Will the US Housing Market boom or bust in 2024? Part 3

US homebuyers are becoming older as millennials get priced out of the market. Meanwhile, Redfin and Morgan Stanley expect housing conditions to improve in 2024. Is now a good time to buy a house?

««Monday Macro- The 2-minute version»»

As we (almost) near the end of 2023, the big question on everyone’s mind is — “Is the US housing market going to boom or bust in 2024?”

What do we know for a matter of fact? The divergence between the existing and new home markets is stark. With inventory at record low levels, the median price of existing homes remains steady, even with demand falling more than (40)% from its peak. Meanwhile, the new home market has an inventory surplus, which has already led to (15)% decline in median prices.

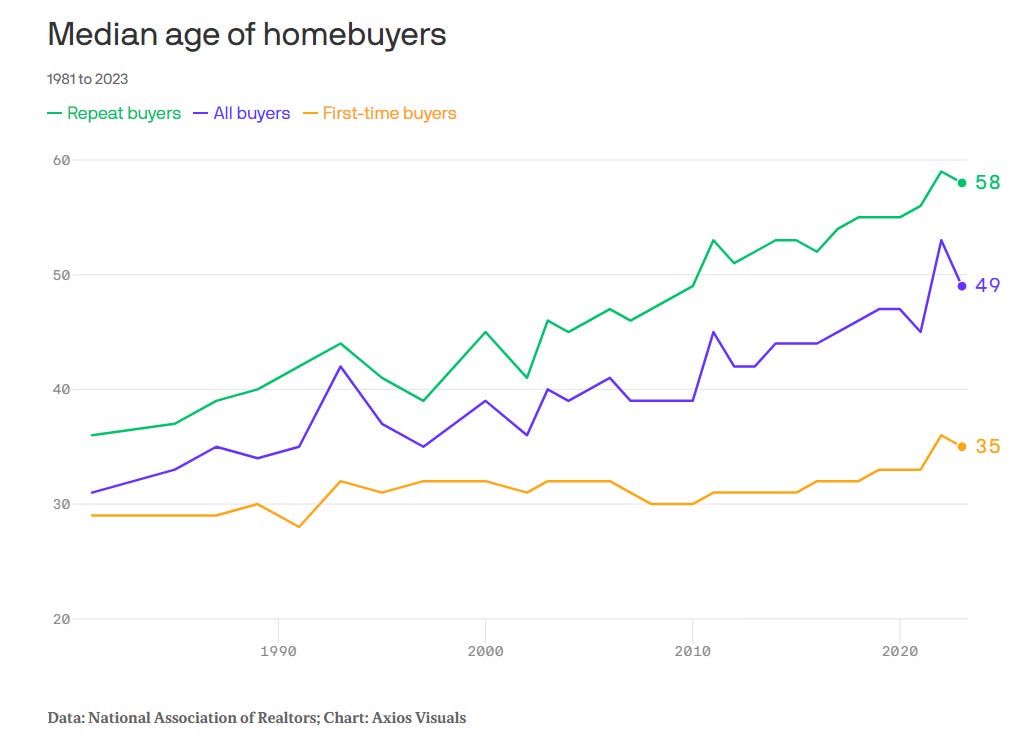

Meanwhile: The demographic gridlock in the US intensifies as US homebuyers get older, with the median age for homebuyers jumping by 10 years to 49. At the same time, the share of mortgage-free houses is at a record high of 40%, with more than half of these homeowners having reached retirement age. Meanwhile, millennials and Gen Z's are increasingly priced out of the market, with 50% of them saying that they are unlikely to purchase a home in the near future as prices are too high.

The light at the end of the tunnel: The good news is that construction activity for new single-family homes has been steadily improving, indicating that new inventory will likely be added soon. At the same time, mortgage rates have recently declined from its peak, which has led to a sizable uptick in new listings and mortgage applications.

Here’s what the experts say: Looking ahead into 2024, Redfin and Morgan Stanley are optimistic, as they predict mortgage rates to drop in the 6.6–7% range as the US economy manages to accomplish a soft-landing. They expect home sales to improve on a YoY basis, given the slightly brighter picture of affordability. Meanwhile, given the addition of new inventory to the market and relatively strong demand, Redfin expects home prices to fall (1)% in 2024. Fannie Mae, on the other hand, is not so optimistic.

Here’s what The Pragmatic Optimist thinks: I am on the same page as Redfin and Morgan Stanley on the short-term outlook for the US Housing Market, but long-term, I believe that housing affordability will continue to plague low and middle-income families, as underlying inflationary forces will force interest rates to remain higher relative to the post-GFC era. Long term, millennials and Gen Z'ers will realize that buying a home doesn’t offer the same financial upside as it did to baby boomers and Gen Xers. Many will decide that renting and investing their money in other ways makes the most sense.

