Friday Five: Meta's AR Glasses, Airbnb's Crackdown on Parties, Google & Apple's Search Deal, Amazon's R&D & more...

1 story, 1 product launch and 3 trends to keep you inspired for the weekend and beyond

At a Glance

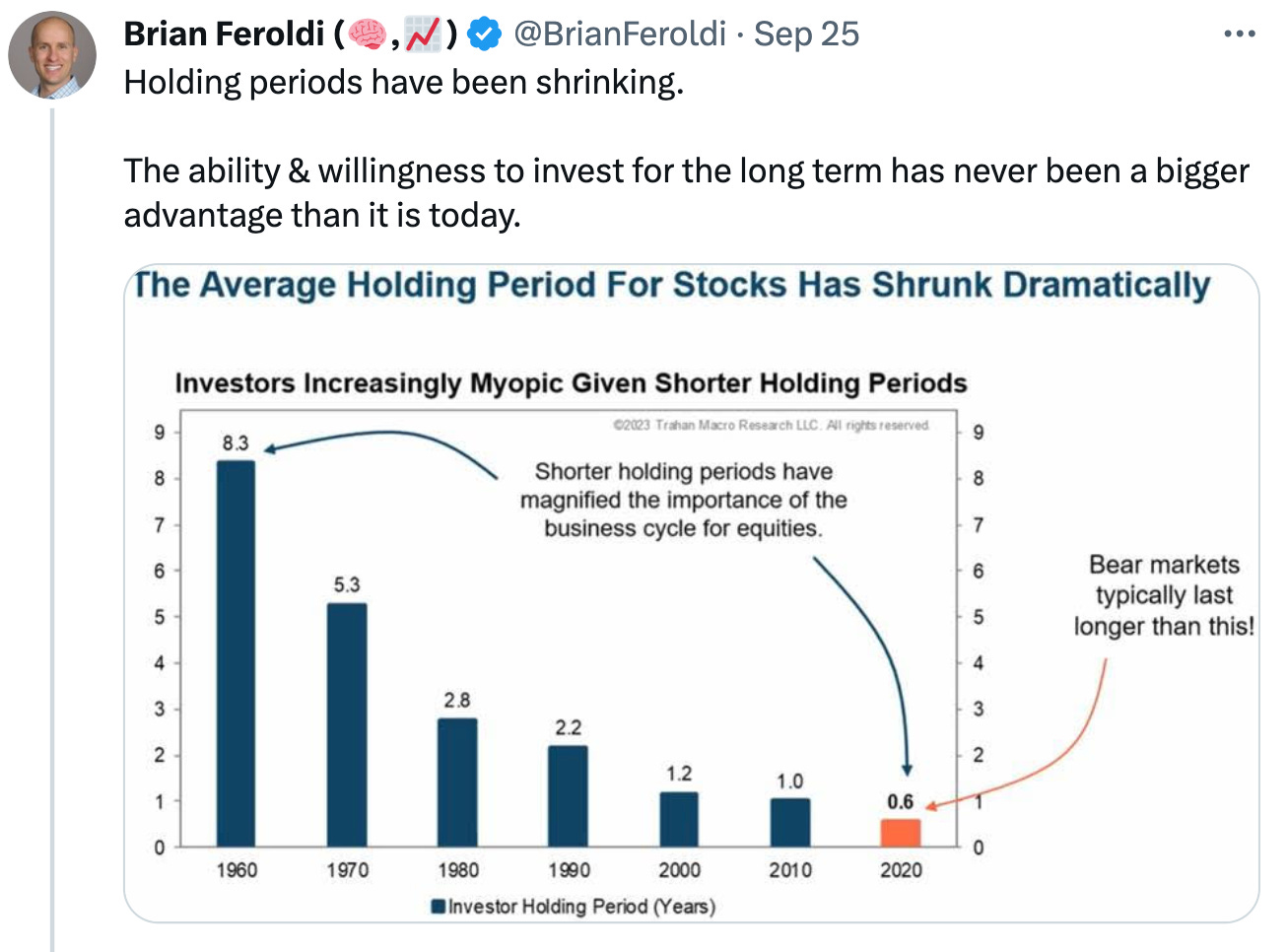

⌛ The Average holding period for stocks in NYSE (New York Stock Exchange) is steadily declining. Today, the holding period is less than 1 year and it is driven by the emergence of high frequency trading, low fees and commissions on trades, social media hype and shrinking company lifespans.

