The US Housing Market is in a gridlock. What happens next? Part 1

As housing demand in the existing home market collapses, new home sales volume picks up. With affordability & mortgage applications at an all time low, is there light at the end of the tunnel?

Welcome back everyone. To all my US readers, I hope you had a wonderful Thanksgiving with your loved ones. And to everyone else outside of the US, hope you had a great weekend.

Since last week, 255 people have joined my budding community here on substack, so a warm welcome to you all and I am very grateful to have you all board. 🙏🏼

««Monday Macro- The 2-minute version»»

Let’s set the stage: 3 years ago, the median existing home price in the US was $294K. Today, the median existing home price is up 33% to $392K. Meanwhile, mortgage rates climbed from 2.99% to 7.3% today.

Result: If you are a homebuyer, expect to pay $20K extra in down payment (assuming 20% down payment). And your monthly mortgage payment would go up from $990 to $2200, an increase of 122% over the last 3 years.

Let’s dig deeper: Today, nominal home price, measured by the Case-Shiller Home price index have created a new all time high, up 2.6% from a year ago. Yet, demand in the existing home market has collapsed, down (40)% from its all time high with inventory below pre-pandemic level. Meanwhile, the dynamics in the new home market is slightly different. While demand has picked up in the new home market, homebuilders are slashing prices to move inventory, resulting in the median prices for new homes down (15)% from its peak.

On top of that: The US Housing Market is experiencing one of the worst housing affordability crisis, as it costs Americans almost 6 times their median income to purchase a home. Plus, 41% of median income is going into paying for monthly mortgage payments.

Light at the end of the tunnel? As mortgage rates dropped nearly half a percentage point from its all time highs, mortgage applications, which includes purchases and refinancing rose for a third week, as refinancing activity picked up.

Let’s set the stage!!!

3 years ago, the median existing home price in the US was $294K. Today, the median existing home price is up 33% to $392K. Meanwhile, mortgage rates climbed from 2.99% to 7.3% today.

Result: If you are a homebuyer, expect to pay $20K extra in down payment (assuming 20% down payment). And your monthly mortgage payment would go up from $990 to $2200, an increase of 122% over the last 3 years.

The US Housing Market is experiencing a very peculiar phenomenon. Common sense dictates that when mortgage rates go up, housing demand falls, which leads to a decline in home prices. However, in this economic cycle, home prices are holding steady despite falling demand. In fact, Home prices, as measured by the Case-Shiller Home price index climbed 2.6% on a year-over-year basis, setting new records, despite mortgage rates having risen to the highest levels since the turn of the millennium.

The culprit in all of this is a lack of adequate housing supply. With home prices and mortgage rates both rising, the US is facing one of the most severe housing affordability crisis. Many buyers, particularly those seeking their initial home purchase, have now been priced out of the market with concerns that they cannot afford home ownership. As a result, mortgage applications for home purchases have hit their lowest point in 20 years.

➡️➡️➡️This brings us to one of the most contested debates in modern times: Is the US housing market headed towards a 2008 style recession?

While there are experts weighing in their opinions on both sides of the debate, I like to take a data-driven, top-down approach in this matter to understand the “big picture”, connect the dots and then outline a well-balanced thesis. This post is broken down into 3 parts.

Part 1 (Today): We will discuss the current state of the existing and new single family home market in the US.

Part 2: We will dive into key leading economic indicators that may help predict the direction of the US housing market into the future.

Part 3: We will explore how different demographic segments are positioned in the current housing market. We will then take a look at what some of the industry experts are saying pertaining to the future direction of the housing market. I will then outline my thesis for the US housing market and what it would mean for the overall economy.

After declining 5% from its 2022 peak, the US Home Price Index sets new all time high.

When the Federal Reserve started hiking interest rates and reducing the size of its balance sheet, the average national home price index (measured by the Case-Shiller Home price index) fell from 308 in June 2022 to 293 in January 2023. That is a decline of roughly (5)%.

