Cash, bonds or TIPS. Which one is a better investment choice?

Cash, 10Y Treasury bond & 10Y TIPS offer attractive yields, a level not seen since 2008, so let's explore the tradeoffs & risk of investing across different economic scenarios.

At a Glance

Cash, bonds and TIPS were once trash. For over a decade, we lived in an environment of negative-yielding government debt driven by low interest rates and an accommodative Fed. Well, the regime has now changed. And cash, bonds and TIPS are attractive once again.

Furthermore, the S&P 500 forward earnings yield is just marginally higher than the return on cash and the US Treasury bond, which begs the question: why invest in a risky asset class, when you can earn the same rate of return on investment from a risk-free asset?

However, there are some tradeoffs and risks an investor should be aware of before making a decision on investing in these asset classes.

Most importantly, cash, 10Y US Treasury and 10Y TIPS perform differently across different economic scenarios. If interest rates continue to stay at elevated levels and rise further, cash is the best option. But how about, if we enter a recession, or worse a stagflationary recession?

Read below to find out more.

How did cash, bonds & TIPS become attractive investments again?

For the longest period of time between 2008 Great Financial Crisis till the end of 2021, we lived in an environment of negative-yielding government debt. At the end of 2021, the 10Y US Treasury bond yield was 1.5%. Meanwhile 10Y Breakeven Inflation rate was 2.3%. This meant, that the real return on the 10Y US Treasury bond was -0.8%. You read that right — this is a negative real return.

During this period of time, the Fed kept interest rates low while accommodating a larger portion of government debt, through a process called Quantitative Easing (QE). QE is a monetary mechanism used by central banks to print “reserves”. These reserves are then used by the central bank to buy government bonds off of the commercial bank’s balance sheet. This procedure pushes down long duration yields and hence eases financial conditions.

This obviously boosted asset prices between 2008 to 2019. But it did not create any material inflation, as the process mostly created financial economy money instead of real economy money.

During this time period, there was no logical investment case for the average investor to invest in cash, bonds or TIPS. This was succinctly summarized by Ray Dalio at that time in three simple words — “cash is trash”.

But the regime flipped when the pandemic hit.

In 2020, at the onset of the pandemic, the government ran massive fiscal deficits equivalent to 10-14% of US GDP, as the government launched a $2.2T Cares Act package, to save the economy out of a deep recession. As part of the package, the government sent stimulus check payments to US families during the pandemic. These stimulus check payments were real economy money, and this boosted the net worth of the private sector. Since the Fed bought the government debt as part of its QE program, it indirectly created real economy money, which got spent on durable and non-durable goods initially and then on services when the economy opened up.

The potent combination of monetary and fiscal policies overrode the deflationary forces of the 2008-2020 period as inflation came roaring back by the end of 2021.

Since then, the Fed has embarked on a journey to quell inflation by raising interest rates and reducing the size of their balance sheets. During this period of time, both the short and long bond yields have risen, as financial conditions have tightened.

Today, the return on cash, 10Y US Treasury bond and 10Y TIPS stand at 5.6%, 4.83% and 2.45% respectively. These level of yields have not been seen since the 2008 Great Financial Crisis.

In the meantime, the S&P 500 forward earnings yield stands at approximately 5.8%, based on its earnings growth expectations in 2024. Compare this to 5.6% yield for cash and 4.83% yield for the 10Y US Treasury bond. The return on equity offers a marginally higher risk premium compared to the rate of return that an investor would get from investing in risk-free assets such as cash and the 10Y US Treasury bond.

Hence, we have one of the strongest investment cases in decades for cash, the 10Y US Treasury bond and the 10Y TIPS. But which one is the better choice?

In this post, we will look individually at the investment cases for cash, the 10Y Treasury bond and the 10Y TIPS. While the return looks attractive on all three of them, I will also focus on the “big picture”, in order to be fully aware of the tradeoffs each of these investment opportunities provide across different economic scenarios.

Cash benefits if interest rates stay anchored or rise. But what happens if there is a recession?

The investment case for cash is quite simple. As an investor, you want to be lending cash when interest rates are rising and the 10Y US Treasury bond yield is above the rate of inflation by more than 1%.

