Friday5: AI hype cooling on Wall St? Safest & riskiest countries to invest in. American homes become fancier though affordability at all time low.

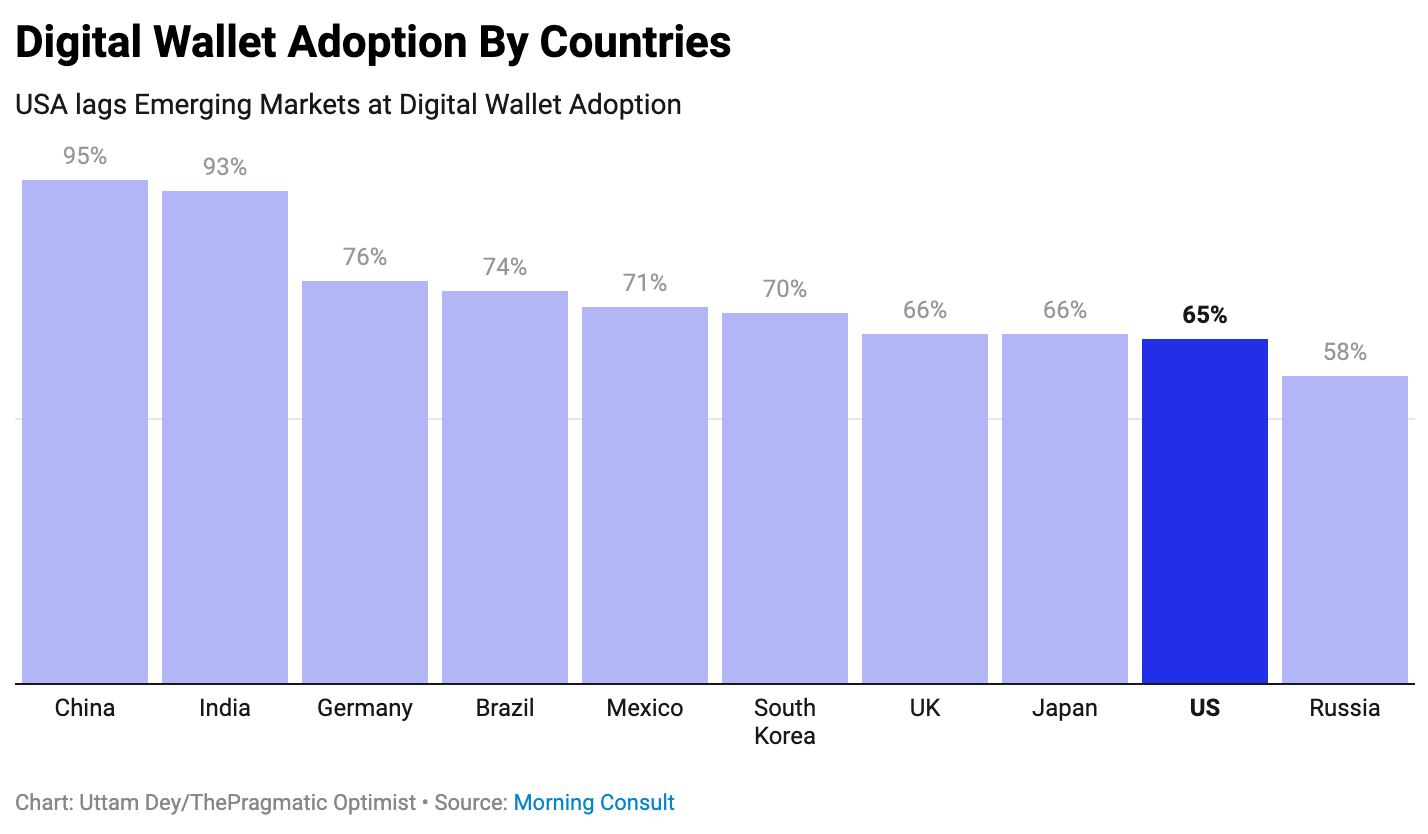

Plus more Americans turn to TikTok for news and turns out the USA is lagging behind in 9th place globally when it comes to digital wallet adoption.

