🎄Friday5: Wall Street's S&P 500 predictions, America's favorite Christmas foods & drinks, how wealthy were the McCallister's in Home Alone & more...

Plus, how will GenAI transform marketplaces in 2024 and beyond? Is TikTok's "silent depression" trend about to reverse in the US?

Welcome back to the last Friday5 of 2023. When I started my substack back in September, I would have never imagined that I would end the year with 2000+ members. So, I am incredibly thankful to each and every one of you who have come on board and supported me on my journey so far. Happy Holidays and a Happy New Year, everyone!!!

««Friday5- At a Glance»»

📈 Where is the stock market headed in 2024? While JPMorgan is bearish, Goldman Sachs and Bank of America are bullish, with a S&P 500 price target of 5000+

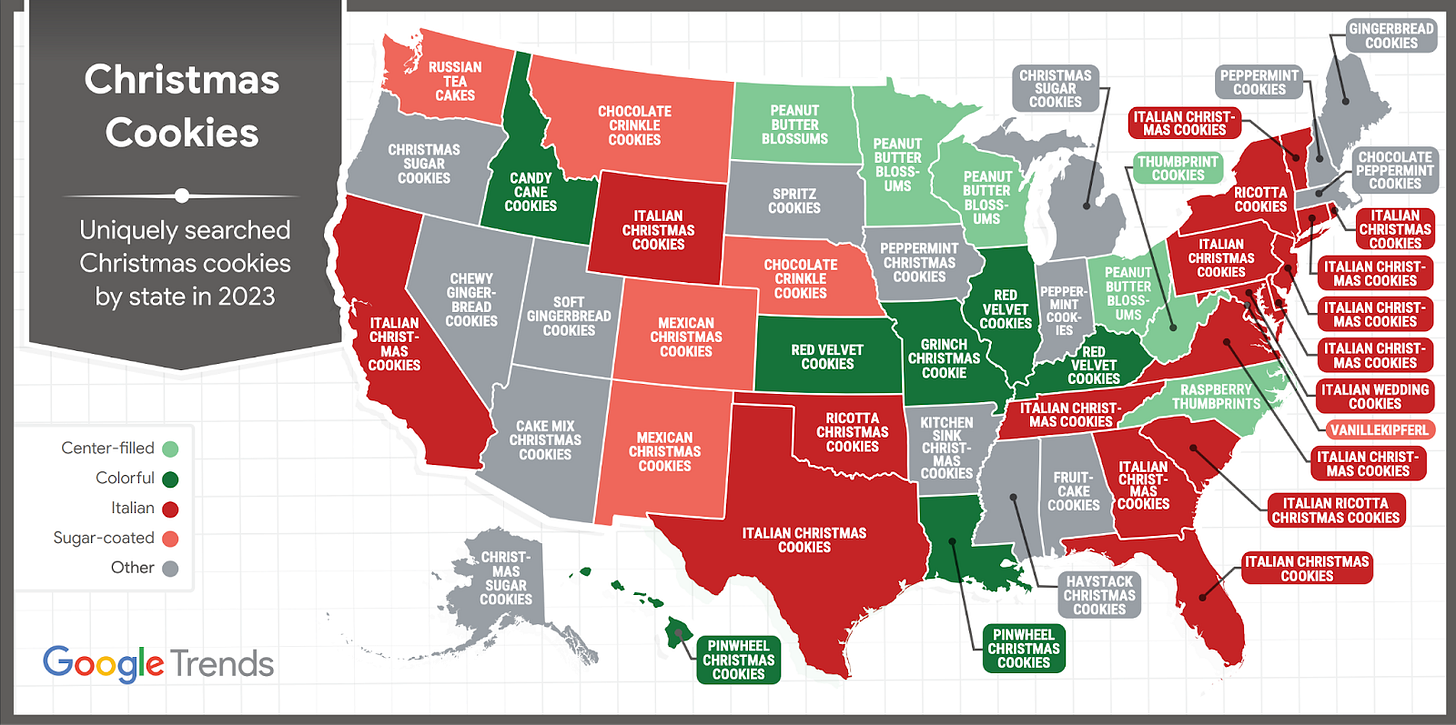

🍲What is cooking in the Christmas kitchen across the USA? Take a look at the uniquely searched Christmas cookies across all the states in the US.

🤖 Generative AI will revolutionize marketplaces in 2024 and beyond. Highly personalized products and services stand to benefit the most. Think Substack, Patreon over Upwork, & Fiverr.

🎄Just how rich were the McCallisters in “Home Alone”? Turns out they were in the top 1 percent. Their house would be worth a whopping $2.4M today.

🌈One viral TikTok theory suggests that the US is in a ‘silent depression’, but the latest economic data points to light at the end of the tunnel. While the lower income segment has been disproportionately hurt, overall consumer confidence is recovering fast as inflation cools and housing market conditions improve.

