Launching The Pragmatic Optimist’s AI Stock Rec Tracker

Track all our stock ratings, price targets and performance in one place

Dear fellow Pragmatic Optimists,

We are excited to present to you our latest feature on The Pragmatic Optimist 2.0, the AI Stock Rec Sheet/Tracker.

✋🛑🛑 For all current paid subscribers: The link to the AI Stock Tracker is at the bottom of this post.About 4 months ago, we had laid out our 2025 roadmap for the publication, where we had decided to narrow our research focus from connecting the dots in macroeconomics to helping readers and investors unlock long-term investment opportunities in the AI value chain.

Since then, we have published twelve research reports that discuss at length how product innovation is impacting revenue and profit cycles of selected companies in the AI ecosystem and how industry crosscurrents are impacting their forward valuations.

With the AI Stock Rec Tracker, our goal is to help readers and investors navigate our recommendations within the AI landscape with ease. Our coverages dive deep into companies across each layer of the AI stack with respective price targets, updated ratings, and price performances since our coverage.

The AI Stock Rec tracker will offer subscribers a level of transparency into our work while making our coverage a lot more accountable.

The tracker contains all the companies that we have covered on The Pragmatic Optimist 2.0 since January 2025, as well as additional companies that we covered on other platforms like Seeking Alpha over the last 30 days. The Stock Tracker will also show which of the companies we own in our investment portfolio at the moment.

We will be updating our price targets for the companies on the tracker every quarter, unless there is a compelling event for us to do it sooner. For stock ratings, we will be updating more frequently depending on the magnitude of stock price movements or concrete events that impact the stock.

Note: This is a feature that is exclusively available to premium and founding members only, which will be made available by the end of today before markets close.

The Tracker will also contain an “Instruction” tab that will help you navigate the sheet with ease.

This is also our first step towards making our coverage more transparent as we prepare to launch our Portfolio offering in H2 (as outlined in the 2025 roadmap), as we want to build it with the right foundation and best practices.

📈📊 All paid members can access the tracker by navigating to the bottom of this page.Take a look at some of the winning calls in the last 4 months.

Before we start, I want to emphasize that The Pragmatic Optimist 2.0 is one of the most credible & transparent ways for us to build a track record for our AI investment research strategy.

However, because of the way our strategy works, the research we publish is more than “one and done” type of work, and being a long-term supporter of our work is what will get you the updated information as it occurs.

Having said that, let’s break down the performance of the stocks we have covered in The Pragmatic Optimist 2.0 based on the date of publishing over the last 4 months.

Had you invested $1000 each time we publicly released a report with a “buy” rating, you would have had a return of 8.3% so far, (over the last four months) compared to a 0.19% YTD return for the S&P 500 thus far 💸💸💸.

Note, we own 7 of these 10 names in our portfolio, with incremental position sizes increased across all four names since the beginning of the year.

Paid members have full transparency into the positions we own. Beginning H2 this year, Real Time Trade Alerts will be released followed by our Portfolio offering.

By upgrading to Premium for $160 annually, you are getting close to a 50% discount on the annualized rate of the monthly price of $300. A premium member get access to 9-12 Research posts every quarter with select stock picks that have proven success in the AI ecosystem, along with product features such as the AI Stock Rec Tracker and upcoming Portfolio offering in H2.

Why launch the AI Stock Rec Tracker now?

There is no doubt that 2025 has been one helluva roller coaster ride so far.

Yet, amid the macroeconomic noise, AI has turned out to be one of the safest growth vectors.

It all started at the top of the AI infrastructure stack when we had ASML ASML 0.00%↑ and TSMC TSM 0.00%↑ report their earnings, where they not only beat their earnings estimates but also held their full-year guidance steady. Particularly, TSMC noted that their AI revenue will double despite the US ban on AI chip exports to China while implementing a 30% price hike for its 4nm chips at its Arizona lab, as demand continues to outstrip supply.

Then, we heard from the hyperscalers, which included Microsoft MSFT 0.00%↑, Alphabet GOOG 0.00%↑, Amazon AMZN 0.00%↑, and Meta META 0.00%↑ , where none of these companies backed down from their previous capex guidance as they saw growing adoption of their products and services.

It didn’t end there.

Moving on to the enterprise software layer, companies like ServiceNow NOW 0.00%↑ and Palantir PLTR 0.00%↑ silenced all doubters who thought that enterprise software spending would take a backseat amid macroeconomic uncertainties.

