US GDP grew 4.9% in Q3. But CEOs from 5 industries have turned cautious. Is this the peak?

While the USA recorded its largest GDP gain since Q4 2021, CEOs across the financial, logistics, technology & consumer discretionary industries have turned cautious of an impending economic slowdown.

Monday Macro At a Glance

The US GDP grew at an adjusted annualized rate of 4.9% in Q3 2023. This is is the biggest gain since Q4 2021. Meanwhile, 78% of companies in the S&P 500 have reported earnings growth above estimates so far in this earnings season.

Yet, there is a growing sentiment amongst CEOs of some of the largest companies in the S&P 500 that growth may be slowing moving forward, as consumers, businesses and government spending may have seen a peak.

While earnings came in strong for JPMorgan, Citigroup and Wells Fargo, their execs have warned that the good times may be coming to an end. Plus, the 5 largest US banks, with the exception of JPMorgan have been quietly laying off workers through all of 2023.

Earlier this week, when the French payment processor Worldline warned of economic challenges in Europe, shares of Affirm, PayPal & Block tumbled. Meanwhile, Mastercard and American Express have turned cautious after their latest earnings call as they reigned in their forecast for revenue and profit growth.

It’s not just the banking and the payments industry that have become alert. Read below to find out how companies in the logistics, technology and consumer discretionary industries are cutting back spending and lowering their growth outlook for the remainder of the year.

The US economy grew faster than expected in Q3 2023, buoyed by a strong consumer. Real Gross Domestic Product (Real GDP), a measure of all goods and services produced in the US, rose 4.9% on a year-over-year basis, beating economists’ expectations of 4.7% growth rate. The Real GDP increase marked the biggest gain since Q4 2021.

In the meantime, over 49% of the companies in the S&P 500 have reported earnings results for Q3 2023 to date. Of these companies, 78% of them have reported earnings above estimates, which is above the 5-year and 10-year average estimates. As of now, the projected year-over-year earnings growth rate for Q3 2023 stands at 2.7%. If 2.7% is the actual growth rate for the quarter, it will mark the first quarter of year-over-year earnings growth reported by the index since Q3 2022.

Yet, markets have reacted little to the news, with the S&P 500 falling -2.2% during the week ending October 28, 2023. In fact, there is a growing sentiment amongst economists and CEOs of some of the largest companies in the S&P 500 that have reported earnings that suggest growth may be slowing moving forward, as consumers, businesses and government spending may have seen a peak.

In this post, we are going to take a look at companies across 5 different industries, which include banking, payments, logistics, technology and consumer discretionary, where the management is becoming increasingly cautious about about the macroeconomic environment. We will take a look at what is driving the sentiment across the companies and the actions the management is taking to shield themselves from the slowdown.

Big banks may have reported strong earnings but their outlook turns cautionary. Layoffs make this news worse.

While big banks earnings came in strong during the most recent earnings call, their executives increasingly warned that the good times may be coming to an end.

“This may be the most dangerous time the world has seen in decades,” JPMorgan Chief Executive Officer Jamie Dimon said.

“All of these macro dynamics have clearly impacted client sentiment,” Citigroup CEO Jane Fraser said. “September is always a busy month seeing clients, and I’m struck by how consistently CEOs are less optimistic about 2024 than a few months ago.”

The strong earnings results at JPMorgan JPM 0.00%↑ , Citigroup C 0.00%↑ and Wells Fargo WFC 0.00%↑ were driven by a continued rise in interest income, with yields on the long-term bonds reaching the highest point since 2007. Wells Fargo and JPMorgan both said they expect net interest income to grow by more than previously expected in 2023.

