact, this is what Synergy Research had to say when the cloud research specialists published their own Q1 update on the cloud market:

From a virtual standing start two years ago, CoreWeave is now on the verge of breaking into the top twelve ranking of cloud providers, thanks to its AI and GPU services.

The Neocloud market has been growing rapidly since H2 of last year, coinciding with the launch of Nvidia’s Blackwell GPU systems. CoreWeave became one of the first companies in the world to get delivery of Nvidia’s Blackwell server systems.

Neocloud companies like CoreWeave differ from their traditional hyperscaler counterparts in the sense that neoclouds focus almost exclusively on GPU Cloud services, renting out virtualized access to GPUs.

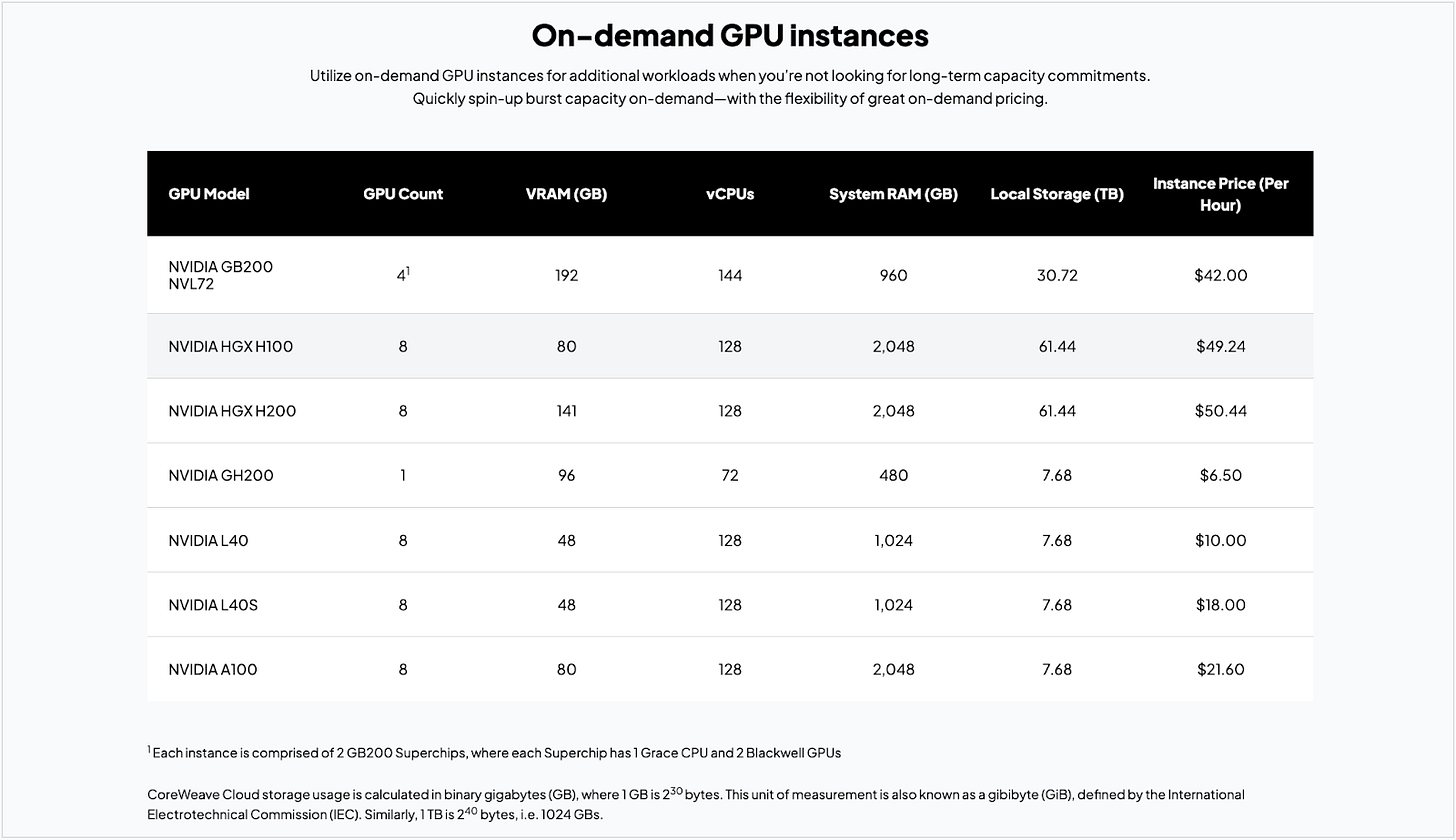

The entire business model of Neoclouds is to build capacity by securing fleets of GPUs, mostly from Nvidia, and then rent out these GPUs/GPU systems on an hourly rate.

