Is America's shoplifting problem all that bad?

The rise of post-pandemic retail theft has left America's retailers with holes in their cash flows and an array of questions that need answers but a look deeper suggests other dangers are lurking.

At a Glance

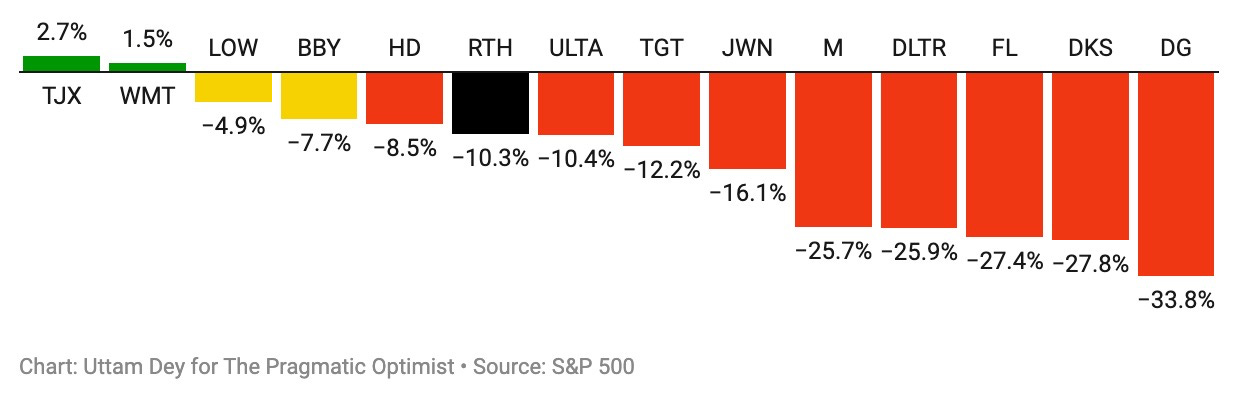

With the Q2-FY23 earnings season coming to an end, Shoplifting incidents and Inventory Shrink were among the most hotly discussed topics on the retail earnings calls sending some stocks like Dollar General down over -30% since they reported earnings.

Target has been one of the earliest voices sounding the alarm on investor shrink. They now estimate to have lost over $1B to shrink since 2022 and have decided to close stores in high risk areas.

The nation’s leading retail body, National Retail Foundation, estimates that shrink is now a near $100B problem and is projected to grow to $115Bn by 2025.

However, a deeper analysis of the balance sheets of America’s biggest retail store chains show that there may be other factors to blame for the dent in retail sector’s earnings.

Moreover, other macro indicators in the economy point to a weakening customer and the burgeoning risks of credit delinquencies that are starting to hurt retail companies in a big way.

Inventory shrink is striking terror in US retail stocks

“Shrink” was one of the most hotly discussed topics during the retail earnings calls in the US this earnings season. Today, the word “shrink” has managed to strike terror in the balance sheets of America’s favorite retail stores and department chains.

Shrink is boardroom-talk for loss of retail inventory, due to shoplifting and theft. You must have seen incidents on the news or on social media, where thieves brazenly barge into stores, steal goods and run off. Well, these companies eventually need to write off those “stolen” items as Inventory Shrinkage in their books of accounts.

What started as isolated incidents since mid-2021, eventually became a thorn in the performance of Target. Today “shrink” has snowballed into a retail crisis, which is dampening the profitability of many US retail stores. And, investors want nothing to do with retail stocks until these companies can fix their “shrink” problem.

Since Aug 15 this year, as earnings started trickling in for major retail store companies, the S&P500 index has lost just -3.7% over the past month and a half. In the meantime, the retail heavy VanEck Retail ETF RTH 0.00%↑ is down -10.3% during the same period. Any company that mentioned “shrink” in its earnings reports faced the heat from investors, with a few exceptions.

So naturally, I decided to dig deeper to understand how deeply the shoplifting crisis is affecting retail companies in the US and their business performance. But first, lets understand how the industry feels about inventory shrinkage.

