Friday5: The American dream costs $3.4M, Deal-making makes a comeback, Chocoholics need to make some sacrifices

Plus, American's job jitters rise despite a strong labor market, corporate America vows to make 2024 the year of cost cuts, Tinder expands its ID verification to fight AI-related dating crimes.

Welcome back everyone to another edition of the Friday5.

In today’s post, we will talk about 5 different topics at the intersection of macroeconomics, tech and culture in a bite-size edition that will spark your curiosity and hopefully leave you pragmatically optimistic about the world that is often quite noisy and confusing.

So, let’s a coffee and a muffin on this almost spring afternoon and dive right in. ☕🧁

««Friday5- At a Glance»»

💰Food is eating 11% of disposable income, while it takes a household earning a median income 8.5 years to buy a house. What’s happening to the American dream?

💸Corporate deal making is back in fashion this year. Here’s what you need to know about the latest Capital One and Discover merger.

👩🏻💼Americans’ job jitters rise as corporate America vows to make 2024 the year of cost cuts.

🍫To the chocolate lovers (including me), I have some bad news.

🏴☠️Romance scams cost victims $1.3B in 2022. Tinder is rolling out extensive identity verification to protect users from falling prey.

🎥Before we begin…

On Monday this week,

and I teamed up in his podcast to discuss the following:We break down the latest earnings report in Nvidia, as the company continues to impress investors over and over again, given the greater than anticipated boom in AI capex spending.

We also address the possible cyclical and secular components within AI and how this may shape the industry in the coming year(s), as the hype slowly fades.

And finally, we do a deep dive into the current state of the US and global macro and where we may be heading next.

So, I would love for you all to watch it and let me know what you think in the comments section below.

💰Food is eating 11% of disposable income, while it takes a household earning a median income 8.5 years to buy a house. What’s happening to the American dream?

Eating continues to cost more, even as overall inflation has eased from the blistering pace consumers endured throughout much of 2022 and 2023. Prices at restaurants and other eateries were up 5.1% last month compared with January 2023, while grocery costs increased 1.2% during the same period, Labor Department data show.

“If you look historically after periods of inflation, there’s really no period you could point to where food prices go back down,” said Steve Cahillane, chief executive of snack giant Kellanova, in an interview. “They tend to be sticky.”

In 1991, U.S. consumers spent 11.4% of their disposable personal income on food, according to data from the U.S. Agriculture Department. More than three decades later, food spending has reattained that level, USDA data shows. In 2022, consumers spent 11.3% of their disposable income on food, according to the most recent USDA data available.

Many diners have said they are going out less frequently or skipping appetizers, while buying cheaper store brands more frequently at supermarkets and seeking out promotions or deals offered via apps. That is starting to chip away at some sales for food makers and restaurant operators.

Food inflation has raised the ire of President Biden, who took to Instagram during the Super Bowl to blast food makers that he said were providing less bang for consumers’ buck—putting fewer chips in each bag or shrinking the size of ice-cream containers.

“The American public is tired of being played for suckers,” Biden said. “I’ve had enough of what they call shrinkflation. It’s a rip-off.”

At the same time, housing affordability still remains at record low, with a new report from Zillow that suggests that homebuyers need to make north of $106,000 to comfortably afford a house in this market. That's $47,000, or 80% more than they needed in January 2020, pre-COVID.

Today, home prices are 42.4% more expensive than they were prior to the pandemic, with a typical home costing about $343,000. And at the same time, median incomes have risen only 23% to $81,000.

But it's more than just home prices. Monthly mortgage payments have nearly doubled. From January 2020, they are up 96.4% to $2,188 a month (assuming a 10% down payment).

According to the report, it would now take a household earning a median income 8.5 years, a year longer than the 2020 estimates to save up enough to put 10% down on a typical US home.

"It's no wonder, then, that half of first-time buyers say at least part of their down payment came from a gift or loan from family or friends," Zillow said.

In fact, the American dream now costs a whooping $3.4M, as per this infographic below.

While it is possible that with the right mix of innovation and policy, the US economy can continue to steer ahead and create opportunities, the discrepancy in wealth between the haves and have-nots is certainly making large scale participation in “the American dream” harder.

💸Corporate deal making is back in fashion this year. Here’s what you need to know about the latest Capital One and Discover merger.

Over the last 2 weeks, Capital One agreed to acquire Discover for $35B, Truist Financial announced a $15.5B sale of its insurance arm, and Walmart shook hands to buy TV maker Vizio for $2.3B.

