Here's my 2024 S&P 500 target, investment outlook and portfolio strategy.

The tailwinds that helped cushion the US economy are fading rapidly. As inflation normalizes, I expect the S&P 500 to remain rangebound in 2024. Read more to find out how I am designing my portfolio.

Welcome to the last Monday Macroview of 2023. In case you are wondering, yes, today is Tuesday, and I took longer than expected to finish the post.

««Monday Macro- The 2-minute version»»

S&P 500 came roaring back in 2023. But, will the momentum continue in 2024?

How to think about it? The forces that cushioned the impact of monetary tightening in the US are fading away.

On the household front: consumers that were once flush with cash have depleted their savings and have increasingly tapped into credit debt, where interest payments are growing. Meanwhile, the labor market shows signs of cooling, which will weigh down on consumer spending moving forward.

On the corporate front: While rising interest rates made corporates with strong balance sheets and credit ratings even richer, the longer interest rates remain high, there will be real stress, if not distress, in the leveraged credit market.

On the US Treasury market front: Up until now, the Treasury has chosen to fund the deficit almost entirely by issuing T-bills versus longer-duration bonds. This has been a net positive for the overall liquidity. However, once the reverse repo facility is drawn out, the Treasury and/or the banking system may run into liquidity issues.

A 2008 style recession is unlikely: While inflation continues to normalize, I think 2% inflation will likely represent more of a floor than a ceiling for price moves. Market-based indicators of future inflation suggest that investors expect US inflation to run between 2.0% and 2.5% over the next 5–10 years. This would compare with the 1.5% to 2.0% range that prevailed from 2015 through 2020.

Plus: A record US household net worth, elevated levels of projected government spending, energy transition, near-shoring, and supply chain adjustments will continue to put upward pressure on overall inflation in the coming decade.

Moving forward: I expect the S&P 500 to remain rangebound between 4300-4500 as we enter the economic scenario that I call “The Grind," where inflation continues to moderate but remains above 2.2-2.5% while earnings come in below expectation.

This is how I have designed my portfolio in 2025: I am bullish on defensives, particularly in the healthcare and staples sectors. I also see a surge in investments in energy, defense, infrastructure, and cybersecurity as geopolitical tensions remain elevated. While Mag 7’s PE is elevated, I still believe in the overall AI theme as surplus moves up through to the “application” layer. Furthermore, given the overall direction of global macro, I am overweight on emerging markets, gold, bitcoin, and short-duration bonds, while underweight on cash.

Three years ago, nearly 30% of all global government debt traded with a negative yield. It seemed the era of super-low interest rates might never end. But it did. Today, negative-yielding debt has all but disappeared. Over half of the developed world’s sovereign debt trades with a yield higher than 4%, and U.S. Treasury yields across the curve, from 3-month bills to 30-year bonds, range from 4.1% to 4.2%.

Meanwhile, the US economy has proved remarkably resilient despite the biggest tightening in over 40 years. Markets are now extrapolating this strength, believing that with the economy having held up so far and the Fed unlikely to tighten much more, we are largely out of the woods.

On Wednesday last week, the Fed held its effective Fed funds rate steady at 5.25–5.5%. At the same time, as per the latest FOMC projections, the Feds now expect to cut interest rates by 75 b.p. next year to 4.6%, as they believe core inflation will decline from current levels to 2.4%. During this process, the Fed still expects the economy to grow 1.4% in 2024, while the labor market is expected to weaken from current levels, with the unemployment rate projected at 4.1%.

With the Fed’s dovish note last week, we witnessed a face-ripper rally across the S&P 500, Nasdaq 100, and Russell 2000, which are now up 23%, 41%, and 12% YTD, respectively. Meanwhile, the 10Y US Treasury bond yield fell from 4.25% to 3.9% in the course of a week.

So, what lies ahead for the US economy, and how do we position our investments accordingly in 2024 and beyond? On Tuesday last week,

from Moods Investment Research, and I got together to discuss this topic.In this post, I will break down some of the key areas that we discussed on the podcast that will lay the foundation for understanding the current state of the US economy and where it is likely headed in 2024 and beyond.

