Duolingo is a language app. Why does it want to teach Maths and Music?

Duolingo's sensational social media presence has spearheaded user acquisition & engagement, yet revenue per user is flatlining, forcing management to diversify its product lines & subscription plans.

At a Glance

Duolingo has built a sensational social media presence since the pandemic started, allowing it to exponentially grow its user base around the world as the app partners with their users on their language learning journeys.

“Power users” of Duolingo, who are defined as users who open the app at least 15 days in a month have risen from 20% to 30% of the entire user base.

However, as Duolingo launches its news products “ Duolingo Math” and “Duolingo Music”, along with an app redesign, the company faces backlash from some users who are not happy about the changes.

Duolingo boasts itself on its world-class gamification strategies and a robust experimentation culture that allows it to engage with its users and monetize their user base. In fact, in-app purchases, which is a product of Duolingo’s gamification of the language learning process, is expected to become the second largest source of revenue growth, after subscription revenue.

However, the company noted that its average revenue-per-user is starting to flatline, forcing the management to diversify its product lines and subscription plan offerings.

Read below to unlock the data insights driving Duolingo’s decision to offer Maths and Music as new product offerings in its quest to deepen the experience and engagement with its user base.

Duolingo’s sensational social media presence has spearheaded its user acquisition and user engagement

Duolingo, the language learning app that almost feels like a cross-over between Angry Birds and Candy Crush has captivated millions of users around the world by partnering with them on their language learning journeys and converted them into Duo-loving fans along the way.

Duo, the app’s mascot, has a fierce fan following on most social media channels. There’s this Twitter account that documents the funniest translations of sentences on its app platform while Giphy has a meme page dedicated for the app.

But Duo’s official TikTok account is where the app’s cheeky mascot saw an explosive growth in followers, especially since the beginning of the pandemic. The account had a revelation overnight with Duo finding funny and creative ways to engage its followers, even if it means that Duo has to twerk.

The app’s explosive social media growth could be one of the reasons that made user acquisition and engagement for Duolingo easy. Today the company and its stock has grown into a fan favorite among Wall Street analysts as well.

However, with everything going so well, one begs the question - why is Duolingo looking to teach its users Maths? And Music??

While power users grow at Duolingo, the company is also battling with an increasing number of angry users as the company launches new products and an app redesign

Early last year, Duolingo teased a couple of major initiatives which included a major app redesign and products like Duolingo Math. While Duolingo Math seems to have been targeted to mostly primary and middle school kids, it is the app’s global redesign late last year that has infuriated a section of its user base. Users took to social forums, such as Reddit, to vent their frustration. Duolingo’s own official user forum was shut down without any explanation.

Then at DuoCon, last year, the comment section of the live stream event was again flooded with comments from angry users. When the CEO was asked about it, he dismissed the angry users as “change-averse” - quite courageous for a CEO to dismiss his user base like that. Either he knows for sure what he is doing or this will come back to bite him in a big way.

When an analyst asked a similar question early last year during Duolingo’s Q1-FY21 earnings review call, Luis Von Ahn, the CEO of Duolingo confidently pointed them to the company’s rich history of user experimentation and said, “that they’re constantly running thousands of A/B tests”. In the same call, the CEO had said that they would only launch a redesign of the app once their experimentation metrics gave them enough confidence to do so.

An analysis of data from SensorTower in August, corroborates the CEO’s reason for optimism.

“Power users” are defined as those who open the Duolingo app more than 15 days a month. You can see from the chart that there is a sudden rise of “power users” since 2022. This coincides with the same time when Duolingo started implementing a number of gamification mechanics, including an overhaul of the interface and broad structure of the learning tracks.

Prior to this change, power users made up around 20% of all Duolingo users. Following the update, the share of power users as percentage of Duolingo’s user base has jumped to over 30%. At the same time, the share of “churned users” (users who opened the Duolingo app in a given month, but failed to do so the following month), declined considerably, from 47% in mid 2020 to around 37% in early 2023.

How Duolingo monetizes its user base with world-class gamification strategies and a robust experimentation culture?

Duolingo was started in 2012 by a Carnegie-Mellon Professor/Student duo - Luis Von Ahn (Founder/CEO) and Severin Hacker (Founder/CTO). Headquartered in Pittsburgh, Duolingo initially started out as a non-profit organization, but the business model quickly changed to a language coaching app with the goal to teach English for free.