In case you are wondering if now is a good time to buy: Depends where you live. If you live in an area where there is a lot of new construction, you may be in a buyer’s market with valuations that are roughly average relative to history, with good chances for valuations to drop below average given the still elevated month’s supply. Looking for deals in these markets could make a lot of sense, as homebuilders want to unload inventory.

Relief may be coming for the frozen housing market.

For one, it's becoming a little bit cheaper to buy a home. Not only that, but there are finally more homes to choose from.

Mortgage rates are dropping due to easing inflation, and investors are betting the Fed will cut interest rates sooner than expected. Mortgage payments have dropped for the fifth week in a row, and new listings are up 6%. This is the biggest uptick in new listings over the past two years, which points towards an easing supply crunch in the housing market.

And buyers are taking note. According to the release, mortgage-purchase applications are up 5% week over week. So, is the downturn in the US housing market over, and are we set to see a new boom cycle?

➡️Welcome to Part 3 — the final of the US Housing Deep Dive Series.

In this post, we will cover the following areas:

The demographic gridlock in the US

Housing prediction for 2024, as per Redfin, Morgan Stanley, and Fannie Mae

The Pragmatic Optimist’s take on the short and long-term outlook for the US Housing Market

Based on the above, is it a good time to buy a home?

Here’s a quick recap of the previous 2 parts:

In Part 1, we discussed the state of the US existing and new home markets. We identified that the divergence in home prices and month’s supply in the existing and new home markets in the US is stark. With the month’s supply of new homes elevated at 7.8, homebuilders are slashing prices to move inventory. This has led to a revival of demand in the new home market, with the median price of new homes down (15)% from its peak. Meanwhile, the month’s supply of existing homes is still extremely tight, at 3.4. As a result, the median price of existing homes has remained steady, despite a (43)% drop in demand from its peak. While it has affected cities across the US differently, depending on the level of new construction activity, there is no doubt that the US Housing Market is experiencing one of the worst affordability crises.

In Part 2, we discussed the state of the residential construction activity in the US, and based on the data from building permits and units under construction, we identified that the construction activity in the single-family housing market has considerably improved and is continuing to show strength since hitting a trough in December 2022. With building permits as one of the most reliable leading indicators, we can expect housing supply in certain markets in the US to pick up in the coming months.

Now, let’s dive in to Part 3!! 👇🏼👇🏼

The Demographic Gridlock: US homebuyers are getting older, Millennials & Gen Z's are getting squeezed, while the share of mortgage-free homes reaches an all-time high.

The US housing market has shattered the stereotypical American dream as the dominant group of homebuyers ages and moves without young children. The median homebuyer age has jumped 10 years to 49 in two decades, new data shows, as the housing affordability crisis deepens.