««Friday5- The 2-minute version»»

🌍A map that shows sovereign credit risk across countries globally and a meme that will make you laugh.

🤖 Is the Artificial Intelligence hype starting to cool in the stock market? Are we about to see stocks of companies that rode on the hype since the beginning of 2023 about to see a sharp reversal in their gains?

🏡 Although housing-affordability is at record low, US houses continue to become larger and fancier. There is a growing percentage of houses with more bedrooms and bathrooms and the media area for newly constructed homes stands at 2300 square feet in 2022. Plus, Goldman Sachs believe that home prices are set to rise 3.5% in 2024.

💸USA lags behind 8 countries in Asia, Europe and South America when it comes to digital wallet adoption. China and India are leading when it comes to digital wallet adoption, thanks to the growing fintech industry in these economies.

📱Half of all Americans say that they get news from social media. Meanwhile, users who consume news on TikTok has exploded since 2020. In fact, Americans are roughly twice as likely to say they prefer getting news on digital devices than television.

📢📢Before we begin…

Last week

invited me to his podcast The Pragmatic Investor. I must admit, I was a tad bit nervous, as I was speaking on a podcast for the first time in my life.During the podcast, we chatted in depth about the economic outlook for the US going into 2024, structural forces that are will drive the narrative behind companies that thrive or fail in the coming decade and how to position your investments accordingly.

Check out the video below. And know that I am always open to critical feedback.

Now, let’s get back to work.

🌍A map that shows sovereign credit risk across countries globally and a meme that will make you laugh

On Monday, I had written about why Moody’s downgraded their credit-rating outlook for the US from stable to negative. Their decision to downgrade their outlook was based on the fact that US fiscal deficits continue to widen, which poses increasing risk to the country’s fiscal strength.

A sovereign credit-rating is used by investors to assess the riskiness of a particular country’s bond.

While the US government debt is still investment grade, we continue to see foreign institutions and central banks reduce the size of US Treasury Holdings. On the back of that, I found this hilarious meme on the internet that I could not resist to share with you.

If you want to understand how macroeconomic conditions can impact the US credit rating and how you should position your portfolio, you can read the post here.

