Friday5: Have we officially conquered inflation? How low can the Fed rates go? The tide is turning in the rental market & more...

Plus, 24 out of 50 states in the US are mandating a personal finance class in high school. On the other hand, love has broken the boundaries of dating apps to connect people on Strava & Duolingo.

Welcome back to another episode of Friday5.

««Friday5- At a Glance»»

📉 Is the inflation battle finally conquered? US consumers’ near-term inflation expectations dropped in November to the lowest level since April 2021, while views about the labor market also worsened somewhat.

🏦How low will Federal funds rate go in 2024? While the Fed prices in 3 rate cuts, UBS, ING and Barclays are pricing in more than 3 cuts, with UBS pricing in 11 cuts with a recession warning.

💵Did you know that Utah is the first state to mandate high school students to take a personal course to graduate? Meanwhile, only 60% of Americans are financially literate.

🏡The tide turns for renters as median asking rent drops 2.1% amidst rising inventory and vacancies. Perspective: While rents are dropping, they’re still 22.1% higher than they were in November 2019 before the pandemic housing boom. Meanwhile, Redfin cautions against expectations of a broader rent drop through 2024.

💌 Love knows no bounds. So, why do people have to stick to the boundaries of dating apps, when they can find love on Duolingo and Strava?

Before we begin…

But, before we begin, I wanted to let you all know that I have introduced a “buy-me-a-coffee” business model for my newsletter. What is a “buy-me-a-coffee” model, you may ask?

But first, a little background: As you know, I started my newsletter a little over 3 months ago. During this period of time, I had a lot of fun writing and connecting with you all. You have all shown me tremendous support, for which I am forever grateful.

The truth is: I have genuinely fallen in love with my work and my community here on Substack. I also want to keep my writing free and accessible to all. My vision (or mission?) for my newsletter has been to connect the dots in macroeconomics, investing, and culture to help you understand the “big” picture, identify great businesses and improve our overall mental and financial wellbeing. And I know that I won’t achieve that by going behind a paywall.

So, if you want to support me on my mission: You can buy me a coffee (and a muffin) for $8 a month. I promise I will be working out to burn off those muffin calories in a responsible way. Plus, once a quarter, we can catch up over Zoom for 30 minutes to discuss any questions you have on macroeconomics, investing, or other general stuff, like how to grow your Substack.

If you choose to pass: Please know that you are still a valued member of the community and I always encourage everyone to freely express their views, comments and questions about my work.

Once again, all of my work will remain free, but I will be very happy should you decide to buy me a coffee (and a muffin… yes the muffin is very important to me 💟).

Now back to Friday5 👇🏼👇🏼👇🏼

📉 Is the inflation battle finally conquered?

US consumers’ near-term inflation expectations dropped in November to the lowest level since April 2021, according to a Federal Reserve Bank of New York survey released Monday.

Median year-ahead inflation expectations declined for a second month to 3.4%, down from 3.6% in October. Expectations for what inflation will be at the three-year and five-year horizons held steady at 3% and 2.7%, respectively. Currently, inflation as measured by Core PCE stands at 3.5%, and per the latest FOMC projections, inflation is expected to drop to 2.4% in 2024 from current levels.

The pullback in consumers’ near-term inflation views reflected a number of factors. The expected price changes for gasoline slipped, and those for both rent and a college education fell to the lowest since January 2021. Inflation views among those over the age of 60 retreated to a nearly three-year low.

Consumers’ views about the labor market worsened somewhat. The mean perceived probability of losing one’s job in the next 12 months increased by nearly a percentage point to 13.6%. The probability of finding a job after becoming unemployed decreased to a seven-month low of 55.2%.

That said, several measures of household finances did improve in the month. Consumers said they were less likely to miss a minimum debt payment over the next three months, and respondents were more optimistic about their year-ahead financial situation.

Meanwhile, on Wednesday, the Federal Reserve held benchmark interest rates steady. Powell added that the risks of the Fed doing too much or too little to fight inflation have become more balanced.

🏦How low will the Federal Funds rate go in 2024?

Since its last interest rate hike in July, it seems the Fed has made solid progress in lowering inflation without significantly hurting the labor market or the broader economy. This has spurred many analysts on Wall Street to forecast significant interest rate cuts next year.

Here's a rundown of what Wall Street expects the Fed to do with interest rates in 2024. 👇🏼👇🏼👇🏼

➡️ UBS: The Fed will cut interest rates by 275 basis points | Recession Alert

The US economy will enter a recession in 2024, according to UBS, and that will spark the Fed to aggressively cut interest rates next year.