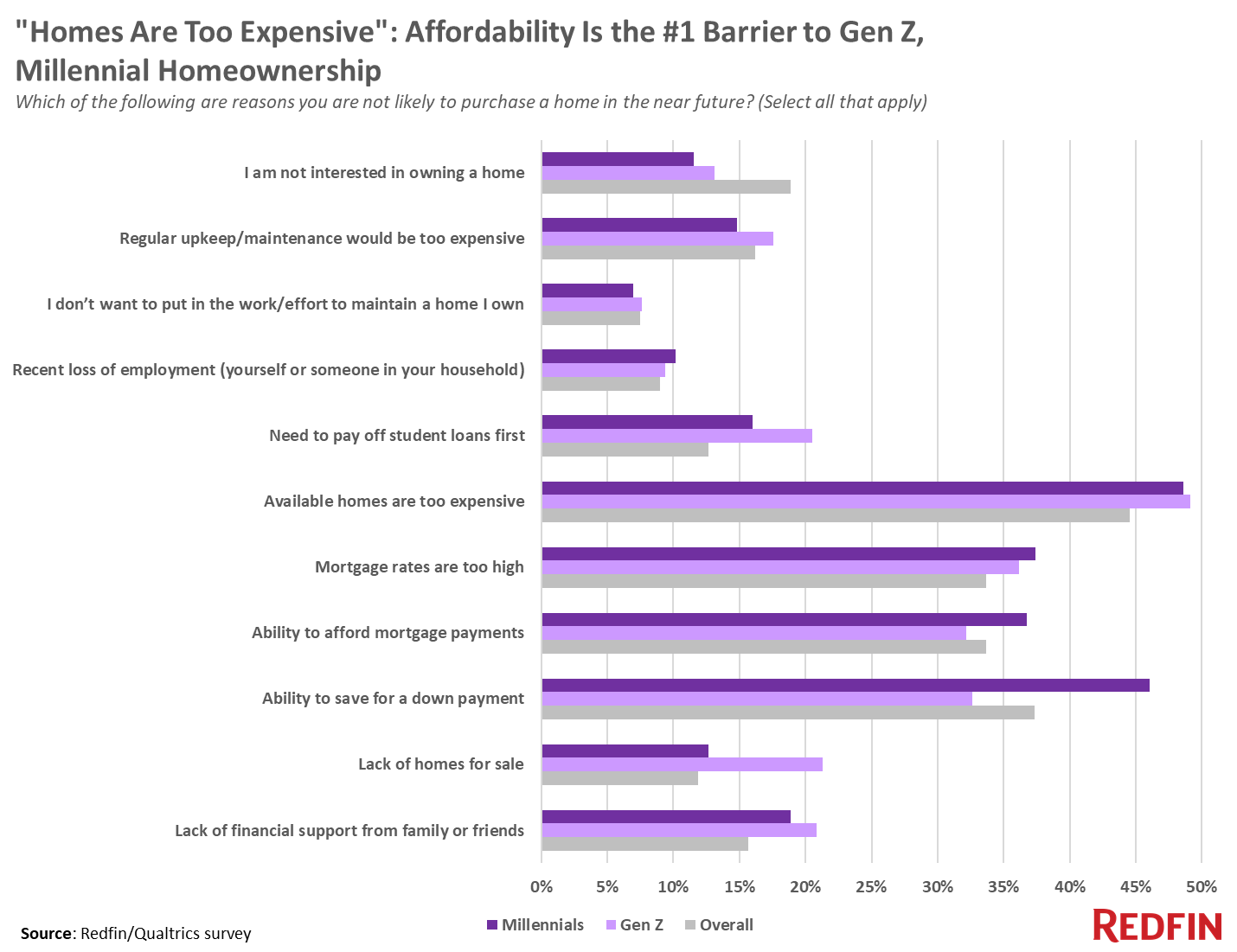

There is no denying that millennials and Gen Z'ers are feeling the brunt of one of the harshest housing markets in the US, forcing them to work two jobs to fund their down payment. Roughly 50% of Gen Z and millennial renters who believe they are unlikely to purchase a home in the near future say the high price of homes on the market is blocking them from buying.

Of the young Americans who are planning to buy a home in the next year, many are turning to side hustles for their down payment. About 41% of Gen Zers and 36% of millennials say they will work a second job to help fund their down payment, the most commonly cited method aside from saving directly from paychecks.

Meanwhile, the typical down payment for a first-time home buyer is at its highest level since 1997. One of the main reasons why the typical down payment for first-time buyers is at a two-decade high is because wealthier first-time buyers, who can more easily afford a higher down payment, have been particularly active in the housing market.

“In a still-competitive housing market, more well-off home buyers were able to have their bids accepted by offering larger down payments and even by paying cash,” Jessica Lautz, NAR deputy chief economist and vice president of research, said.

First-time homebuyers are using savings and other financial assets to get closer to meeting their down payment goals. In fact, 71% of first-time buyers cited savings as one of the ways they financed their down payment, compared to 46% of repeat buyers, according to the NAR report.

At the same time, there is a rapidly growing number of Americans who own their homes outright. The share of US homes that are mortgage-free jumped 5% from 2012 to 2022, to a record just shy of 40%. More than half of these owners have reached retirement age.

The number of mortgage-free, single-family homes and condos increased by 7.9M from 2012 to 2022, to 33.3M, according to Census Bureau data.

As baby boomers age, they are snapping up or holding on to a larger share of homes overall. Of the 84.6M owner-occupied homes that existed in 2022, almost 33% were owned by people aged 65 or older, a 4.6% increase from 10 years earlier.

Some mortgage-free boomers say they feel less pressure to downsize as they reach retirement age and are electing to stay put. Nevertheless, many older Americans are opting to sell their homes in pricier regions and use the proceeds to fully pay for a new home in the Sun Belt, where construction is booming and the proportion of no-mortgage homes is among the highest in the country.

Of the 4.1M new homes built in the US from the start of the pandemic through 2022, 29% were in Florida and Texas, according to Census Bureau figures that include rental properties. In both states, the share of fully paid-up homes tops 43%.

So, where do we head from here?

What do Redfin, Morgan Stanley, & Fannie Mae think the US housing market will look like in 2024?