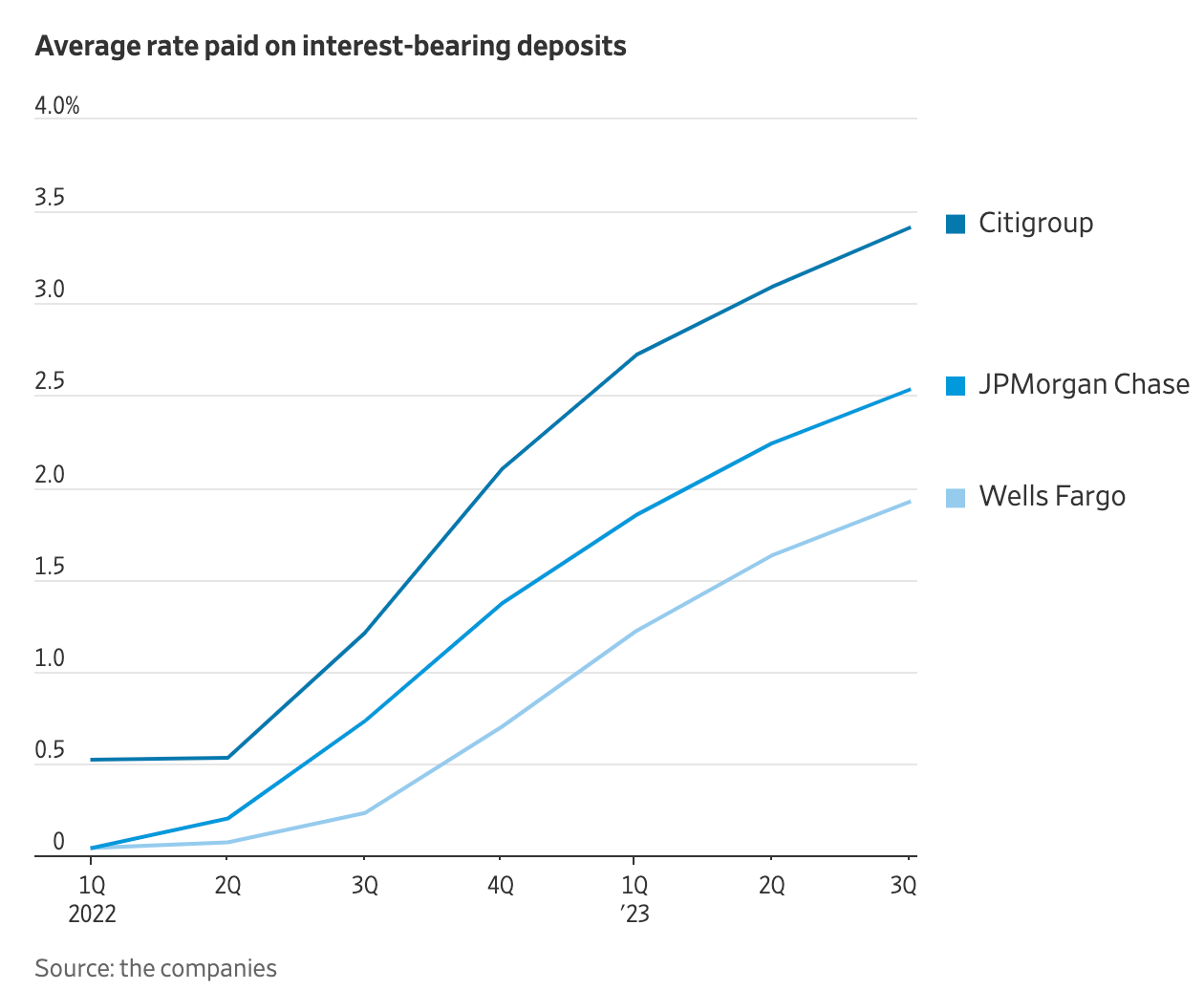

The banks have been able to raise the rates they charge on loans faster than they increase their payouts on deposits. But deposit costs are starting to catch up. JPMorgan is paying 2.53% on its interest-bearing deposits, versus 0.73% a year ago. Wells Fargo and Citi are also paying sharply higher deposit rates.

Plus, consumers broadly continued to spend and borrow, with credit card spending up at all 3 banks. Overall, credit card loans jumped by more than spending at both JPMorgan and Citigroup, a sign that borrowers are carrying over bigger balances each month. This could be a precarious situation if borrowers start to fall behind on loan payments in case their income suddenly falls. As per the latest earnings reports across JPMorgan, Citigroup and Wells Fargo, net charge-offs roughly doubled at all 3 banks compared to a year ago, though they remain a small portion of overall lending.

