Trade Desk’s S&P 500 Inclusion Is Great For Ad Tech

Also, will AppLovin ever achieve S&P 500 glory?

At The Pragmatic Optimist, we help hundreds of investors navigate the evolving AI innovation landscape, identify rock-solid businesses with strong growth trajectories and operational grit, and make long-term investments in the space with proven alpha generating returns.

Become a paid subscriber today

🎥Let’s Set The Stage

2025 is not shaping out to be a good year for the digital ad landscape and the broader ad tech industry, based on performances and anecdotes from H1.

Initial research suggested traditional marketing would marginally taper off this year but growth would remain moderately strong in digital ads. The Trade Desk TTD 0.00%↑, a company that is being gradually recognized as a bellwether for digital ads, jolted markets earlier this year with their shocking Q4 earnings results, leading to a series of downgrades for the entire ad ecosystem.

MAGNA’s Global Ad Forecast, released last month, downgraded the global ad spending outlook in CY25 by 120 bp, following prior downgraded forecasts by other industry players citing tariffs and uncertainties.

And then we have hyper-growth players like AppLovin APP 0.00%↑ which are on the hit lists of at least 3 separate short sellers, hitting the credibility of not just AppLovin but also the digital ad ecosystem.

However, we believe that ad tech is one of the most misunderstood industries on the market, and we have been utilizing the volatility in 2025 to increase our position size in both The Trade Desk and AppLovin.

Earlier this week, the S&P 500 announced the inclusion of The Trade Desk into its index. The question is, will it be enough to turn around the sentiment that is currently souring on ad tech?

Unpacking The Digital Ad Ecosystem

The digital ad system is one of the most misunderstood tech ecosystems in our view. This is something we mentioned at the start of the post, and we will keep circling back to this point as the post unfurls below.

The inner bearings of the ad tech landscape can often be opaque, the incentive system among different digital ad players can come across as ambiguous, and the degree of fragmentation among ad players and their digital ad solutions is high and often overlapping.

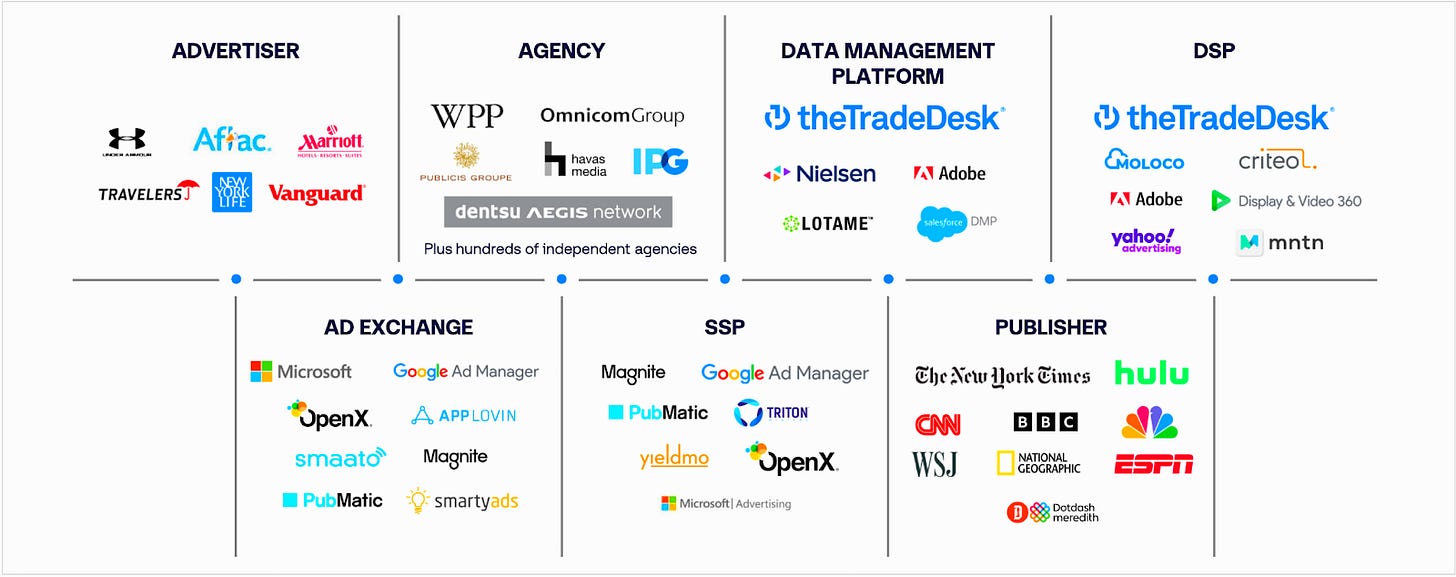

Take the digital ad ecosystem that we have borrowed from The Trade Desk’s point of view. 👇