1. Redfin believes that home prices will fall (1)% YoY, while mortgage rates remain above the pre-pandemic level at 6.6–7%. This will translate to a 5% YoY increase in home sales in the US.

Redfin predicts 2024 will be the year that homebuyers catch a break, with home prices falling and new listings rising. According to Redfin, prices of homes will fall (1)% YoY in the second and third quarters, when the home-selling season is in full swing.

That will mark the first time prices have declined since 2012, when the housing market was recovering from the Great Recession, with the exception of a brief period in the first half of 2023.

“Prices are ending 2023 up around 3% YoY, and the typical homebuyer’s monthly payment is only about $150 shy of its all-time high. Home prices will still be out of reach for many Americans, but any break in the affordability crisis is a welcome development nonetheless,” Daryl Fairweather, Chief Economist of Redfin, said.

The reason why home prices will fall is because supply will rise more than demand. Listings will climb from 2023’s record low as the mortgage-rate lock-in effect eases. Nearly all mortgaged homeowners have a rate below the current level. Many are starting to accept that we won’t see rates in the 3s or 4s anytime soon, and they want to sell before prices fall. Redfin agents report that homeowners in places like South Florida, where prices have soared the last few years, are deciding to cash out on their equity and move to more affordable areas.

Mortgage rates are likely to remain well above pandemic-era record lows because financial markets increasingly believe the country will avoid a recession in 2024. The Fed will likely keep interest rates at their current level at the start of the year, even though inflation is largely under control. But then they’re likely to cut rates two or three times starting in the summer, which is why mortgage rates will decline as the year goes on.

“We predict the average 30-year mortgage rate will linger at 7% in the first quarter, then decline throughout the year. Mortgage rates will fall to about 6.6% by the end of 2024. The gradual decline in rates combined with the small dip in prices will bring homebuyers some much-needed relief,” Daryl Fairweather, Chief Economist of Redfin, said.

At the same time, home sales are expected to grow 5% YoY in 2024. A crucial difference between 2024 and 2023 will be sales gaining momentum throughout the year instead of losing momentum. Home sales will speed up throughout 2024 as affordability improves and more homes hit the market.

2. Morgan Stanley also echoes Redfin’s housing market prediction for 2024. Plus, it expects homebuilding activity to grow stronger next year.

According to Morgan Stanley, a change of fortune will be in the cards for the housing market in 2024, driven by improved affordability, as supply of homes increases.

"We expect home sales to be weak in the first half of next year, but activity should pick up in the second half and further into 2025, and that's primarily because affordability will improve," Ellen Zentner, Chief Economist at Morgan Stanley said.

With fewer existing homes on the market, new construction has been the main source of additional supply. And Morgan Stanley expects homebuilding activity to grow stronger next year.

"Home prices should see modest declines as growth in inventory offsets the increase in demand. By 2025, with lower rates, existing home sales should rise more convincingly," Zentner added.

3. However, Fannie Mae is more pessimistic than the rest, as they believe US existing home sales will remain subdued whether or not the US economy avoids a recession.

Contrary to Redfin and Morgan Stanley, Fannie Mae believes that the housing market isn't coming out of its deep freeze anytime soon, even if the US economy manages to steer away from a recession in the next year.

"With an ongoing tight supply of existing homes for sale and a 30-year fixed-rate mortgage rate of around 7%, we expect home sales in 2023 to remain near the lowest annual level since 2009," Fannie Mae economists said. "Regardless of whether a soft landing is achieved over the coming year, we expect existing home sales to stay subdued and within a tight range."

That's because the US avoiding a recession means real interest rates in the economy will likely stay elevated, which will influence mortgage rates to stay high as well. Higher rates have weighed heavily on the housing market over the past year, as they slam buyers with a high cost of borrowing and discourage sellers from listing their properties for sale, many of which were financed at ultra-low rates years ago.

In the event the US does fall into a recession, interest rates will likely dial back "somewhat," the firm estimated, which could cause mortgage rates to ease slightly, but the housing market would still likely be affected by a weakening labor market and an ongoing crunch in credit conditions, in addition to dampened consumer confidence.

"We therefore do not anticipate a meaningful recovery in existing home sales over our forecast horizon under any of the more likely scenarios," Fannie Mae said.

What do I make of it all? The Pragmatic Optimist’s short and long-term view on the US Housing Market

This is my thesis for 2024 and beyond: I believe that in the short term, there will indeed be relief (of some form) in the housing market. Long term, I believe that housing affordability will continue to plague lower and middle-income households, as underlying inflationary forces will keep the cost of borrowing at higher levels than in the post-GFC (Global Financial Crisis) era.