Some, like Nebius and Crusoe, rent access per GPU, whereas the largest neocloud company, CoreWeave, also rents access per GPU system instance. Note that Nvidia’s HGX H100 server instances have 8 GPUs per server. Nevertheless, most neoclouds are doubling down on building GPU capacity due to the demand that these companies are reportedly seeing.

For example, Crusoe, which is not publicly listed yet, is one of OpenAI’s partners in the $500B Stargate project and is currently in the second phase of building a 1.2 GW data center, consisting of 8 buildings in the data center facility at Abilene, TX. Each of these buildings has the capacity to hold up to 50,000 NVIDIA GB200 NVL72s on a single integrated network fabric (each GB200 NVL72 GPU system has 72 Nvidia Blackwell GPUs). Ahem! Cue Nvidia bulls…🙌

But public companies such as CoreWeave and Nebius often cite backlogs of orders and contracts secured (remaining performance obligations, or RPOs) as a signal of future demand to justify the capex dollars these companies need to build out their own AI data centers. While Nebius will start reporting its backlog metric in H2, CoreWeave has already reported ~$25.9B in backlog, up 71.5% y/y.

Generally, investors tend to question the business model of neoclouds from a competitive standpoint given the presence of large, deep-pocketed hyperscalers who may compete for share in the neocloud category. The irony of this observation is that in many cases, hyperscalers actually have ended up becoming customers of neocloud companies.

You see, hyperscalers and neoclouds are required to allocate capex dollars towards buying Nvidia’s GPUs/GPU systems, the costs of which can be high and are often spread out over 3-6 years as amortized costs.

As markets are increasingly raising concerns over hyperscalers’ capex expenditure versus forward revenue growth, many are waking up to an important realization: why buy when you can rent GPUs?

In this case, hyperscalers can just rent GPUs from neoclouds and incur operational expenses, which are far more manageable than capital expenses that they have to amortize given the current mood of markets.

A final note for investors as we wrap up this section: Almost all neoclouds led by the big 4—CoreWeave, Nebius, Crusoe, and Lambda are locked in a tight race to rapidly build data centers and secure GPU capacity for the robust demand each of them is seeing. Therefore, most neoclouds have looked to finance their aspirations with a combination of meaningfully elevated levels of equity and debt financing.

As you will see in later sections, this has led to huge piles of debt, which is a big downside in the current environment of elevated interest rates.

CoreWeave’s Growth Prospects & FY25 Revenue Projections

CoreWeave is the biggest neocloud of all, currently reporting ~$2.7B in revenues on a TTM basis. When the Trenton, NJ-based Neocloud filed its S-1 earlier this year, CY24 revenues had grown 8x, or 736%, to $1.92B. So, the 42% sequential acceleration in TTM revenues to $2.7B was very impressive to see. As discussed earlier, all of CoreWeave’s revenues come from rentals of its Nvidia GPUs and GPU systems.

CoreWeave’s S-1 also revealed that Microsoft was one of the biggest reasons behind CoreWeave's billion-dollar revenue base in CY24, with the Seattle, WA-based hyperscaler accounting for 72% of CoreWeave’s revenues per Q1 filings. With Microsoft sticking to its spending plans, it's likely that Microsoft will remain a major client for CoreWeave.

OpenAI has also emerged as another big client for CoreWeave, signing a deal worth almost $12B, which they recently topped up by committing an additional $4B in future sales. The deal will also see OpenAI becoming an investor in CoreWeave.

In the Q1 earnings call last week, CoreWeave’s management pointed out that while the company’s backlog had grown impressively by 71.5% y/y to $25.9B, OpenAI’s future commitments were not yet fully included in Q1’s backlog due to accounting deadlines in the first quarter.

Therefore, between Microsoft reiterating its capex plans, OpenAI ramping up its spending on CoreWeave’s GPU cloud services, and the cloud market continuing to grow due to AI, as we noted in the previous section, CoreWeave’s growth prospects look quite promising.

Here is how we project CoreWeave’s sales and compare it to the future revenue capacity it has built up.

CoreWeave’s CY24 revenues of $1.92B billion indicate a 0.6% market share in the

global cloud market which jumped to $330B in CY24, up $60B or 22% from CY23. In Q1, the global cloud market meaningfully accelerated to $94B, up almost 25% y/y as we mentioned in the previous section. If we assume a reasonable pace of acceleration through the year, we believe the global cloud market could grow by 26-27% y/y in CY25 to ~$416-419B.