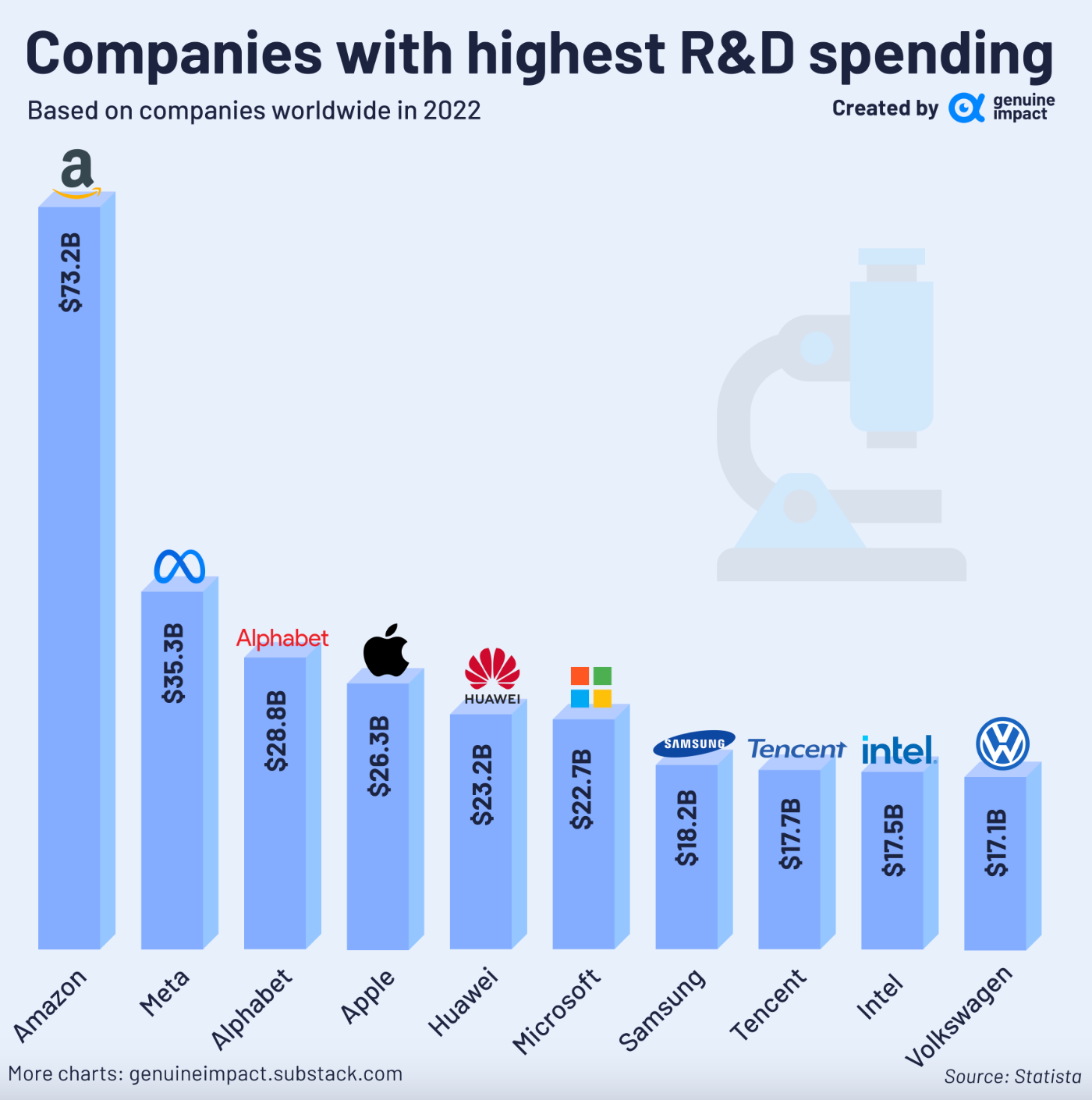

💸Amazon spent nearly 14% of its Revenues in 2022 on R&D, totaling $73B. Amazon R&D spend is more than double of its closest competitors, Meta (ex. Facebook) and Alphabet.

