Friday5: Apple Vision Pro hype faded, Bitcoin surges past $50,000, Small banks teeter & more...

Plus, professionals are using gen AI more at workplace than the previous year as AI threatens white-collar jobs. Meanwhile, the world's biggest economies are on different economic trajectories.

Welcome back everyone to another edition of the Friday5.

In today’s post, we will talk about 5 different topics (all related to macroeconomics, tech, culture & investing) in a bite-size edition that will spark your curiosity and hopefully leave you pragmatically optimistic about the world that is often quite noisy and confusing.

So, let’s a coffee and a muffin on this almost spring afternoon and dive right in. ☕🧁

««Friday5- At a Glance»»

👓Google searches for “Return Apple Vision” have surged, as users are not finding their initial investment worthwhile.. Also, Zuckerberg thinks Meta Quest 3 is way better.

📈Bitcoin ETFs now own 3.5% of all bitcoins in existence, as higher demand has boosted the price beyond $50,000. However, those inflows for bitcoin appear to have come at the cost of outflows from Gold ETFs

🤖 Professionals are using gen AI at workplace more than ever, as AI threatens white-collar jobs.

🌎The world’s biggest economies are seeing a “decoupling”. While the US remains resilient, Europe and China weaken, and Japan enters a recession.

🏦New York Community Bank flashed a warning sign that has reignited fears about commercial real estate. Small banks are in trouble.

👓Google searches for “Return Apple Vision” have surged. Also, Zuckerberg thinks Meta Quest 3 is way better

When the Apple Vision Pro hit the market on February 2nd, would-be fans lined up at the break of dawn to test the mixed-reality headset at their local Apple Stores.

But nearly two weeks after its release, first impressions of the futuristic gadget appear to have soured for some buyers, who say they're returning the $3,500 device. Meanwhile, Google trends show that searches for “Return Apple Vision” have erupted in the last week, as many initial owners are hoping to get their $3,500 back.

One major reason Vision Pro customers say they want a refund: its seemingly clunky design. Farzad Mesbahi, who regularly creates YouTube videos about tech, says that wearing a device on his head and face can be inconvenient even if he can get it to sit comfortably. He can't see himself using the headset for long periods as people do with smartphones, tablets, and computers.

"For a technology/productivity device, this is a non-starter for me," Mesbahi wrote on X, formerly known as Twitter.

Meanwhile, Collin Michael, a self-proclaimed Apple nerd, would agree with him. In a YouTube video he uploaded on why he's returning his Vision Pro, he says the device's weight is "noticeable" enough to be a burden. Using the headset to do things he would normally do on an iPhone or Mac, like pulling up Safari or searching for used cars, he says, requires extra steps that just aren't worth the effort.

Disappointment in the headset's vision quality is another gripe expressed by Vision Pro customers.

Mesbahi wrote on X that the device's ability to overlay virtual apps on top of a user's line of vision is "not good" when it comes to clearly observing his surroundings. When looking at real objects, Mesbahi says his line of vision is "still quite grainy in most lighting conditions."

At the same time, Michael also noted how he needs to turn his head to look at different elements on the screen because there are "giant black edges" along its perimeter that blur and distort "10 to 20 percent" of his line of vision. Similarly, when he casts his MacBook onto his headset, he says the icons on the bottom of the laptop screen are difficult to decipher.

But despite their critiques and plans to return the headset, Mesbahi and Michael expressed enthusiasm for Apple's forward-looking vision and the headset's cutting-edge capabilities. They say they're open to potentially revisiting the goggles again in the future once the technology advances.

On a separate note, this is what Mark Zuckerberg had to say, when he tried the Apple Vision Pro and compared it to the Meta Quest 3.

The gist:

Quest is 7x less expensive yet way more comfortable

Quest is better for gaming, Xbox, YouTube

"I'm surprised how much better Quest is better for majority of things"

📈Bitcoin ETFs now own 3.5% of all bitcoins in existence, as higher demand has boosted the price beyond $50,000

The total market value of Bitcoin's circulating supply crossed $1T this week for the first time since November 2021.