Cash at 5.6% is very attractive today, because you are capturing an attractive rate of return without the risk of losing principal. And should interest rates rise further from current levels, you would stand to capture higher yields as rates rise. This is because, you don’t lock yourself with a fixed rate of return on cash, which is different than when you invest in long duration bonds where you are locked in for a period of time with a specified yield.

Furthermore, the current yield of cash is at par with the forward earnings yield on the S&P 500.

In fact, the current yield on cash has been a boon to savers. According to the Commerce Department, US households are earning an additional $121B of additional income on investments annually versus a year ago.

However, when choosing to invest in cash and cash equivalent instruments, it’s important to keep the “big picture” in mind and be fully aware of the tradeoffs.

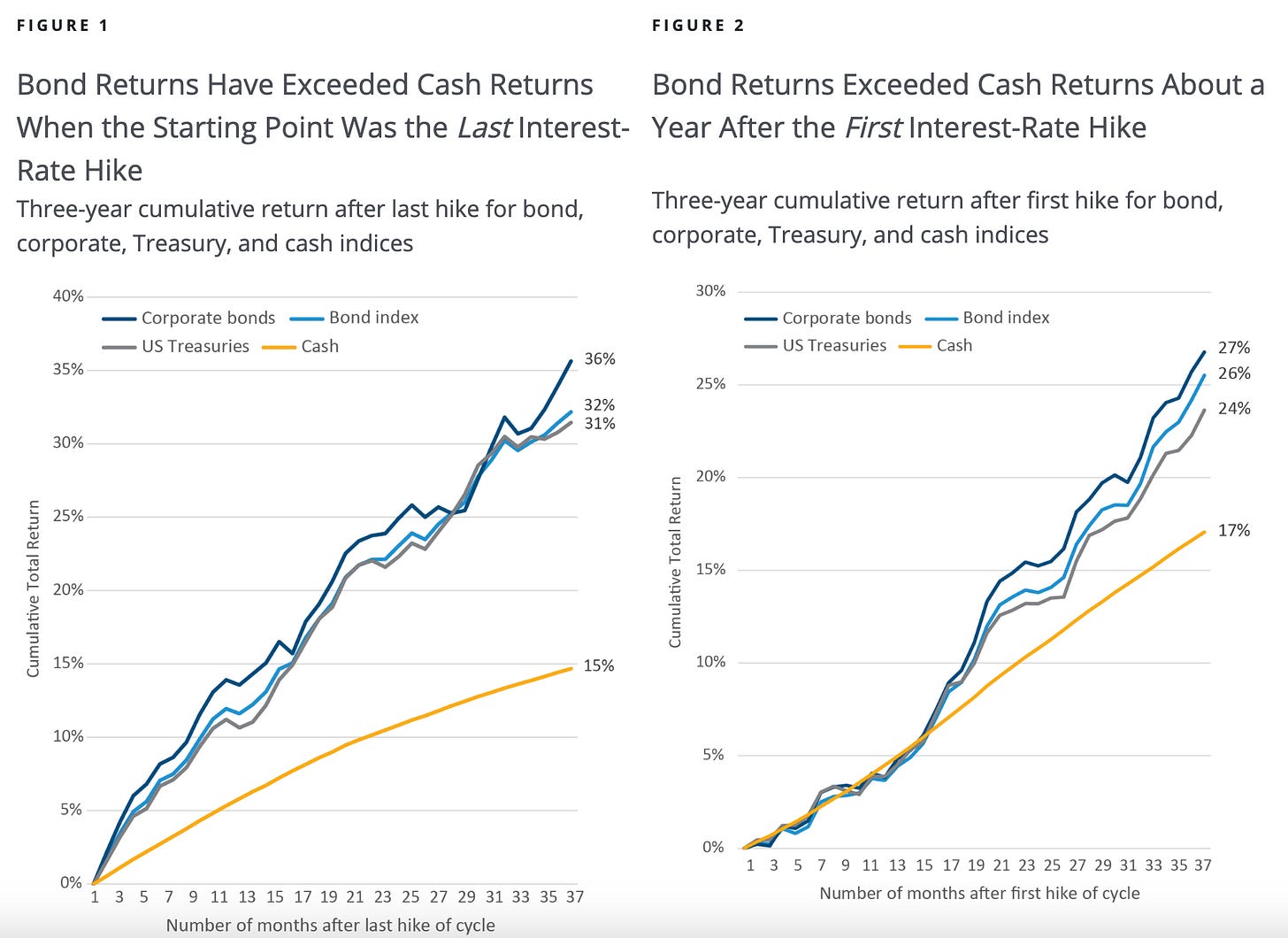

Let’s take a look at the tradeoff between cash and the 10Y US Treasury bond. Hartford Funds analyzed the return on cash and bonds using 2 scenarios. The first scenario starts at the last interest rate hike in each Fed tightening cycle since 1983. The second scenario starts at the first hike in each Fed tightening cycle since 1983.

In both the charts above, we can see the following:

Whether or not the investment horizon began with the first hike or the last hike of each Fed-tightening cycle, it incorporated the next Fed easing cycle when the yield curve steepened with short term rates falling.

The market anticipated rate cuts in each tightening cycle 3 to 13 months before the next rate cut. While bonds may not fare as well as cash if one invests early in the Fed tightening cycle, the chart above shows that bond returns are comparable to cash in the short term and the subsequent easing cycle more than compensates.

Cash also tends to suffer during easing cycles as its yield drops along with the Fed interest-rate cuts.

Obviously, this cycle could play out differently, as the Fed could continue to keep hiking rates or stay on hold for longer at the current rate levels to fight inflation. Concerns about the growing federal debt could also weigh on US Treasuries and increase risk premium. And at the same time, the bond yield curve is inverted today, which means if an investor chooses to invest in a 10Y Treasury bond over a money market fund, they are settling for a lower yield and higher duration risk. In order to make that decision, the investor must firmly believe that the US economy is going to enter a recession in order for his investment to produce an outsized return.

The Bond Math doesn’t make a strong investment case to hold long duration US Treasury bond. Unless of course there is a recession.