“The Fed's cuts would be a response to the forecasted US recession in Q2–Q3 2024 and the ongoing slowdown in both headline and core inflation," UBS said.

UBS expects the interest rate cuts to begin during the Fed's March FOMC meeting.

➡️ING Economics: The Fed will cut interest rates by 150 basis points | Goldilocks for the win

Moderating inflation, a cooling jobs market, and a deteriorating outlook for consumer spending mean the Fed may need to cut interest rates more than the market expects.

"We have modest growth, cooling inflation, and a cooling labor market—exactly what the Fed wants to see," ING's chief international economist, James Knightley, wrote in a note last month.

Knightley says he expects the Fed will start cutting interest rates in Q2 of 2024, delivering as many as six 25-basis-point rate cuts totaling 150 basis points. He also says he expects the interest-rate cuts to extend into 2025 with at least four 25-basis-point interest-rate cuts.

➡️Barclays: The Fed will cut interest rates by 100 basis points | Goldilocks followed by a return to higher inflation.

Continued resilience in the economy next year will make the Fed cautious about cutting interest rates too aggressively, according to a recent note from Barclays.

The firm expects the Fed to cut interest rates by 100 basis points next year, followed by another 100 basis points of cuts in 2025.

➡️Goldman Sachs: The Fed will cut interest rates by 50 basis points | A resilient economy with no recession on the horizon

Falling inflation and "healthy" economic growth suggest to Goldman Sachs that the Fed won't be in a hurry to cut interest rates next year.

The bank said it expects the Fed to cut rates by 50 basis points next year, with the first interest rate cut occurring in Q3 of 2024.

"Healthy growth and labor market data suggest that interest cuts are not imminent," Goldman Sachs' chief economist Jan Hatzius said in a recent note.

➡️The Federal Reserve: The Fed expects to cut interest rates by 75 basis points | Three cheers for Goldilocks 🙌🙌🙌

The median projection of the Fed's most recent "dot plot" chart puts the Federal Funds Rate at 4.6% at the end of 2024, representing three 25-basis-point rate cuts for all of next year.

The projection, released at the Fed's December FOMC meeting on Wednesday, signals that the Fed is turning more dovish as inflation continues to moderate. The Fed's previous dot plot projection, released in September, had suggested no more than two 25-basis-point cuts in 2024.

My take: If the Fed's updated projection is correct, then the market has gotten ahead of itself in forecasting as many as five quarter-point cuts, and that could ultimately provide a bout of volatility for the stock market. But that didn't happen post-Fed meeting, as stocks surged following the Fed's FOMC statement.

👉🏼👉🏼👉🏼Check out my latest podcast where

and I got together to discuss the current state of the US economy and the macroeconomic risks that it faces going into next year. We talked about the likelihood of a “soft landing” and how much the Fed is going to lower its interest rates in light of weakening consumer spending and the labor market, especially in an election year.On Monday next week, I will publish my outlook and positioning for 2024, where I will highlight some of the key points from my podcast. Stay tuned.

💵Did you know that Utah is the first state to mandate high school students take a personal course to graduate? Meanwhile, only 60% of Americans are financially literate.

For many years, personal finance courses played a minor role in U.S. high schools.

It was not until 2008 that Utah became the first state to mandate high school students take a personal finance course to graduate. By 2019, six states had made this a requirement. Since then, it has risen to 24 states as of this year, covering more than 50% of the country’s student population. Wisconsin became the most recent state to implement this requirement as of December.