Today, the nominal home price index has created a new all time high at 311, up 2.6% from a year ago.

In the past economic cycles, the home price index has only declined 3 times in the last 30 years.

In the 1990 recession, the home price index declined by 2.2%, affecting 74% of all major cities and it took 37 months for it to make a new all time high.

In the 2008 Great Financial crisis, the home price index declined by 30%, affecting 100% of all major cities and it took 116 months for it to reclaim its all time high.

In the post-pandemic cycle, the home price index declined by 5%, affecting 75% of major cities and it took 11 months to reclaim its previous peak and make a new high.

But, as we know real estate is regional. Since the beginning of the Fed’s tightening cycle, we witnessed average home prices fall across all 20 major US cities. However, there are cities where home prices held up much better than the others as can be seen in the chart below.

Most importantly, out of the 20 major cities, 50% of them have fully recovered with average home prices reaching new all time highs . On the other hand, average home prices in Tampa, Seattle, San Francisco, San Diego, Portland, Phoenix, Los Angeles, Las Vegas, Denver and Dallas are still below their all time highs.

In fact, on a year-over-year basis, the average home prices are rising faster than the national average in the same group of cities where home prices have reached new all-time highs. An interesting observation is that while the average home prices in Los Angeles and San Diego have yet to reclaim their previous highs, it is climbing at a much faster rate than the national average.

Now, let’s dig a level deeper.👇🏼👇🏼

Existing Home Sales Volume has collapsed more than 40%. Amidst tight inventory, median existing home prices are down just 6% from their all time highs.

In the US, there are 2 housing markets. There is the Existing single family home market and then there is the New single family home market. There is also a third one- multifamily housing market. In this post, we will focus our attention on the first two, since single family housing is sometimes seen as a barometer of US Housing Health.

The existing home market is the buying and selling of homes with a previous owner, whereas the new home market is the purchase of newly constructed homes. The existing home market represents 85% of all transactions, so most news headlines focus their attention on this market. On the other hand, while the new home market makes up only 15% of all transactions, it is an important metric for the overall economy because it directly impacts the construction sector and construction employment.

Looking at the existing home market, sales volume peaked in 2020 at 6.7M units. As of the latest reading in October 2023, volume of existing home sales stood at 3.79M units. This is a decline of (43)% from its peak in 2020. Plus, this is the lowest volume of existing homes sold since August 2010.