The entire ad ecosystem exists, in the first place, because of the volumes of ad inventory that is made available through the prevalence of online properties such as websites, social media, games, apps, emails, podcasts, videos, connected TV systems, etc. And that’s still not an exhaustive list of places online to place ads.

The owners of these online properties that are looking to monetize their online presence typically allocate a certain portion of the online property for ads. That could be a segment of a video or a podcast, a part of an email, or a certain percentage of social media posts. This part of the online property that is earmarked for online ads by the online property owner is called ad inventory, and the owner looking to sell that ad inventory to the right buyer is called the publisher.

The buyer who wants to ‘buy’ the publisher’s ad inventory, for a certain predetermined cost and for a predetermined period of time, is called (surprise, surprise!) the advertiser.

Some advertisers are well-acquainted with the intricacies of the digital ad ecosystem and manage the entire process of (digitally) communicating with publishers on their own. Others hire digital ad agencies like WPP Plc WPP 0.00%↑ , Dentsu, etc. to manage the communication with the publisher for them.

Over time, the ‘communication’ between the advertiser or the buyer and the publisher or the seller has gotten complex with the introduction of programmatic advertising, regulation (remember GDPR?), and AI, leading to a multitude of brokers and intermediaries in between to manage the efficiency of the communication between advertisers and publishers.

Ad exchanges were among the first cohort of intermediaries to blossom and facilitate the process of ad buying/selling. Google’s GOOG 0.00%↑ AdX (formerly DoubleClick Ad Exchange) to date is the largest and most popular ad exchange. Ad exchanges like Google’s AdX function as a digital marketplace where online publishers offer ad space, advertisers can bid for this space, and Google takes a cut for facilitating every bid. AppLovin also has their own ALX ad exchange for real-time mobile ads.

Over time, bidding systems got complex, and this introduced additional players like DSPs (demand-side platforms) and SSPs (supply-side platforms). The shortest way to explain the role of both of them is that both DSPs and SSPs act as brokers for their respective parties—DSPs represent the demand side, or advertisers, and SSPs represent the supply side, or publishers. The Trade Desk emerged as the most popular DSP, while Magnite MGNI 0.00%↑, PubMatic PUBM 0.00%↑, etc., are some popular SSP tools.

The Trade Desk IR also took the liberty of throwing in some examples of companies that participate in various capacities across the ad tech landscape.👇

Over the last half a decade, value-added solutions such as DMPs (data management platforms, or just data platforms) also emerged, and solution providers quickly started designing DMP solutions for both demand-side clients, or advertisers, and supply-side clients, like ad publishers. For example, advertisers use DMPs for segmenting and targeting their intended target audience with the right ad at the right time, whereas publishers would use DMPs for optimizing & streamlining their ad inventories.

However, since the pandemic, the proliferation of online usage and consumption has spread beyond traditional digital mediums and given rise to new media formats such as podcasts, CTV, retail networks, etc. (Amazon AMZN 0.00%↑ & Walmart’s WMT 0.00%↑ respective retail ad networks).

This gave rise to ad networks & managed DSPs (see Exhibit A again) that directly collected and created repositories of ad inventory from publishers and sold it to advertisers. In some ad network solutions, ad networks would directly link up with demand-side or supply-side DMPs (data management platforms) and provide their clients (advertisers and publishers) with value-added services that we discussed a few paragraphs earlier. These ad networks helped the advertiser and the publisher bypass the walled gardens of ad exchanges.

The Trade Desk & AppLovin represent some of those companies that haven’t just formed their own individual ad networks. They’re at the forefront of innovation in the ad tech space, pioneering ad tech solutions for the industry and creating strong runways of growth ahead.