What are the largest retailers saying about the damage inflicted on their businesses by the shoplifting crisis?

Earlier this year, Target advised its investors that inventory shrink will cost $500M more compared with a year ago. Last year, Target lost $763Mn to inventory shrink. Furthermore, yesterday, Target announced that it will close 9 stores in major cities across the country, citing violence, theft and organized retail crime.

“We cannot continue operating these stores because theft and organized retail crime are threatening the safety of our team and guests, and contributing to unsustainable business performance,” Target said in a news release.

Target is not alone. Home Improvement retailers, such as Lowe’s and Home Depot also see “shrink” affecting their revenues and creating pressures on earnings in the back half of FY23. Lowe’s explicitly stated that “shrink” “was worse than expected impacting product margins by 30 basis points”. Footage like these on social media further corroborate what executives of some of the largest well-managed store chains have to say while warning investors.

Discount stores are also facing the brunt of increased “shrink” on their profitability. The executives at Dollar-General went on record to say that “With sales and shrink not where we want them to be, we have evolved how we are thinking about the rest of 2023”. Dollar General said “shrink” has cost them $100M so far and they do not see the outlook improving this year. The discount store’s stock has shed -33.8% since the last earnings call.

The shoplifting crisis is costing ~$100B in lost revenue

According to the National Retail Federation, retail theft is nearly a $100B problem in the US. The National Retail Federation (NRF) is a US-based retail trade association whose 3.8 million members include department stores, specialty/discount/electronic/grocery stores, retail distributors & wholesale/independent retailers.

The NRF is of the opinion that “shrink” is more systemic and not just restricted to brazen smash-n-grab incidents that we’ve all come to know of. Unlike shoplifting events where an individual steals for personal consumption or use, there has been a dramatic increase across the nation in the number of large-scale, targeted thefts using methods of coordinated and planned attacks on retailers. These incidents are labelled as “Organized Retail Crime” (ORC).

While retail shrink encompasses many types of loss, it is primarily driven by theft, including organized retail crime. Theft - both internal and external, accounts for nearly two-thirds (65%) of shrink overall and up to 70% in some retail sectors.

Is shoplifting/ORC the only factor to blame for the massacre in retail stocks?

While a majority of the retail industry concurs on the proliferation of ORC and inventory shrink, a few industry players differ from their peers. When asked about the issue of retail theft on a conference call with analysts, WMT 0.00%↑ Walmart CEO Doug McMillan’s said “We do think that in some jurisdictions here in the U.S., there needs to be action taken to help protect people from crime, including theft.” Walmart’s CFO, John Rainey said that retail theft had increased “a bit” this year, and it also increased last year. “It’s uneven across the country — it’s not in every market,” he added. “Some markets are higher than others”. Mr Rainey has a point.

A research study from CapitalOne Shopping looked at the impact of ORC by states in the USA and computed revenue lost per capita from ORC. The number one state to lose out the most Revenue Lost Per Capita from ORC should not be surprising - California.

There is no denying that retail theft, or broadly ORC is unacceptable and detrimental to society’s economic output. But the problem isn’t as clear-cut and evenly spread out, as retailers and trade groups have made it seem.

In fact, there are may be other exogenous factors at hand that may be impacting the sales of retail companies. For example, just take a look at the rate at which inventory has been growing at most retail companies and you will already start to see some trends.

Retail stores where Inventory levels grew at an alarming rate in 2022 have seen their stock prices cut in half or more. Stocks like Dollar-General DG 0.00%↑ , Dollar-Tree DLTR 0.00%↑ & Dick’s Sporting Goods DKS 0.00%↑ are among the worst performers of the year.

Target TGT 0.00%↑ , Home Depot HD 0.00%↑ were already penalized by investors in 2022 for their lack of efficiency to manage their inventory levels. Foot Locker FL 0.00%↑ has had it the worst because it too has been struggling to manage its inventory levels.