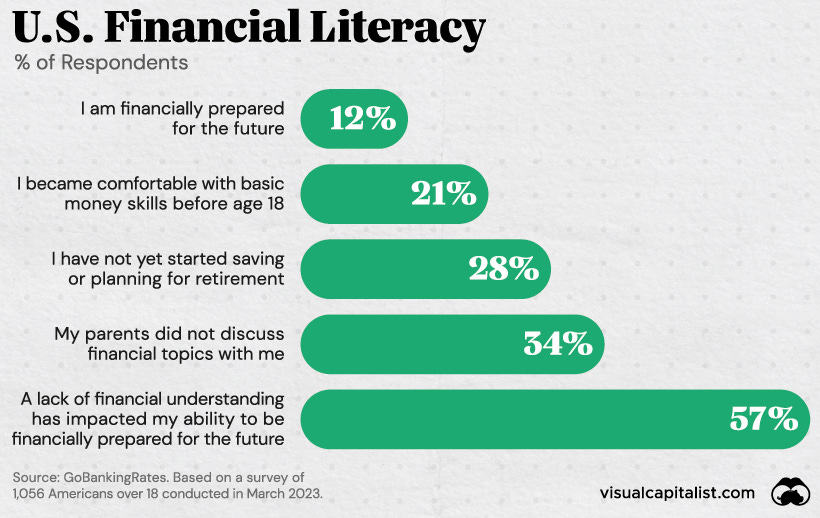

When it comes to financial literacy, roughly six in 10 Americans are financially literate, as measured by their knowledge of inflation, numeracy, compound interest, and risk diversification.

Separately, many Americans do not feel financially prepared for the future, and over a third of respondents did not discuss financial topics with their parents growing up.

❓How would you rate yourself on a scale of 1–5 on your perceived level of financial literacy? Let’s assume 1 = "I have no clue about personal finance” and 5 = “I am a personal finance wiz.”.

🏡The tide turns for renters as median asking rent drops 2.1% amidst rising inventory and vacancies. What lies ahead?

The rental market may finally be shifting in favor of prospective tenants, as better deals are on the rise.

"The tide turns for renters," Redfin said in the title of its latest report, which found that US median asking rent dropped 2.1% in November from a year ago. This marked the largest annual decline since February 2020, it added.

Climbing rent prices have been a broad theme since the boom of remote work, only to be made worse by a shortage in housing supply, an issue faced by both homebuyers and potential renters.

But a surge in construction has boosted inventory, with the number of completed apartments up 7% year over year in the third quarter.

Meanwhile, rental vacancies hit their highest level at 6.6% since the first quarter of 2021, prompting landlords to offer more concessions to attract new tenants.

That's backed by earlier data from Zillow, which found that 30% of rental listings in November offered at least one perk, rising from 24% in the previous year.

"Renters are finally catching a break," Redfin Chief Economist Daryl Fairweather said in the report. "Better deals are easier to come by because landlords are doling out concessions and rents have started falling in a meaningful way. Rising supply also means renters have more good options to choose from."

While rents are dropping, they’re still 22.1% higher than they were in November 2019 before the pandemic housing boom and are just 4.2% below the $2,054 record high hit in August 2022.

Still, Redfin cautioned against expectations of a broader rent drop through 2024. While more apartments have come online, few single-family homes have become available. And larger rental units will probably see higher prices, given growing families and the popularity of remote work.

If you want to understand the dynamics of the current and future state of the US Housing Market, you can take a deeper look at my Housing Deep Dive Series here:

💌 Love knows no bounds. So, why do people have to stick to the boundaries of dating apps when they can find love on Duolingo and Strava?

Countless dating apps promise to connect you with a soul mate or fling, but some intrepid daters scout for romance on other sites, from language-learning platform Duolingo to social media fitness platform Strava.

Striking up a conversation on a service where you know someone shares your interests can feel more natural than sifting through dating apps, former dating service users say.

Online dating also has become more expensive, with subscriptions that can cost more than a monthly Netflix plan. Fewer people are willing to pay up, as the companies’ financial reports have shown lately.

💕💕💕 Meanwhile, take a look at some of the budding love stories on Strava and Duolingo

Hollingsworth was 29 years old and working for Pinterest in San Francisco when she met Peter Krzywosz at a group relay race in May 2021. They followed each other on Strava. That fall, she started dropping him hints on the app, in one post comparing a tough workout to the Bay Area dating scene.

Krzywosz, then 27 and living in Chicago, commented on her posts and gave daily kudos.

The two met up at another race and, afterward, started texting and video chatting. By late spring of 2022, they were officially a couple and now live together in San Francisco. Hollingsworth got a job at Strava, and they still use the app to flirt with each other.

And here’s one more 👇🏼👇🏼👇🏼

Rob Ciesielski and Amanda Lopez met doing more cerebral workouts.

Both downloaded Duolingo to learn new languages. Ciesielski, a 43-year-old event manager who lives in Washington, D.C., was learning Spanish. Lopez, a 38-year-old writer who lives in the Philippines, was learning Mandarin.

In 2021, Ciesielski followed Lopez after she appeared in the top ranks and began congratulating her for her daily achievements on the app.