Below, we outline our outlooks and price targets for The Trade Desk and AppLovin.

The Trade Desk’s Leads The Ad Tech Industry, Despite Threats

If there are two forces that have shaped the future of the digital ad landscape, they are the rapid proliferation of digitization in the post-pandemic era and the constant back-and-forth in Google’s policy on ditching third-party cookies (Google finally decided on keeping ad cookies).

Google was initially supposed to deprecate ad cookies and, to the frustration of the ad industry, kept reversing their stance on cookies. During that time, The Trade Desk launched UID2 (Unified ID 2.0), the company’s response to Google’s ad cookies, which would allow advertisers to target their intended audience without personally identifying the audience. The solution was not fully able to garner the industry’s support, with ad publishers showing some concern over sharing data with The Trade Desk. But the threat of low industry participation reduced after Google decided to keep their ad cookie policy intact.

In the past year, The Trade Desk’s management has focused their attention on

pushing its managed services DSP solution, called Kokai, to advertisers and agencies. Ideologically, the best way to explain Kokai is by quoting the Ad Exchanger that said Kokai “takes inspiration from the walled gardens it reviles.”

If investors go back to Exhibit A above, they will see how solutions like ad networks and managed services DSPs are allowing advertisers and agencies to bypass the walled gardens of the ad world, allowing The Trade Desk to claim a higher take rate in the advertiser/publisher transaction while pushing down the overall cost for the advertiser due to the elimination of intermediaries like the walled garden of ad exchanges.

We noted how The Trade Desk stunned markets earlier this year with the first-ever guidance miss, and that was attributed to a slower-than-expected rollout and adoption of Kokai. At the time, we strongly viewed this as quarterly noise, which should not really impact the long-term trajectory of Kokai’s value proposition as an alternate ad tech solution to the current fragmented landscape.