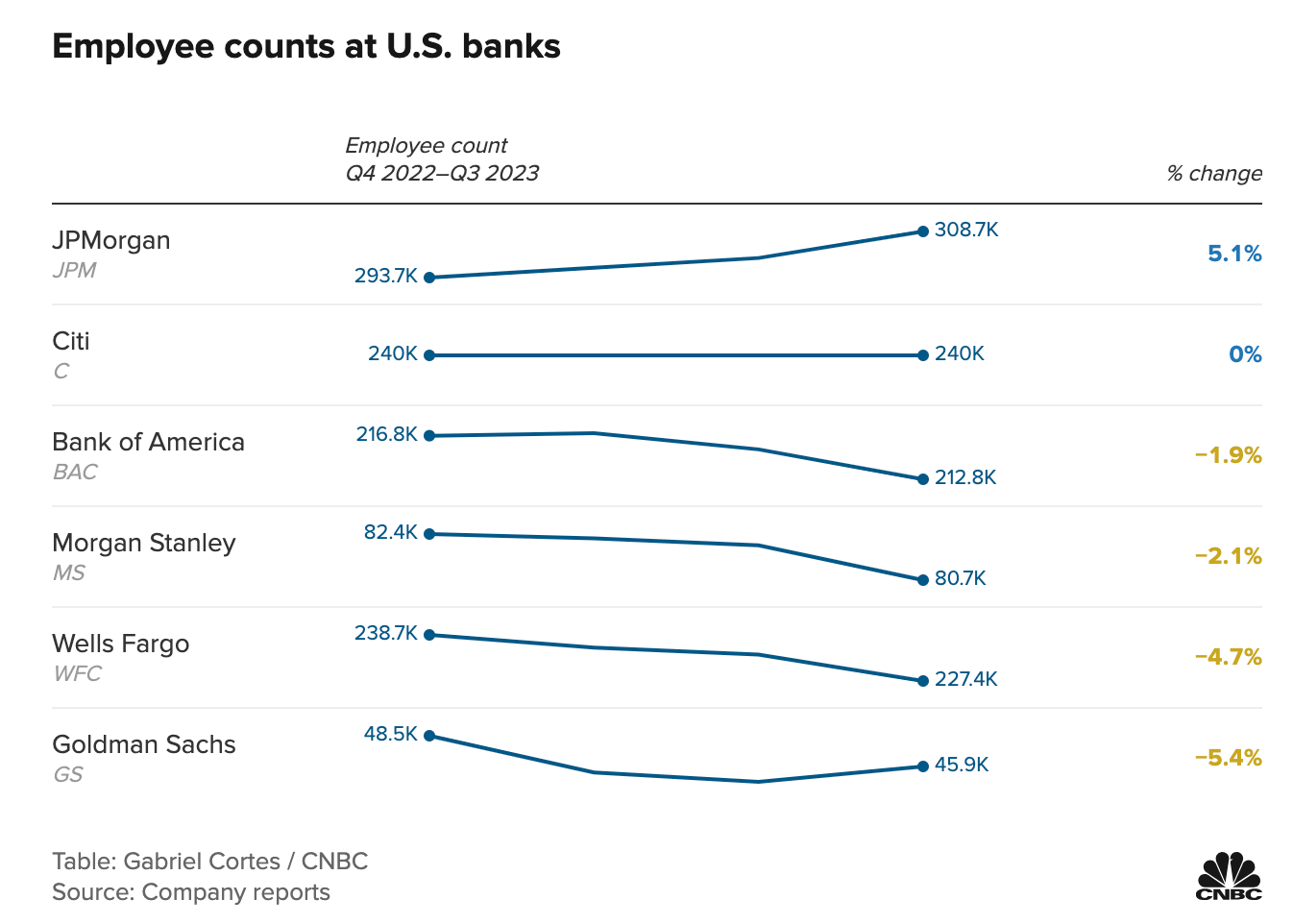

In the meantime, the largest American banks have also been quietly laying off workers all year and some of the deepest cuts are yet to come. In fact, the 5 largest US banks, with the exception of JPMorgan have cut 20,000 positions so far this year.

“Banks are cutting costs where they can because things are really uncertain next year,” Chris Marinac, research director at Janney Montgomery Scott, said in a phone interview. He further stated that job losses in the financial industry could pressure the broader U.S. labor market in 2024, as lenders are poised to make deeper cuts next year as they face rising defaults on corporate and consumer loans.

JPMorgan has been the industry’s outlier, growing its headcount by 5.1% in 2023. However, CEO Jamie Dimon warned about the dangers of locking in an outlook about the economy. He pointed out that the Fed was 100% dead wrong on its economic forecast 18 months ago, when it claimed that inflation would be transitory and insisted on holding interest rates at 0%. As a result, Jamie Dimon reiterated that given the track record of the Fed, he would be cautious about what might happen next year.

In the meantime, the economic growth prospects in Europe is quickly worsening, and as uncertainty mounts, the payment industry is also becoming increasingly cautious.

Shares of Affirm, PayPal & Block tumbled after Worldline warned of economic challenges in Europe. Meanwhile, Mastercard & American Express also turn cautious.

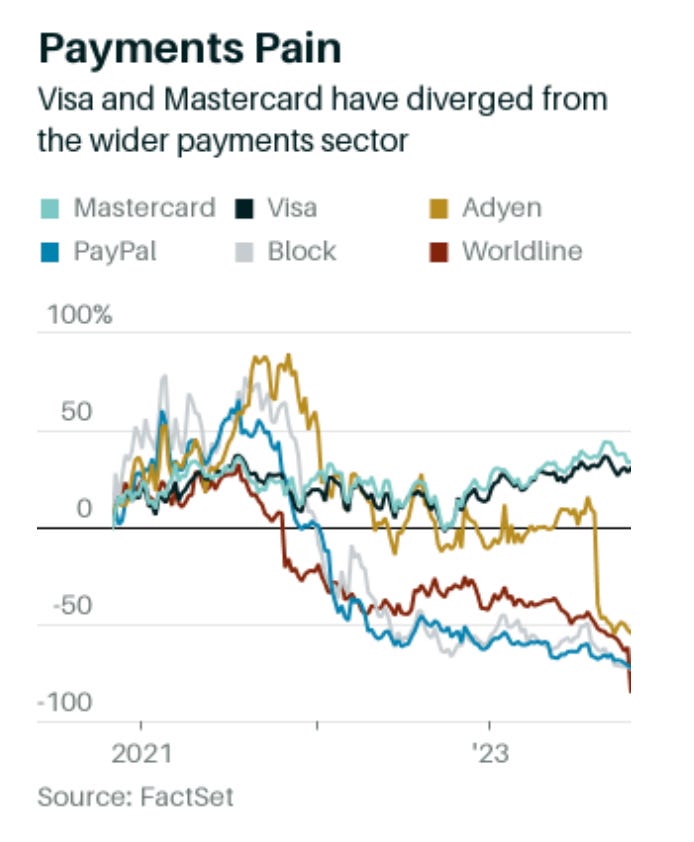

Shares of Affirm Holdings AFRM 0.00%↑ , Block SQ 0.00%↑ and PayPal Holdings PYPL 0.00%↑ tumbled Wednesday Oct 25, after a French financial tech firm WorldlineSA cut its sales outlook and warned of economic challenges ahead.

