The curious case to include defense tech companies in your investment portfolio | Part 2

US military budget is expected to grow 3.6% YoY until 2033. The US is home to the world’s Top 10 defense companies. With VC firms increasingly funding defense tech startups, how can you participate?

««The 2-minute version»»

Some of the worlds largest venture capital firms such as Founder’s Fund and Lux Capital began allocating capital towards startups in defense technology since the start of this decade. But the Russia/Ukraine war really spearheaded venture capital funding into this space.

Why it matters? With defense budgets rising all around the world, military spend has created record order books for makers of military technology. According to the projections from the Congressional Budget Office, the US is expected to increase their defense budget at 3.6% average annual rate from 2023 until 2033. If this plays out as per projection, this will mark the second time in this century that defense budgets are set to rise consistently for the following decade.

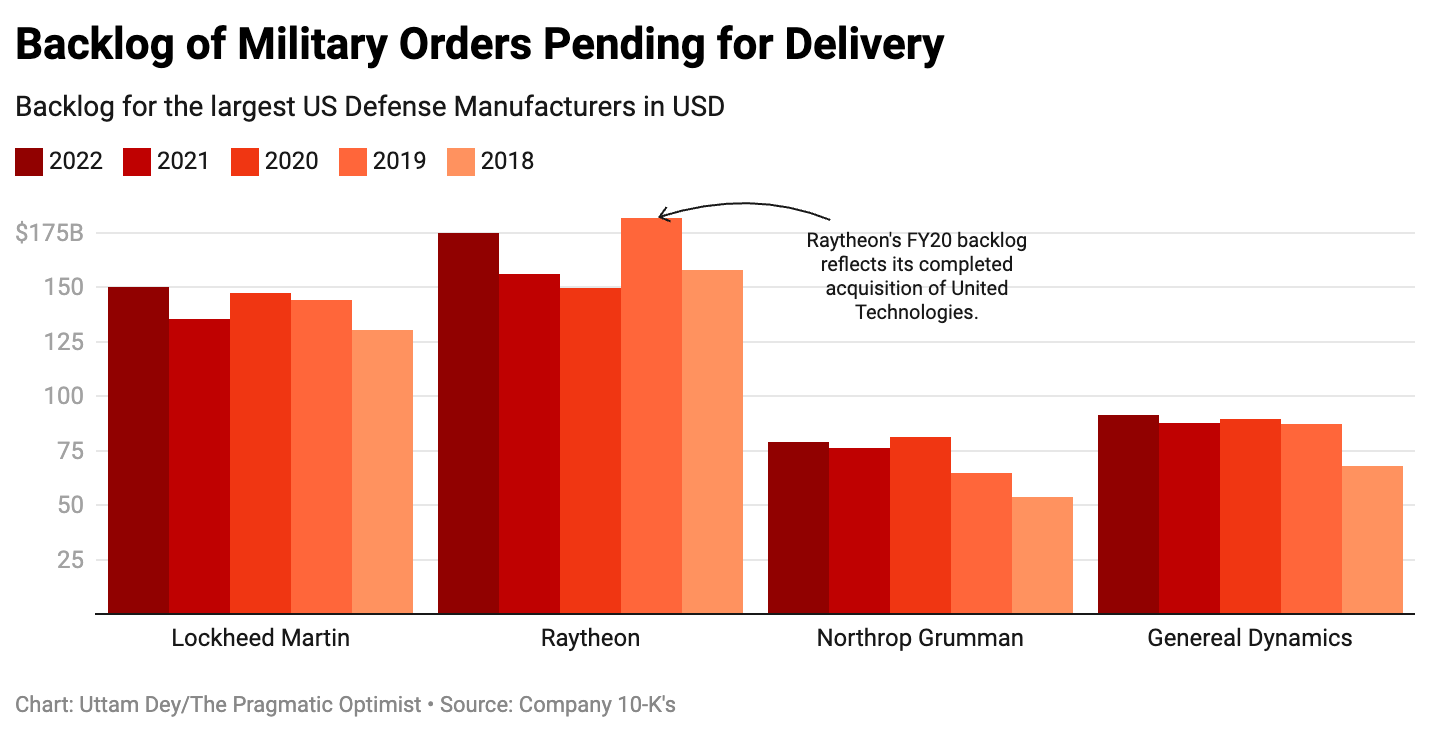

Did you know? The Top 10 defense manufacturers in the world are US companies. This includes Lockheed Martin, Raytheon, Northrop Grumman, Boeing and General Dynamics.

How can you participate?

If you are investing in individual companies, the key metric to look at when you assess defense companies is to look at the size of its order backlog. For example, Lockheed Martin states that it expects to recognize approximately 37% of their backlog over the next 12 months and 61% over the next 24 months as revenue, with the remainder recognized thereafter.

You could also choose to invest in defense-sector ETFs that will give you exposure to the defense industry as a whole.

Further, you have the option to explore emerging defense technologies which include unmanned vehicles and cyber intelligence. The Russo/Ukraine war last year and Azerbaijan’s scuffle with Armenia in 2020 showed how wars can be remotely fought using drones and remotely piloted vehicles (RPV’s). This led to a surge in demand for drones all over the world and AeroVironment was one such beneficiary of this demand.

In the previous post, we had outlined how Venture Capital firms around the world were beginning to increase their investment positioning towards Defense Technology. Some of the worlds largest venture cap firms such as Founder’s Fund and Lux Capital had begun allocating capital towards startups in this industry since the start of this decade. But the Russia/Ukraine war really propelled the investments into this space.

In Part 1, there were many questions on how to take advantage of these trends as a retail investor. Before we get into the details, we’ll further explore the defense space at a high level and then delve into some specifics about different defense sectors, emerging trends and key industry players around the world.