The recent renaissance in crypto has been fueled in large part by the inflows to Bitcoin Spot ETFs, which have very recently started to accelerate. Yesterday saw the largest net inflow into the ETFs since inception.

Spot bitcoin ETFs own a combined 692,939 bitcoins, representing 3.5% of all bitcoin currently in existence.

The launch of spot bitcoin ETFs last month opened the floodgates for Main Street investors to conveniently purchase bitcoin through their existing brokerage accounts.

The iShares Bitcoin Trust has seen the highest inflows, hitting $4.39B in assets as of Monday 12th February, while the Fidelity Wise Origin Bitcoin ETF is in second place, attracting $3.67B in assets.

"I think a lot of this is just indicative of the popularity of bitcoin as an asset class. There's 10-years of pent-up demand. People have been waiting for these ETFs, and finally mainstream investors are able to access bitcoin and I think that's what's driving the surge of capital in the asset class," MicroStrategy Executive Chairman Michael Saylor told CNBC on Monday.

Saylor said that the bitcoin ETFs are important because they conveniently offer investors access to a risk asset that has a history of displaying low correlations to other asset classes.

"It's uncorrelated to traditional risk assets because it doesn't come with exposure to any given country, currency, company, quarterly result, product cycle, competitor, not to weather, not to war, not to an employee base or supply chain. So that makes it a natural addition to the portfolio of a responsible investor," Saylor said.

The solid demand for bitcoin ETFs should create a favorable supply and demand environment for bitcoin holders, according to Saylor, who acknowledged that bitcoin will undergo a halving later this year, which lowers the bitcoin reward for miners.

There are currently 19.63M bitcoins in existence, and the last of the 21M tokens won't be mined until 2140.

However, according to ZeroHedge, those inflows for bitcoin appear to have come at the cost of outflows from Gold ETFs, which saw investors redeem $858M last week ahead of the recent CPI reading, bringing year-to-date outflows out of the metal to $3.2B.

However, one word of warning: the 'Fear & Greed Index' for Bitcoin, which aggregates data on market momentum, volatility, volume and social media, is now at 79 out of 100, its highest score since Bitcoin reached $69,000 in November 2021.

And as always, a crypto post is never complete without a meme. I tried hard to resist, but here it goes…

Feel free to restack with some of your own favorite crypto memes that you saw on the internet this week, or something cool you have built yourself.

🤖 Professionals are using gen AI at workplace more than ever, as AI threatens white-collar jobs

The list of white-collar layoffs is growing almost daily and includes job cuts at Google GOOG 0.00%↑, Duolingo DUOL 0.00%↑ and UPS UPS 0.00%↑ in recent weeks. While the total number of jobs directly lost to generative AI remains low, some of these companies and others have linked cuts to new productivity-boosting technologies such as machine learning and other AI applications.

Unlike previous waves of automation technology, generative AI doesn’t just speed up routine tasks or make predictions by recognizing data patterns. It has the power to create content and synthesize ideas—in essence, the kind of knowledge work millions of people now do behind computers.

“This wave of technology is a potential replacement or an enhancement for lots of critical-thinking, white-collar jobs,” said Andy Challenger, senior vice president of outplacement firm Challenger, Gray & Christmas.