The French-based payment processor, which services more than 1 million merchants globally, cited weakness in the Germany market. The stock plunge wiped out €3.8B ($4B) off its market value, as the stock was cut down by more than half.

While Worldline pointed to Germany as a particular pain point, investors fear that the US may face similar challenges soon. While consumer spending has been resilient in the US, spending could take a hit if the Federal Reserve keeps interest rates higher for longer, as it has suggested it might need to do.

Since PayPal, Block and Affirm’s revenues are highly dependent on e-commerce spending, investors are fleeing the stocks in anticipation of weaker consumer spending. Furthermore, there are growing worries about the rising competition from Apple, that is further weighing down on the stock prices of these companies.

In the meantime, Visa V 0.00%↑ , Mastercard MA 0.00%↑ and American Express AXP 0.00%↑ have fared better compared to PayPal, Block and Affirm. While the outperformance could be attributed to the robust networks these larger companies benefit from, even then, Mastercard and American Express have turned cautious on their revenue and profit outlook in their recent earnings calls, citing economic slowdown.

Mastercard forecasted a weaker than expected growth in net revenue in Q4 2023 and American Express kept its annual profit forecast unchanged despite a record spending on its credit cards by consumers in its most recent quarter. In addition to that, American Express has further raised its provisions for credit losses to $1.2B from $410M a year ago, which may signal that the company is taking precautions for severe potential defaults in debt repayments within the next year.

It is not just the financial industry that is turning cautious, the global transportation and logistics services giant UPS is also facing challenges amidst a slowing global economy and a tight US labor market.

UPS revised down its FY23 revenue & profit forecasts as global economic slowdown hurts its Package Volumes and higher labor costs squeezes its Margins.