Now, with CoreWeave’s revenues accelerating from $1.92B in CY24 to $2.71B in Q1 TTM revenues, that implies market share expansion of ~12 bp to 0.72% share for the neocloud company. Assuming CoreWeave is able to maintain ~12-15 bp of market share penetration in the global cloud market in every quarter of CY25, we estimate CoreWeave would end CY25 with a ~1.3% share in the global cloud market.

In this case, a 1.3% share of the global cloud market which we estimated earlier at ~$416-419B in CY25 translates to ~$5.4B in CY25 forward revenues for CoreWeave. This itself would be an impressive feat for CoreWeave with projected CY25 revenues growing almost 3x.

Note that current consensus revenue estimates for CoreWeave range from $5 to 5.12B, putting our revenue projections for CoreWeave above the higher end of the expectations range.

However, CoreWeave’s projected 3x revenue growth in CY25 implies a growth slowdown versus the 8x growth seen last year. And slowing growth becomes a bigger problem when the company’s business operations are fueled by ballooning debt, resulting in substantial interest overhead.

In Q1, CoreWeave reported contraction in GAAP operating margins to -2.8%, versus 16.9% GAAP operating margins through CY24, as seen below.

However, interest expenses skyrocketed by 6.5x to $263.8M, accounting for 27% of CoreWeave’s Q1 revenues of $981M due to the large volume of debt CoreWeave holds on its books.

In Q1, CoreWeave reported almost ~$12B in debt and obligations, with a large portion of its $8.8B debt profile financed at interest rates that usually exceed 10%, as seen below.

Popular credit rating company Fitch recently assessed CoreWeave’s debt, assigning it a junk bond rating of BB-. Fitch maintains that CoreWeave’s gross leverage of 6.7x is elevated and has scope to fall to 5.7x by the end of the year due to “strong EBITDA growth potential,” but that is all predicated on the assumption that “EBITDA grows faster than new debt issuance needs.”

As it now stands, Q1 EBITDA has grown 3.3x to $416M, slower than the 5x growth seen in Q1 revenues of $981M and even slower than the 6x growth in CoreWeave’s total debt. This also does not include billion-dollar new debt offerings recently issued by the company.

So, while growth prospects for CoreWeave are impressive, with revenues that are projected to be ~$5.4B per our estimates, the company’s debt-fueled growth at all costs warrants meaningful concern.

How Does Nebius Differ From CoreWeave

Nebius is the entity that was left behind after the Dutch holding company of Russian internet giant Yandex delisted, divested, & offloaded most of its Russian-based assets as a result of the 2022 war. With Yandex no more and all Russian assets divested, Nebius AI was the resulting holding entity, with GPUs-as-a-Service being Nebius' primary business. As part of the initial capital raise, Nvidia was a lead investor in Nebius. (But so is Nvidia an investor in CoreWeave as well.)

In addition to its Core Infrastructure business (of renting GPUs), Nebius also holds smaller businesses as part of its portfolio. The first is Texas-based Avride, originally Yandex’s self-driving & mobility unit, which spun out of a joint venture with Uber in 2020. The second is a small ed tech platform called TripleTen based out of Wyoming, and the third, and perhaps the other rapidly growing business apart from its GPU rentals business, is Toloka, a data labeling and model annotation service for GenAI models. Earlier this month, Bezos Expeditions led a $72M investment in Toloka.

When it comes to Nebius’ core GPU rentals business, the European neocloud is much smaller compared to its American neocloud peer, CoreWeave. Per annual filings, Nebius has deployed ~30,000 GPUs across its global data center footprint, mostly Nvidia H200 GPUs, as of March 31st this year. The company plans to take ownership of ~22,000 Nvidia Blackwell and Blackwell Ultra GPUs this year, and most of the Blackwell shipment will be deployed at Nebius’ New Jersey-based data center.

Still, the end result of possibly 52,000 GPUs gets dwarfed by CoreWeave’s army of 250,000 GPUs.

But for a neocloud the size of Nebius, the company looks well on track to achieve its own ARR target this year of $750M-1B.

In the recently concluded Q1 earnings report, Nebius reiterated their ARR targets, with Q1 group revenues coming in at $55.3M and Q1 ARR being ~$249M. Core Infrastructure made up three-fourths of the company’s revenue base, while the rest of the revenues came from its other businesses, such as Toloka, TripleTen, etc.

Based on our modeling below, there is a strong possibility that Nebius could actually exceed the upper end of its $750M-1B ARR target range if all GPUs are utilized at 80% utilization and assuming an average GPU rental rate of $2.3 per GPU based on Nebius's pricing page. Note that this also takes into account that Nebius successfully takes delivery of Nvidia Blackwell GPUs by H2 of this year, as the management has reiterated.

Unlike CoreWeave, Nebius also looks extremely well capitalized with ~$1.45B in cash versus just $187M in debt and obligations.