As inflation has cooled from its peak and long-term financial conditions have eased, marked by the decline in the 10Y US Treasury bond yield, this is a net positive for overall liquidity. We have already seen mortgage applications pick up 2.8% in the week ending December 1st, marking the fifth consecutive period of increase. This is indicative of the magnitude of the pent-up demand for housing in the US economy.

With improved liquidity conditions, I expect that homebuilding activity in the single-family housing market will continue to improve. This will add additional inventory to the new housing market, which will put further downward pressure on new home prices, which will bleed into the existing home market. The effect of it will be more pronounced in some cities in the US than in others.

Meanwhile, President Biden will most certainly make “affordability” a cornerstone of his reelection debate. With home prices up more than 20% since President Biden took office, I expect President Biden and his opponents to make splashy housing policy proposals to try to lure voters who are unhappy with their economic prospects. Democrats are likely to focus on subsidizing down payments for first-time homebuyers, promoting inclusionary zoning, and funding housing vouchers, which are all popular with liberal voters. Republicans are more likely to focus on reducing regulations that limit development.

At the same time, I expect unemployment to weaken from current levels; however, I am not anticipating a spike in unemployment in 2024. This is due to the forces of an aging population and low labor force participation that have created a structurally tight labor market. During this period of time, I do not anticipate AI will have a material impact on employment and productivity.

Given the above dynamic, I expect home sales to rise from current levels, as falling prices and mortgage rates would quickly rekindle the pent-up demand in the US housing market, alongside a reasonably healthy labor market. Therefore, any decline in home prices is going to be modest.

If you are thinking about whether we see a repeat of the 2008 housing bust, I don’t see it on the horizon. With a structurally tight labor market, a strong financial position of baby boomers, and a steady growth rate in government deficit spending, I expect overall inflationary pressures to continue to linger. Meanwhile, unlike in 2008, lending standards remain strict and foreclosure activity is muted.

Looking further out into the future, given the above inflationary trends shaping up the narrative for the US economy, I expect inflation and interest rate expectations to be at elevated levels relative to the prior decade. This will continue to widen the gap between the haves and the have-nots, which will also affect overall housing affordability in the US.

Long term, I see that demand for large rental apartments and houses will climb as more young families embrace the renter lifestyle. We’re already seeing signs that young people are redefining the American Dream; nearly one in five millennials who responded to a 2023 housing survey believe they’ll never own a home. Nearly half of those survey respondents said homes for sale are too expensive, and a similar share said they couldn’t afford to save for a down payment. But others just prefer renting: 12% said they aren’t interested in homeownership, and 7% said they don’t want to put in the effort to maintain their own home.

With prices so high, buying a home doesn’t offer the same financial upside to young millennials and Gen Z'ers as it did for baby boomers and Gen Xers. Rather than shelling out cash on agent fees, interest on a loan, property taxes, insurance, and maintenance, many will decide that renting and investing their money in other ways makes the most sense.

Is now a good time to buy a home?

It depends on where you live.

As per research done by Eric Basmajian of EPB Research, the average home price-to-income ratio for a new home is 8.1. At the start of 2022, the average new home was selling for 9.7x the average income. That was the highest level it had ever reached. As new home prices have come down, the average price-to-income ratio for new homes has dropped to 8.3, which is not too far from average. Plus, the month’s supply of new homes stands above 6. This indicates that prices will continue to fall, which would mean that the average price-to-income ratio would ideally correct to its long-term average or even trend lower.

On the other hand, the existing home market has an average home price-to-income ratio of 9.2, while its long-term average ratio sits slightly below 8. This is an indication that an existing home is massively overvalued relative to its history. The month’s supply of existing homes is still very low, so there is little chance for this to change dramatically in the coming months, unless, of course, there is a deep recession.

➡️Coming back to whether it’s a good time to buy or not, if you live in an area where there is a lot of new construction, you may be in a buyer’s market with valuations that are roughly average relative to history, with good chances for valuations to drop below average, given the still elevated month’s supply. Looking for deals in this market could make a lot of sense, as homebuilders want to unload inventory.

In the UK, housing prices for first time buyers have remained high as well as deposits so it’s much the same as the US. For millennials and younger, housing is often a dream that cannot be realised. I’m lucky that we live in my husband’s childhood home and he purchased it about fifteen years ago for a good rate and we are almost mortgage free (I’ll be 40 and he will be 50 when that happens) which will allow us amazing financial freedom that many of our peers cannot have. For me, it’s by luck and chance that I’m in this position as I couldn’t have afforded a house on my own without my husband. When I did live in the US, I was an adjunct English prof so wasn’t getting out of the renter’s market in any foreseeable future.

Very impressive, Amrita.