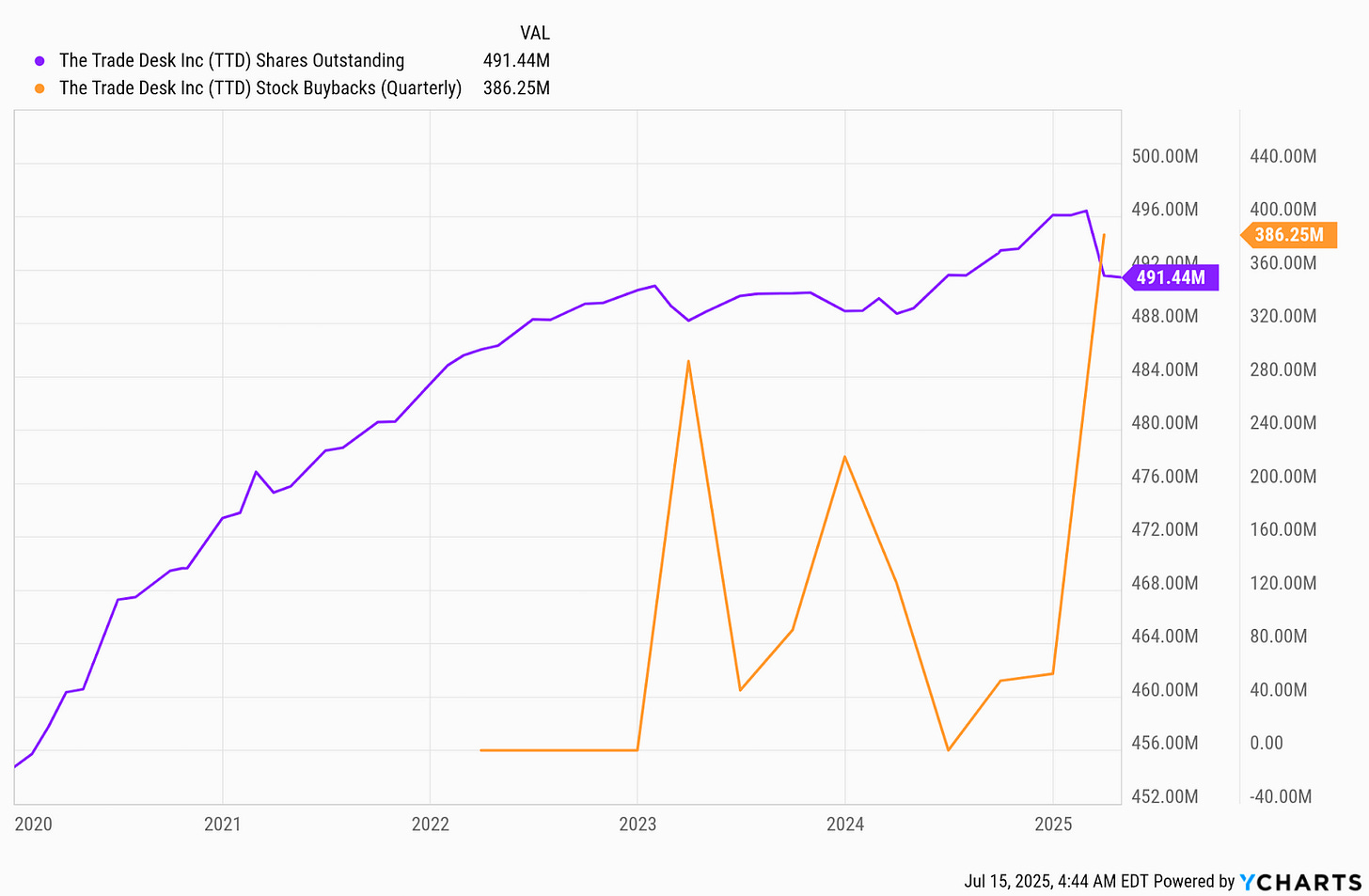

And per The Trade Desk’s Q1 results published in May, we see that management bought back shares of the company at one of the most furious paces in the company’s post-pandemic history.

Of late, there have also been growing concerns about another “walled garden” ad tech provider, Amazon Ads, encroaching on The Trade Desk’s dominance. But this comes already after news that Kokai adoption keeps growing, enabling a higher “market share in programmatic advertising,” while driving “growth amid challenging macroeconomic conditions.”

However, when it comes to The Trade Desk, its Kokai platform has already started seeing growing adoption as per its Q1 earnings report, with two-thirds of their clients already on the platform and management expecting full adoption by year-end.

At the same time, its superior objectivity compared to the walled gardens of Google, Meta, and Amazon should not be ignored, where innovations such as OpenPath make the advertising ecosystem more transparent for both advertisers and publishers.

Along with that, we believe that The Trade Desk has a lot of whitespace to penetrate when it comes to audio, retail, and international markets, in addition to CTV (Connected TV) that represents roughly 40% of its revenue, therefore positioning it well to drive revenue growth in the high teens to low twenties range in the coming few years.