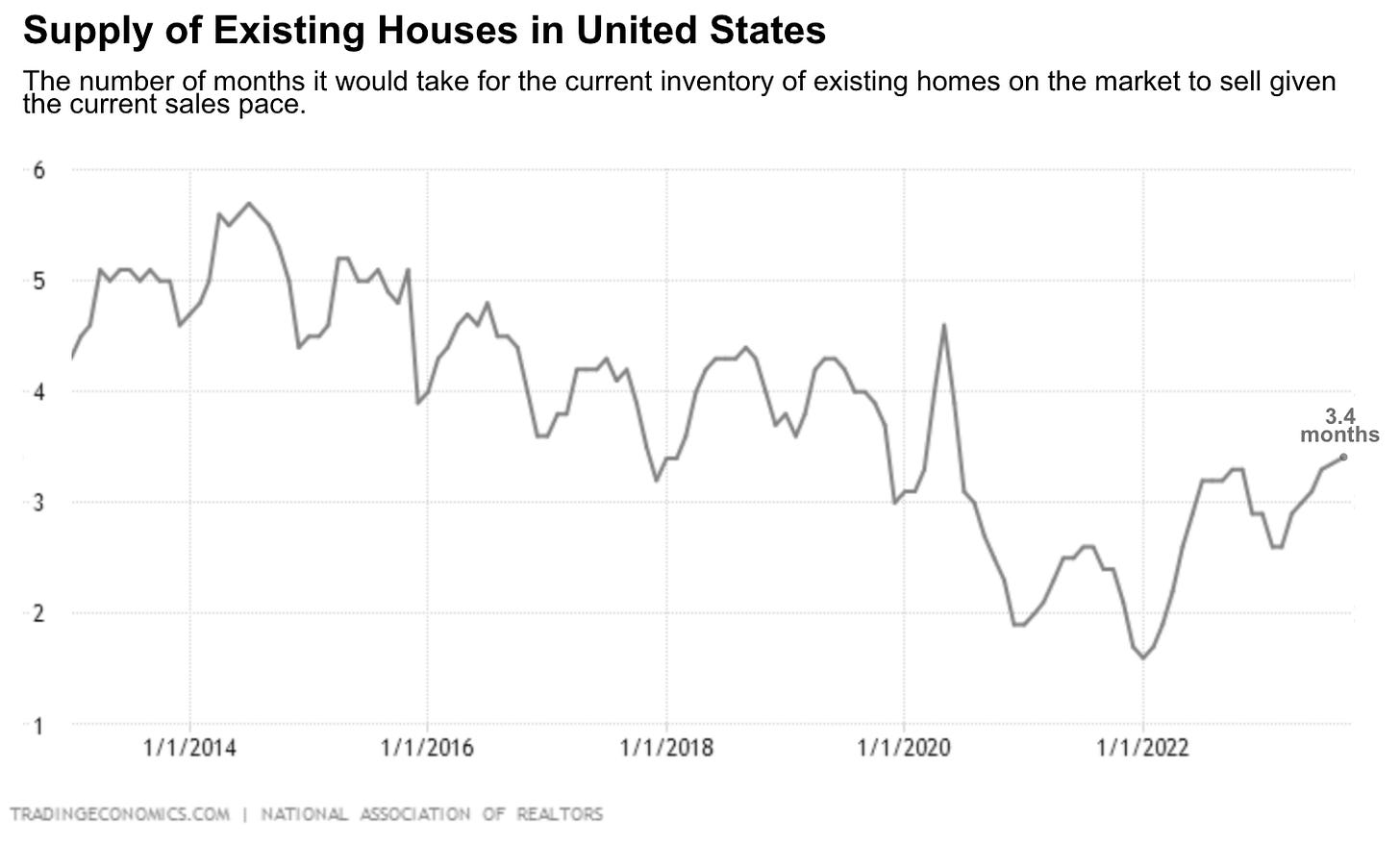

Despite the fact that demand in the existing housing market has collapsed, housing inventory remains tight at 3.4 month’s supply, which is below the pre-pandemic level. While the existing home inventory has somewhat improved from its low in 2022, five months of housing supply is usually considered a balanced market dynamic between supply and demand. 3.4 months supply indicates that existing housing inventory is constrained as homeowners are not selling.

During the pandemic, a record number of mortgages were refinanced. As a result 22% of mortgages today have an interest rate below 3%, up from 1% of all mortgages in 2019. As you can see from the chart below, most borrowers are locked-in to low rates and are not moving.

This has led to an unusual phenomenon in the existing home market, where median existing home prices are down (6)% from an all time high of $416K in June 2022 to $392K in October 2023, despite demand collapsing by (43)% from its peak.

Demand for new homes picks up. Yet, as inventories fall, median price for new homes are on the decline.

The new single family home market is a bit different. New home sales volume stood at 759K in September 2023. While still down from its all time high volume, new home sales volume has grown 38% from its 2022 troughs.

Although sales volume has picked up in the new home market, median price for a new home has continued to fall from its peak at $496K in October 2022 to $418K in September 2023. That is a sizable decline of (15)% from its peak.