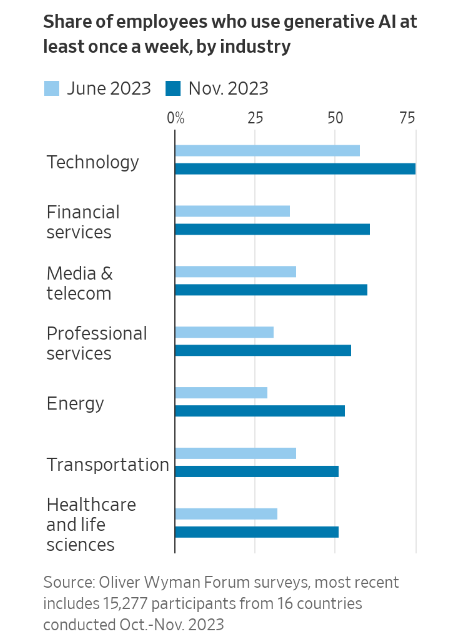

Meanwhile, the number of professionals who now use generative AI in their daily work lives has surged. A majority of more than 15,000 workers in fields ranging from financial services to marketing analytics and professional services said they were using the technology at least once a week in late 2023, a sharp jump from May, according to Oliver Wyman Forum, the research arm of management-consulting group Oliver Wyman, which conducted the survey.

Plus, nearly two-thirds of those white-collar workers said their productivity had improved as a result, compared with 54% of blue-collar workers who had incorporated generative AI into their jobs.

At the same time, as AI adoption grows, it is likely to reconfigure management hierarchies, the Oliver Wyman study projects. Entry-level workers are likely to bear the initial brunt as more of their duties are automated away. In turn, future entry-level work will look more like first-level management roles.

Finally, when it comes to job cuts, while some of it is taking place as a result of the changes coming from AI, other companies are cutting jobs to spend more money on the promise of AI and under pressure to operate more efficiently.

Alphabet’s Google last month laid off hundreds of employees in business areas including hardware and internal-software tools as it reins in costs and shifts more investments into AI development. The language-learning software company Duolingo said in the same week that it had cut 10% of its contractors and that AI would replace some of the content creation they had handled.

Companies beyond the tech sector have embarked on similar AI transitions.

United Parcel Service said that it would cut 12,000 jobs, primarily those of management staff and some contract workers and that those positions weren’t likely to return even when the package-shipping business picks up again.

“The use of generative AI and related technologies is also changing some jobs at UPS by reducing repetitive tasks and physical stress,” UPS spokesperson Glenn Zaccara said.

🌎The world’s biggest economies are seeing a “decoupling”. While the US remains resilient, Europe and China weaken, and Japan enters a recession

The biggest players in the global economy are on different trajectories, and markets around the world are reflecting the shifting landscape.

In Bank of America's view, the US economy continues to show remarkable resilience, European growth has faltered, and China faces the most challenging outlook amid real estate woes, deflation, and demographic headwinds.

"Signs of decoupling are present in global growth, trade, and equity markets," Bank of America strategists wrote last week.

The US in particular has seen strong GDP growth in recent quarters and steadily cooling inflation, as well as promising economic data and a stock market rally that won't quit.

There's still some uncertainty on what the Federal Reserve will do next to address the "last mile" of inflation, but that won't dramatically sway the US's positioning compared to other economic powerhouses.

To that point, the outlook for the Euro area looks softer.

"Growth in the Euro area has been very anemic, including weaker-than-expected data in Germany. In spite of this, our base case remains for the ECB to start cutting rates in June," Bank of America strategists said.

Bank of America expects Euro area growth at 0.4% in 2024 and 1.1% in 2025. But Germany, the bloc's biggest economy, will be weak at -0.4%, and Spain will show its strength with 1.3% growth. The wide spectrum of outlooks within Europe will eventually converge, assuming there are no additional growth shocks.

And China, for its part, faces a unique bearish cocktail of unfavorable demographics, bleak consumer confidence, and an exodus of foreign investors.