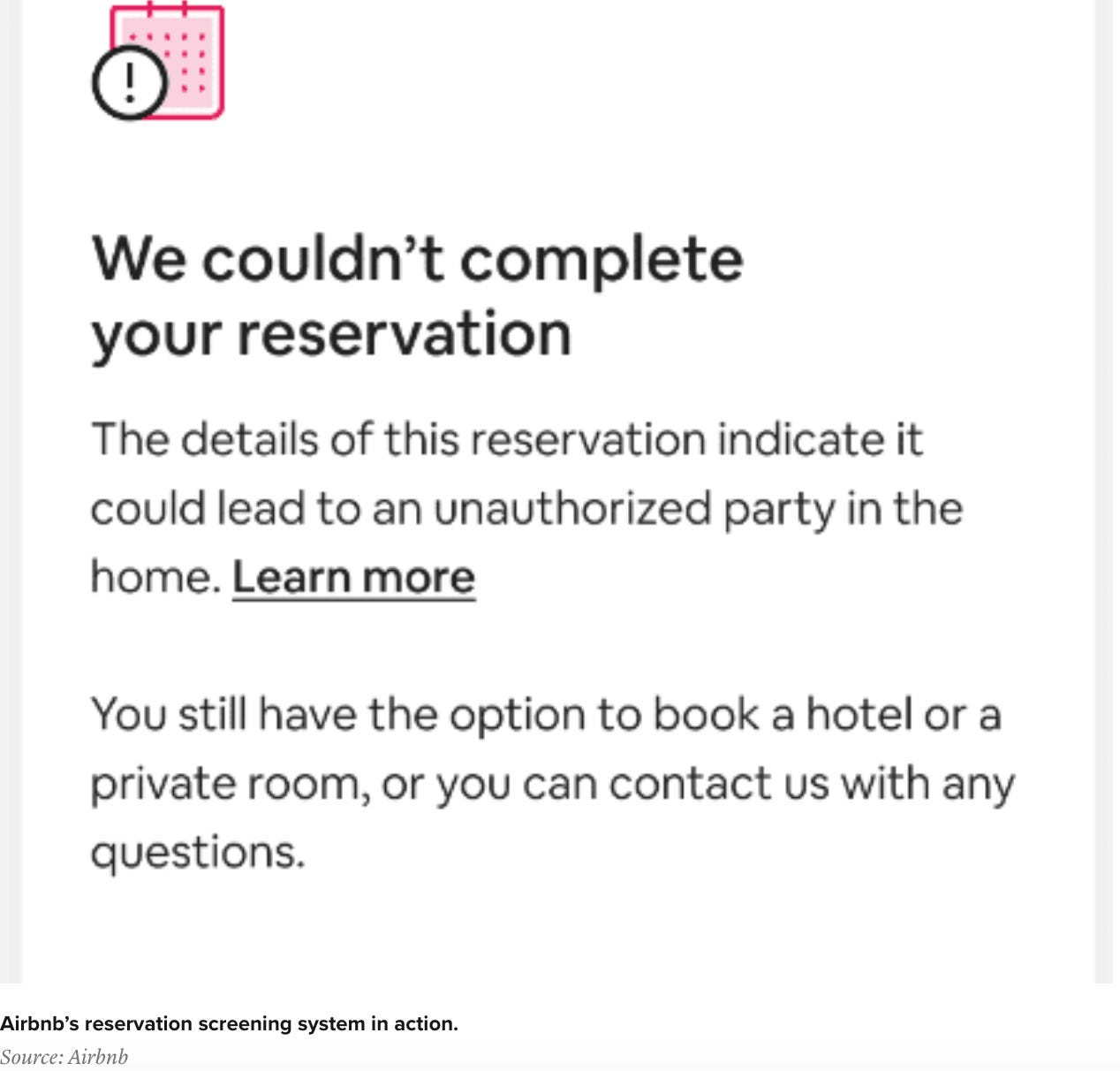

👮♀️ Did you know that Airbnb has reduced partying in its properties by 55% in 2 years, thanks to the anti-party AI system that looks at multiple factors, such as the reservation’s closeness to the user’s birthday, the user’s age, length of stay, etc.?

😎 Meta just introduced its Ray-Ban Meta Smart Glasses for $299. In addition to taking photos and videos on the camera, you can now start a livestream on Facebook or Instagram with just a couple of taps on the stem of the glasses.