Three forces that cushioned the impact of monetary tightening in the US economy in 2023.

The past two years have seen the largest monetary tightening since the Volcker era, as measured by the speed and degree of rate hikes and quantitative tightening. The Fed has hiked rates from 0% to 5.25–5.5% and reduced the size of its balance sheet by nearly 15% from a peak of $9T to $7.7T.

But while the monetary tightening has led to a collapse in private sector credit growth, economic growth has held up in a way that is atypical. When I dig into what allowed the US economy to remain resilient, I see three main factors:

1. The US Household was flush with cash.

When the Fed started raising interest rates in March 2022, US consumers still had excess savings from the Covid stimulus program. At its peak, the US consumer had an excess savings of $2.1T in August 2021. Therefore, despite the Fed raising interest rates, consumer spending remained resilient, as consumers were drawing from their excess savings. The effect of the so-called “revenge spending” was especially felt in out-of-home entertainment and cosmetic stores, followed closely by the travel segment this summer, as per a research conducted by McKinsey. Meanwhile, the labor market also remained resilient, which probably played a role in boosting consumer’s confidence to increasingly tap into credit card debt, which surpassed $1T for the first time ever.

2. Rising interest rates made companies with strong balance sheets and credit ratings even richer.

The winners from higher rates were companies that are high-quality borrowers and locked in low interest rates around the pandemic, with bonds maturing further in the future. Higher rates have little immediate impact on their borrowing costs—only affecting bonds when they are refinanced—while they earn more on their cash piles right away. Companies that find they have more money thanks to higher rates can raise dividends, invest more, and be more willing to pay up for the right staff, all of which support the economy.

3. The surging government budget deficit was funded without bond issuance, delaying what would otherwise have been a drag on assets and spending.

As the Fed continues its quantitative tightening and the government continues to run large deficits (despite record low unemployment), I expected a liquidity gap to open up in the bond market that would suck money in from other assets. But this did not play out as expected. A significant factor was that the Treasury made the rather unusual choice of funding the deficit almost entirely by issuing T-bills versus longer-duration bonds. The money to purchase the T-bills that were used to fund the deficit largely came from the Fed’s reverse repo facility. This allowed the deficit to be funded without absorbing capital that was in productive use.

Tailwinds to Headwinds- The same forces above are now fading away, as we enter the next stage of the tightening cycle.

While inflation has come down from its peak of 5.5% to 3.5%, higher interest rates will be a drag on household and corporate cash flows moving forward. Plus, the liquidity boost from funding the government deficit using reverse repos is likely to fade soon.

1. The US Household’s excess savings is mostly over, while the US consumers interest payment on credit debt continues to rise.

As the chart below shows, since the peak of $2.1T in excess savings, $1.7T has been drawn out, as per latest estimates by the Federal Reserve Bank of San Francisco. This implies that approximately $430B in extra savings still remains in the aggregate economy. Should the recent pace of drawdowns persist, the aggregate excess savings would likely deplete by the first half of 2024.

Meanwhile, credit card debt topped $1T for the first time since Q2 2023 and is growing 10% on a year-over-year basis (YoY). At the same time, non-mortgage debt service payments (which consist of debt service payments for auto loans, student loans, and credit card debt) are growing at 8.5% on a YoY basis. The debt service payments from non-mortgage debt represent 5.8% of personal disposable income, and the number is growing.

Meanwhile, the labor market is showing early signs of cooling as job openings continue to fall, and the ratio of job openings to the number of unemployed people has now dropped to 1.3. This is reflected in the slowing wage growth, which is now growing at 4.0% YoY, relative to its peak of 5.9% in March 2022.

2. The longer interest rates remain high, the higher the chances of stress developing in the leveraged credit market.

While higher interest rates have been a boon to certain companies, the pain falls on weaker companies that were unable to lock in low rates for very long or that chose to borrow using floating-rate bank loans or similar debt where rates rise as the Fed hikes. Companies rated as junk, the weakest category, now have the shortest-ever maturity on their debt on average, meaning they face more frequent refinancing at much higher rates.

