For Starbucks to turn around, these two things need to change.

With Brian Niccol assuming role as CEO of Starbucks on Sept 9, his work is cut out. Strike balance between the digital and in-person experiences, while keeping Howard Schultz at bay.

«The 2-minute version»

PSL-season is here and that means change of weather & flavor🍂. This year at Starbucks it also means change of leadership with the highly-revered Brian Niccol taking over the reins from Laxman Narasimhan who ended up serving one of the shortest leadership roles at Starbucks. Niccol (who served as the CEO of Chipotle since 2018) has assumed the throne 👑 yesterday from his remote office in Southern California to lead the ailing company’s turnaround efforts.

Since the announcement 3 weeks ago: Starbucks’ stock shot up like a double shot of espresso, rising over 25%, making it one of the strongest performers in the month of August. Wall Street believes Brian Niccol is the right pick for the role given his deep experience in restaurants where he (and his team) has delivered a generous return of over 800% 👑 for Chipotle’s stock during his tenure at the company.

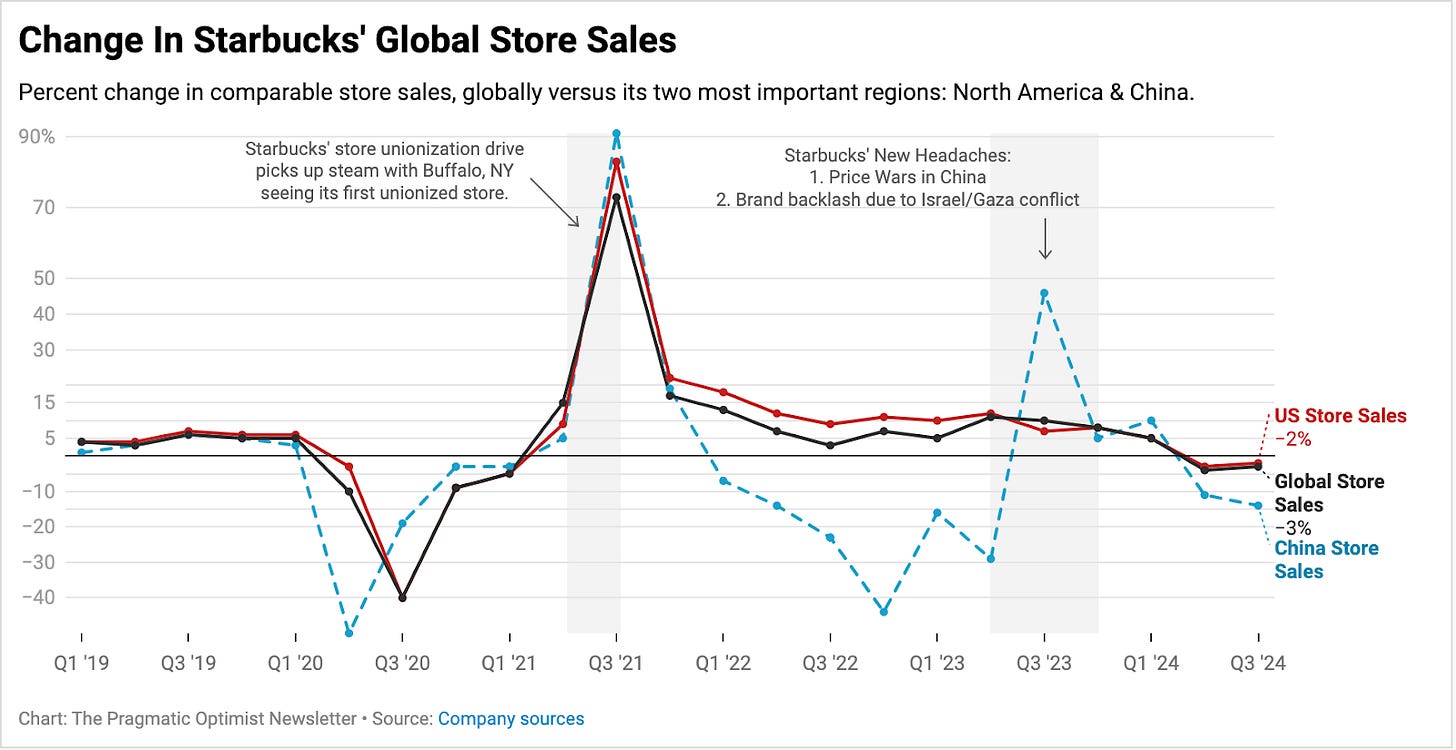

Meanwhile: Starbucks has been severely underperforming the S&P 500 since hitting its peak of $125 in July 2021, as it saw its revenues decline for two straight quarters, with falling store sales in the US & China and, a lower average ticket size per customer, while earnings also decelerated.