This begs the question: Why is the inventory at such high levels at these stores (especially when the management is claiming that they are facing headwinds from inventory shrink fueled by retail theft and ORC)?

High inventory levels can be a problem for retailers

A retail store having a high inventory level is not always good news.

It means that all those items that you see stocked in a store shelf at a Walgreens or the shoes displayed at a Foot Locker store waiting to be bought by shoppers are, in reality, not getting bought. Worse, there is probably a pile of products that is stored in the warehouse/stock room. Excess inventory is a problem for multiple reasons.

The products in the excess inventory may get damaged, expire or go bad. This leads to increased costs for the business holding the excess inventory.

More inventory available means that there is a higher potential for loss or theft.

Excess inventory correlates with the financial reality that the retailer is not effectively selling its products or is inaccurately ordering inventory.

When faced with excess inventory, some retailers will mark down prices and offer promotions to shoppers in a bid to entice them to buy. While discounting can hurt margins, it is still better than having to discard the items completely and write them off as a loss. In fact, companies like TJ Maxx TJX 0.00%↑, Ross Stores ROST 0.00%↑ and Burlington Coat Company BURL 0.00%↑ often use steep discounts to get rid of excess inventory and are able to grow their revenues and margins profitably.

Today, it is becoming increasingly evident that excess inventory levels is secretly becoming the number one metric that Wall Street uses to judge the performance of a retail company.

