How fast-food chains are using technology to drive customer loyalty and higher spend?

Did you know that consumers who are members of fast-food chains' loyalty programs outspend non-loyalty members by 5% every month? How fast-food companies are embracing technology to win long term?

At a glance:

The pandemic changed how consumers order food from their favorite restaurants. This ushered in a new age for the restaurant industry as it rapidly embraced technological innovation to create alternate channels for their customers to buy food from their restaurants. Curbside pickups and mobile app orders were some of the early innovations.

Although restaurant companies are generally slow to embrace technological innovation, some like McDonalds and Chipotle had already started to pilot digital offerings before the pandemic. A few like Shake Shack set up digital hubs overnight.

This post looks at some of the innovative ways restaurants and fast-food chains are using technology to streamline business operations and boost their consumers’ digital experiences.

The large swathes of data collected from the restaurants’ digital channels have led to the proliferation of highly targeted loyalty programs. And consumers are loving these targeted offers as they look for bargains in today’s high inflationary times. This has helped some fast-food companies to build a robust network of highly loyal customers who are spending more than the average customer.

Investors are also rewarding restaurant stocks where management have committed to building and delivering digital transformation programs aimed at elevating customer experiences. The wave of optimism has sizably driven up the valuation premium of these companies’ stocks, in an environment where economic and social risks are looming.

The restaurant sector is transforming rapidly. Once laggards, when it came to digitization, restaurants had to adopt digital tools and online sales channels overnight to survive the pandemic. Technology now plays a critical part in the restaurant experience, and its importance continues to grow.

A recent survey by PYMNTS found that almost 55% of all restaurants have implemented curbside pickup and 50% have adopted mobile ordering. Overall, restaurants are boosting their digital engagement capabilities to deliver flawless, convenient and memorable customer experiences.

Today, when consumers crave their favorite burritos, burgers or bowls, they order it using the restaurants’ branded apps, websites and aggregator platforms. In fact, more than 146 million Americans are now ordering food digitally in some shape and form.

The pandemic has changed how consumers buy their food. Forever.

During the pandemic, the lockdowns forced consumers to order their food online, thus limiting their in-person dining experiences. Restaurants and fast-food chains that heavily relied on providing in-store dining experiences were suddenly up against the wall staring at bleak prospects of their sales falling off a cliff. Many restaurant chains spun up new divisions in their respective companies overnight to tackle the problem and leveraged technologies to create alternate channels for their customers to buy food from their restaurants.

Take Shake Shack SHAK 0.00%↑ for example. The burger chain that has a cult like following had almost zero digital sales prior to the pandemic. But when the pandemic hit, they went full force on digital via app, web and third-party delivery. A few like Shake Shack were able to turn things around over night. Others like McDonalds MCD 0.00%↑ , Chipotle CMG 0.00%↑ and Domino’s DPZ 0.00%↑ had already been laying down the building blocks for their digital transformation initiatives prior to the pandemic, and as a result these companies were well positioned to take advantage of the sudden spike in digital sales volume.

The chart below shows the speed at which digital sales became an increasingly larger contributor to total revenue since 2019 across all the restaurant and fast-food chains, with the exception of Restaurant Brands.

Of all the restaurant chain companies reporting growing digital sales in the chart above, only Restaurant Brands International QSR 0.00%↑ is struggling. Restaurant Brands owns chains such as Tim Hortons, Burger King etc. Other brands such as Wendy’s WEN 0.00%↑ & Yum Brands YUM 0.00%↑(owner of KFC, Taco Bell) don’t typically break out Digital Sales in their income statements, which probably indicate that revenue contribution from Digital Sales is either meaningless or non-existential.

A look at the relative performance of restaurants chains vs the S&P 500 solidifies how investors are prioritizing their capital allocations based on the the degree of the restaurant’s focus on digital transformation initiatives. An equally weighted index of Domino’s+ShakeShack+McDonalds+Chipotle+Wingstop vs other restaurant chains illustrate the difference in performance. The equally weighted index, which consist of highly innovative fast-food chains are outperforming the rest (that are not actively focusing on technological initiatives) by 1.5-2x since the markets bottomed in March 2020.