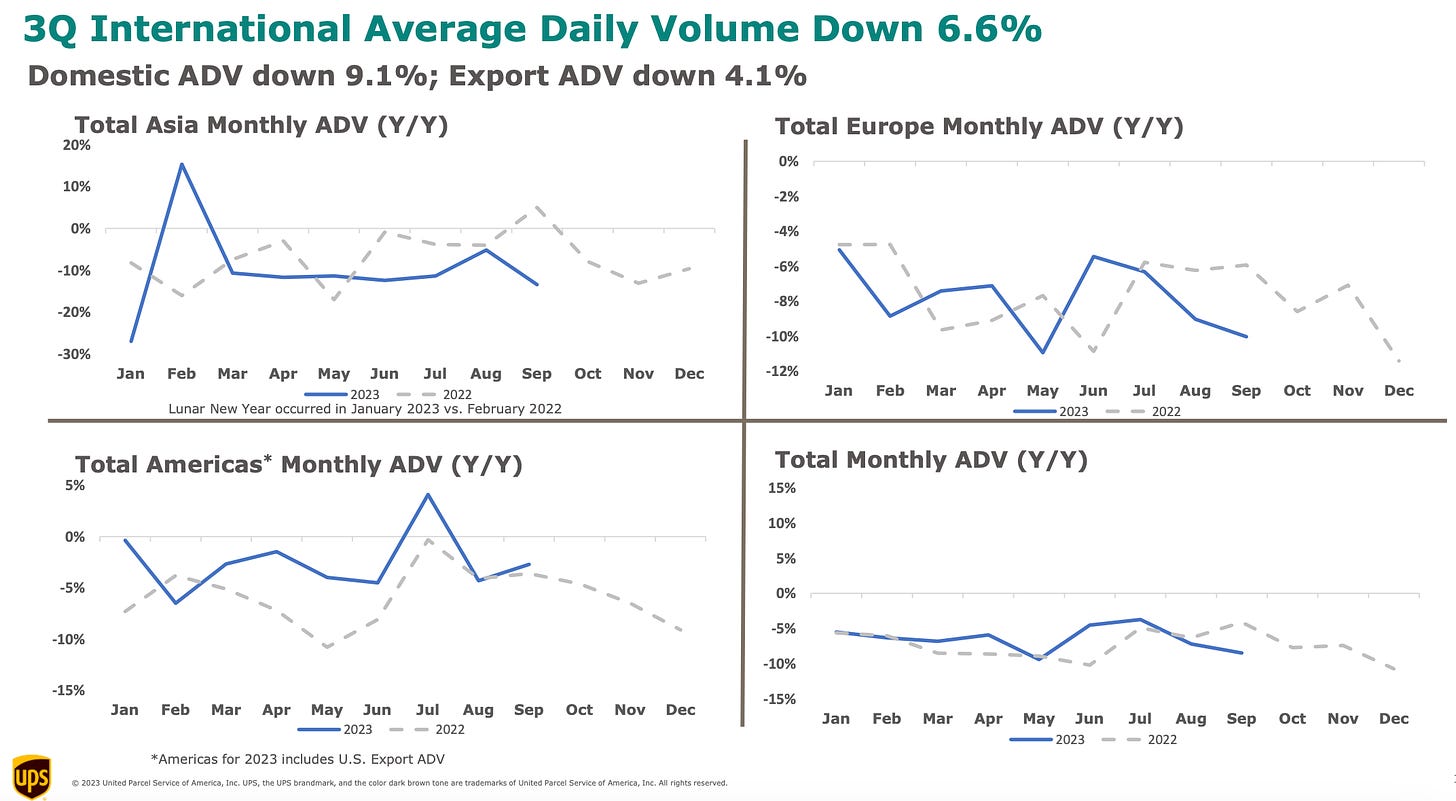

United Parcel Service Inc UPS 0.00%↑ , an Atlanta based global transportation and logistics services provider cut its annual profit target for a second time in less than 3 months, hurt by a spike in labor costs and lower delivery volumes for shipped packages. The company posted Q3 revenue of $21.1B, and earnings per share of $1.57, which were down -12.8% and -47.5% respectively, on a year-over-year basis.

“We expected the conditions in Q3 to be challenging and they were,” Chief Executive Officer Carol Tomé said during the Q3 earnings call. She blamed slowing economic growth for lower international and freight forwarding volume, and also said labor strife cost UPS some business in the US.

The cost of UPS’ new labor contract with the Teamsters is front-loaded with 46% coming in the first year, crimping the company’s profit margins. The contentious summer talks, which were resolved only days before a strike was scheduled, also drove some customers to switch to competitors.

UPS said the lost volume stemming from the labor negotiations totaled 1.5M daily packages, higher than an earlier estimate of 1.2M. The company has regained about 600,000 daily packages of that diverted volume and expects to win back all of it by the end of the year.

However, the company has revised down its 2023 forecast for adjusted operating profit margin at 10.8% (vs. 11.3%) and revenue at $91.2M (vs. $92.3M). UPS has also pledged to cut 2500 management jobs and lean on automation to boost worker efficiency.

While technology is the long term answer to boost productivity growth, this often requires capital spending to build the necessary infrastructure. Unfortunately, more than expected capital spending in a difficult macroeconomic environment can be a difficult message to communicate to shareholders, and one such company that is facing the conundrum today is Meta.

Meta Platforms warns that their revenue outlook for 2024 is uncertain as ad revenue might suffer.

Facebook owner, Meta Platforms warned that its advertising depends heavily on the macroeconomic environment for spending, during the Q3 earnings call, on October 25, 2023. Meta Platforms META 0.00%↑ was down -7% since the earnings call.

“We are very subject to volatility in the macro landscape,” CFO Susan Li said on a call with investors. She further warned that the revenue outlook is uncertain for 2024.

