Friday Five: 2 stats, 1 trend, 1 insight & 1 delightful new finding to end your Friday on a high note

Nvidia's CEO dumps shares, Millionaire migration resumes, founder-led companies' superior performance, your dog's human years recalculated & more...

At a Glance

💸 Jensen Huang, the CEO of Nvidia has sold close to $105 million worth of Nvidia stock. Nvidia stock is up 180% YTD. Does the magnitude of selling signal a shift in optimism?

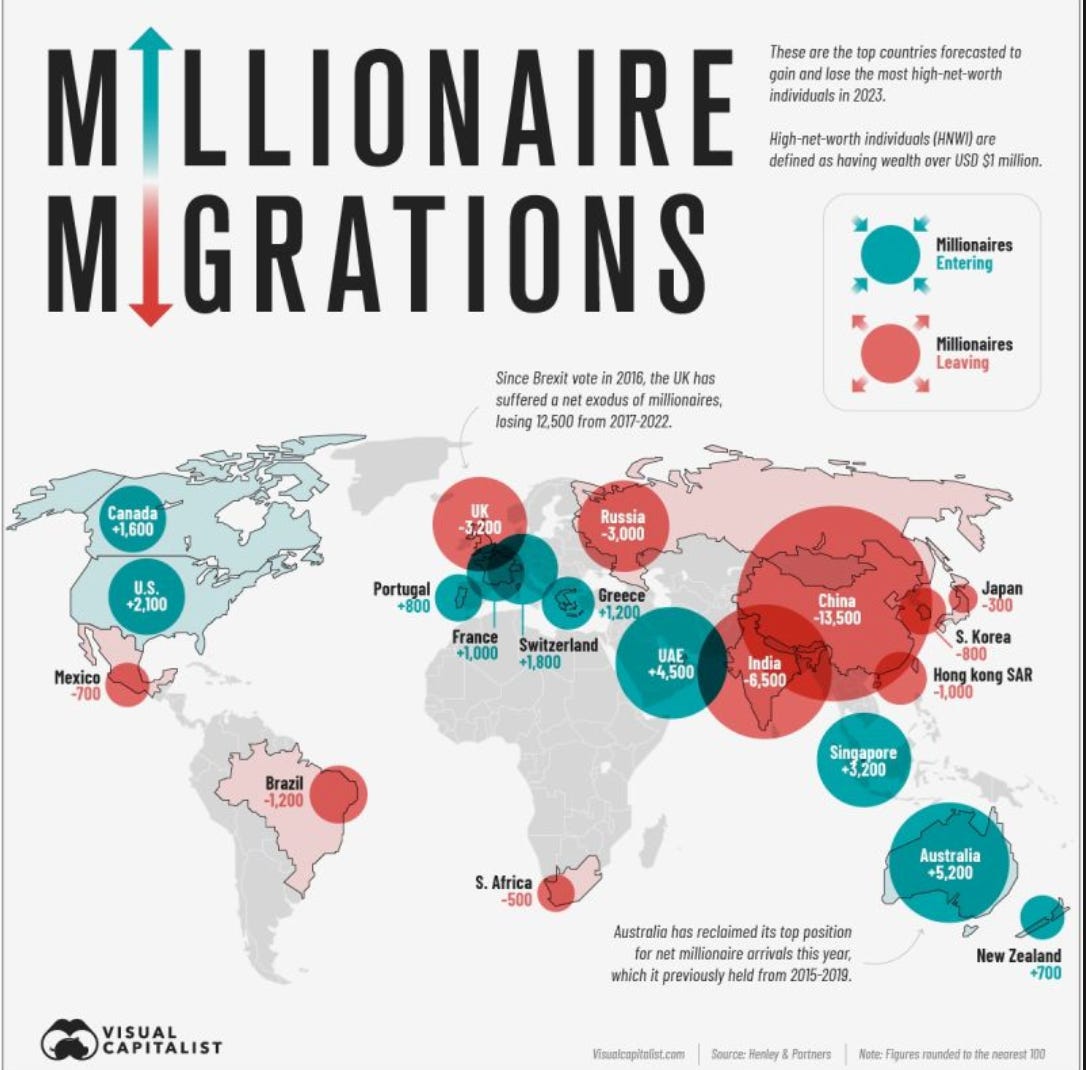

🌎 Millionaires and billionaires are on the move once again. It is anticipated that 122,000 high net worth individuals will move to a new country by the end of the year. Australia is the top spot, followed by the UAE. On the other hand, China is anticipated to lose 13,500 High Net Worth Individuals in 2023.

📈 Did you know that founder-led companies (where the founder still plays a significant role as CEO, chairman, board member, owner or advisor) performed 3.1 times better than the rest of the companies in the S&P500 over the past 15 years?

🐶 If there’s one myth that has persisted through the years without much evidence, it’s this: multiply your dog’s age by seven to calculate how old they are in “human years.” Well, the myth is finally busted. Turns out the dogs age faster when they are young and slower when they are old.

👩🏻💻 Only 10% of employees startup company stay for 4 years or longer. This means very few make it through the option grant.

💸 The CEO of Nvidia is dumping stock- should we worry?