On the contrary, ServiceNow’s Bill McDermott made it quite clear that their customers are laser-focused on increasing competitiveness amid tariff-induced macroeconomic uncertainty, while Palantir had a mic-drop moment for its Commercial business segment that it set to accelerate at 64% YoY, after growing at an eye-watering rate of 54% in the previous year.

So, what to make of all of this?

You see, the first phase of the AI Revolution was about laying out the infrastructure, where Nvidia’s GPUs came into play for training LLMs.

But we have now entered the next phase of the AI Revolution. I am talking about the application layer, where we are about to see an explosion of companies building with AI across use cases. This is no longer about running pilots on LLMs and building out dashboards anymore. We are looking at mass AI deployment and decision loops that close in seconds.

Need some more convincing that this is the case?

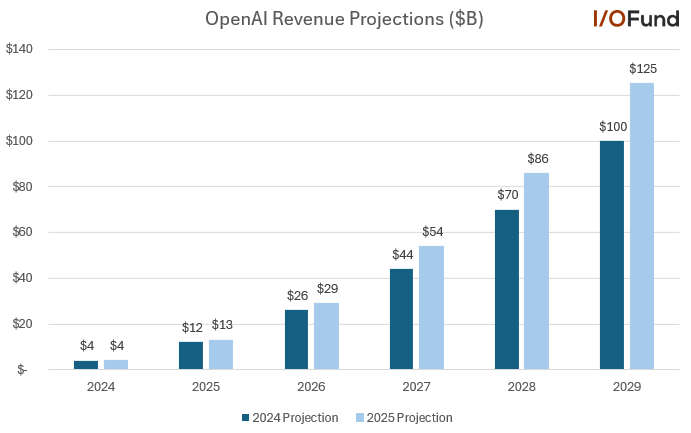

Take a look at OpenAI, which has boosted its long-term revenue forecasts by as much as 25%, now seeing 2029 revenue at $125 billion, up from its prior projection of $100 billion.

Now, here’s the cherry 🍒 on top.

Over the last week or so, there is increasing evidence of de-escalation when it comes to the tariff wars.

In fact, the latest US-China agreement, where both nations have agreed to cut tariffs significantly for a window of 90 days to allow for negotiations, has renewed investor confidence that a protracted trade war is now off the table.

Plus, as the AI Revolution finds its next area of market penetration, Saudi Arabia, which will be a major buyer of AI chips, software, autonomous/robotics, and data centers, it is just more evidence that there is no slowing the AI train.

In response to all of this, the S&P 500 index is now finally in positive territory in 2025. What a ride, I must say!!!

However, it is often in these growing moments of euphoria that we start to lose sight of the fundamentals and chase momentum.

So, let’s take a moment to re-ground ourselves so we can manage risk and our emotions in the best way possible.

First, analysts have reduced their earnings per share estimates for the S&P 500 by 3.1% in FY25. This brings the estimated earnings per estimate for FY25 from $274.12 at the beginning of the year to $265.38 at the moment, translating to a forward price-to-earnings ratio of 22, which is higher than its 5- and 10-year averages of 19.9 and 18.3, respectively.

While Q1 earnings were strong, there is considerable uncertainty for Q2. Let’s not forget that despite the de-escalation talks, the effective tariff rate is still much higher compared to the previous year, which will put pressure on both inflation and consumer spending trends.

Sure, recession odds are now being lowered, but that does not strip away the possibility of short-term macroeconomic shocks, which are never kind to AI stocks.

In these times, it is about picking your winners wisely. At The Pragmatic Optimist, we pick our candidates based on the rate of free cash flow growth per stock.

You see, a company that wants free cash flow per share growth must also increase operating leverage and increase it quickly. A company’s operating leverage rises when revenue growth starts meaningfully outpacing costs, ultimately yielding more FCF/share.

However, despite studying the technology in depth and understanding the potential upside that a particular stock has to offer, the market will find ingenious ways to test your conviction.

Is it easy to manage large declines of, say, 10, 20, or 30x on a position, like we saw last month? The answer is no.

But it is through extensive deep research and appropriate risk management that you will be able to conquer the emotional tests that often come with compounding thousands into millions.

With the AI Stock Rec Sheet, we aim to provide price targets with transparency and updated ratings to help you navigate the rapidly evolving AI landscape so you can take advantage of market asymmetries way before the momentum crowd swoops in.

Amrita & Uttam