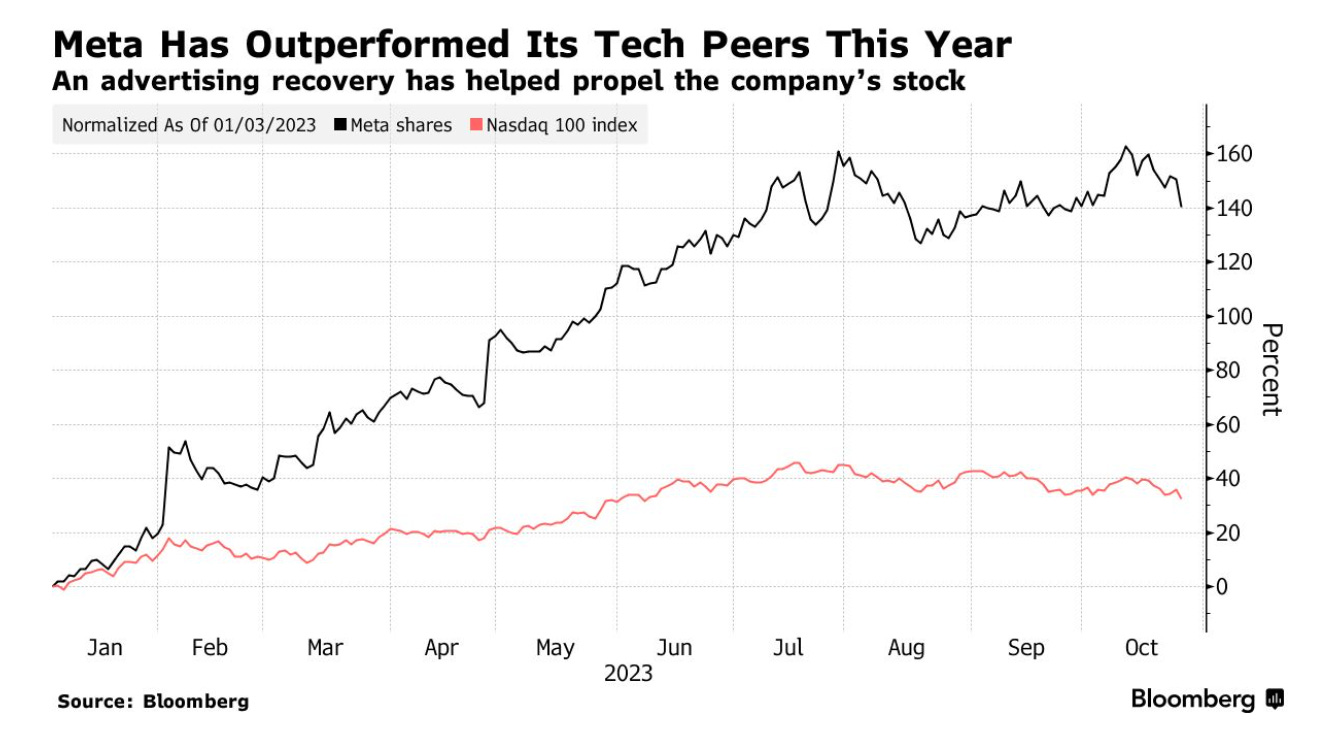

Meta has been making a lot of progress to improve investor confidence since the beginning of 2023. Earlier this year, the company cut thousands of employees and a wide range of projects, while sharpening its focus on improving its advertising and algorithms with artificial intelligence. As Meta’s core advertising business returned to growth, the stock has climbed 146% YTD (year-to-date), while outperforming its peers.

The company exceeded revenue and earnings growth expectations for Q3 2023. Meta also reported that its Reality Labs division (that makes smart glasses and headsets) incurred a lesser than expected operating loss. In the meantime, Meta’s overall monthly users rose 7% to 3.14B, which was higher than 3.05B estimated by the analysts.

However, the revenue from Reality Labs division in Meta is growing slower than expected and as a result, investors are closely scrutinizing Meta’s spending on projects like virtual reality and artificial intelligence technology. In order to ensure that the stock doesn’t slip back into a downward spiral loop like it did in 2022, Meta has lowered its spending expectation for 2023.

This is an exceptionally challenging situation for a technology company like Meta, as they try to balance short term investor confidence in an uncertain macroeconomic environment, with their long term vision of building the metaverse, which is undoubtedly a capital intensive process.

Consumers are cutting back on air travel, motorbikes & orthodontic treatments and companies in these industries forecast weaker than expected growth in Q4 2023.

Switching back to consumer discretionary spending, consumers are starting to cut back on travel, motorbikes and orthodontic treatments, among other categories.