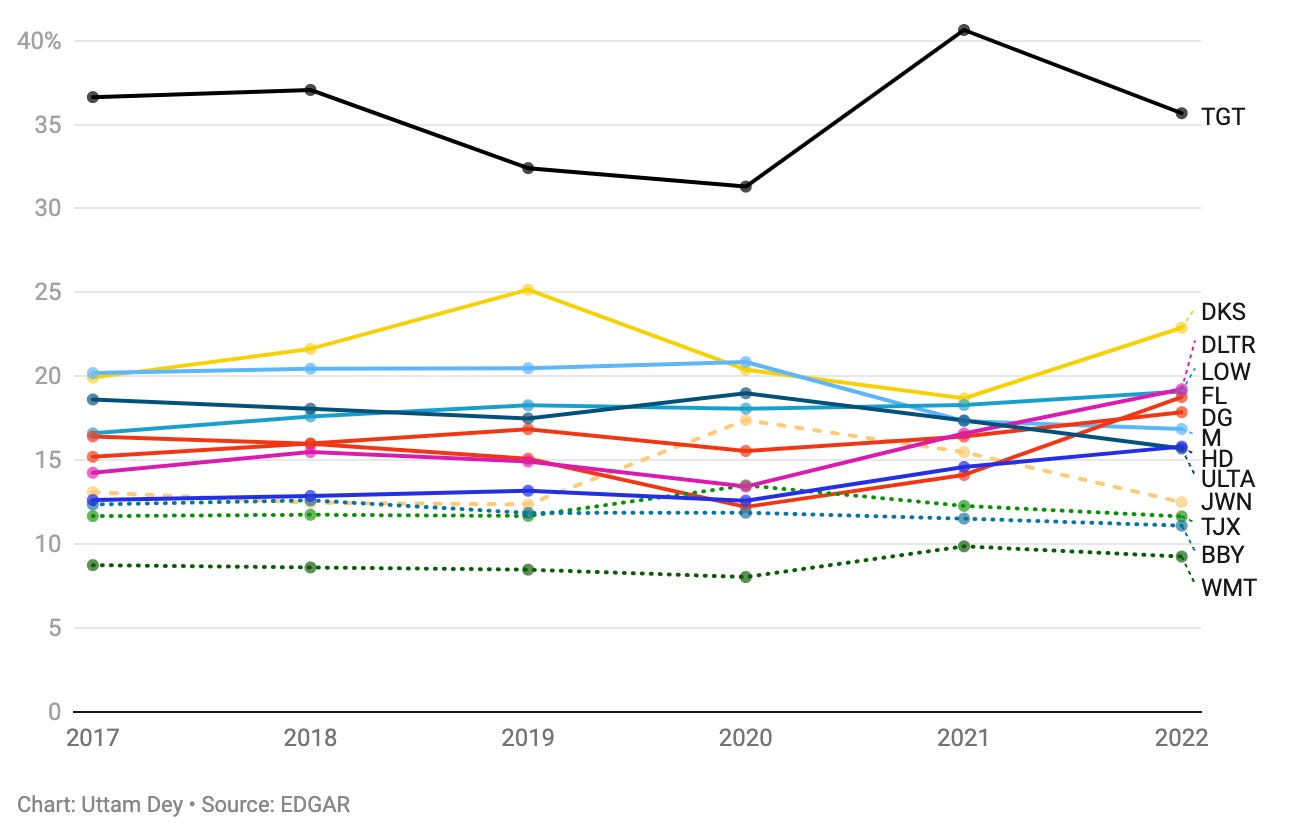

The following chart illustrates the trend of the Inventory-to-Sales ratio for each company over time. The Inventory-to-Sales ratio measures the value of inventory units the retail store buys versus the value of sales made at the store. It is a measure of the retail company’s efficiency.

The companies with higher trending Inventory-to-sales ratio are getting punished and those with lower trending or relatively stable inventory-to-sales ratio are rewarded, more or less. Target is in a league of its own with Inventory-to-Sales ratio going as high as +40%. No wonder its stock price had the rugs pulled from under its feet.

A rule of thumb is that if the inventory-to-sales ratio of a retail company is trending higher, then big discounts are probably on the way soon because they have to get rid of the excess inventory, before it gets bad.

Its important to note that companies such as Macy’s M 0.00%↑ & Nordstrom JWN 0.00%↑, which have better Inventory-to-sales ratios (versus their peers) are still seeing their stock price plummet after their Q2 earnings last month.

Why? This brings us to the resilience of the US consumer, that might finally be giving away.

US Consumer Health might also be to blame for the Retail Weakness

If there is anything we learnt since the US economy re-opened (after the pandemic), it is that the average consumer has changed their shopping preferences. The recession that was supposed to take place in 2022-2023 ,was the most anticipated recession of all times. As a result, consumers quickly adjusted how & where they spend their money. But, is the US consumer still resilient? Let’s find out.

Many retail companies issue co-branded credit cards to their customer base. When the economy is healthy, consumer spending is healthy and credit card debt is in line with the overall economic growth. Since consumers are resilient, they are able to pay their credit card bills on time.

However, since 2022, the US consumer is getting squeezed on rising prices of goods and services, higher interest rates and the pandemic savings drying up. As a result, the US consumer has increasingly tapped into credit card debt to meet their daily needs. While the US economy is still growing and the labor market is strong, the US consumer is feeling the squeeze nonetheless and delinquency rates are starting to go up.

Matt Bilunas, CFO at BestBuy BBY 0.00%↑ told investors that revenue from the co-branded credit card segment contributes 1.4% of revenue. Earlier, this segment was a tailwind in the first half of 2023. However, in the back half, they see it as a headwind as delinquency rates pick up, noting “net credit-losses actually turned higher than they used to be”.

Executives from the GAP store GPS 0.00%↑ also explained that they’re working with their credit card provider to adjust their underwriting strategies to make sure that they are mitigating risk of higher delinquencies.

To add to delinquency risks, retailers are concerned about a myriad of lingering risks that might further pull down sales. Student loan repayment restarts. Excess savings from the pandemic is drying up. And consumers are increasingly shifting their wallet spend away from retail goods and towards services.