Big Picture Time: Breaking out the areas of Defense Spending

With defense budgets rising all around the world, military spend has created record order books for makers of military technology. With the USA being the world’s biggest military spender, currently with an outlay of $877B in 2022, it would be a good place to start at the top and work our way down through the analysis.

According to the most recent projections available from the Congressional Budget Office, the US is expected to increase their defense budgets at 3.6% average annual rate from 2023 until 2033. If this plays out as per projection, this will mark the second time in this century that defense budgets are set to rise consistently for the following decade.

We know how USA’s invasion of Iraq at the turn of this century spurred massive spurts in defense spending in the USA and the world over. Note that there was no immediate increase in 2022 military budgets despite USA providing record military aid to Ukraine in the ongoing Russo/Ukraine War. That is because supplies to Ukraine involved relatively less advanced and mainly second-hand military equipment from existing US military stock.

We also saw how USA’s share in the global trade of military export had risen to 40% since Russia’s invasion of Ukraine. Research by analysts at Stockholm International Peace Research Institute (SIPRI) suggest that most of the spending in the USA is expected to be focused on Combat Aircraft & Armored Vehicles as is shown in the chart below.

The data on combat aircraft and major warships, which have a notably high military dollar value, is particularly telling. As the table above shows, the United States will almost certainly continue to be by far the largest exporter of major arms beyond 2022, especially as around 60% of all combat aircraft currently on order will be supplied by the USA.

The Top 10 Defense Manufacturers of the world are US companies

Given the leadership American manufacturers command in military order books, its no surprise that seven of the Top 10 defense manufacturers of the world are US companies. The rest of the defense manufacturers are from countries such as China, UK, France which also specialize in their own defense equipment.

While Lockheed’s F-16 and F-35 fighter jets are household names in the defense budgets of countries, the Astute class submarine from BAE Systems and Israel’s Iron Dome are some other highly advanced machinery used in warfare.

However, as an investor it is important to abstract feelings of sentiment and think with analytical reason while updating the outlook on longer term investment horizons. Hence for the purpose of this post, we have outlined the one major indicator to look out for when assessing the order books of a defense manufacturing company and reviewing opportunity of returns from capital deployed.

Order Backlog: The Key Metric to Assess All Defense Companies’ Growth Prospects

Order backlog is the most crucial indicator to review when assessing the growth possibilities of a defense manufacturer. Typically when clients enter into agreements with a defense manufacturer, they sign their intent to purchase equipment, products or services and the manufacturer adds the value of these agreements into their order backlog. Based on the engineering complexity or the urgency of their client, defense manufacturers take 1-3 years to manufacture the product and deliver it to their client. Sometimes, defense backlog is also called as remaining performance obligations (RPO). For example, Lockheed Martin LMT 0.00%↑ defines backlog or RPO as:

Backlog represents the sales Lockheed expects to recognize for its products and services for which control has not yet transferred to its customer(s). It is converted into sales in future periods as work is performed or deliveries are made.

Essentially, order backlog gives investors a clue as to the rate at which the company’s revenue will grow in future, similar to how most software companies record their future growth.

Most of these companies will also usually state what percent of their backlog is projected to be recognized as revenue within the next 12-24 months.

For example, according to its latest filings, Lockheed states that it expects to recognize approximately 37% of their backlog over the next 12 months and approximately 61% over the next 24 months as revenue, with the remainder recognized thereafter.

Based on latest analyst estimates, from Refinitiv, this works out to >3% growth in revenue next year. With USA’s defense budgets rising at 3.6% on average per year for the next decade, large companies such as Lockheed provide a solid income and respectable revenue growth.

Alternatively, investing in Defense-focused ETFs provides a way to strip away the need to deeply understand defense technologies and invest into the entire Defense Space as a whole. Here are the 3 largest Defense ETF’s with links to their Top 10 holdings:

Emerging Defense Technologies: Unmanned Vehicles, Aerospace, Cyber Intelligence.

These are newer technologies that are either currently in development or are already deployed in geopolitically tense areas for different purposes. Since most of these technologies are highly critical to national security they are either heavily safeguarded from public scrutiny or are largely hidden from the world for countries to maintain their competitive edge over their geopolitical rivals. Hence, these sectors are mostly un-investible for regular financial market participants & retail investors. However, there are some players that still exist in the public financial markets today.

Take Unmanned Aerial Vehicles (UAV’s) a.k.a drones for example. The Russo/Ukraine war last year and Azerbaijan’s scuffle with Armenia in 2020 showed how wars can be remotely fought using drones and remotely piloted vehicles (RPV’s). This led to a surge in demand for drones all over the world and AeroVironment AVAV 0.00%↑ was one such beneficiary of this demand. The drone company’s backlog more than doubled last year and their management continues to see sustained demand for their products, making this stock a standout winner amongst its peers this year.

The chart below explains the number of hedge funds cumulatively holding defense stocks since Russia’s invasion of Ukraine.

Although a smaller number of hedge funds hold AeroVironment, it still shows how hedge funds are increasingly initiating positions with the drone company’s stock even as some hedge funds trim their positions in other defense stocks.

Aerospace and Cyber Intelligence are some other promising areas in defense with Palantir Technologies being another fan favorite among hedge funds for its cyber intelligence products. If you want deep dives on Palantir Technologies PLTR 0.00%↑ we would recommend checking out

substack which is a treasure trove of information and insights on the company.Here are a couple ETFs that focus on investing in some emerging defense technologies that you can take a look into.

DISCLAIMER: This is solely our opinion based on our observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!). Also, the author(s) have a position with RTX.

Great coverage, thank you!

P.S. don't forget, you need Maverick also in your arsenal ... he can go inverted and show the birdie to the enemy ;) :P :> ;) :)

Extremely informative!