After the largest correction in the bond market, the 10Y US Treasury bond yield stands at 4.83%. Since the start of the Fed tightening cycle to now, the 10Y Treasury bond has lost 44% of its value. This is huge.

While there very well could be a tradeable bottom in the US 10Y Treasury bond, I do not see a convincing case, given the long term structural trends in the US economy.

However, I would like to point out that compared to 2021, there is a much more favorable investment case for the 10Y US Treasury today. This is because, today the 10Y US Treasury bond yield is 2.44% above the breakeven inflation rate, compared to 2021 when the 10Y US Treasury bond yield was 0.8% lower than the breakeven inflation rate.

Furthermore, the spread between the 10Y US Treasury bond and the S&P 500 forward earnings yield is now 1%, which is a very low risk premium for an investor to invest in a riskier asset class such as equities versus a risk-free asset, which is the 10Y US Treasury bond.

There is also a growing narrative around the rising possibility of a US recession, or general economic weakness, as can be seen in Bill Ackman’s tweet below. Either of those scenarios would bode well for the US Treasury bond.

However, it is the supply-demand dynamic amidst rising government debt levels that makes the math unfavorable to the hold the 10Y US Treasury bond, in my opinion.

When I look at the supply side of the US Treasury bond, I see that the prospective supply of Treasury bonds to be issued is large, because the government’s deficits are large and growing. Not only that, given the current interest rate environment, the government’s interest payments are also ballooning, forcing them to issue even more debt and hence the vicious cycle continuous.

👇🏽Here’s some quick calculations by Lyn Alden on the magnitude of government debt and interest payments that we will see over the coming years.

“If the Fed merely holds rates at where they are, then more and more of the existing $33.5T in debt will be refinanced at these high current rates. In other words, if all of the debt was yielding 5% on average, the total interest expense would be ~$1.7T, rather than the ~$900B today. It would take time to get there, but that’s the direction.

Plus, we also have to consider upwards of $1.7T in new debt per year. If we add $1.7T to the debt for the next four years, that’ll be upwards of $40T in debt. If that yields an average of 5%, that’s $2T in interest expense.”

Now when I look at the demand side, I suspect prospective demand to be lower than before, as foreign buyers of bonds, banks and central banks already own a lot of US Treasury bonds and have unrealized losses on them. Plus some foreign holders of bonds are worried that they could be sanctioned in the future which could mean that they wouldn’t be able to convert their US Treasury bond holding into cash that they could spend.