Starbucks lattes have lost their shine: Long wait times, incomplete orders, growing competition, especially from independent coffee shops and chains like Dutch Bros as well as fast food chains like McDonalds, unionizing employees, and a highly discerning customer with tighter wallets are all to blame. Not to mention its food innovation towards colder beverages may have alienated its core customer base.

Starbucks’ “The Third Place” identity is under crisis: Originally built for people in a community to hang out, the increasing digitalization of the business in the form of mobile orders and grab n’ go meant that store ambience mattered less. Essentially, there is a shift in mindset from “how can I enjoy my time here?” to “how fast can I get out?" Yet, despite the vibe change, Starbucks continues to charge its products at premium prices, causing it to lose market share to competitors.

There’s a herculean task ahead for Niccol: With Starbucks needing a new recipe for success, Niccol’s track record of success made him the flavor of the month. It is important to realize, however, that this won’t be a straightforward line. Not only is Starbucks more than three times Chipotle’s size in revenue with a footprint spanning myriad countries, but current trends are more challenged than when Niccol joined Chipotle. For now, his tasks are set.

Striking the balance between growing its in-app digital and mobile sales while rekindling its in-store experience to restore the vibe.

Not getting on the wrong side of Howard Schultz.

🎥Let’s set the stage…

The air has definitely changed in Seattle. Staying in Vancouver, across the border, we feel the air has become crisper already. And that means more of three things: More foliage, more pies, and a lot more pumpkin-flavored everything, especially PSLs.

While PSLs and Peppermint Mochas will remain on the Starbucks’ seasonal menu, this fall season is going to feel notably different at Starbucks’ HQ.

In the last month, the entire food and restaurant industry has been shaken up with Starbucks launching one of the biggest leadership heists in corporate history, firing previous CEO Laxman Narasimhan and hiring celebrated former Taco Bell guru Brian Niccol away from Chipotle CMG 0.00%↑.

With Brian Niccol officially assuming the role of CEO yesterday (on September 9th) from his remote office in Southern California, his first job will be to remind patrons like us of what Starbucks used to be and why we should be buying more Starbucks coffee.

Starbucks Lattes Have Lost Its Shine & Value

When Starbucks brought in Narasimhan as its CEO less than two years ago, the company embarked on multiple roadshows to highlight the strength of its new CEO hire at the time. Having worked in consumer product companies such as Pepsi & Reckitt, Narasimhan’s background was viewed by the board as a lateral fit to the brand building that Starbucks needed. A statement from the Chair of Starbucks’ board at the time called Narasimhan a “proven brand builder” and an "innovator,” praising Narasimhan’s “intensive immersion” into the Starbucks business.

This was severely needed as the coffee chain’s vision of being ‘The Third Place’ for consumers was rapidly dissipating. Howard Schultz, who is sometimes credited for being the unofficial fourth founder of Starbucks, had envisioned every Starbucks cafe to be the third place where consumers could visit after their home and their workplace.

But as soon as Narasimhan took over, the company’s coffee store sales, which had once again started to pick up during Schultz’s third CEO stint, started to decline. This year was one of the worst years for Starbucks sales, if one ignores the pandemic distortions.