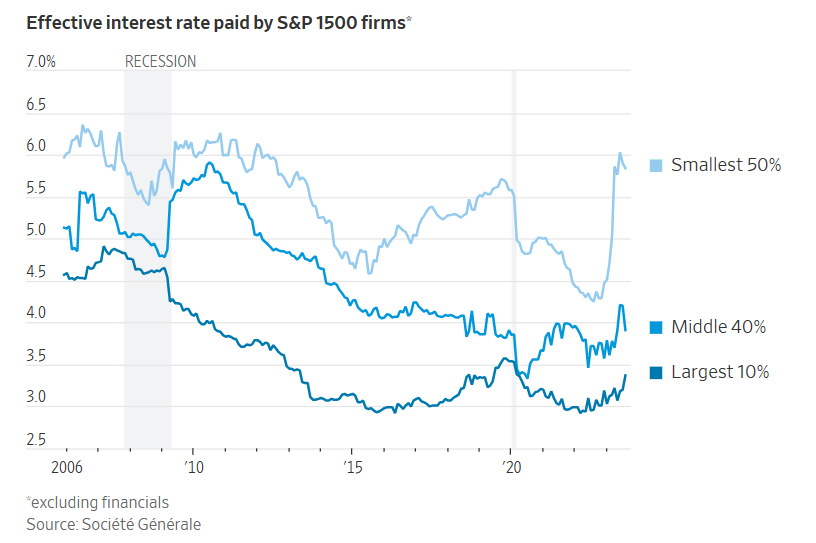

Therefore, if we keep rates where they are now and there continues to be a cooling of the economy, then there will be real stress, if not distress, in the leveraged credit market. Plus, if you look at the chart below, you can see that the rate paid by the smallest half of companies in the S&P 1500 index has risen to the highest in more than a decade, while those in the middle are roughly back at pre-pandemic rates.

As per J.P. Morgan Wealth Management, over 50% of commercial real estate loans are at a floating rate, and nearly $2T of commercial real estate debt matures by 2025. Indeed, BBB-rated commercial mortgage-backed securities spreads are nearing 1,000 bps (which is higher than their COVID crisis peaks), while high-yield spreads remain well anchored. In corporate credit, the healthcare sector is under particular stress, accounting for more than a quarter of all corporate credit defaults YTD. The sector faces regulatory headwinds, labor inflation (which crimps margins), and liability payments. The longer that interest rates stay elevated, the faster interest coverage metrics will deteriorate, especially for smaller companies. And, of course, many U.S. regional banks are under the strain of earning low rates on old loans while having to pay higher and higher rates on cash to attract deposits. Commercial real estate debt on regional bank balance sheets only exacerbates those strains.

3. The Reverse repo facility is drawn from its peak of $2.5T to $683B.

The Treasury market and/or banking system may run into liquidity issues when the reverse repo is drawn all the way down. As we have established by now, while the Fed’s balance sheet reduction is negative for liquidity, it is being offset by the reverse repo drawdown to fund the government deficit, which is positive for liquidity.

Once the facility is drawn out, the Fed would most likely need to stop its balance sheet run-off in order to not induce a repo market crisis like the one we witnessed in 2019.

All of these above forces will start acting as a headwind for the overall economy and the stock market, accompanied by weaker consumer spending and the labor market. This should put further downward pressure on inflation as the economy grows slower than before.

But a 2008 style deflationary recession is unlikely.

As inflation has retreated from its peak of over 5.5% to under 3.5%, I am especially encouraged by the recent cooling in inflation rates for service sectors such as hotels and recreation, where price increases tend to be stickier. Plus, the most current data on where shelter inflation is heading, including home prices and new rents, signals that shelter inflation will continue to cool to a manageable level.