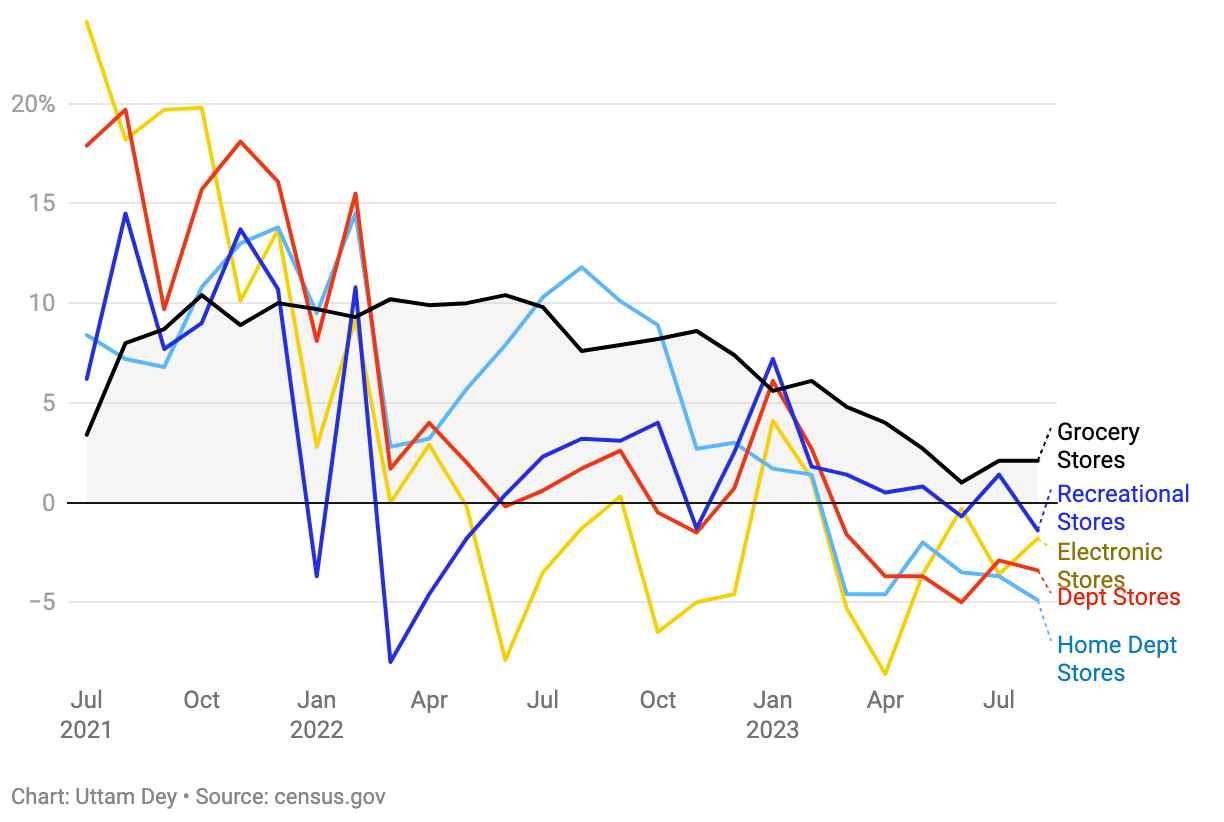

But the BIGGEST CONCERN of allis that the general sales direction is slowing. The chart below validates their concerns.

US Retail sales for most retail stores in the US started precipitously dropping and are showing no signs of real recovery. Shoppers have been aggressively cutting back spending at these stores and are adjusting their spend towards groceries and other one-off items. No wonder Target has re-prioritized their strategic roadmap towards grocery items.

Closing Thoughts

Organized retail crime is undoubtedly a systemic problem in retail, that is threatening the safety of the employees and customers at the retail stores and contributing to unsustainable business performance. However, there is also one equally, if not more daunting factor contributing to the weakness in US retail. And that is, the US consumer demand is showing signs of weakening , in the face of tough macroeconomic conditions.

While we trust that the retail bodies and lobbies continue to act in the interest of the respective retail institutions, we also hope that institutions in the retail industry prudently steer their ship away from the depths of inventory mismanagement and eventually make their firms investible again.

Amrita & Uttam 👋🏼👋🏼

Perhaps shoplifting is blamed for many of these corporations collapses?