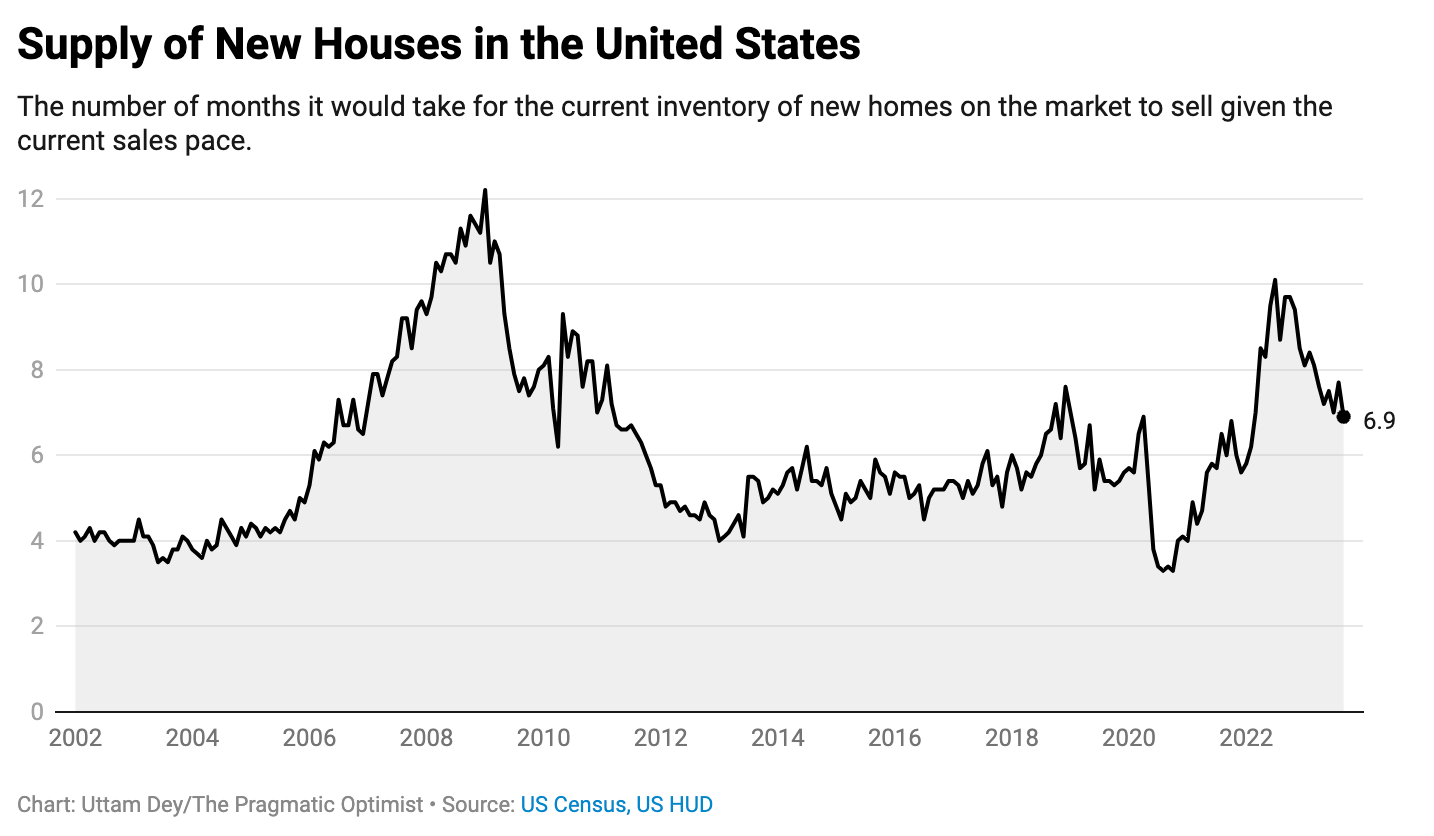

One would think that this is directly correlated to inventory. But that is not entirely the case. While the inventory of the new home market is significantly more abundant than the existing home market inventory at 6.9 month’s supply, inventory in the new home market has actually dropped from 10.1 in June 2022 to 6.9 in September 2023.

When housing inventory gets tighter, with rising demand, we usually see home prices rise. Yet, the dynamic is quite the opposite with the new home market, where median prices have fallen, despite rising demand and contracting inventory.