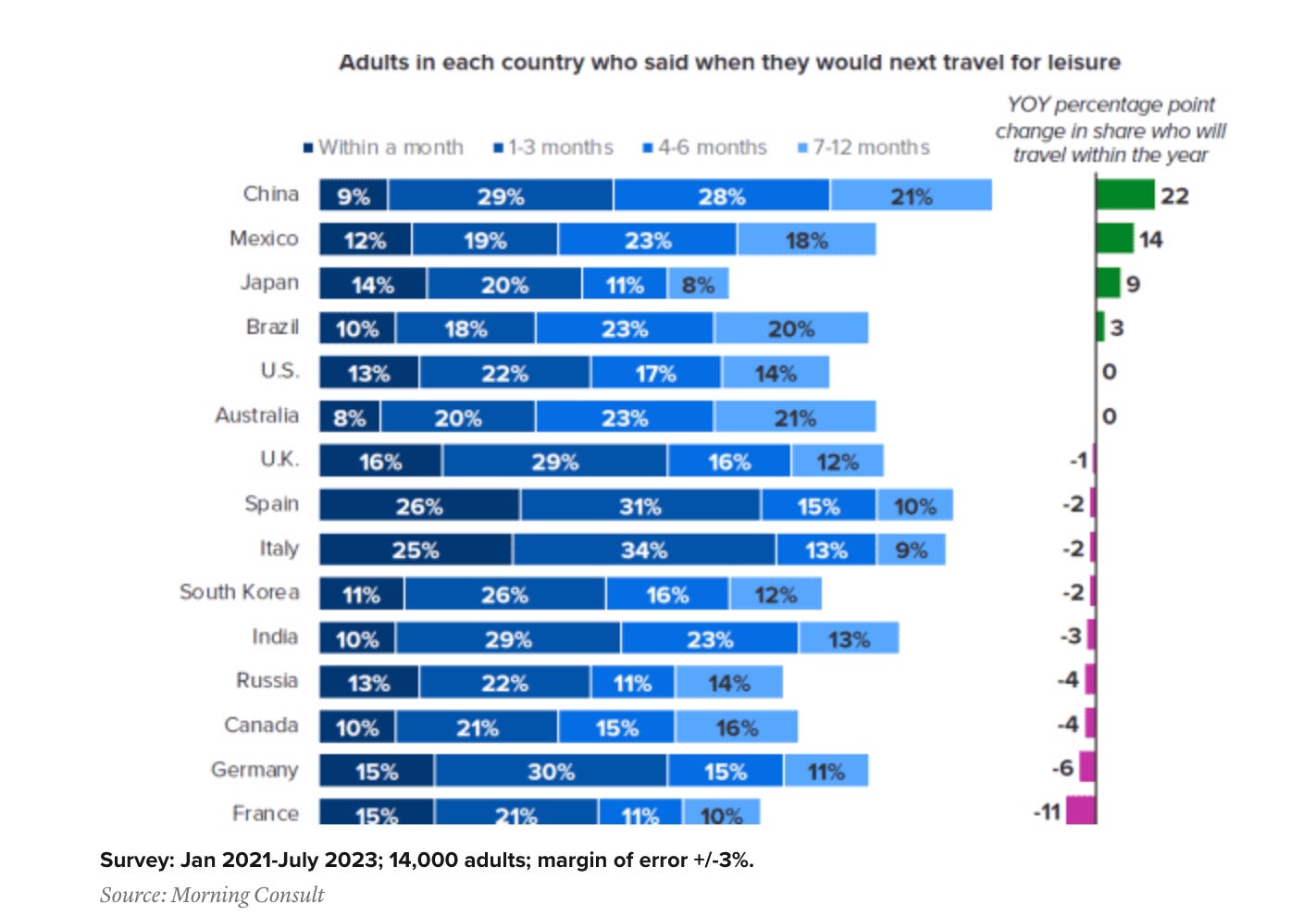

The travel industry is becoming alert, as the era of unabated “revenge travel” may be coming to a close. A report by the research company Morning Consult shows that travel intentions are flatlining or falling in countries, especially in Europe, where the intention to travel has dropped 11% in France and 6% in Germany compared to 2022.

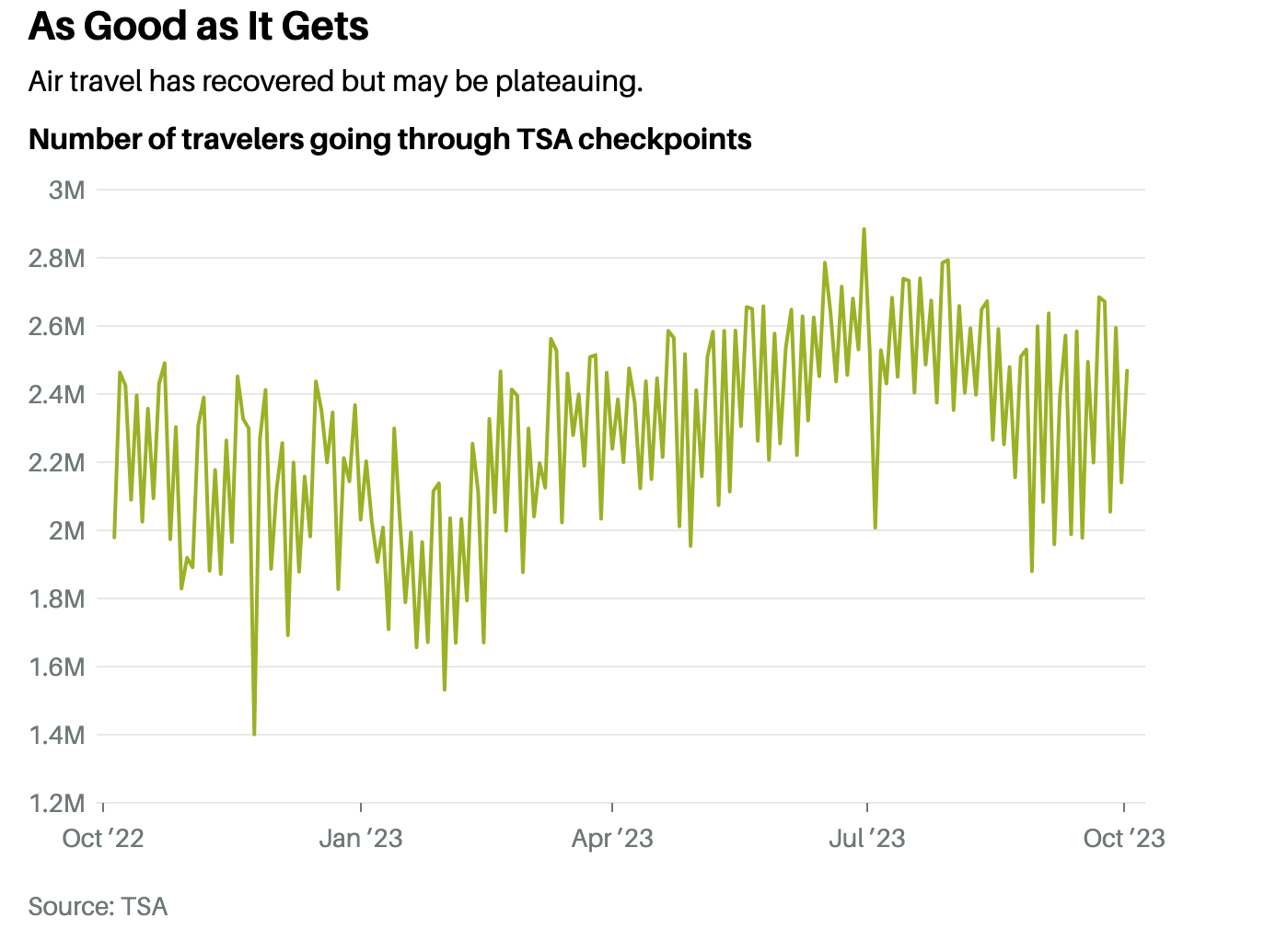

Meanwhile the Transportation Security Administration (TSA) which reports its daily checkpoint numbers is also showing the growth in air travel may have plateaued.