The trio of transactions, worth a combined $53B, have lifted the value of deals announced worldwide this year to $425B, a 55% increase from the same period in 2023, as per Bloomberg.

This year's deal bonanza reflects a sunnier market and economic outlook. Stocks are trading at record highs, giving companies a powerful currency for dealmaking.

As for the potential Capital One and Discover merger, should the deal get approved, it will make Capital One the biggest credit card company by loans, leapfrogging JPMorgan. Ultimately, it is a bet on the credit-card sector, which has been booming thanks to a robust US consumer and labor market coupled with generous rewards programs and the digitization of commerce.

Here’s what you need to know about the deal and why it is important: 👇🏼👇🏼👇🏼

➡️ The deal would give Capital One access to Discover’s payments network.

Capital One is the ninth-largest bank in the country and a major credit-card issuer. Buying Discover would allow it to process card transactions on a payment network that isn’t controlled by Visa or Mastercard. That could give it a new stream of revenue and result in cost savings.

“That network is a very, very rare asset. We have always had a belief that the Holy Grail is to be able to be an issuer with one’s own network so that one can deal directly with merchants,” Richard Fairbank, CEO of Capital One said.

🤔🤔🤔In case you are wondering what a payment network is: it is a communications system that connects banks with businesses from large retailers to mom-and-pop shops to process purchases that customers make with credit or debit cards. There are 4 payment networks, which include Visa, Mastercard, American Express and Discover in descending order of size.

➡️If you own a Discover or Capital One card

Assuming that the acquisition closes, Capital One plans to switch some of its cards to the Discover network, which shouldn’t change things for users. The bank also plans to continue using the Discover brand on cards. We can also expect to see Discover cards become more widely available and accepted in more places, given that Capital One would be motivated to expand the use of Discover’s payment network.

➡️What if I am a business owner?

The economy of so-called interchange fees has long been a source of contention between merchants and card networks. Merchant trade groups argue that the fees, typically around 2% of a transaction, are too high. The card networks, meanwhile, say the fees help cover costs related to fraud prevention, innovation and rewards programs.

While Capital One hasn’t explicitly stated that it plans to lower interchange fees, CEO Richard Fairbank said on an investor call that the deal would “add significant scale, increasing the network’s value to merchants, small businesses and consumers.”

➡️What does it mean for Visa and Mastercard?

It’s probably not welcome news, with both Visa and Mastercard likely to lose some business, given that Capital One has stated its plans to move some of its cardholders from their network to Discover’s.

“Overall, combining two of the top ten credit card issuers could be a small negative for Visa and Mastercard, in our opinion, if Capital One chooses to emphasize the Discover brand,” Andrew Jeffrey, an analyst at Truist Securities, wrote in a research note.

➡️Will regulators approve?

The Biden administration has been especially tough on big deals and takes particular interest in those involving consumers and financial institutions, and there will be political pressure to take a close look at this one.

Still, analysts point to several reasons the deal could ultimately be blessed. TD Cowen’s Jaret Seiberg expects it to be approved given that the combined bank would be similar in size to other recent tie-ups that were given the nod. And some expect officials to like that it adds competition to a field currently dominated by Visa and Mastercard.

👩🏻💼Americans’ job jitters rise as corporate America vows to make 2024 the year of cost cuts.

Americans' fears about their job security rose this month, according to polling by Morning Consult, even as the labor market remains historically strong, with non-farm payrolls growing 0.2% MoM and Average Hourly Earnings growing 0.6% MoM.

The uptick in anxiety comes on the heels of a string of headlines about high-profile companies laying off workers. These headlines often get outsized attention and help shape Americans' views of the economy.

In an earlier edition of the Friday5, I had outlined the following observation, where people who switched jobs in August 2022 were rewarded with an average 8.4% pay bump for making the move, around 3 percentage points more than those who stayed in their jobs, according to wage-tracking data from the Federal Reserve Bank of Atlanta. By last month, the average raise that came with switching jobs was 5.6%, compared with 4.7% for workers who stayed put.

In other words, companies are offering new hires less-generous pay and flexibility than they did a year or two ago. They are also holding the line in negotiations over perks such as additional vacation time, applicants say. Furthermore, there is now one job opening for every two applicants on LinkedIn, compared to the previous year, when jobs outnumbered applicants two to one.

There is no denying that corporate America is serious about cutting costs this year. In January, U.S. companies announced 82,307 job cuts, more than double the number in December. And the tightening of months prior is already showing up in financial reports.

