Unwrapping Spotify’s year of frugality🎵

From optimizing its cost structure to boosting net interest income, while diversifying its revenue streams, Spotify's stock is up 138% YTD. Will the growth streak continue into 2024?

««The 2-minute version»»

It is that time of the year again when: Spotify publishes its much awaited “Spotify Wrapped”, so, in the spirit of season, we decided to unwrap Spotify’s financials as the stock has come back roaring in 2023, up 138% YTD.

Here’s the background story: Spotify decided to change the course of its fate going into fiscal 2023, as the stock was heavily punished in 2022 due to high inflation and high interest rates beating down on valuation multiples.

Its first line of attack: Employees. Unfortunately, Spotify workforce felt the brunt of mass layoffs as the company strived to optimize its cost structure and boost efficiency. It looks like it is still not done yet, with Spotify’s management announcing mass layoffs this past Monday, that will affect 17% of its workforce.

On top of that: Spotify optimized its cash to debt structure, so that it increasingly earns more in interest income than paying out in interest expense.

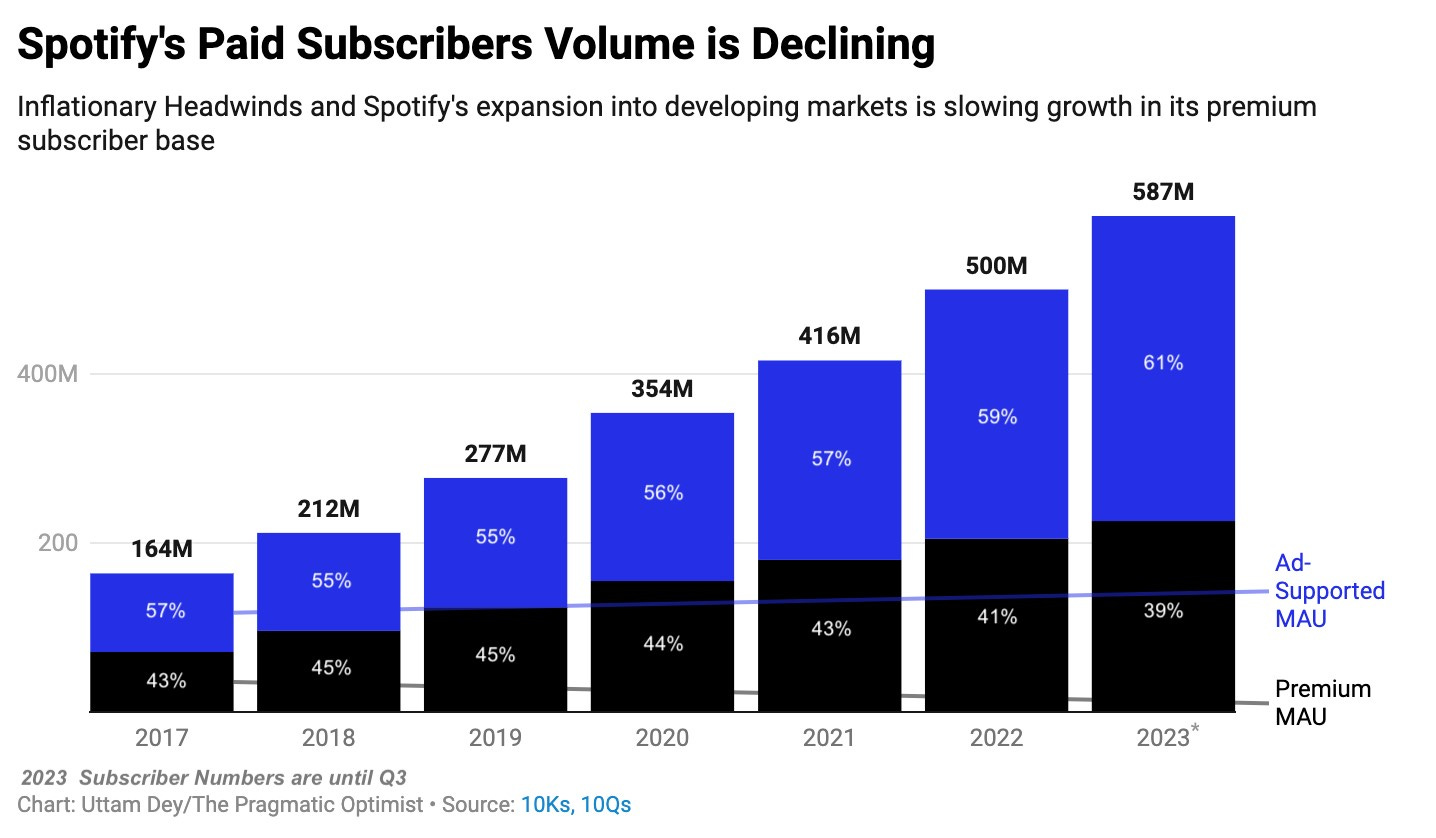

Will Spotify continue its winning streak in 2024? While Spotify has been successful at growing its premium subscriber base while increasing prices and controlling for subscriber churn, there are doubts whether Spotify will continue to see similar growth rate continue as it enters developing markets. Plus, the conversion rate from ad-supported users to premium subscribers has been declining over the past 6 months. However, the company is continuing to innovate, with the introduction of audiobooks to further diversify its revenue streams. This is a particularly smart move given the direction in demographic trend and their preferences.

It is that time of the year when Black Friday deals wind down (for a bit), shoppers catch a break and George Michael begins his annual Christmas battle with Mariah Carey for Top Christmas songs of the year.

For all Spotify users (including me) it is also that time of the year when Spotify Wrapped is published.