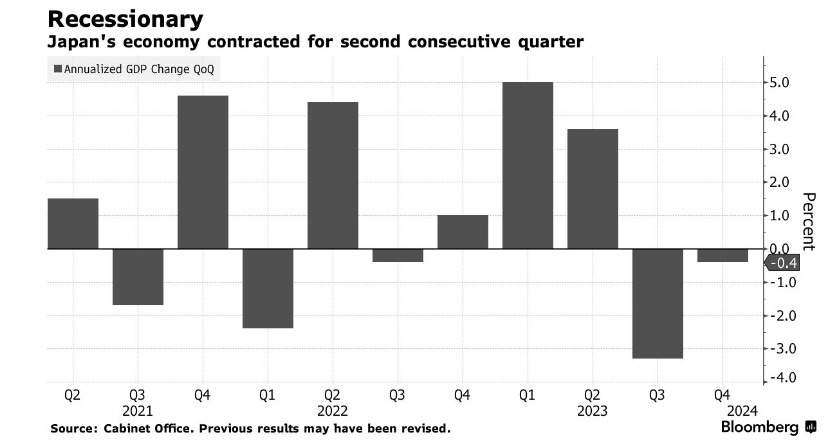

Meanwhile, Japan’s economy unexpectedly slipped into recession after its GDP contracted at an annualized pace of 0.4% in the final three months of last year, following a revised 3.3% retreat in the previous quarter.

The report showed both households and businesses cut spending for a third straight quarter as Japan’s economy slipped to fourth-largest in the world in dollar terms last year. Germany now has the world’s third-largest economy.

Atsushi Takeda, chief economist at Itochu Research Institute, said the slide in consumption was jarring.

“Sticky inflation is cutting into consumers’ purchasing power, leading to weak consumption. That’s mild stagflation,” Takeda said.

Takeda further said the possibility of a BOJ rate hike in March is now virtually eliminated, though he still expects a move in April.

🏦New York Community Bank flashed a warning sign that has reignited fears about commercial real estate. Small banks are in trouble.

The commercial real estate market has been in turmoil since the start of the pandemic, and investors remain concerned about the fallout from the slumping value of office buildings and other properties around the world. New York Community Bancorp NYCB 0.00%↑ flashed a fresh warning sign recently, rattling markets after it cut its dividend and set aside more money than expected for losses on bad real estate loans.

There is a systemic risk of large-scale bank failures in the U.S. in 2024 due to charge-offs and write-downs emanating from the commercial real estate sector. Bank regulators have been vocal about their concerns that the too-big-to-fail banks would have sufficient capital to cover losses and a recession. However, they do not appear to be as concerned about how the projected losses will impact the large number of regional banks in the country.