Since the beginning of September, Jensen Huang, the President and CEO of NVIDIA, has sold close to $105 million worth of NVIDIA stock.

YTD, Nvidia stock price is up a whooping 180%. The company reported stellar revenue and earnings growth in 2023 and has undoubtedly a bright future ahead with revenue and earnings projected to grow 48% and 55% respectively in FY2024.

But is too much optimism baked into the stock price of Nvidia today? Is that why Huang is selling his shares because he is anticipating some form of a slowdown that will hurt the stock in the future?

Let’s put some context:

✔️ Nvidia's comprehensive stock ownership document was filed with the SEC on May 8 and reflected holdings on April 3. As of April 3, 2023, Huang owned 86,878,193 shares of company stock. This gives him a 3.5% ownership stake in the company and also makes him the largest individual shareholder.

✔️ In comparison, Vanguard, BlackRock, and Fidelity Investments owned 8.3%, 7.3%, and 5.6% of the company's shares, respectively.

✔️ Huang's recent combined stock sales don't even come close to approaching 1% of his total holdings in the company.

✔️ In short, Huang's recent stock sales amount to little more than a blip on the radar. Even after selling shares this month, Nvidia's CEO remains heavily invested in the business. He still has plenty of skin in the game, and his heavy insider ownership position should continue to incentivize him to pursue actions and strategies that work to the benefit of the broader shareholder base.

🌎Millionaire Migrations: Which countries are they going to?

Millionaires and billionaires are on the move again. Most recently, Sam Altman, Eric Schmidt & Peter Thiel received their respective golden visa this year.

It is anticipated that 122,000 HNWIs (High net-worth individuals) will move to a new country by the end of the year. Henley & Partners’ Private Wealth Migration Report has tracked the countries HNWIs have moved from and to over the last 10 years.

The map below showcases the 2023 forecasts. (In this context, HNWIs are defined as individuals with a net worth of at least $1 million USD.)

Here are the takeaways:

The top 10 countries which are likely to become home to the highest number of millionaires and billionaires in 2023 are scattered across the globe, with Australia reclaiming its top spot this year from the UAE.

Only two Asian countries make the top 10, with the rest spread across Europe, North America, and Oceania.

Many of the leading millionaire destinations are attractive for wealthy individuals because of higher levels of economic freedom, allowing for lower tax burdens or ease of investment. Singapore, which expects to gain 3,200 millionaires, is the most economically free market in the world.

However, China is anticipated to lose 13,500 High Net Worth Individuals this year, more than double that of India, which is also expected to lose 6500 HNWI’s.

In a geopolitically fragile world, it’s no surprise to see millionaires voting with their feet. As a result, governments are increasingly in competition to win the hearts and minds of the world’s economic elite to their side.

📈 Founder-led companies outperform the rest by 3.1x in the S&P500

A recent study by professors at Purdue’s Krannert School of Management found that companies where the founder still plays a significant role as CEO, chairman, board member, owner or advisor tend to have more more lasting performance compared to companies where the founders no longer have skin in the game.

Specifically, the study found that S&P 500 companies where the founder is still CEO are more innovative, generate 31% more patents, create patents that are more valuable, and are more likely to make bold investments to renew and adapt the business model, demonstrating a willingness to take risk to invent the future.

The research also showed that companies that maintain the founder’s mentality as they age are four to five times more likely to be top quartile performers. For instance, an index of S&P 500 companies in which the founder is still deeply involved performed 3.1 times better than the rest over the past 15 years.

The founder’s mentality is an indicator of a company’s readiness to act quickly, to adapt to change, to retain the ground-level instincts of a founder, and to innovate to invent and not fight the future.

🐶 How old is your dog in human years?

If there’s one myth that has persisted through the years without much evidence, it’s this: multiply your dog’s age by seven to calculate how old they are in “human years.” In other words, a 1 year old dog is similar in physiological age to a 7 year old human being and a 4 year old dog is similar to a 28 year old person and so forth.

❌ Turns out that is wrong.

A new study by researchers at UC San Diego busted the myth. Instead, they created a formula that more accurately compares the ages of humans and dogs. The formula is not linear, as we thought it once was. Instead, it is curved.

What does this mean?

This means when your dog is 1 year old, that is not equivalent to a 7 year old human being. Instead, a dog at 1 year old is equivalent to an adult human being at 30 years old. And a dog at 14 years old, would be equivalent to a human being at 70 years old.

In other words, dogs and human beings age at different rates, at different times in their lives. Dogs age faster than we do when they are young and slower when they are old.

👩🏻💻How many startup employees stay at a company for 4 years?

If you guessed less than 10%, congrats, you win. This means very few make it through the 4-year option grant.

64% of startup employees have been at their current company less than 2 years, which begs the following questions:

• How do you manage knowledge transfer, especially in high-turnover roles?

• How do you mitigate against key person risk (not just the founder, but founding employees in each department)?

• How do you incentivize top performers as they approach their 2-year mark, never mind the 4-year one?

Let’s do some quick polling for fun!

Hope you enjoyed today’s post. Don’t forget to leave a comment to share your feedback. Have a great weekend, everyone.

Amrita 👋🏽👋🏽