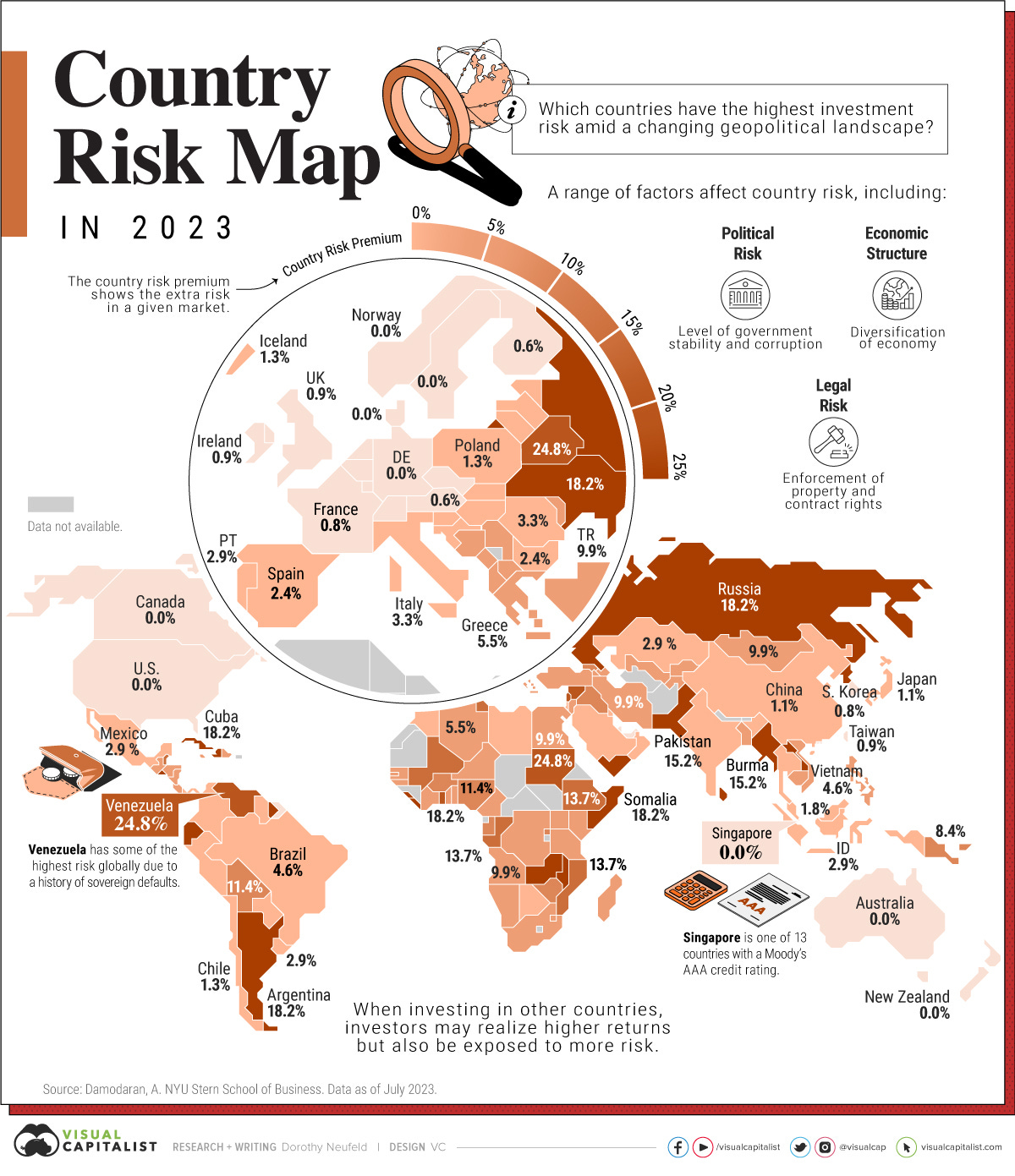

Meanwhile Visual Capitalist has produced an amazing visual to illustrate sovereign credit risk by countries. As you can see, there are various sovereign risks across different countries.

The 5 countries that share the highest risk include Belarus, Lebanon, Venezuela, Sudan and Syria. On the other hand, there are 13 countries that have the lowest risk, including several European nations, Singapore, and New Zealand.

Whether a country has a high or low degree of sovereign risk depends on 3 kinds of risks.

Political risk: The type of regime, corruption and level of conflict

Legal risk: Property rights protections, contract rights

Economic risk: Whether the economy is in a stage of early growth and the diversification of export revenue streams.

🤔Question for you: Do you invest in government bonds of countries outside of the US? If yes, what are those countries and why do you choose to invest over the US Treasury bond?

🤖 Is the Artificial Intelligence hype starting to cool in the stock market?

The artificial intelligence hype in the stock market is beginning to cool down, according to Goldman Sachs. The proportion of S&P 500 companies mentioning “AI” during their quarterly earnings declined 29% in Q3 from a peak of 35% in Q2.

“Likewise, Google search volumes for AI rose sharply in early 2023, but appear to have stabilized in recent weeks,” Goldman Sachs said.

If AI enthusiasm among companies and investors is indeed reaching an inflection point, that could be a risk for the mega-cap stocks, such as Microsoft and Alphabet whose valuations have gotten extended since the debut of OpenAI’s ChatGPT in November 2022.

"The emergence of ChatGPT, and AI more broadly, benefited the largest stocks who were either directly or indirectly involved in the development of the technology," Goldman Sachs said.

The moderating hype in AI comes at a time when hedge funds have piled into mega-cap tech stocks this year. If the enthusiasm for AI wanes further in Wall Street, we might be looking at a big group of potential sellers who may want to book profits from their existing positions.

Despite the slowdown in mentions of AI on quarterly earnings calls, Wedbush analyst Dan Ives sees plenty of runway ahead for the new technology to generate more business for tech companies like Microsoft.