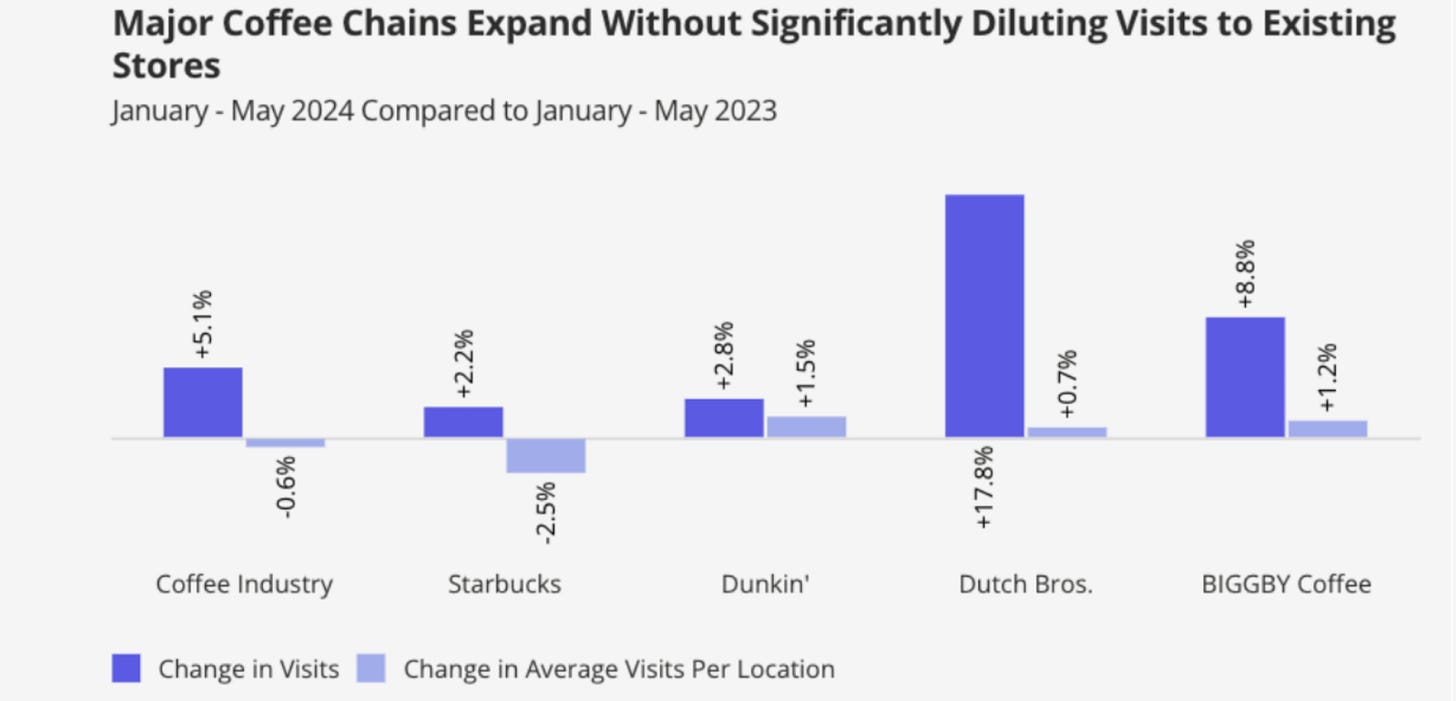

On one hand, people are visiting Starbucks stores less frequently, with comparable sales in company-operated stores contracting for two consecutive quarters in a row.

On the other hand, people are also spending less per order in North America, as can be seen below with the declining average ticket size.

In contrast to that, some of Starbucks competitors have been seeing a rise in customers visiting their coffee stores, with one company in particular being a big beneficiary: Dutch Bros BROS 0.00%↑.

You see, when Schultz built Starbucks as a “Third Place” for people in a community to hang out, the brand was able to justify a premium price by offering a decent product and upscale interiors. However, the increasing digitalization of the business has been slowly eroding the soul of the brand, and now it stands at odds with its original “Third Place” vision.

lays it out perfectly in the paragraph below 👇🏼“The transition to mobile orders and grab ‘n go meant that store ambience mattered less. Customers cared about “how fast can I get out?” vs. “how long can I enjoy my time here?”. Somewhat ironically, everyone rushing to mobile orders for convenience creates long wait times. This added volume turns the work of a barista from that of a quasi-artisan into a McDonald’s-like assembly line worker. Even as the product commoditized and independent coffee shops offered the old Starbucks vibe, the current Starbucks keeps charging premium prices. Sir, I need caffeine in my dome immediately. Why am I paying $6 for a Grande Iced Coffee that I have to wait 13 minutes to get when I could grab a Red Bull from 7-11 in 2 seconds?”

Plus, we also think its menu could have alienated its core customers with recent innovations, like lavender beverages, energy drinks, and popping pearls, which (surprise, surprise) take longer to make and consist of multiple steps, thus leading to longer wait times.

To further complicate matters, prices for coffee beans surged through 2021-2022, and Starbucks conveniently passed on the prices to the consumer in many price waves. This led to a growing number of consumers to dissent against the coffee chain, and that sentiment is only picking up steam as more consumers lose trust in the value that Starbucks provides.

The culmination of these trends leading to revenue decline and customer visits spooked the board of Starbucks. This also led Schultz to write a widely circulated critique piece on LinkedIn a few months ago, aimed at Narasimhan and his team for losing market share on American grounds, leading the company to do something that it never saw itself doing in the last 3 months: it jumped into the price wars in the U.S., advertising its own $5 deal and offering customers a “pairings menu,” a.k.a. menu bundles.

However, with an ailing stock and deteriorating employee morale, Narasimhan did not have much to shield himself in this interview, which went horribly wrong and may have been the final straw for the board that eventually decided to replace him with Brian Niccol from Chipotle in an abrupt management shake-up.

***If you are enjoying the content so far, consider upgrading to annual membership of $80 before prices go up. Also, booking an annual membership now will guarantee no further price increases EVER ***

Mobile & Digital Is The First Problem For Niccol To Tackle

Brian Niccol is a marketing guru who rose to fame, leading Taco Bell to record market share and profitability during the early 2010’s. During his time at Taco Bell, one of the key changes Niccol made was to give Taco Bell’s young consumers a way to order from their stores online and through mobile phones. In fact, Taco Bell was probably one of the earliest restaurant chains to adopt digital payment methods.

