PayPal attacked Apple in 2014 with this ad. 9 years later, PayPal has fallen behind. Can it build back again?

PayPal once a "badass" has fallen behind as Apple Pay has grown its active users at an exponentially faster rate than PayPal. The stock has fallen out of favor & the management scrambles to innovate.

At a Glance

PayPal spun off from eBay in 2014 to operate as a separate payment entity. Dan Schulman was hired as CEO in September that year to lead the company through the IPO stage and spearhead the company forward.

However, before Schulman arrived, PayPal had launched a series of attack ads against Apple Pay in response to the payments company being left out of Apple Pay’s lineup of payment providers. Apple Pay initially included payments processors such as Mastercard, Visa and American Express, but excluded PayPal.

Karma comes full circle in 2022 as the meteoric growth of Apple Pay continues to persistently weigh down on PayPal’s earnings.

PayPal has marked 2023 as their year of transformation. In addition to expanding into newer areas such as crypto, the fintech company also hired a new CEO Alex Chriss after their previous CEO, Schulman stepped down earlier this year.

Investors want the new CEO to prioritize revenue growth over profit. Until then, expect the stock to languish at the bottom of the payment industry’s pecking order.

On September 30, 2014, PayPal announced that Dan Schulman would become its new CEO. On the same day, the company also announced that it would split from eBay to run its operations on its own as a separate entity. eBay had finally caved in to the pressure campaign that an activist investor Carl Icahn had been pushing in its boardroom to spin off PayPal since it was growing faster than eBay.

For Schulman, his job was already set — to take a company that was already growing its revenue annually at a 20% rate and continue to expand it to become the biggest digital payment platform in the world. PayPal had already made several acquisitions before Schulman’s arrival with Venmo and Braintree being some of the noteworthy acquisitions. But the fintech landscape was evolving rapidly by the day and Schulman knew PayPal had to keep up.

From getting a new CEO to launching a publicity attack on Apple, PayPal was on “badass” mode in 2014

By the end of 2013, it was an open secret that AAPL 0.00%↑ Apple was working on its own digital wallet service, internally code named Project Stockholm, which would be embedded within the iPhone. But what was not known at the time was that PYPL 0.00%↑ PayPal was selected as one of the chosen partners to integrate with Apple’s digital wallet.

Surprisingly, in February 2014, PayPal suddenly announced that it had reached a deal with Apple’s direct competitor, Samsung Pay to integrate with the Korean phone company’s digital wallet. Caught off guard, Apple’s SVP, Eddy Cue started holding talks with banks and credit card companies to add their cards into Apple’s digital wallet.

Unfortunately, Apple was hit with a scandal in August 2014, where the iCloud accounts of prominent celebrities such as Jennifer Lawrence Kate Upton, Ariana Grande and others were hacked and their nude selfies were posted online.

A week later, Apple announced its digital wallet, Apple Pay with MA 0.00%↑Mastercard, V 0.00%↑ Visa and AXP 0.00%↑ American Express signed up as payment partners. However, Apple Pay had one noticeable payment partner omission- PayPal.

And within a week of announcing Apple Pay, PayPal published front page ads in newspapers mocking Apple’s mishap with nude celebrity selfies.

In 2022 Apple came back with vengeance at PayPal as its Apple Pay saw a meteoric rise in active users.

When Apple launched the iPhone 6 in 2014 for large-screen smartphones, it seemed natural that Apple Pay would be as much as a runaway success as the iPhone 6. But while the iPhone 6 was a smash hit, it took quite some time for Apple Pay’s adoption to take off. The chart below shows how Apple Pay quietly caught up from behind to overtake PayPal in active users since 2016.

Until PayPal’s fatal FY-21 earnings report published in February 2022, no one was truly paying attention to Apple Pay’s meteoric rise. But as the active user base at PayPal and its competitors in Cash app’s parent, SQ 0.00%↑ Block Inc started flatlining, Apple Pay continued to see explosive growth in its user base. Since 2016, Apple Pay has grown its active users at a 48% CAGR (compounded annual growth rate). In comparison, PayPal has seen active user grow at only 14% CAGR since 2016.