“Companies in years past could get away with passing on higher costs to customers who were willing to splurge on everything from new appliances to beach vacations. But businesses’ pricing power has waned, so executives are looking for other ways to manage the budget or squeeze out more profits,” said Gregory Daco, chief economist for EY.

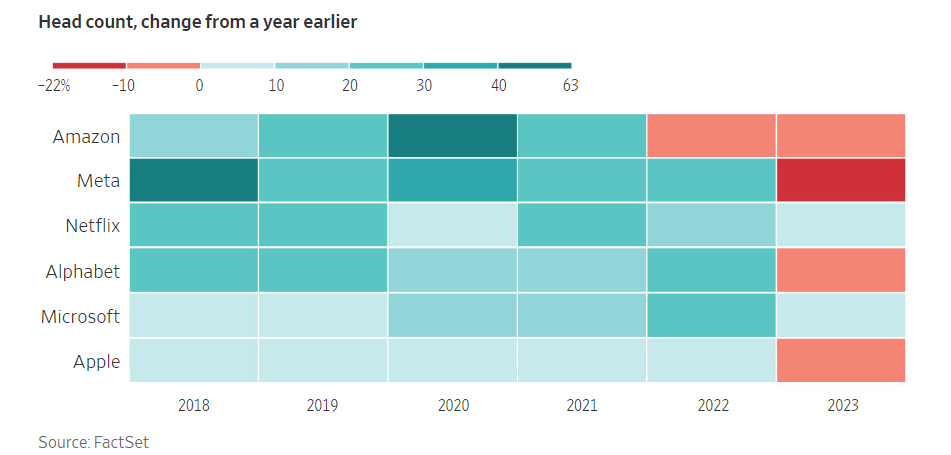

Downsizing has rippled across the tech industry, as companies followed the lead of Meta’s 2023 cuts, which many analysts credited with helping the social media giant rebound from a rough 2022. In recent weeks, Amazon, Alphabet, Microsoft and Cisco, among others, have announced staffing reductions.

Even Chipotle, which reported more foot traffic and sales at its restaurants in the most recently reported quarter, is chasing higher productivity by testing an avocado-scooping robot called the Autocado that shortens the time it takes to make guacamole. It’s also testing another robot that can put together burrito bowls and salads that can cut costs by minimizing food waste and/or reducing the number of workers needed for those tasks.

EY’s Daco said the past few years have been marked by a mismatch in supply and demand when it comes to goods, services and even workers.

“You’re seeing a rebalancing happening in the labor markets, in the capital markets,” he said. “And that rebalancing is still going to play out and gradually lead to a more sustainable environment of lower inflation and lower interest rates, and perhaps a little bit slower growth.”

🍫To the chocolate lovers (including me), I have some bad news.

When Mars Inc. made a quiet tweak to its popular Galaxy chocolate bar last year, shaving 10 grams off the standard product size and repackaging the leaner treat without lowering the price, UK shoppers were surprised, but cocoa traders weren’t.

The 113-year-old company, best known for its packaged sweets including Twix and M&M’s, appeared to be taking a well-used page from the confectioners’ playbook: When the cost of cocoa rises, they find ways to sell households smaller doses of chocolate or, for some candy makers, new goodies with no chocolate at all.

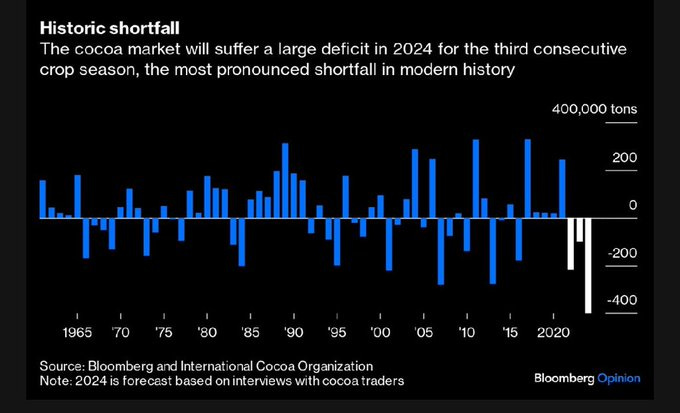

Cocoa prices have climbed to record highs, and market participants don’t expect any near-term relief. On Feb. 22, cocoa futures surpassed $6,000 a ton for the first time, and the market worries they could still have further to run.