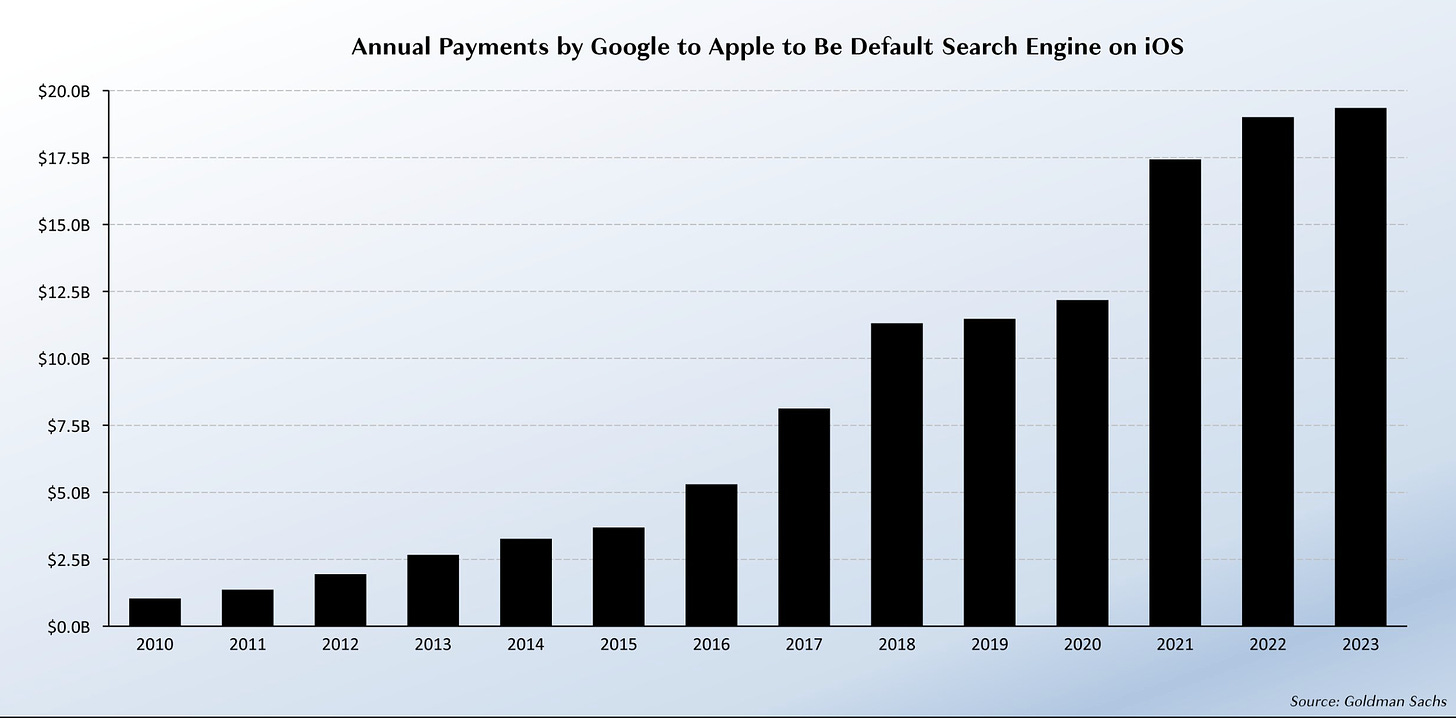

🔎 Did you know Google has paid an estimated $120 billion since 2010 to be the default search engine on all Apple’s devices? In 2022, Google’s payments to Apple was approximately contributing to 20% of Apple’s net income.

⌛ The Average Holding Period for stocks is now <1 year and is steadily declining

Did you know that the average holding period of shares on the New York Stock Exchange (NYSE) is now less than 1 year? In 1960, the holding period for stocks was 8.3 years. Since then, the holding period has been trending lower.

Last week, when Brian Feroldi tweeted the following, so, I was curious to understand what is driving the decline in long term investing?

Turns out, the decline in holding period appears to have been caused by a number of factors, with the most prominent one being technological advancement.

Automated exchanges have led to the introduction of high-frequency trading (HFT), which uses computer algorithms to analyze markets and execute trades within seconds. HFT represents 50% of trading volume in the US equity markets, making it a significant contributor to the decline in holding periods.

Furthermore, online trading platforms have proliferated and they are charging lower fees and commissions on trades. As a result, investors are now more active than ever.

Social media is also playing a role. The wallstreetbets saga from 2021 is an example of how the stock market can become sensational and fad-driven. This is causing investors to seek short term results, vs. long term gains.

Finally, companies are exhibiting shorter lifespans. This results in greater index turnover (companies being added or removed from stock indexes), and is likely a contributor to the decline in the holding periods. In 1970, companies that were included in the S&P 500 had an average tenure of 35 years. By 2018, the average tenure was down to 20 years, and by 2030, it’s expected to fall below 15 years.

💸 Amazon’s R&D spend dwarfs its closest competitors by more than double

“You can’t solve a problem on the same level that it was created. You have to rise above it to the next level.” ~ Albert Einstein

Research and development (R&D) is imperative to withstand competition, waves of disruption, and obsolescence. R&D initiatives provide an edge of innovation to corporates for their products and services.