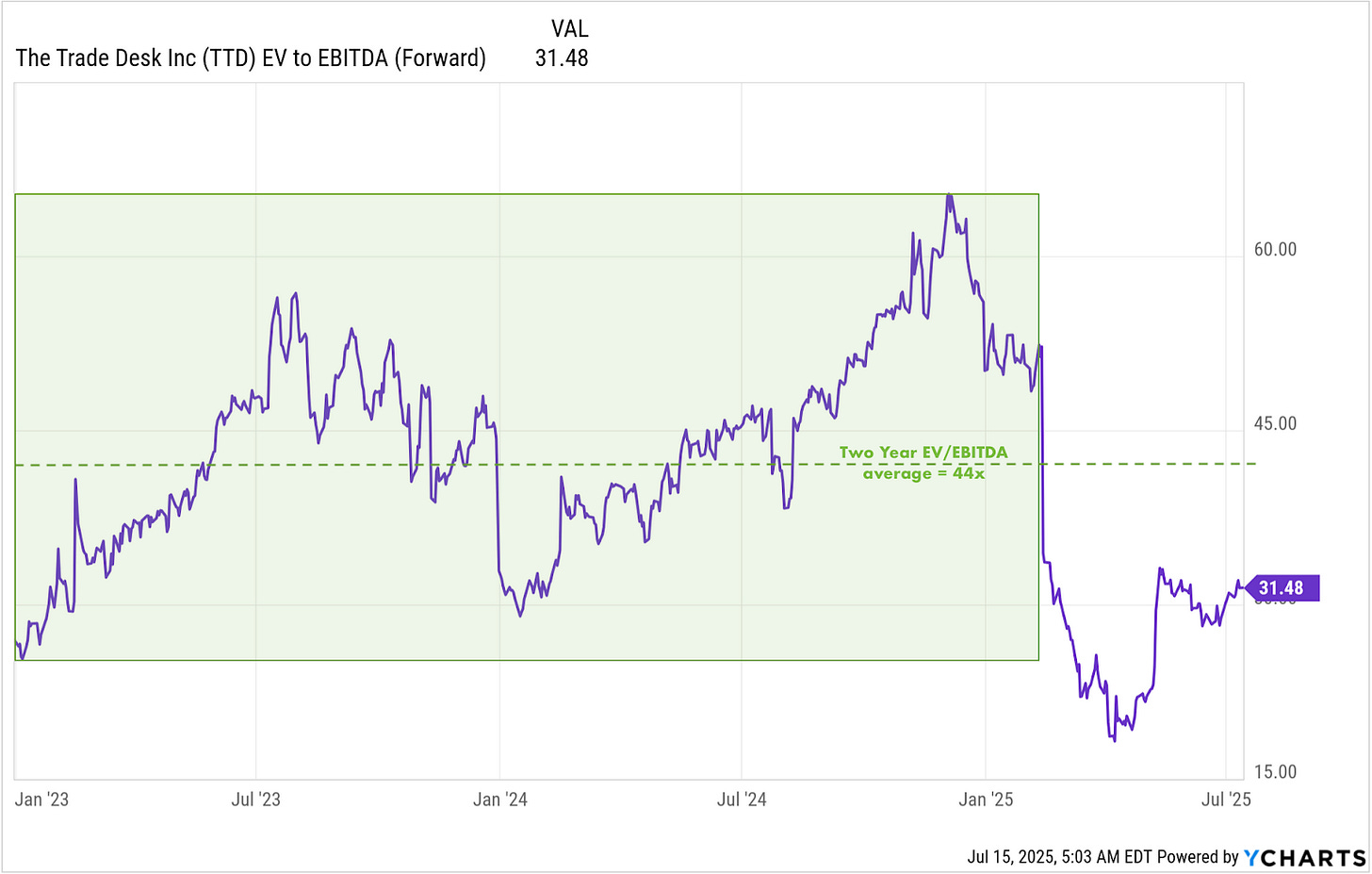

Looking forward, we’re still confident that The Trade Desk can continue growing its revenues at a +20% CAGR pace on an annual basis while growing EBITDA at a pace that is at least twice that of the revenue growth rates. With those assumptions, we believe The Trade Desk looks very attractive at a 31-32x EBITDA multiple. There is enough room for the EBITDA multiple to, at the very least, expand to its previous 2-year average of 44x, implying ~38% growth from current levels or a PT of ~$104 per share.

News of The Trade Desk getting added to the S&P 500 earlier this week is a further catalyst to the market outlook. The Trade Desk will now take the place of semiconductor IP company Ansys ANSS 0.00%↑, which is very close to getting merged with Synopsys SNPS 0.00%↑ after finally receiving all regulatory approvals.