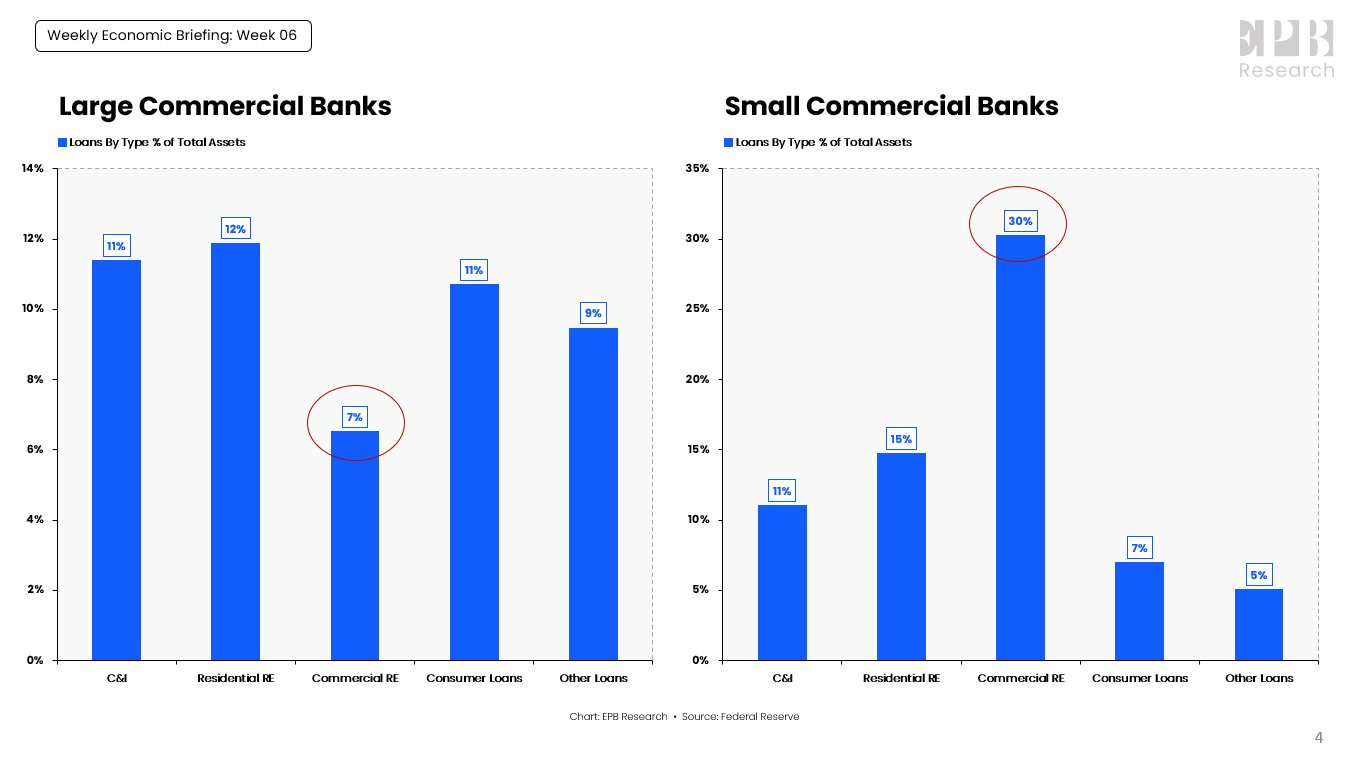

Meanwhile, in a separate tweet Eric Basmajian, Founder of EPB Research had illustrated the following:

At the same time, large banks are in a much better shape when you look at the growing amount of cash relative to their relative assets, compared to smaller banks.

Generally, regional banks are defined as banks with less than $10B in assets. That encompasses most of the US. banks. More than half are in rural communities of less than 50,000 people, and often they are the only bank in town.

In a large national economy, different banks and regions have their own problems. But the crux of the larger problem is in the office building component. Offices around the country recently hit a new vacancy record. As the owners fail to pay their banks, charge-offs at the banks have dramatically increased and are still accelerating.

“A correction in office property valuations accompanied by even a mild recession could result in significant losses for a range of financial institutions with sizable exposures, including some regional and community banks and insurance companies,” the Federal Reserve noted in its November 2023 Financial Stability Report.

But that’s not the only trouble community banks are facing. First, many banks and especially small banks are seeing the loss of uninsured deposits. Uninsured deposits are the amounts held by the bank in excess of the FDIC depository insurance. Second, community banks are vulnerable to margin squeeze. The small banks’ funding costs have risen, but lending rates have not increased commensurately. As a result, community banks have less money to cover any losses. Finally, community banks are the largest agricultural lenders. As many areas are hit with drought and other environmental issues, banks have seen losses and write-downs. These and other factors have increased the vulnerability to the community banks.

I wrote a post last week that talks about the Fed’s dilemma to cut interest rates given a seemingly resilient US economy and the longer interest rates remain high, the higher the risks grow for these regional banks to falter.

That’s all for today, folks.

Have you tried on Apple’s Vision Pro? Are you keeping or returning it?

Are you a bitcoin investor/hodler? Do restack your thoughts with your favorite meme.

Want to share some of the genAI tools that you have been playing with lately (or using them more seriously at your workplace)?

Educational, well written and well said. Always a pleasure to read !!!

Wonderful read for this layman. : ) Is Saylor reliable? The Atlas Society (an Ayn Rand think tank) gave him the Atlas Society's Lifetime Achievement Award in 2022. At the 2021 Gala the founder, David Kelley, introduced me to his date, later confirming to me that she was a CIA handler! Saylor also wore a burgundy-colored brocaded jacket on his website bio, screaming vampire to this artist's eye.