If someone had told PayPal’s executives in 2014, that publishing the advert would come back to haunt them later, they would have been laughed it off. In fact, right after Apple’s 2014 announcement of Apple Pay, PayPal’s Senior Director of Communications at the time, Rob Skinner told TechRadar:

“We’re quite surprised that Apple Pay has limited functionality. You can’t expect people just to swap their leather wallets for digital ones, you have to offer more and there is nothing to reward loyalty or provide offers or anything built in with Apple Pay.

It’s much more difficult to do payments than to keep a live stream working!”

Cheeky jibe, yes — But PayPal has a history of taking competition head-on.

Will PayPal be able to turn around its business in 2023-2024?

With the stock trading at 9 times its forward earnings which is almost at a 50% discount to the 17 times forward earnings of the S&P 500 Index, it is fair to say that investors have lost confidence in PayPal. Much of that angst comes from the fact that PayPal had fallen asleep at the wheel and allowed Apple Pay to overtake itself. But PayPal is no stranger to competition and has been gradually making moves this year. Let’s take a look at some of the latest areas that PayPal has been building on in order to rebuild its business and investor confidence.

🛒 E-commerce

Last year, Amazon announced that users could start paying for Amazon orders using Venmo checkout. At the same time, PayPal has also launched package tracking features similar to AMZN 0.00%↑ Amazon and SHOP 0.00%↑ Shopify’s tracking features to add incremental value to the user’s online shopping experience.

💳 Payment Integrations

Most recently, PayPal announced that its credit and debit cards, including Venmo cards, will be available to add to the Apple Wallet and can be used to make tap payments using an iPhone/Apple Watch or online with Apple Pay. (Looks like the 2 giants finally called peace? 😉).

Following this announcement, Morgan Stanley analyst James Faucette noted the following:

"We believe the news should be a modest relief to investors, as concern around share loss to Apple Pay has been a key debate around PYPL amid Apple Pay's faster growth, heavier usage among younger consumers, and unique tech advantage”.

🔥 Crypto

As of yesterday November 1, 2023, the payments giant secured regulatory approvals in Britain to offer crypto services in the region. PayPal already offers crypto services in the US. Furthermore, in August 2023, PayPal launched their own stablecoin PayPal USD, which we think is a forward-thinking move for a legacy payments company.

💸 Buy-Now-Pay-Later

PayPal has at least 25 acquisitions till date with the most recent one being Paidy - a Japanese Buy-Now-Pay-Later start up that PayPal acquired in September 2021 to throw its hat in the Buy-Now-Pay-Later ring of competition. With PayPal entering the Buy-Now-Pay-Later space in 2021, PayPal expanded its tentacles into newer business domains it had fallen behind on.

PayPal’s new CEO hire might offer clues to the payment company’s future direction

Earlier this year, Dan Schulman announced his intention to retire from PayPal after serving 9 years at the company. A few months later, PayPal’s board hired Alex Chriss, a veteran of Intuit’s Quickbooks business segment.