This week

shared the following chart on companies (globally) with the highest R&D spending. So, I decided to include the chart for my Friday Five edition.Amazon is the world’s largest R&D spender by a sheer magnitude. Amazon’s SEC filing reveals a whopping R&D expenditure of $73.73B in FY 2022 (14% of Revenue). Its R&D expenditure is focused on advancements in areas of artificial intelligence (AI), machine learning and computer vision.

Amazon is followed by Meta and Alphabet, with impressive R&D budgets of $35.3B and $28.8B, respectively.

What’s truly awe-inspiring is the sheer scale of Amazon’s commitment to R&D, eclipsing its closest competitors by more than double.

Here’s a food for thought: Out of the top 10 R&D spenders, none of them is a healthcare company. Why do you think that is?

👮♀️ Did you know that Airbnb has reduced partying in its properties by 55% in 2 years?

Meet Naba Banerjee, the proud party pooper of Airbnb. As the person in charge of Airbnb’s worldwide ban on parties, Naba Banerjee has spent more than 3 years designing an anti-party AI system.

The AI models look at hundreds of factors, including the reservation’s closeness to the user’s birthday, the user’s age, length of stay, the listing’s proximity to where the user is based, weekend vs. weekday, and whether the listing is in a popular location.

Airbnb defines a party as a gathering that occurs at an Airbnb listing and “causes significant disruption to neighbors and the surrounding community,” according to a company rep.

There was a 55% drop in parties reported on Airbnb globally, between August 2020 and August 2022, and since the worldwide launch of Naba Banerjee’s AI system in May, more than 320,000 guests have been blocked or redirected from booking attempts.

Overall, the company’s business is getting stronger. Last month, the company reported earnings that beat analysts’ expectations on earnings per share and revenue, with the latter growing 18% year over year, despite fewer-than-expected numbers of nights and experiences booked via the platform.

😎 Meta (ex. Facebook) just introduced the Ray-Ban Meta Smart Glasses for $299. Are you going to buy?

Meta’s smart glasses are not called “Stories” anymore. They’re just called smart glasses now. Technically, the new model Meta just announced is called the Ray-Ban Meta Smart Glasses.

The new glasses, which Meta just announced at its Connect launch event are up for preorder now and will be on sale October 17th starting at $299. The Ray-ban Meta Smart glasses have 2 primary purposes:

Replace your headphones: The smart glasses have a similar personal audio system like Amazon’s Echo Frames and the Bose Tempo series. Meta also upgraded the microphone system in a big way. The specs have five mics, including one in the nose bridge, which should make both your calls and voice commands much clearer.

Become the camera: The smart glasses have small camera lenses on each right temple and take 12-megapixel photos and 1080p videos, both big upgrades from the previous generation.

In addition to taking photos and videos on the camera, you can also now start a livestream on Facebook or Instagram with just a couple of taps on the stem of the glasses.

🔎 Google paid Apple roughly $20B in 2022 to remain the default search engine on all Apple devices

Google has paid an estimated $120 billion since 2010 to be the default search engine on iOS. In 2022, Google's payment was equal to a third of its net income and increased Apple's income by 25%.

When searching for something on the internet, most of us have grown accustomed to just "googling" it. Almost no one changes the default search engine to Bing or Firefox, for example. So, it's no wonder that Google has more than 90% share in the global search engine market, essentially making it a monopoly.

Since Google owns the Android OS, it's obvious why Google Search comes set as the default search engine on Android phones. But how come it's the default search engine on the Safari browser on iPhones, iPads, and MacBooks as well? It's not that Apple decided to use it out of love towards Google.

Turns out, Google pays Apple billions of dollars every year to remain the default search engine on all Apple devices.

Clearly, this is one of the biggest partnerships in the tech industry, and Google is ready to pay a hefty sum to maintain its monopoly status in the search engine market.

Keep in mind that if Apple were to suddenly switch the default search engine to Bing on Apple devices, Google would immediately lose hundreds of millions of users, severely affecting its ads business. But then again, why would Apple do such a thing, when Google’s payments is roughly 20-25% of its net income?

Stay inspired. Stay curious.

Have a great weekend, everyone.

Amrita 👋🏽

Great post, thanks for sharing Amrita.

The reduced holding period is also due to way higher turnover from asset managers, which now seek more quantitative approaches rather than fundamental ones, which require more patience!

Elections... And this Bidenomics suxs but they have something up their sleeves you know you don’t want to know but found a bit of gold in all the misery https://youtu.be/3XtEJLTJlO8