This means that home builders have been actively slashing their prices to move inventory. As mortgage rates rose to an all time high in 2023 (in this millennium), price cuts have been one of the only ways to lure in potential home buyers into the market, given that inventory in the existing home market is extremely scarce. Remember home builders will only keep inventory on their books for so long as they set prices on the margin.

One more thing to consider is the rate of cancellations in the new home market, which has been on the rise. Prior to the pandemic, the home sale cancellation rate generally hovered at around 12% to 13%. In October 2022, the frequency of cancellations came close to 17% as per Redfin data. These cancellations are not captured in the census bureau, so it is possible that the sales volume in the new home market is overstated, which could be another reason why new home prices are continuing to fall.

To summarize: On one hand, as sales volume has collapsed more than 40% in the existing home market, median existing home prices have declined just 6% from its all time highs. This is driven by record low inventory. On the other hand, sales volume in the new home market is growing, which has led inventory to tighten up from its all time highs. Even then, the inventory in the new home market is above pre-pandemic levels and median prices have come down 15% from its all time high. In fact, the median price of a new home is now just 6% more than the median price of an existing home.

Housing affordability is at its lowest, but is there light at the end of the tunnel?

Meanwhile, buying and paying for a house costs Americans more now than at any point in almost 4 decades. It now takes nearly 41% of the median household’s monthly income to afford the payments on a median priced home, according to research from Intercontinental Exchange (ICE). The last time housing payments cost that much was in 1984.

Housing payments are only part of the problem. The Freddie Mac 30-year fixed mortgage rate as of November 25 was 7.3%. A new homebuyer in October 1981 carried an 18.45% mortgage rate, or 55% of the median income. But the median home price was much lower than today. As a result, it cost Americans 3.69 times their median income to purchase a home in 1984, compared to 5.87 times the median income in 2023. This ratio is higher than at any point since ICE began collecting data, including during the housing bubble of mid 2000’s.

Yet, we may be at a turning point in time. If inflation has indeed peaked and the Fed is done hiking rates, we may have seen a peak in mortgage rates. Mortgage rates tend to move in tandem with Treasury yields. The 10 Y US Treasury bond has fallen steeply this month after hitting a 16-year high in October. As a result, mortgage rates have plunged nearly half a percentage point. With that, the overall index of MBA applications, which includes purchases and refinancing rose for a third week, as refinancing activity picked up.

If financial conditions ease from here on, without a material decline in employment, we may see housing demand pick up in both the existing and new home market. In the existing home market, homeowners may be incentivized to sell as mortgage rates go down, which will bring more inventory to the market. This will ideally create a better supply-demand dynamic in the overall housing market. We can also expect that prices in the new home market will start to increase once again if demand rises sustainably with falling mortgage rates. An increase in new home sales will also positively impact the housing construction industry and employment.

On the other hand, we may continue to see the housing market weaken as mortgage rates fall if it accompanies a rise in unemployment.

In case you are wondering…

For those of you wondering why home prices are shown to have recovered as per Case-Shiller index when the median price of existing and new homes are below their all time highs, it comes down to the methodology of data collection.

At a high level, while Case-Shiller home price index is computed using a 3 month moving average, existing and new home prices are median values that are collected and reported by the National Association of Realtors and National Census Bureau respectively. Plus, there is usually 1-2 month lag between the Case-Shiller Home price index and the existing and new home data prints.

Great stuffs Amrita, in my recent in-depth research into NVR Inc and homebuilders, I estimated that it would take roughly 13 years to close the structural supply deficit. For details you can read here - https://www.sleepwellinvestments.com/p/nvr-a-homebuilding-black-sheep-to

In the writeup, I also quantified the structural problem - roughly, there are:

1.7M newborns and net migrants each year

1M+ new households form each year

2.7M millennials looking for their first home, while we have

3.8M to 6.5M homes short

Homebuilders must build more than the current 1.4M homes/year to close this gap. Assuming it could build 1.7M homes each year, closing the current gap would take 13 years.

Things would be so much better if we didn't let housing become a commodity. I have too many friends that can't afford homes.