There were doubts about the business viability of a free app that could self-sustain but the phlegmatic cofounders were unfazed & continued to trust their “Human Computation” fundamentals. In case you are wondering if the name “Luis Von Ahn” sounds familiar, he was also the founder of reCAPTCHA tests that are deployed all over the internet to test if you are human.

Over the next decade, Duolingo saw some tremendous growth. They launched the Duo English Test, which costs $49 and partnered with ad publishers to push ads on their platform. But questions about its freemium model lingered.

In April 2017, Duolingo debuted its subscription service called Duolingo Plus, aimed at users who wanted the ad-free experience. At that time, the CEO hinted that they were spending roughly around $42,000 per day to cover the cost of employees, servers etc.

The subscription strategy seems to have paid off because today, subscriptions account for roughly three quarters of its entire revenue. The remainder of the revenue comes from Ads and Duo English Test which provide marginal, but steady contributions to Duolingo’s revenue.

Ultimately, Duolingo’s secret sauce lies in its ability to gamify each and every user’s learning journey on the app and incentivize them to be engaged. Such is the app’s mastery to drive app engagement that users are willing to buy their way to success on their Duolingo journey by buying various tokens available for purchase on the app. In-app purchases which was almost meaningless to Duolingo’s top line revenue growth at the start of FY21, is now poised to overtake Duolingo English Test to become the second biggest source of revenue growth.

A quick summary of Duolingo’s reward mechanism will explain the level of engagement & Duolingo’s concurrent monetization strategy.

✅ When you sign up for a Language Lesson, the app breaks down your lesson into daily milestones called XP goals.

✅ Every time you achieve your daily XP goal, the app rewards you with a combination of virtual currency called Gems💎 & Lingots♦️.

✅ To control the pace of your lesson completion and the quality of your responses during the lesson, the app also awards you with Hearts. Then there are knowledge tests called Daily Quests which will also reward you with hearts❤️.

✅ During the tests, the app records your winning streak of answering the right questions.

✅ If you miss out your lesson plans even for a day, you may loose your winning streak at which point, the app deducts hearts and will remove your winning streak badge. Winning-streak-badges are bragging rights which are highly sought after in Duolingo’s community, especially by the app’s younger users.

While Adults show more propensity to stay focused on completing winning streaks, Gen-Z’s are more prone to buying their way to complete streaks. By the way, Gen-Z’s also account for over 50% of site traffic to Duolingo according to SimilarWeb. Mr. Von Ahn knows this and alluded to this crucial piece of insight in an investor conference, while subtly explaining the need for more product diversification and an app redesign around the company’s gamification strategy.

Duolingo pushes new products and a premium subscription plan to shield itself from declining revenue per user