In fact, the Spotify Wrapped campaign has been so influential on social media that even Apple and YouTube music decided to release their own versions, with Apple releasing Apple Music Replay and Youtube releasing its YT Music Recap.

So, in the spirit of season, we decided to unwrap Spotify’s SPOT 0.00%↑ financials for the year and take the diagnosis back to the streaming giant. 🎄🎵🎧

Frugality was Spotify’s theme song in 2023.

It was hard watching valuation multiples of tech stocks plummet in 2022 as the Fed was aggressively raising interest rates. Spotify was among them, and it too was not spared. The Stockholm-headquartered company shed 66% of its market capitalization to settle at $79 a share at the end of last year. However, it looks as if Spotify’s 2023 resolution was to streamline its operating expenses and bring back financial discipline.

Employees - the first casualty in Spotify’s flight to frugality

Spotify rang in 2023 by announcing it would lay off 6% of its workforce like many tech companies had started to do at the time. It would later top up on that announcement by expanding its layoffs to another 2% of its workforce. At the time of the announcement, Spotify’s CEO, Daniel Ek had noted - “I was too ambitious in investing ahead of our revenue growth”.

Most recently, as of Monday this week, Spotify’s management announced a third round of layoffs that will impact 17% of its workforce.

Until 2023, Selling, General & Administrative expense (SG&A) would constitute 60% of all Spotify’s operating expense. However, in 2023, the company knew that if it had to rebuild investor confidence, it would be shed off its weight of financial expenses to boost profitability. As you can see in the chart above, Spotify did that by cutting its SG&A expenses which has dropped (3.6)% in the first nine months in 2023 compared to the same time period of 2022.

High interest rates may be helping Spotify’s bottom line

In a note to investors earlier this year, Spotify’s CFO, Paul Vogel mentioned that investors should expect “a meaningful improvement” in operating losses in 2023 relative to 2022. While the company is on track to deliver financial efficiencies so far, the company has also turned around the high interest rate environment to their advantage in what seems to be a growing trend among many shrewd tech CFO’s this year.