In order to understand the root of the “chocolate crisis”, one has to travel to West Africa, home to 75% of the world’s production. The king of cocoa is Ivory Coast, which accounts for 2M tons of bean output, compared to global consumption of about 5M tons.

In West Africa, cocoa is still grown overwhelmingly by poor smallholders. Just making enough to subsist, most lack the means to re-invest in their plots, either by planting new trees or investing in fertilizer and pesticides.

The upshot is a brutal gap between supply and demand. Even when accounting for the damping impact of high prices on consumption, the market is heading for a deficit of 300,000-to-500,000 tons. If confirmed, that would be the largest shortfall in at least 65 years.

So far, companies have been passing on higher costs to consumers. Meanwhile, companies are also shrinking packages, using automation to trim production costs and promoting products with less cocoa or other starring flavors.

This shift was on full display for the nearly 124M people watching the Super Bowl telecast in February. Instead of selling consumers on rich, traditional chocolate options in multimillion-dollar commercial slots, candy giants Mars and Hershey respectively pitched peanut-butter-filled M&M’s and Reese’s cups with added caramel.

➡️Meanwhile, here’s a fun fact: Did you know that a 700g of Nutella costs €7.13 per kg in Austria, compared to €6.12/kg in Germany, making the Austrian Euro 16% overvalued compared to German Euro when it comes to purchasing power parity for Nutella?

Granted, I know majority of my readers are adults and Nutella is likely not a primary source of nutrition for you all, but when I first moved from India to France as a 12-year old in early-mid 2000’s and discovered Nutella on the food shelves, I have to admit I had the best time over the following couple of months when I finished a couple of these jars all by myself. And yes, my mom put me on a fitness/detox routine after that. 😆😆🏃🏻♀️🏃🏻♀️

🏴☠️Romance scams cost victims $1.3B in 2022. Tinder is rolling out extensive identity verification to protect users from falling prey.

Tinder is expanding its identity verification program at a time when artificial intelligence can make it hard to tell who’s real with crime on the rise on dating apps.

The process requires a valid driver’s license or passport and a self-recorded video. A third-party vendor checks the birth date and whether the face in the video selfie matches the individual’s profile photos and ID. Once the user submits the information, it typically takes about one to two minutes to get approved. If they complete the ID and the photo verification, a blue check mark will appear on their profile.

The company is rolling out the system in the US, the UK, Brazil and Mexico over the coming weeks and months. It’s already been testing the feature in Australia and New Zealand, where people who had been verified saw a 67% increase in matches compared to those who didn’t, the company said in a statement on Tuesday.

“Some of the things that we’re seeing with Gen Z is a really deep need and desire for that authenticity. Growing up in a “digital first” era creates a sense of wanting to know whether the person one is seeing on social media platforms is actually the person they will get. A key focus for us is how do we help bring people’s authentic selves to the forefront in their profiles and in their experience,” said Tinder Chief Executive Officer Faye Iosotaluno.

While the company had been developing its ID verification system for years, the technology came to the forefront when the US Embassy in Colombia warned travelers in January that it’s seen an increase over the last year in reports of criminals using online dating apps to lure victims who they then drug and rob.

While romance scams have a long and dark history, modern technology has brought in a new dimension. In a scheme known as pig butchering, fraudsters are using images generated by AI to develop unique dating profiles and trick people into handing over their money. In 2022 alone, romance scams resulted in victims losing $1.3B, according to the US Federal Trade Commission.

“People want to feel safe and confident when connecting and communicating with their matches, and we applaud Tinder for giving users this additional option to help confirm their match is the person in their profile,” said Pamela Zaballa, CEO of NO MORE, an organization that fights to end sexual violence, in a statement provided through Match.

That’s all for today, folks.

What are your thoughts on the rising cost of the American Dream? Do you think the US economy will be able to navigate through to create new opportunities at scale once again and keep the dream alive?

Have you reduced your consumption of chocolate lately? What are some of your favorite chocolate items where you have seen a price increase?

Have you faced any AI or non-AI related scams, if you are using a dating app?

The ID verification for Tinder is interesting. In Canada they are supposed to be coming up with an age verification for social media to protect kids. All good but how do you get people to trust social media companies with our ID? It's a good smaller test before an entire country starts doing it.

Entertaining and informative. Friday 5 is the best when it comes to macroeconomics.

Online scams are the worst. With AI, it is only likely to rise. It becomes all the more necessary that we should be prudent while sharing personal or financial information online.