On top of its capital structure, Nebius maintains a 28% stake in a database management cloud software startup called ClickHouse. In the recently filed annual filings, Nebius valued its 28% stake in ClickHouse at $89.7M. Based on a recent report from The Information, the valuation of ClickHouse is now at $6B, up 3x from its previous valuation of $2B. This bodes very well for Nebius and its shareholders, given the stake that it has in ClickHouse, giving the European neocloud another source of access to capital.

We had mentioned earlier that hyperscalers were warming up to the idea of turning towards neoclouds for scaling up their merchant GPU capacity during periods of elevated demand and had taken the example of Microsoft’s relationship with CoreWeave to illustrate this point. Another recent report by The Information suggests Microsoft’s peer Alphabet-owned Google GOOG 0.00%↑may also be looking at estimating the feasibility of renting out GPUs from CoreWeave.

In the Q1 call last month, Google’s management said that they “exited the year in Cloud specifically with more customer demand than we had capacity” and reiterated similar views from a previous earnings call in February where they said:

“We exited the year with more demand than we had available capacity. So we are in a tight supply-demand situation, working very hard to bring more capacity online.”

According to The Information, these capacity constraints are leading Google to evaluate the feasibility of renting GPUs from CoreWeave and its peers at times when demand outstrips GPU supply on Google’s GCP.

Given Google’s history of pivoting towards the peers of Microsoft’s partners, it is very likely that Google may partner with Nebius for securing GPU supply.

As we end this section on Nebius, there is a final point of difference between Nebius and CoreWeave’s GPU cloud services. CoreWeave specializes in giving developers bare metal access to its GPUs and GPU servers. On the other hand, Nebius offers a ton of managed services for dev teams to manage GPUs.

One example of managed services that Nebius offers, unlike its large peers, is K8s, or Kubernetes. The simplest way of explaining K8s is that dev teams use it to orchestrate the deployment and scale their software applications across GPUs. So dev teams use K8s to orchestrate the deployment and scale of their software application across GPUs. Nebius also offers other managed services for ML workloads, model & application development, and managing & streamlining ML data pipelines.

Valuation and Price Targets of CoreWeave and Nebius

When valuing CoreWeave, we do not believe an EV/EBITDA multiple is the right approach because of the significant volume of amortized costs & depreciation that can skew the EV/EBITDA multiple. For example, CoreWeave is valued at just 18.4x CY25 EBITDA (EV/EBITDA basis), which may appear cheap, but at the same time, if one strips out the depreciation item, CoreWeave would be valued at 75x CY25 EBIT.

With CoreWeave’s debt load growing at breakneck speed, we believe it is appropriate to value the large neocloud based on its book value. At the moment, CoreWeave trades at 12.7x forward book value. Its largest peer, Microsoft, trades at 9.8x forward book value, implying CoreWeave is trading at a 29% premium. Therefore, should CoreWeave revert to trading at where Microsoft’s forward book value is, CoreWeave’s price target should be roughly $83 per share.

On the other hand, Nebius has a balance sheet that is more robust, paving the way for the European neocloud to be valued by more traditional metrics such as EV/Sales, etc.

Plus, with Nebius demonstrating a robust track record since then, growing its revenues, reiterating their ARR targets while also demonstrating sustained buildout of its AI data centers, there is a strong possibility that Nebius can exceed the higher end of its ARR target range, as we demonstrated in Exhibit H in the previous section.

Therefore, we feel comfortable in valuing Nebius at a forward sales multiple of 17-18x. Nebius is currently valued at 14.1x forward sales, implying ~24% upside or a price target of $49.3 per share for Nebius.

Risks & Other Factors To Be Aware Of

The base assumption through our analysis here is that the overall capex environment continues to scale amidst the backdrop of a stable global economy growing at a reasonable pace of 3% growth. At the same time, demand for all types of AI workloads continues to expand, justifying the capacity buildout that most neoclouds are currently focused on as they secure GPUs from Nvidia.

If demand for AI workloads drops, this could lead to an oversupply of Nvidia GPUs from neoclouds, leaving all neoclouds exposed but especially putting neocloud players such as CoreWeave at risk due to significant volumes of debt and the resulting interest overhead.

Assuming a robust demand environment, it is also likely that CoreWeave, the largest neocloud player, would take advantage of its relationship with Nvidia on the supply side and Microsoft/OpenAI on the demand side to create a stronger supply/demand ecosystem versus CoreWeave’s peers. That could imply greater than projected market penetration rates for CoreWeave than we had projected.

Uttam & Amrita

Disclaimer: I/we have a beneficial long position in the shares of AMD, AMZN , GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions, based on my observations and interpretations of events and should not be construed as personal investment advice. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.