Friday 5: Chipotle's robot-made burrito bowls, Jamie Dimon's bold AI prediction, GenZ's hustle for homeownership and more...

One announcement, one prediction, a short history of how the first ever dividend was paid, a housing survey result and five hilariously clever ads that will end your week on a high note.

At a Glance

🦾🌯A robot would soon be making your next Chipotle burrito bowl. Chipotle is collaborating with the food service automation startup, Hyphen to build out its newest robotic prototype that will be installed in Chipotle’s 7000 restaurants in the next 12-18 months.

🤖 🗓️ Jamie Dimon, the CEO of JPMorgan Chase, predicts that A.I will lengthen human lifespan to 100 years, eliminate cancer and shorten the workweek to 3.5 days a week.

🌰💰Did you know that the first dividends were paid out 400 years ago by the Dutch East India Company in spices?

🏠 📈 GenZ’s and millennials face one of the harshest housing markets in the USA, with mortgage rates at a 20 year high. With housing prices having climbed 40% since the beginning of the pandemic, wages certainly have not kept up. This is forcing the younger generation to pick up side hustles and work at least 2 jobs to pay for their down payment.

📰 📺 I have collated 5 delightful and clever ads from well-known brands over the last decade. Read below, have a laugh and vote which one of them you liked the most.

🦾🌯 Are you ready for a robot-made burrito bowl the next time you go to Chipotle?

A robot would soon be making your next Chipotle burrito bowl.

According to the company’s official reveal earlier this week, its newest robotic prototype is a collaboration with the food service automation startup, Hyphen. The robotic prototype will now create virtually any combination of available base ingredients for Chipotle’s burrito bowls and salads underneath human employees’ workspace.

In an April earnings call, CEO Brian Niccol called the technology an exciting part of the chain's future as it strives to reach 7,000 restaurants. Hyphen "will enable us to be even more accurate," Niccol said. "I think probably go a little bit faster, and I think give people more consistent experiences."

In July, Niccol told investors that Chipotle expects to install Hyphen's automated kitchen line in restaurants "in the next 12 to 18 months."

Meanwhile, staff are reportedly allowed to focus on making other, presumably more structurally complex and involved dishes such as burritos, quesadillas, tacos, and kid’s meals. Watch the robot prototype plop food into little piles in the bowl under the workspace here:

🤖 🗓️ JPMorgan CEO Jamie Dimon says Artificial Intelligence could bring workweek down to 3.5 days

JPMorgan Chase CEO Jamie Dimon is bullish on the benefits of artificial intelligence, which is already being used by thousands of employees at his bank, and he predicts it’ll usher in the norm of a shortened workweek.

“Your children are going to live to 100 and not have cancer because of technology,” Dimon said Monday in an interview with Bloomberg TV. “And literally they’ll probably be working 3½ days a week.”

When asked if the technology is likely to replace some bank jobs, he responded that “of course” it will, but that “technologies always replace jobs.” He added the bank hires some 30,000 people a year, and that he expects many displaced workers will be transferred to new locations and roles within the company.

My take: The prediction of a 3.5 day workweek reminds me of the famous economist John Keynes's 1930 prediction that his grandkids would have a 15-hour workweek. What Keynes missed then (and what Jaime Dimon misses now) is that work is less a product of technology and more a product of “culture”. AI will no doubt accelerate productivity per worker, but I expect in 10, 20, 30 years, we'll be working the same number of hours, if not more. Think about it, before the Industrial Revolution, human labor was concentrated around subsistence farming, to get enough to eat. Today, work is defined by our need for community and self-actualization. Result: While the evolution of “culture” has redefined what we do for a living, we work the same, if not more hours than our ancestors.

🌰💰 A history lesson: Did you know the first dividends were paid out in spices?

The history of dividends stretches back 400 years to the first issuance by the Dutch East India Company (VOC) management.

The modern stock market began in 1602 on the Amsterdam Stock Exchange, when shares of the Dutch East India Company first traded. Despite the company’s incredible monopoly on trade and demands from shareholders, the VOC did not pay a dividend until 1610.

Even still, this first dividend was paid in spices. Shareholders received “mace at a value of 75% of the nominal capital”.

It was not until 1612 that the company finally paid investors a cash dividend.

Source: Investor Amnesia

🏠 📈 Gen Z’s and millennials are facing the brunt of one of the harshest housing markets in the USA, forcing them to work 2 jobs to fund their down payment.