Meanwhile, the Fed will continue to look for further moderation, but the progress is clear and encouraging. Still, I think 2% inflation will likely represent more of a floor than a ceiling for price moves. Market-based indicators of future inflation (such as breakeven inflation rates and inflation swaps) suggest that investors expect US inflation to run between 2.0% and 2.5% over the next 5–10 years. This would compare with the 1.5% to 2.0% range that prevailed from 2015 through 2020.

There are, to be sure, countervailing forces that may push inflation rates higher over the medium term. Aside from the highest ever net worth of US households, which stands at $155T, and government deficit spending, which is projected to double over the next decade. Industrial policy and the energy transition could also lead to higher commodity prices. In fact, at least initially, the shift to clean energy sources could lead to bouts of inflation. Consumer and investor inflation expectations could also nudge inflation higher, becoming, in effect, a self-fulfilling prophecy. The process of “nearshoring” and global supply chain adjustments will also limit how much the price of goods could fall. Fundamentally, it seems to me that many parts of the economy (labor markets, housing, and commodities) have insufficient supply to meet demand. This should place more upward pressure on prices than occurred in the 2010s.

Ultimately, I see the Fed living with higher inflation (higher than 2%) amid hefty government spending and debt loads.

The bottom line: This is a regime of slower growth, higher inflation, higher interest rates and therefore greater volatility.

Revealing my S&P 500 price target for 2024

Based on my set of assumptions for the implied equity risk premium of the S&P 500 and the possible path that inflation and interest rates can take from here, it can give rise to the following 6 economic scenarios, with the S&P 500 target listed out for each of the scenarios.

My take: While the S&P 500 is roaring on the back of bullish sentiment that the US economy will engineer a soft landing, I believe that expecting S&P 500 earnings to grow 11% on a YoY basis is overly optimistic. When the overall economy is slowing down, marked by weaker and more vulnerable households and corporations, an earnings downside of any magnitude will cause a spike in the equity risk premium. As a result, I am expecting continuing volatility in 2024. While I am not optimistic about the Productivity Acceleration scenario, I don’t believe we are heading into a severe recession either. Plus, I think inflation will further normalize from current levels. Given my set of beliefs and assumptions, I think we are in for “The Grind”, which is marked by slowing inflation and weaker than expected earnings growth. This will put S&P 500 in a range between 4300-4500.

The Pragmatic Optimist’s Portfolio strategy and design for 2024

2023 was marked as the year of Magnificent 7’s outperformance, as it went up 118%. Driven by better than expected liquidity conditions, strong earnings growth driven by the AI narrative, and resilient corporate balance sheets, Mag 7 was the poster child of 2023 market performance. At the same time, the valuation multiple of the Mag 7 complex also expanded in 2023, which has boosted the price-to-earnings ratio (PE) of the S&P 500.

But it was not just the Mag 7. Homebuilders, Semiconductors, and Discretionary also outperformed the S&P 500 in 2023. Meanwhile, the defensive and industrial sectors of the economy, which includes Healthcare, Industrials, Finance, Staples, Utilities and Energy underperformed the S&P 500, as can be seen in the chart below.

It is also important to note that Small Caps represented by Russell 2000, severely underperformed the S&P 500, as these companies have more vulnerable balance sheets, as we saw earlier in the post, and are more sensitive to the overall interest rate movement in the economy.

In 2023, we also saw a deepening bear market in the long-duration US Treasury market as yields reached upwards of 5%, with real yields reaching 2.5% in October 2023. It is only recently that weaker than expected economic data has pushed long-duration bond yields down, which has sparked a rally in the Treasury bond market over the last 2 months.

Meanwhile, cash yielded close to 5% in money market funds, one of the highest levels ever, as the Fed continued to raise interest rates. This was marked by significant inflows in the money market funds throughout the course of the year.

Finally, Bitcoin came back from its grave in 2023, outperforming all the indices, up 120% YTD, as institutional adoption of bitcoin continued to deepen and the narrative of its long-term store of value strengthened.

On the other hand, gold had bouts of outperformance in different periods throughout the year, as its performance is inversely proportional to the direction of real yields and the investors’ overall outlook on inflation.