The different ways restaurant chains are embracing technology to transform their business operations and improve customer experience

As digital sales become a larger contributor to restaurants’ overall top-line and investors increasingly reward restaurants where management puts “technological innovation” as a top priority, let’s explore some of the ways that restaurants and fast-food chain companies are leveraging technology to streamline business operations and improve customer experience.

1. Restaurant companies are partnering with third-party food delivery companies to spearhead online sales growth.

During and after the pandemic, restaurant and fast-food chains heavily partnered with Delivery apps like Doordash DASH 0.00%↑ & Uber Eats UBER 0.00%↑ to allow consumers to order food and have it delivered via these third party food delivery apps.

Domino’s was one of the chains that had already built out its entire delivery fleet well before the pandemic and always resisted the urge to partner with food delivery apps. However, the post pandemic boom in food delivery seems to have humbled the world’s largest pizza chain. In a call with investors last week, the company’s CFO Mr. Sandeep Reddy announced that they have been seeing a great deal of success in a pilot partnership with Uber Eats. Domino’s now expects to roll out its partnership with Uber Eats across the US by the end of FY23. According to Reddy, they now expect the Uber Eats partnership to drive “considerable improvement” in their pizza deliveries in 2024.

2. Restaurant companies that have built in-store kiosks are seeing larger customer order value.

According to a survey conducted by Tillster, a loyalty solutions firm, customers of fast-food and fast-casual chains want to see more kiosks. The respondents of the survey said that ordering from kiosks allow them to explore more menu options and fully customize their order - stress free.

Kiosk fans fall into two categories: “beeliners,” who value speed and convenience, and “explorers,” who like to use the kiosk to browse options. In fact, the survey shows that “explorers” who spend time browsing through options on the kiosks, often order larger orders, than they otherwise would have. .

3. Restaurant companies are spending their capital budgets on disruptive technologies such as robotics, Gen AI, autonomous delivery & others to delight customers & deliver consistently high quality service.

As per Chipotle’s announcement 2 weeks ago, the company is collaborating with the food service automation startup Hyphen to build its newest robotic prototype that will create virtually any combination of available base ingredients for Chipotle’s burrito bowls and salads underneath human employee’s workspace. Chipotle’s CEO Brian Niccol told investors that Chipotle expects to install Hyphen’s automated kitchen line in restaurants in the next 12 to 18 months. Chipotle is also launching a ghost-kitchen concept brand called Farmesa to cater to a subset of consumers that order online only.

Meanwhile, Domino’s jumped onto the Gen AI bandwagon by announcing its partnership with Microsoft earlier this month to launch services that make it easier for consumers to decide and order their pizzas via the app. Expect an AI assistant who helps you decide and take your order on the app, instead of you having to call your local Domino’s store.

Autonomous delivery has also been top-of-mind for many restaurant and fast-food chains especially after the pandemic. Chick-fil-A and Domino’s are testing different ways in using autonomic delivery bots to deliver food in certain US locations.

In 2021, McDonalds & IBM announced a partnership to accelerate the development and deployment of Automated Ordering Technology as part of McDonald’s ‘Accelerate the Arches’ growth program. An automated ordering system centralizes orders from all sales channels, streamlines order processing and tracks order fulfillment in real time. This reduces order fulfillment time and mistakes related to manual order handling. While, there had been some backlash from consumers who shared their frustration online of having to fight with a McDonalds robot to correct the order, or stopping the machine from ordering hundreds of chicken nuggets, there is also optimism amongst customer segments that such initiatives will eventually lead to better customer service and experience long term.

Restaurant branded apps are driving sizable Customer Loyalty and increased spend value in a higher than normal inflationary environment.