"It has become crystal clear to us that the monetization opportunities around deploying AI and ChatGPT in the cloud is a transformational opportunity across the industry with Microsoft in the driver's seat," Ives said in a recent note, telling clients that shares of the tech giant could reach new highs next year on AI growth.

🤔Question for you: Are you holding or selling stocks that rode on the AI buzz over the last year?

🏡 Although housing-affordability is at record low, US houses continue to become larger and fancier.

Meanwhile, Goldman Sachs says it expects home prices to remain elevated even amid record-high unaffordability levels. The bank's forecast in October said it expected average home prices to rise 1.8% year-over-year in 2023, followed by another 3.5% increase in 2024.

"Absent any negative shocks to the broader economy that would either boost excess supply of homes in the market or fuel an uptick in unemployment, we continue to expect home prices to rise at a slow pace," the note said.

Here are some statistics on how the US homes have become fancier.

Since the 1980s, the percentage of homes being constructed with four bedrooms has on the whole grown, while the percentage of two-bedroom homes has fallen. In 2022, nearly half of all homes constructed had four bedrooms, compared with two-bedroom homes at 9%.

This trend of larger homes is also shown through the number of bathrooms in new houses in 2022, with more than a third having three or more baths, slightly more than the percentage of homes with two baths.

The growing percentage of houses with more bedrooms and bathrooms is seen in part by the median area in square feet of new builds. Though down overall since 2015, the median area grew from 2020 to 2022. The median area came in at about 2,300 square feet for houses built in 2022.

💸USA lags behind 8 countries in Asia, Europe and South America when it comes to digital wallet adoption.

According to a poll by Morning Consult, less than two thirds of Americans used any kind of digital wallet in July, and only 13% used one in the 24 hours before they were polled. In fact, USA is severely lagging in digital wallet adoption

PayPal is still the most popular digital wallet, being used by 69% of Americans who use any such wallet at all, although those numbers have fallen quite rapidly as we covered this in our post 2 weeks ago.

Remarkably enough, many emerging market economies boast a much higher penetration of digital wallet services despite the fact that most of the world’s highest valued fintech startups such as Stripe, Plaid and Revolut sit in the USA and UK.

Much of the digital wallet penetration in emerging markets can be attributed to the spurt in home grown fintech companies that mushroomed almost overnight after the pandemic when the world’s growth engine was in lockdown mode.

While Alipay and WePay already dominated the fintech space in China, India’s fintech space is relatively younger with start ups such as Paytm, PhonePe and CRED to name a few that are spearheading digital wallet adoption in the country.

📱Half of all Americans say that they get news from social media. Meanwhile, users who consume news on TikTok has exploded since 2020.

The share of TikTok users who consume news through the platform has nearly doubled since 2020, according to new Pew Research Center data. The data is in line with a larger cultural shift by consumers towards utilizing digital platforms for news, with roughly half of all Americans saying they get news from social media.

This is important for news organizations, businesses and brands to take note of the evolving preferences of their audience and adapt quickly in order to remain relevant.

Digging into the data

The Pew study shows that news consumers have accelerated their shift toward digital channels in the past year.

Americans are roughly twice as likely to say they prefer getting news on digital devices (58%) than television (27%).

Meanwhile, audience preference for radio and print media remains roughly stagnant at 6% and 5% respectively.

News audiences are increasing the most on TikTok and Instagram. Platforms like LinkedIn, Twitch and Nextdoor are also gaining traction as news sources.

Tik Tok, as reliable news source.......

How dumb are Americans ????

Just look at the performance of our current Federal Gov't, to get the answer....

Supposedly, a majority voted them into power......this slow-motion Train Wreck of a

Communist Gov't.

Many of my countrymen are Ignorant and Brainwashed.....Yes, they are !!!!

1960: average home size was 1,289 square ft. and average family size was 3.3. Today's family size is 2.5 yet they seem to require one thousand square feet more to survive in. I'll contribute this "need" to their generous nature of allowing the less fortunate to live in with them. Perhaps I'm mistaken though, and it's simply a need to be farther away from their love one's.