Furthermore, as of the recent FOMC meeting, the Fed has indicated that they are looking to hold rates at higher levels for much longer than anticipated. This has created a bloodbath in the Treasury market since September 20, 2023, as the 10Y US bond yield has surged from 4.5% to 5%, in a matter of weeks and the market continues to struggle to find a supply-demand equilibrium.

Given the complexities and uncertainties in long duration US Treasury bond, I would personally prefer to stick to cash in the short term. Or perhaps explore TIPS, as an alternative option, should I expect inflation to remain anchored or higher for longer.

TIPS stands to benefit if inflation remains over breakeven inflation & risk premium stays anchored.

The 10Y TIPS or Treasury Inflation Protection Securities yield an attractive 2.45% today. But how are TIPS different from cash and bonds?

Let’s say you invest $1000 in a 10Y TIPS with the present coupon rate of 2.45%. If inflation is 3% over the next year, the face value of the TIPS will adjust upwards to $1030 and you will get an annual interest payment of $55, or 2.45% (the coupon rate) of the adjusted principal. In a deflationary environment, the reverse would be true where the face value and interest payments would decrease, but still keep pace with the now-lower cost of goods and services.

This is different from a traditional bond that offers a “nominal” return and maintains a fixed face value until maturity, with no adjustments for inflation.

The investment case for TIPS is anchored around the investors’ inflation expectation for the economy. Currently, the 10Y US Treasury bond yields a nominal rate of return of 4.83%. This is 2.38% higher than the 10Y TIPS which yields a real rate of return at 2.45%.

The difference between the 10Y US Treasury bond yield and the 10Y TIPS is called “breakeven inflation”.

If the investor believes that inflation would be less than 2.38% over the next 10 years, then it would be better to buy the 10Y US Treasury bond that yields a nominal rate of return of 4.83% and hold it to maturity. Alternatively, the investor could choose to hold cash for the time being.

If the investor believes that inflation would be higher than 2.38% on average for the next 10 years, TIPS would be a better investment choice compared to the 10Y Treasury bond. As for cash, if inflation is rising faster than interest rates, TIPS would again be a better choice.

The biggest risk for TIPS is that real yields could keep heading higher as inflation persists longer, interest rates rise and risk premium goes up . In that case, the price of TIPS will weaken. The second risk for TIPS is that if inflation undershoots the breakeven rate due to an economic slowdown or a recession, TIPS will underperform nominal bonds. Finally, the third risk is that actual expenses for the investor could increase at a faster rate than overall inflation; think how the price of houses, hospital services, meat and so forth have risen at a much faster pace than CPI over the long term. In such instances, the interest payment from TIPS wont be keeping up with the pace of growth in personal expenses for the investor.

A Scenario Map to guide through investment tradeoffs between cash, bonds and TIPS in different economic scenarios

While cash, 10Y US Treasury bond and 10Y US TIPS offer attractive yields, they also come with tradeoffs based on the investors’ expectation for inflation and interest rates.

Therefore, I present to you with a quick map to guide you through the potential relative performance of cash, the 10Y US Treasury bond and the 10Y TIPS across possible economic scenarios below.

From the above chart, we can make the following conclusions:

Cash is king as long as rates are rising in the “high for longer” economic scenario.

The 10Y Treasury bond will outperform the rest only if there is a 2008 style recession.

The 10Y TIPS stands to benefit if rates rise from current levels because of rising inflation expectations and not risk premium. Furthermore, should we enter a recession with inflation at high levels, the 10Y TIPS may also stand to benefit, depending on future inflation expectations.

Hope you enjoyed today’s post. Are you bullish or bearish on cash, bonds or TIPS? Please leave your comments in the section below.

Amrita 👋🏽👋🏽

Great post Amrita. I love scenario analysis so especially loved your table showing potential growth and inflation outlooks and their effects on cash, US treasuries and TIPS. Great work!

Thank you for another insightful article, Amrita! 😃

My father-in-law was a very wealthy man, and only invested in bonds and a few stocks. His wealth didn't grow so much as his investments were safe and preserved the wealth he made from being a successful farmer.