AppLovin: Ad Tech’s Ugly Duckling

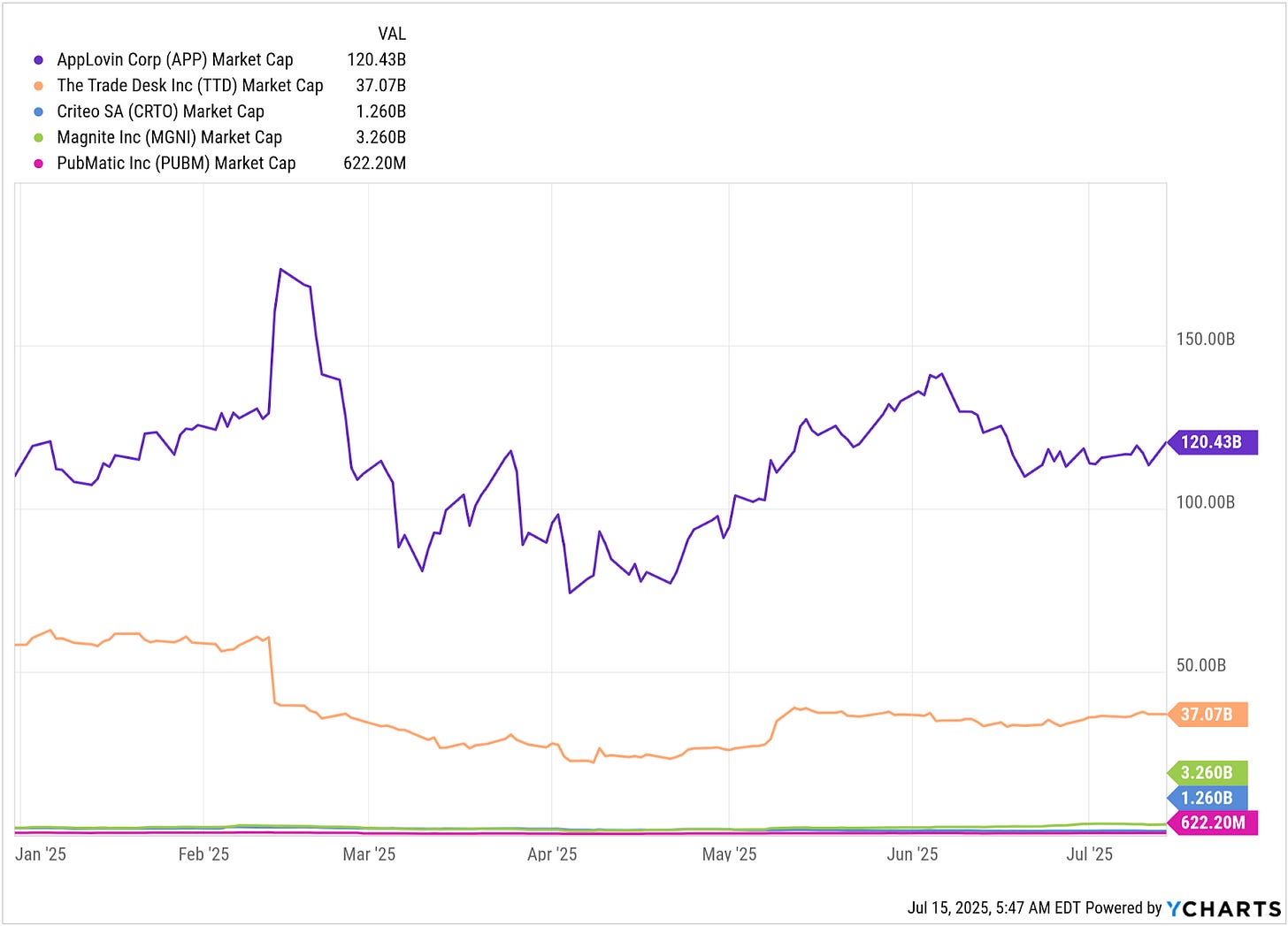

For the longest time, The Trade Desk and AppLovin, two of the biggest ad tech players by market cap, were constantly snubbed from the benchmark index despite their market capitalization and their strong history of profitability.

The Trade Desk getting added to the S&P 500 index represents a big win for the ad tech industry. That’s because markets had higher expectations of AppLovin to be added to the index, solely because of the latter’s higher market cap.

So, with every quarter that passed by where AppLovin’s stock would be snubbed from the S&P 500 index, like in December last year, or in March this year, or even as recently as last month, markets would get disappointed and sell off AppLovin. But long-term bulls never flinched and remained confident in AppLovin’s outlook, with the stock rising through the year.

Therefore, despite the pessimism surrounding AppLovin’s constant snub from the S&P 500 index, the stock continues to outperform the benchmark index as well as the larger ad tech industry.

Much of that pessimism also comes from a flurry of short seller reports published earlier this year targeting AppLovin for its “obscure” ad-tech business and labeling the source code powering AppLovin’s suite of ad tech solutions as a “black box.”

We do not agree with the skepticism in AppLovin’s outlook and continue to believe that pessimists misunderstand AppLovin’s business model and its evolution.