This is further validated by the recent earnings reports of United Airlines UAL 0.00%↑ and Southwest Airlines LUV 0.00%↑ , where they forecast weaker Q4 profits as fuel costs rise and demand softens.

Meanwhile, Harley Davidson HOG 0.00%↑ missed its earnings expectations and saw its revenue decline -9% from a year ago. While the company has rolled out generous new incentives at dealerships to stimulate demand, sales continued to be weak in Q3.

“It is clear that the macroeconomic backdrop has been a challenge for our customers globally,” CEO Jochen Zeitz said in the Q3 earnings call, citing both “inflationary pressures creating affordability challenges and high interest rates.”

It’s not just air travel and motorbikes. Consumers also seem to have cut back on orthodontic treatments, as Align Technology ALGN 0.00%↑, the maker of Invisalign orthodontic aligners posted weaker than expected Q3 earnings.

“Our Q3 results reflect lower than expected demand and a more difficult macro environment than we experienced in the first half of 2023,” CEO Joe Hogan said during the earnings call. “Dental practices and industry research firms have reported deteriorating trends, including decreased patient visits and increased patient appointment cancellations, along with fewer orthodontic case starts overall, especially among adult patients.”

The company said it expects its revenue to drop sequentially in the Q4 2023, as consumers continue to hurt from inflation and preserve cash for essentials. Its revenue outlook for the period, which assumes that “no circumstances occur that are beyond our control,” is between $920M to $940M, which is lower than analyst expectations of $1.02B

Closing Thoughts!!!

There is no doubt that the US growing at an adjusted rate of 4.9% annually in Q3 2023 is a huge feat, especially when most of the developed nations are undergoing economic slowdown. The reason the US has been able to grow faster than any of the other developed nation is because of the US consumers’ willingness to maintain spending levels despite rising prices. The confidence driving the US consumer has been a resilient labor market.

But is this as good as it gets? Companies across industries spanning across finance, logistics, technology & discretionary spending are increasingly becoming cautious, as they take the necessary steps to cut back spending and inform investors of downward revisions to their revenue and earnings forecast.

If this is indeed the peak, we are about to see a slowdown in spending, which would impact the labor market. Depending on the degree of the slowdown, we may or may not have a recession. But in either case, the Fed would lower its interest rates, which would help stimulate the economy into growth mode once again.

However, if this is not the peak, and the US economy continues to grow at a faster pace from here onwards, the Fed will be forced to raise rates even higher. The longer rates remain high, the fragility of the system grows and the likelihood of a possible “soft landing” scenario vanishes.

I think the unrelenting focus on increasing profit-margins by cutting costs leaves out an important consideration-offering a satisfactory product that customers are ok paying for. The last time I went to my local Apple Store with a relatively simple request, I thought, I was told, after a 45 minute wait, that my issue could only be resolve by on-line tech support-the real live employee in front of me was no longer allowed to do the thing. Back home, I waited well over an hour to talk to a real live voice who sent me to a robot which eventually messed up other things and so a real live voice spent a long time undoing what the robot had helpfully messed up, etc., etc. There are half as many checkers at any time at the grocery store than there used to be, which means standing in line waiting to pay often takes longer than collecting the groceries. Wait times to see someone on my physician’s “team” is 6-8 weeks...The value of my time clearly does not figure in the calculations of value offered of the corporations that offer the three services I mentioned. How much more money do these CEO need to have squirreled away before they will feel comfortable participating in the world around them, I wonder?

GDP and other government statistics seem more and more disconnected from the reality of most people. Something is really off. I see few people living it up on consumer spending. Most restaurants around me are mostly empty and no one buys anything unless it is on sale, so perhaps more to Walmart online and Amazon but that is hardly reason to celebrate. Yes I feel the CEOs are telling the truth. Commercial real estate is still a big problem. When loans come due companies need to refinance at much higher rates. Housing is unaffordable. There has been so much government stimulus in various areas such as in green tech but this is causing bubbles that are already popping as inflation and supply chain issues are big issues (as well as other realities in integrating new technology to our current infrastructure). More GDP because of illness and war is not terribly inspiring. GDP as a model for global economic prosperity needs a major rethink. AI has propped things up this year. When you take the top AI companies out you see more of the reality which you are hi lighting very well in your article. Excellent job! Still confusing to sort out admittedly. Thanks for your hard work and sharing so freely.