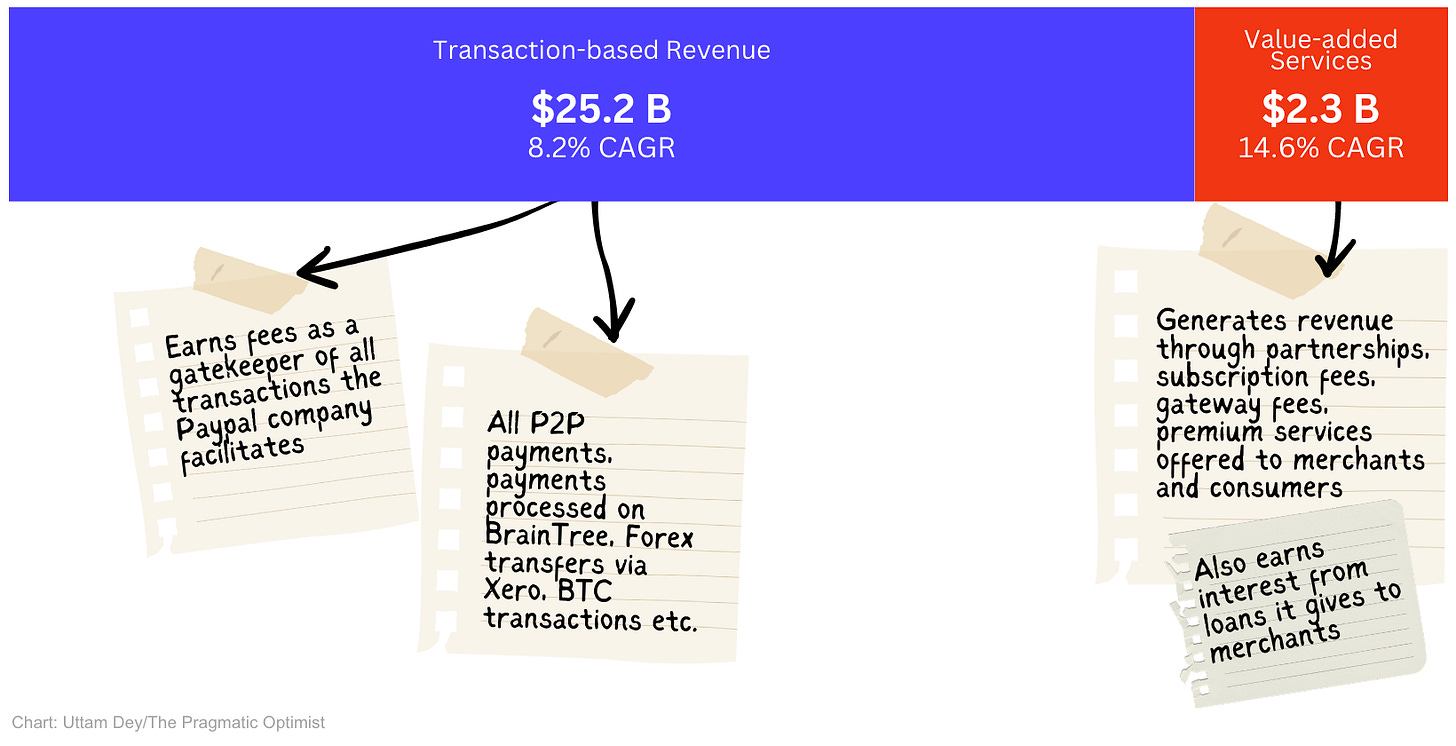

According to his LinkedIn profile, Chriss has a deep background in working with Small and Medium Sized (SMB) businesses and might build on his background to quickly start offering solutions & integrations to SMB clients. These strategies fit very well into the Value-added Services segment of the PayPal’s business that is growing at a much faster rate than PayPal’s Transaction based Revenue segment.

The chart below explains PayPal’s revenue break up on a high level.

Moreover, Chriss is much more bullish than his predecessor was on crypto. He has been tweeting about crypto since 2013 and his most recent tweet gives us some more insight into how he plans to merge his experience in the SMB space and his passion for crypto to steer PayPal into a fresher direction.

What are investors expecting from PayPal?

Last month, SVB Moffett Nathanson’s analyst Lisa Ellis gave the clearest indication of how PayPal might face pressure from Apple Pay and Block’s Cash app in the digital wallet space.

"Looking forward, unfortunately, we expect PayPal's gross profit growth to remain lackluster, in the low- to mid-single digits," Ellis said. "We see the potential for further downside to our estimates, particularly given the strong momentum of Apple Pay, which we worry will begin to benefit from the powerful network effects in payments.” Ellis downgraded PayPal with a price target of $75.

For PayPal and its new CEO Alex Chriss, the good news is that institutional investors still believe the payments company is fixable. As per a recent survey by Mizuho Securities, the majority of institutional investors (78%) prefer to see management prioritize revenue growth over margin expansion and 64% wish for a combination of the PayPal and Venmo platforms.

Based on the guidance that PayPal gave on yesterdays Q3 earnings call, it appears that the company is refocusing its efforts on revenue growth to build back investor confidence once again. While it has still got a lot of work to do, PayPal’s stock was up +4% after market close.

I am not certain if this is true with Apple Pay but I know that PayPal has been known to block users whose ideas don't line up with their own.

Great post. PayPal has faced competition, but has done well to maintain market share. At this price it feels like a no-brainer. The downside is priced in, but not the upside.