AppLovin was predominantly an app monetization business offering mobile apps a way to monetize their online property via mobile ads. The company got quite good at helping mobile monetize via ads and ad-based tools and even started doubling down on its own business by acquiring apps to boost its ad inventory. That’s when the trouble started.

In 2022, global ad spending had hit a wall, particularly in mobile ad spend, as well as a broader slowdown in smartphone sales.

AppLovin used that year to pivot to the broader ad ecosystem instead of just limiting its ad solutions to the mobile app space. The company also migrated its entire ad tech ad engine in 2022 onto Google’s GCP cloud platform, allowing them to use GCP machine learning models to vastly optimize its internal ad tech engine.

Post the migration, AppLovin re-christened its ad tech engine Axon 2.0. Following the success of Axon 2.0, AppLovin further deepened its relationship with Google by partnering on real-time ad bidding technologies through the former’s Max bidding solution.

Together, Axon 2.0 and Max form the basis of AppLovin’s AppDiscovery platform and address both sides of the digital ad spectrum: advertisers & publishers. The AppDiscovery platform establishes a direct facilitation of the business channel between the advertiser looking for ad inventory and the publisher looking to sell ad inventory, quite similar to The Trade Desk’s approach that we noted in the previous section. One can also see how the company turned around the unit economics of its ad business after the critical backend technology optimization that the company engaged in in CY22.

The company is in the midst of testing out its ad solutions for the e-commerce sector. AppLovin’s management has laid out expectations with “2025 to be a banner year for its e-commerce initiatives,” after observing better-than-expected pilots. This comes after last year’s note from The Information, which reported that consumer brands were very receptive of AppLovin’s AppDiscovery tools for the e-commerce sector after most brands were "burned by higher digital ad prices over the past three years."

The company is so sure about its path ahead of becoming an ad network platform that it is finally ditching its app monetization business, which had been a drag on its hyper-growth phase seen since CY22. It expects to receive ~$900M from the divestments of its app portfolio, including ~$500B in cash.

The road ahead looks very clear to us for AppLovin, and we continue to stay invested in the company after initiating a position in AppLovin earlier this year. AppLovin is expected to grow its EBITDA by ~80% this year to $4.2B, and over the next two years, AppLovin’s EBITDA is expected to grow at a CAGR of 52%.

Given the strong prospect of EBITDA growth, we believe the company is undervalued at the current EBITDA multiple of 29-30x, while it should warrant an EBITDA multiple of 40x.

The room for expansion in the EBITDA multiple implies an upside of ~37% from current levels or a PT of ~$488 per share.

Investors must note that, unlike Trade Desk, AppLovin does carry moderate levels of debt on its balance sheet, with the company carrying $551M in cash+equivalents versus $3.7B in debt and obligations as per its Q1 report.

However, AppLovin’s explosive growth in EBITDA over the years has led to a rapid de-escalation in the gross leverage from remaining at elevated levels above 5x to dropping to below 2x in CY24. Credit ratings company Fitch assigned a stable rating to AppLovin’s debt and noted a similar escalation in the leverage ratio as well. Given our forward outlook of 52% CAGR growth in EBITDA along with the expected divestment of its mobile app business, we believe AppLovin has significant room to further strengthen its capital structure, with the leverage ratio falling to below 1x for the first time in years.

Summary Of Risks & Other Factors

At the moment both companies face significant competitive risks not only from strategic measures being adopted by each company to bypass the walled garden of the current ad ecosystem, which may impact one another, but also from large players that may threaten the +20% growth pace that AppLovin and The Trade Desk usually demonstrate.

We will also be monitoring updates from Amazon Ads and other players as they attempt to win over clients from the companies covered in this post.

Meanwhile, in order for The Trade Desk to reach our price target, we need to see the company making progress with its Kokai platform adoption. Simultaneously, when it comes to AppLovin, investors need to be cognizant of the added volatility that comes with 5% of its shares that are shorted.

Uttam & Amrita

Disclaimer: I/we have a beneficial long position in the shares of TTD, GOOG, APP, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions, based on my observations and interpretations of events and should not be construed as personal investment advice. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

I am slowly catching up on my substack reading after a long time away from the desk. I have been enjoying your recent posts on adtech, cybersecurity, AI networking etc.

Happy to see how your substack has matured into a very high value offering.

Keep up the excellent work and thank you!!