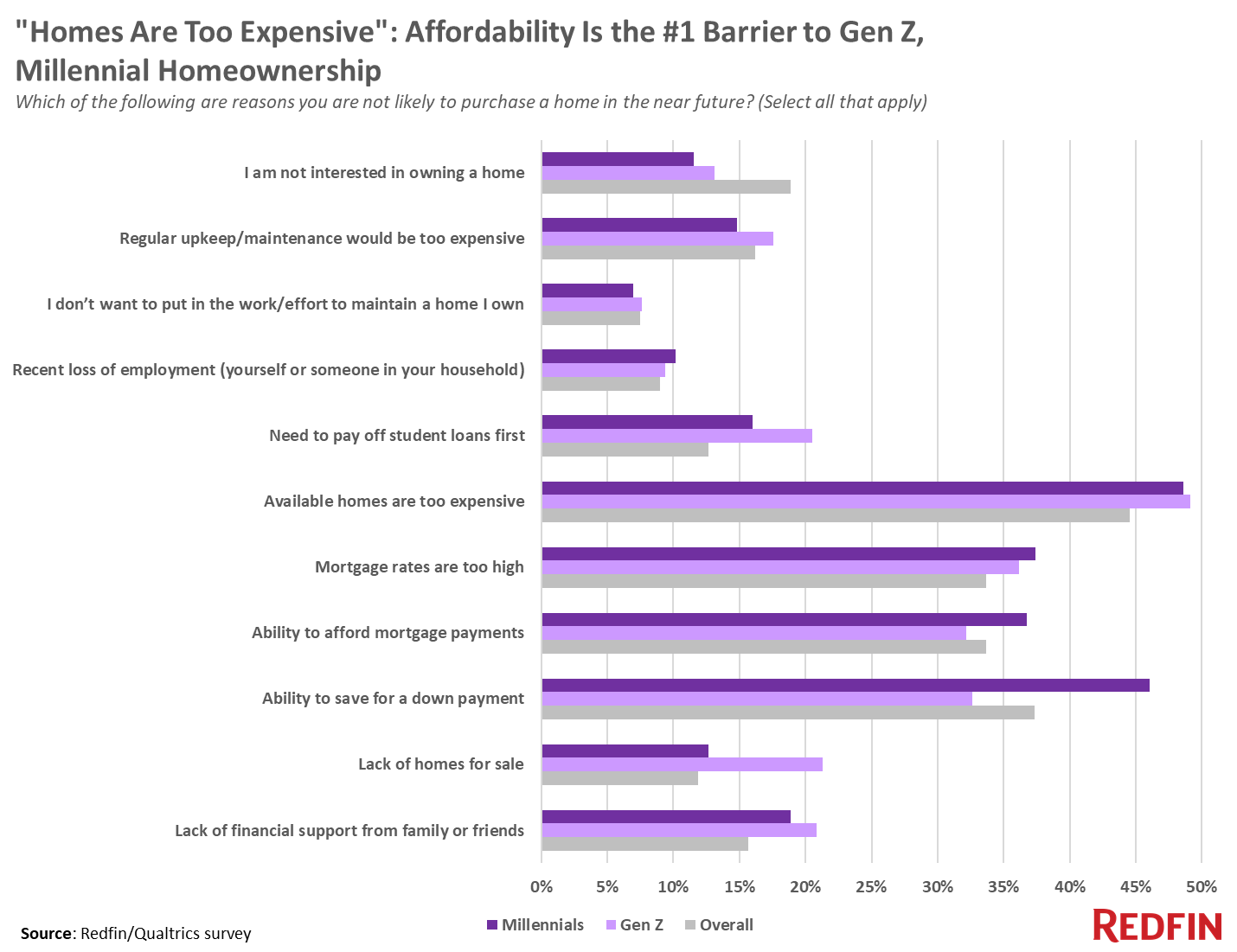

Lack of affordability is the number-one barrier to homeownership for young Americans. Roughly 50% of Gen Z’s and millennial renters who believe they’re unlikely to purchase a home in the near future, say the high price of homes on the market is blocking them from buying.

Record-low mortgage rates and the increasing prevalence of remote work during 2020 and 2021 fueled intense housing demand, which drove prices up. Now, rising mortgage rates have exacerbated the expense of owning a home. Mortgage rates have more than doubled from their low, hitting their highest level in more than 20 years in October, while home prices still remain high.

“The worsening housing affordability crisis has an outsized impact on Gen Zers and millennials because they’re much less likely to own a home than older generations,” said Redfin Chief Economist Daryl Fairweather. “That means many young Americans don’t benefit from rising home prices by gaining equity. Instead, these would-be first-time homebuyers bear the burden of high prices, high down payments and high monthly mortgage payments, without profits from a previous home to offset the cost.

Of the young Americans who are planning to buy a home in the next year, many are turning to side hustles for their down payment. About two of every five Gen Zers (41%) and millennials (36%) say they’ll work a second job to help fund their down payment, the most commonly cited method aside from saving directly from paychecks.

📰 📺 5 hilariously clever ads that will brighten your mood going into the weekend!!!

☕ McDonald’s 2009

💋 Durex on Happy Father’s Day

🏃🏽♀️ Nike 2018

⌚Timex 2022

🦷 Smile at the World 2020

Have a great weekend, everyone!!!

Amrita 👋🏽👋🏽

Amrita, make the subject of economics a good read! Thank you!

Thank you, have a great weekend!