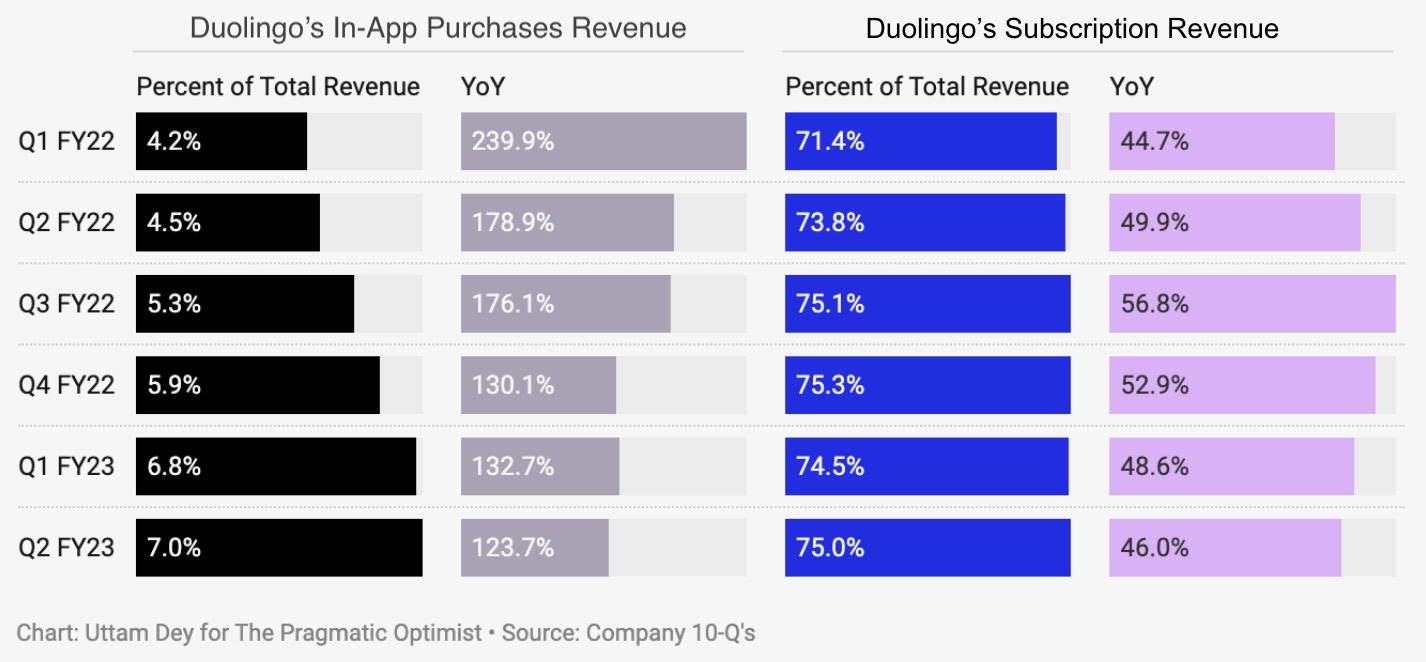

The chart below shows an interesting trend of the contribution that “In App Purchases & Other Revenue” segment make to Duolingo’s top line. While In App Purchases are expected to overtake Duo English Test to become the second largest source of revenue, the same chart also shows that the growth of the in-app purchase revenue segment is starting to decline on a YoY basis.

On a call with investors last month, Duolingo’s management explained that they are experimenting with offering a premium tier subscription service called Duolingo Max. Duolingo Max is planned to be priced at 2x the current Super Duolingo subscription plans (Super Duolingo is priced at $7 per month or $84 per year, USD). While Super Duolingo offers ad-free experience & unlimited hearts as perks, the premium subscription is built around OpenAI’s language model and allows users to chat with Duo - the app’s zany mascot.

With the new updates from management, its quite clear that Duolingo is focused on deepening the experience and engagement with the massive user base that they’ve acquired over the past 3 years. This is taking place in the background where the CEO Luis Von Ahn admitted that they are expecting flat YoY growth in Average Revenue per User in 2023.

The chart below illustrates Duolingo’s massive growth in user acquisition per quarter, which at the same time, is accompanied by the flatline trend in the Average Revenue Per Daily Active User.

For now, it seems that Duolingo is using the newly launched products such as Music and Maths to continue the momentum in user acquisition while exploiting their gamification strategy to deepen user relationships and monetize engagement. Eventually, their goal is to convert more free members from their newly acquired user base to premium subscribers, just like the typical freemium-to-premium app model.

What Others are saying?

UBS believes that Duolingo has a “best-in-class brand” within the language learning space which is still early in its online penetration ramp. According to the bank, Duolingo has the potential to accelerate user engagement and payer penetration trends by leveraging Generative AI-powered content creation, which could result in a 29% CAGR (compounded annual growth rate) in subscribers over the next two years.

Most other investment banks have similar views on Duolingo. Some firms like RaymondJames have neutral views whereas others like JMP securities have given the stock a minor downgrade due to the stock’s meteoric performance on the stock market. In general, it seems like Duolingo’s plans does have Wall Street analysts excited for now.

Further Reading!

In case you’re interested in getting deeper into Duolingo’s experimentation & gamification frameworks, I’ll just leave the links below:

How Duolingo reignited user growth |Lenny’s Newsletter (Substack)

Improving Duolingo, one experiment at a time | Duolingo Blog

How Duolingo Runs Experiments at Scale |Q&A with Severin Hacker, Duolingo’s CTO (Medium)

Let’s do a quick polling!!

If you have used Duolingo to learn a new language, let us know in the comments section which language you picked up using the app.

Have a great rest of the week.

Uttam & Amrita 👋🏽👋🏽

I’ve used the free version of Duolingo and eventually became frustrated with it due to the extreme frequency of interruptions to shill for the paid version. I found the free model to be virtually useless which meant I dropped the app rather than becoming a paid subscriber.

Great write-up! I liked the coverage of some important SaaS KPIs such as Active Daily/Monthly users and ARPU.