Spotify has adjusted their cash and debt portfolio on their books such that they invest their cash in shorter dated treasuries such as 1-3month bills, while reducing the size of their longer-duration debt. As you can see in the chart (above), while Spotify’s interest income has continued to grow throughout 2023, their interest expenses has kept a relatively steady cost profile. This means that their net interest income is growing, which is a boon for net income. The stock is up 138% YTD.

Not everyone is convinced with Spotify’s growth story

Last week, Citibank analyst Jason Bazinet cut his rating on Spotify to Neutral from Buy, calling for investors to be more cautious on Spotify. The stock sold off 2% in response to the downgrade.

One of the main concerns Bazinet has with Spotify is that investors are expecting that company will see rising average revenue per user, while also keeping its subscriber churn rate low. The underlying idea is that the overall paid subscribers will continue to accelerate, thus driving the higher average revenue per user. As of Q3, paid or “premium” subscribers contribute to 86% of total revenue, while ad-supported users contribute to the remaining 14%.

But what is crucial, is that the gross margin from the premium subscriber segment is significantly higher at 29%, compared to the gross margin from the ad-supported subscriber segment at 8%. Bazinet’s concern is stemming from the fact that over the last 6 months, the conversion of ad-supported users to premium subscribers has declined, as Spotify expands in developing markets. This would eventually affect Spotify’s margins.

“It means Spotify’s model is becoming less efficient as growth shifts to less developed markets,” Bazinet comments. “This may pose some risk to Premium gross subscriber adds (additions) unless conversion rates from the ad-supported to Premium service improve.”

What’s Next For Spotify?

So far, Spotify’s bet with podcasts may be paying off with the podcast industry growing at a faster rate in double digits versus. Meanwhile, music streaming still contributes a lion share of Spotify’s revenue.

Projections from Exploding Topics shows that Spotify is expected to gain more podcast listeners in the US market in 2024 and 2025.

At the same time, the company has turned their attention to the audiobook industry as well. According to Morning Consult’s The State of Media & Entertainment Report: H2 2023 earlier this year, 15% of GenZ survey respondents in May 2023 indicated that they had listened to audiobooks, which is 3% more than the number of GenZ respondents who listened to podcasts in the same month.

With Amazon’s Audible audiobook platform growing at 25% in 2022, Spotify is well positioned to capture some market share as it expands its presence.

However, the question begs whether the company’s valuation has gotten too a little stretched after its 100%+ move up in 2023. While we are not going to be doing an in-depth valuation dive in this post, here are the key things to consider if you are deciding whether or not you want to invest in the stock.

On one hand, price increases for premium subscribers have helped to boost revenue growth and improve profitability in 2023. So far, the company hasn’t experienced any material churn, since the price changes went into effect, which proves how sticky the platform really is. This could also be because this was Spotify’s first price hike ever since it started offering its premium services in 2011.

Next, Spotify’s efforts to grow its audiobooks to diversify overall revenue is definitely a move in the right direction, given the general trend of demographic preference. And finally, tightening its balance sheet and focusing its financial discipline by reducing operating expenses by 12% YoY, has definitely helped regain investor confidence.

Meanwhile, the company is expected to grow its revenue by 17% in 2024 and improve its adjusted earnings per share by 165%. Should the overall direction of inflation and interest rates stay steady or decline from current levels, without causing a recession, the company may have upside from here onwards depending on the magnitude of its revenue and earnings beat. On the other hand, if Spotify reports weakening premium subscriber growth, with an uptick in churn rate, as consumers feel the lag effect of interest rates, we most certainly will see some volatility ahead.

I loved it when I discovered the Audiobook feature! Just means I can listen to more books than with my Audible subscription and to me, the subscription now feels a little more value for money as I listen to more books than music (but my husband loves the music and we share an account — not that I don't get endless emails about getting two memberships 🤦🏻♀️). Thanks for this interesting post.

Great analysis on the present and future of Spotify. I feel that YouTube music which is now available with a YouTube premium subscription, may pose a threat to Spotify's growth.