Looking forward into 2024…

I believe that the overall picture of liquidity will remain steady until the reverse repo facility is drawn out, the earnings picture will be mixed across sectors and companies, and credit stress will emerge in pockets but be more or less contained.

As a result, going into 2024, I am overweight on the Defensives complex, with allocations to the Healthcare and Staples sectors.

Plus, with the rewiring of economic ties along geopolitical lines set to accelerate, I expect a surge of investments in strategic sectors like energy, defense, and infrastructure. I also see opportunities in firms with expertise in managing and reducing cybersecurity risks.

At a high level, while valuations are extended in the Magnificent 7, a lot of these companies enable and/or stand to benefit from AI, which is undeniably one of the strongest secular forces shaping the world. But AI is not just limited to Mag 7.

When it comes to AI, we need to think about what the AI technology stack looks like. On a high level, AI can be said to be made up of three layers: Compute, Model and App. The “compute” layer covers cloud infrastructure and chips, which are the building blocks. The “model” layer covers data and data infrastructure, and the “app” layer comprises the apps that actually harness innovation and serve customers like you and me. I believe that up until now, most of the value has been accrued to the first and second layers, and this is led by a handful of large tech firms. As a result, if I look at it from an optimistic lens, we may be on the cusp of this intelligence revolution, as the broader impact of AI seeps through the “app” layer to harness the surplus and drive productivity gains. As a result, I am overweight on AI and neutral on Mag 7.

Moving away from US equities, I am bullish on the fundamentals of emerging markets, as they trade at a steep valuation compared to the US. Furthermore, the Chinese government has once again vowed to step up its measures to stimulate its moribund economy in 2024. I choose to participate in the emerging market complex using the iShares MSCI Emerging Markets ETF EEM 0.00%↑, which is dominated by China, India, Taiwan, South Korea, and Brazil, with the largest sector weights in Financials, Information Technology, Consumer Discretionary, Communications and Materials. While a lot of investor sentiment regarding Emerging Markets is dependent on China, where the rebound has been uneven so far, one big tailwind could be the weaker outlook for the US dollar in 2024.

Along the lines of peak growth, inflation, and interest rates, I am also bullish on both gold and bitcoin. As the US economy swings back and forth from the “soft landing” to the “hard landing” narrative, investors search for opportunities to find shelter and protect their wealth from unknown outcomes. While gold was outperforming the S&P 500 until recently, it is now lagging. Despite the lagging performance, central banks around the world have added gold to their balance sheets at a record pace. With the economic narrative still uncertain and long-term inflationary pressures lingering with record government debt issuance, both bitcoin and gold can also act as portfolio diversifiers and hedges at the same time.

When it comes to cash, I was overweight in 2023. However, I am turning underweight cash in 2024. This is because 2024 will likely deliver a backdrop of falling rates, where cash works less well.

Finally, we may be entering the end of “the greatest bond bear market of all time." Plus, the macroeconomic narrative makes the possible case for the bond whales, i.e., insurance companies, asset managers, and pension funds, to swoop in as the guaranteed real yields are high enough for these bond whales to help them meet their return objectives and simultaneously hedge interest rate risk. Given my stance that long-term inflationary pressures still linger in the economy while we continue to see inflation normalize in the short term, I am overweight short duration US Treasury bonds and neutral longer duration at this time.

This is the final Monday Macro post for 2023. While I have covered the outlook and portfolio themes and allocation at a high level, I intend to go into more detail into the individual themes and companies that fit into those themes in much more detail in the coming year.

Where do you think the S&P 500 is headed in 2024? And what does your investment strategy look like? If there are stocks or sectors you are bullish on that I have missed out on, please feel free to write down your recommendations in the comments section below.

See you on Thursday. Have a great week

Amrita 👋🏼👋🏼

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

I'm also emphasizing those (overweight) sectors, as well as tech in my portfolio. Real macro insights!

Excellent detailed analysis, thank you Amrita.