One of the other mechanisms that restaurant chains are using to build customer loyalty is through branded apps. The reason that branded restaurant apps are so impactful on the restaurant industry is that they can provide a ton of monetary benefits to both the customers and the restaurants. Mobile apps offer the opportunity for a restaurant to better target potential customers with location-based push notifications and customized offers and improve client retention based on loyalty programs.

Restaurant chains ranging from McDonald’s to Chipotle have been pushing loyalty apps for a while in their fight for market share. But, it is the onslaught of inflation, that really demonstrated the importance of restaurant apps, since penny-pinched consumers are now forced to go bargain-hunting for deals. This means that restaurants’ loyalty teams have to dig deeply into customer insights and build out targeted offers, so that their customers keep coming back.

Paytronix’s 2023 annual loyalty report found that consumers who were members of any fast-food chain’s loyalty program outspent non-loyalty members by approximately 5% month after month. The report analyzed customer checks of restaurant chains and found that the smaller the item, the higher the check size difference between loyalty members and non-loyalty members.

Some brands like Domino’s are crafting innovative loyalty strategies to target a wider cohort of their consumer base. In the same earnings call last week, Domino’s management mentioned that they are using their rewards and promotions program as a value prop to re-target low frequency customers (like carryout users). Domino’s is a food chain that famously takes customer loyalty very seriously. In 2016, it ran promotions to offer their own company stock as rewards in exchange for pizzas that consumers bought.

Incidentally, brands that have loyalty programs also found their way in Gen Z’s top food brands, according to the Fall-2023 Taking Stock of Teens survey by Piper Sandler.

In the age of higher than normal inflation, apps and loyalty programs are proving how restaurant and fast-food brands are finding creative ways to stay relevant amongst their customer base. A separate survey by Lending Tree earlier this year had found that while 42% of respondents felt that their views on loyalty programs had not changed, 50% of all respondents felt that having loyalty programs were more important now than ever. This survey shows that 92% of all people surveyed either felt positive or neutral about loyalty programs, thus validating the case for restaurants and fast-food chains to focus their efforts on building robust loyalty programs, in order to win long term.

There are economic, social and valuation based risks to investing in restaurant and fast-food chain companies’ stocks that you should be aware of.

As many of the forward-thinking restaurant chains are actively investing in innovative technologies to streamline operations and boost customer loyalty, Wall Street has also gotten excited about the potential that digital transformation may unlock for these companies’ top and bottom lines. However, there are some glaring economic, social and valuation related risks that are brewing and one must be cognizant of the “big” picture before riding on the wave of optimism.

Social Risk: Employee Unionization is leading to growing uncertainty and broader reputational risk for certain restaurant and fast-food companies.

Employee Unions across the world are taking a stand to fight for their rights as they demand better working conditions and wages at these restaurant chains. While some like Domino’s have been largely unscathed, others like Starbucks have not been lucky. In such times, there are often incidents where union battles get aggressive and expensive and Wall Street backs away.

Economic Risk: Higher Cost of Food Basket & Wages may squeeze gross and operating margins at these companies.

There is an upward trend in the price of certain commodities such as sugar, olive oil, cocoa, orange juice and more. Specifically, rising sugar and oil prices may dampen gross margins at many fast-food chain companies, as these commodities are often the main raw ingredients in a lot of their finished products. Earlier this year, Wedbush had downgraded Wingstop due to rising prices in chicken wings.

At the same time, a tight labor market in an inflationary environment continues to put pressure on the employers to raise wages for their employees. As long as consumer demand remains resilient, the rise in gross and operating expenses can be offset, however, should demand start to weaken, it will severely start to squeeze the restaurant companies’ operating margins.