Curious about the cheerful stranger, Lopez looked him up on Facebook.

The two began messaging each other, which soon turned into video chatting for 20 to 25 hours a week. The two would remotely watch movies on the weekend together and send love poems over email.

In June 2022, Ciesielski flew out to meet her in the Philippines, and they got married the next month. Once Lopez’s visa is approved, she will move to Washington, D.C., to live with her husband.

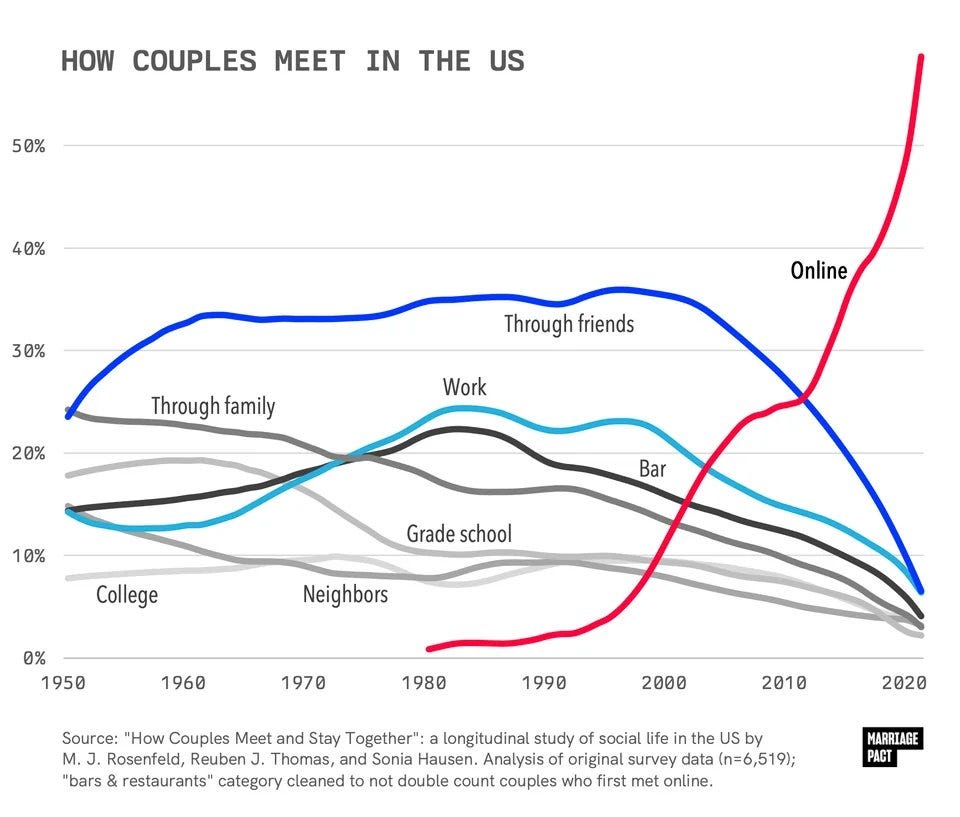

Finally, I will leave you with this chart below on how couples meet in the US.

❓Do you see a swing back to couples meeting each other IRL in the future? If not, what are your thoughts on couples meeting outside of dating apps, such as the ones above? Is this a budding trend, or are conventional dating apps going to stay as relevant as they were before?

Hope you enjoyed today’s Friday5!!!

Here are some questions, that I would love to hear from you:

Do YOU think the inflation battle is conquered?

UBS, ING, Barclays, Goldman & The Fed- who do you think has a better forecast for interest rates in 2024?

On a scale of 1-5, how will you rate yourself on your perceived level of financial literacy? 1- “I have no clue about personal finance”, 5- “ I am a personal finance wiz”.

Dating Apps- Yay or Nay? Finding love on apps other than Dating Apps- Yay or Nay?

>> "mandate high school students take a personal course"

Should that say "personal finanace course"?

Either way, kudos to Utah. Teach kids to save, not to run up credit card debt.

Maybe they can throw in a class on Philosophy, as in "material goods don't always bring us the joy we think they would" 😅

It is interesting to see the ways in which couples meet nowadays. Despite college enrollment being on a general increase since the 1950s, “college” or “grad school” have declined as means through which people find a partner. A lot of people (including myself) are not fans of the online apps but for some reason it seems to stick. Would be interesting to see the “relationship survival rates” based on how people met. Are they more likely or less likely to stay together based on how they met.