When Niccol took over Chipotle’s CEO job in 2018, in addition to customizing his innovation and marketing strategies fit for Chipotle’s target consumers, Niccol ruthlessly prioritized mobile and digital order channels for Chipotle’s customers in the 2 years leading up to the 2020 pandemic. This led Chipotle to be one of the standout performers in the restaurant industry despite a constantly evolving macro backdrop, delivering strong double-digit growth due to the robust momentum in its digital sales, which accounted for a fourth of Chipotle’s business.

One does not have to spend time reading the tea leaves to see what Niccol would start doing at Starbucks. With the coffee chain having around 36M Rewards members worldwide, Niccol is going to find a way to activate these members and incentivize them to return to Starbucks stores.

Expect Dutch Bros to feel the heat because a lot of the Oregon-based coffee chain’s business strategies find synergy with Niccol’s mentality: innovative formats for coffee drinks, a lot more of Starbucks on Reels and TikTok and some fruition to Schultz’s vision of drive-throughs in Starbucks cafes, at least in North America.

In addition, Niccol is also expected to rapidly renovate the entire Starbucks Mobile experience, including Mobile Order & Pay features.

However, our concern is that if it is unable to revamp its in-store experience simultaneously, it will be challenging for it to command a premium price, which will likely compress its margins. Essentially, here is the dilemma. As Starbucks trends more towards digital, countless other independent coffee shops stand to create a truly differentiated in-person experience that actually justified a premium price.

Starbucks’ Backseat Driver Is The Other Danger

With Niccol in at Starbucks, the company’s board has scored a huge win for the company, its employees, its investors and its customers. But Niccol will have to navigate Starbucks through choppy waters keeping his eyes on the rearview mirror at all times for Starbucks’ main man in the back seat, Chairman Emeritus, Howard Schultz, who also happens to be one of the largest shareholders at Starbucks.

History shows that Schultz’s backseat management tactics may have at many times imposed upon the agendas of the previous CEOs in charge of Starbucks. Schultz has in the past swooped in and returned to the CEO’s position three times now in the past two decades to redirect the company towards his overarching vision of the coffee chain. And on many instances he has publicly decried the leadership teams at their jobs, before eventually coming in to “save the day” for Starbucks.

Most recently, Schultz openly criticized Narasimhan’s business strategy in the LinkedIn post we shared earlier in this article. That was after he shared his February letter to Starbucks’ senior management, advising them on how to run the business better. During Jim Donald’s time as Starbucks’ CEO, between 2005 to 2008, Schultz published his notorious armchair memo bemoaning the fact that Donald’s management was erasing “the Starbucks experience” and making it so that Starbucks cafes “no longer have the soul of the past.”

There is no easy way out of this for Niccol. With Schultz being the icon that he is, a large Starbucks shareholder and an enthusiastic fan of the Starbucks brand, Niccol will have to steadily put Starbucks back into growth mode once again with these two things in mind: Striking the balance between Digital and in-person experience & Dealing with Howard Schultz. The latter could possibly be easier given the common goals they share with Starbucks’ digital strategy.

Back to you!!!

While we are staying on the sidelines at the moment given our belief that the stock is still valued at premium multiple given a range of uncertainties that we discussed, we would love to hear what you are planning to do with the company’s stock. Oh and if you are still a Starbucks customer (regular or otherwise), do let us know what your favorite drink is? Ours is the good ol’ fashioned Americano ☕that gives us the necessary shot of caffeine to remain pragmatically optimistic about the world.

Starbucks just made their investors look like StarSchmucks.

I think the are a number of things to consider when it comes to the Starbucks sales slump, and you did a fine job of considering them.

Marketing is definitely *not* an issue -- but those in the advertising world will always tell you it is. 😉 👉

I would only like to add that I think the lingering effects of the COVID-19 scare are effecting all places like Starbucks.

For nearly a year, longer in some places, people were not allowed to have their "Third Place" hangout. As a result, they learned to live without it.

Similarly, as costs (for everything save durable goods) skyrocket, novelty sugary coffee drinks will become rather low priority.

Americans for more than half a century have enjoyed some of the lowest food prices in the world. That is, when considering the cost of food, as a percentage of income. That's changing very quickly. People tend to prioritize "roof over head, food in my stomach."

Also consider, Starbucks being overpriced was actually a part of the brand. After all, you can't sell coffee at Dunkin' Dounuts prices, and claim to be upscale. It just doesn't pan out. Starbucks is what it is -- because it is above a price point.

Now it seems that price point is too high for its base customer.

CEOs can promise the world, but they can't put money in their customers pockets and remain profitable.

My prediction is that places like Starbucks will continue to do poorly, until the economy rebounds, which is likely not to happen for a *very* long time.

This is an extraordinarily comprehensive analysis. And very interesting. The work you do always exceeds expectations. Thank you so much.