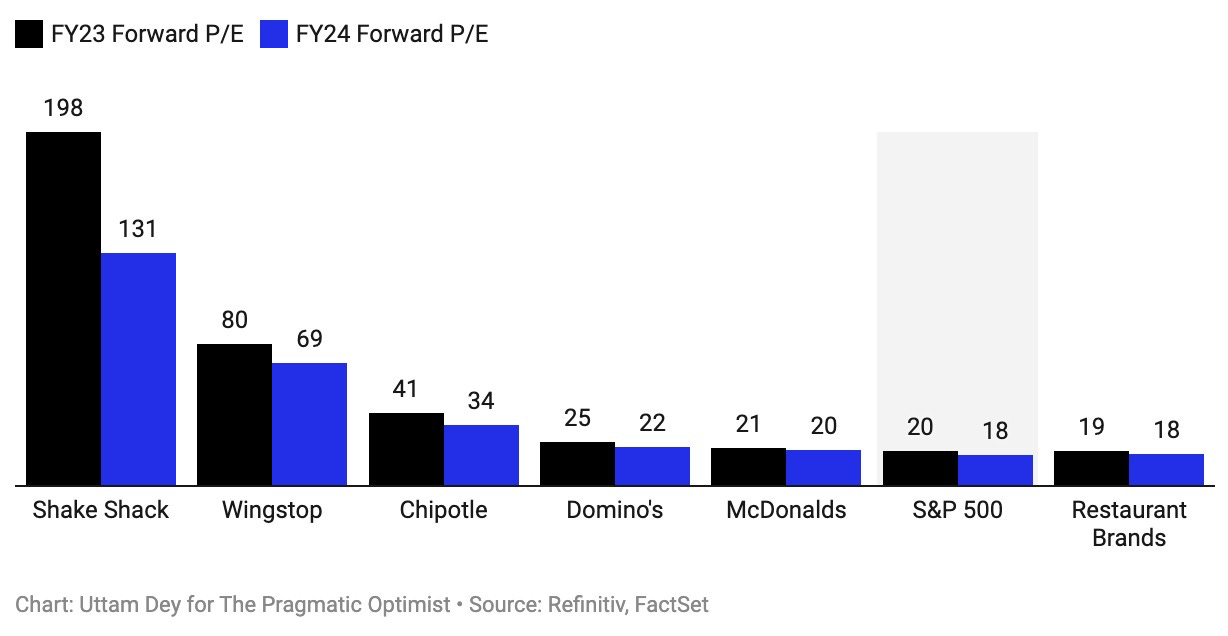

Valuation Risk: Some restaurant and fast-food chain companies are demanding a premium to the S&P 500 index.

With optimism riding high on some of these stocks, investors are paying premium at nose-bleed levels for some of these companies. While S&P 500 is trading at a Price to Earnings Ratio of 18, with expected earnings to grow at 11% in 2024, Domino’s is trading at a Price to Earnings Ratio of 22, which is 22% higher than S&P 500, when its earnings are expected to grow at 8% in 2024.

In the meantime, Shake Shack is trading at a premium that is 627% higher than S&P 500, when its earnings are supposed to grow 4x higher than the growth rate of S&P 500. This would mean that the company’s stock should be trading at a Price to Earnings ratio of around 80 and not 131.

One of the reason why some of these companies are trading at such premium valuations could be the underlying shift in consumer spending trends. For example, Wingstop is trading at a premium, because consumers are shifting their consumption patterns toward eating more chicken than any other meat, as seen in the chart below.

What are some of the ways that you have interacted with your favorite restaurant brands post pandemic?

📱Do you order more online? Or do you dine in more frequently?

🖵 Do you order from kiosks?

💳 Are you a loyalty member of your favorite restaurant brands?

🚗 Did you get food delivery done by an autonomous vehicle?

🦾Have you gotten your food prepared by a robot yet?

We would love to hear your experiences, so please share it in the comments.

Uttam & Amrita👋🏼👋🏼

interesting look at how technology is transforming the fast food industry. As a human who purposefully does not eat fast food I was unaware of the changes surrounding the industry.

Here’s an old photo https://www.alamy.com/stock-photo/waitress-on-roller-skates.html