In case you missed…

You can now support my work on the Pragmatic Optimist by buying me a coffee and a muffin. Please know that I intend to keep my work free, so if you choose to support me, I will be very grateful.

To all those who bought me a coffee and a muffin over the last week, thank you very much.

And should you choose to pass, please know that you are still a valued member of the community, and I always encourage everyone to freely express their views, comments, and questions about my work.

📈 Where is the stock market headed in 2024?

After a dismal 2022, stocks soared in 2023, with the S&P 500 and Nasdaq 100 jumping more than 20% and 50%, respectively.

A resilient economy, moderating inflation, and the potential peak in interest rates helped investors overcome fears of a potential recession and jump back into stocks. Now the biggest question investors have is whether the strong market rally can continue into 2024 and whether an economic slowdown and subsequent stock market crash are imminent.

Here’s a quick rundown of some of the top Wall Street forecasts for the stock market in 2024.👇🏼👇🏼

1. JPMorgan: Bearish, S&P 500 price target of 4200

JPMorgan said high equity valuations, high interest rates, a weakening consumer, rising geopolitical risks, and a potential recession give it little confidence that stocks will move higher in 2024.

"We expect a more challenging macro backdrop for stocks next year with softening consumer trends at a time when investor positioning and sentiment have mostly reversed," JPMorgan's Marko Kolanovic and Dubravko Lakos-Bujas said in their 2024 outlook note.

2. Morgan Stanley: Neutral, S&P 500 price target of 4500

Morgan Stanley expects a flat stock market in 2024 but sees some pockets of the stock market performing better than others.

"The question for investors at this stage is whether the leaders can drag the laggards up to their level of performance or if the laggards will eventually overwhelm the leaders' ability to keep delivering in this challenging macro environment," Morgan Stanley said.

Morgan Stanley recommended investors avoid the high-priced tech stocks and instead focus on defensive growth stocks, typically found in the healthcare, utilities, and consumer staples sectors, as well as late-cycle cyclical stocks typically found in the industrials and energy sectors.

3. Bank of America: Bullish, S&P 500 price target of 5000

Bank of America is bullish on the stock market in 2024 because of how much progress the Federal Reserve has made towards tightening its monetary policy following more than a year of aggressive interest rate hikes and the ongoing reduction of its balance sheet.

"We're bullish not because we expect the Fed to cut, but because of what the Fed has accomplished. Companies have adapted to higher rates and inflation," Bank of America's Savita Subramanian said in her 2024 outlook note.

4. Goldman Sachs: Bullish, S&P 500 price target of 5100

Goldman Sachs now expects the S&P 500 to finish 2024 about 8% higher from current levels as inflation falls, corporate profits rise, and the Fed shifts to a more dovish position.

"By some measures the trend is already at or near 2%," Goldman Sachs said. Decelerating inflation and Fed easing will keep real yields low and support a price-to-earnings multiple greater than 19x," Goldman Sachs said.

🍲What’s cooking in the Christmas kitchen across the USA?

Here’s a snapshot of some of the uniquely searched Christmas cookies across US states as per Google Trends!!

Meanwhile, here are some search results for holiday foods and drinks that are trending on Google.

“christmas morning casserole” and “christmas morning quiche” have both more than doubled over the past week, US

“holiday vegetable side dishes” increased +190%

“jack frost cocktail recipe” is up 200% and “sugar cookie martini” nearly tripled

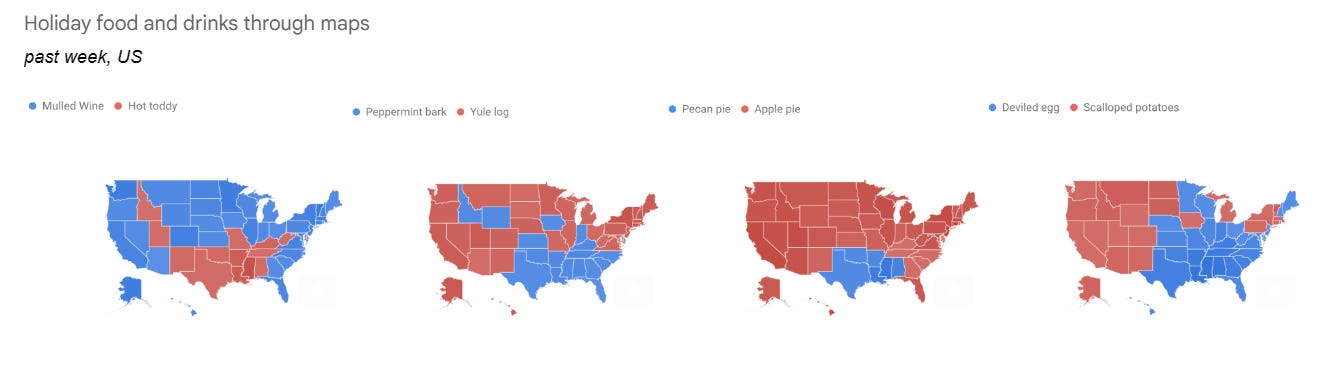

Finally, here’s a quick rundown of the preferences for the following holiday foods and drinks throughout the US. We have the following combinations:

Mulled wine vs. hot toddy

Peppermint bark vs. Yule log

Pecan Pie vs. Apple pie

Deviled egg vs. scalloped potatoes.

🤖 Generative AI will revolutionize marketplaces. Highly personalized products and services stand to benefit the most.

The Internet took us from classifieds and poster boards to sites like Amazon, eBay, and Craigslist, while mobile enabled apps like DoorDash, Uber, and Instacart.

Now, generative AI promises to revolutionize marketplaces again. It will not only transform how products and services are sold but also how they are made.

Over the next 3 to 5 years, we should expect some existing marketplaces to pivot while others go out of business. We’ll also see a group of new companies built from the “ground up” around AI, which will likely look more dynamic than anything we’ve seen before.

AI’s impact on buyers (the demand side) should be fairly consistent across marketplaces and almost entirely positive. Both new and existing marketplaces that embrace AI should see key improvements, such as:

New search modalities: Buyers will no longer have to search for items by an exact title or meander through complex filters. They can use natural language, images, or even just a vibe to describe what they’re looking for and get results. These changes will reduce scrolling fatigue and make it more likely for a search to convert into a transaction.

Custom supply creation: Imagine a marketplace where a searched-for product (e.g., “mittens with the Bernie Sanders meme printed on them”) doesn’t yet exist. The marketplace can then match the user with a supplier who is able to bring their vision to life—at the quality level and price they are looking for. Think of this as “Etsy on steroids” for every type of product.

On the other hand, the impact of AI on sellers, or the supply side, is trickier. There are two main ways that AI will impact supply, based on the type of marketplace:

Digital or IRL product/service: Is what you’re selling delivered entirely digitally, or does it require “real world” inventory or infrastructure? For example, AI can’t fully replace a house on Airbnb, but it can help suppliers on the platform become more efficient by automating their busywork, such as writing listings and answering questions from potential guests, so they can focus solely on the transaction.

Personal or commoditized supply: Buying a logo on a site like Fiverr is, arguably, closer to the “commodity” end of the spectrum. You likely care more about getting a reasonable output for a reasonable price than the specific creator. This approach is more susceptible to AI automation. In other cases, supply is truly personalized—e.g., buying content from your favorite Substack creator. AI is less likely to fully replace these suppliers (at least in the near term) and is, instead, more likely to supercharge their work by helping them create content faster.

Based on the above vectors, here's how different types of marketplaces will be impacted by genAI, from most to least disrupted.

For those of you who are wondering, yes, it would be long-term beneficial to build your brand and voice on platforms such as Substack, Patreon, and others vs. offering a generic set of services on Upwork and Fiverr, in my opinion.

🎄Just how rich were the McCallister’s in “Home Alone”?

The battle in “Home Alone” between 8-year-old Kevin McCallister and two burglars known as the Wet Bandits has unfolded on screens around the world every Christmas since the film premiered in 1990.

And each year, for some viewers, the McCallisters’ grand home and lifestyle inspire their own tradition: wondering just how rich this family was.

So, I have broken it down here for you. 👇🏼👇🏼

The McCallisters are the 1 Percent.

In 1990, the house was affordable only for the top 1% of Chicago household incomes, and that would still be the case today, according to economists at the Federal Reserve Bank of Chicago.

Working with the assumption that the McCallisters did not spend more than 30% of their income on housing, the economists also determined the home would have been affordable to a household with an income of $305,000 in 1990.

In the middle of 2022, a similar house would cost about $2.4M, based on the Zillow estimate for the “Home Alone” house. A home of that value would be affordable to a household with an income of $730,000, which would be in the top 1% of Chicago-area households, the economists said.

How are they so rich?

Todd Strasser, who wrote the official novelizations of “Home Alone” and two of its sequels, said in an interview that he was not closely supervised by the filmmakers.

So in the book, he made Kevin’s mom a fashion designer because of the mannequins, and Kevin’s dad a businessman because it was “a safe bet,” he said.

One fan theory posits that Peter McCallister is involved with organized crime. Under this theory, the McCallister home was specifically targeted as some sort of vendetta, and Kevin’s brutal violence against the burglars is the product of an upbringing exposed to criminal activity.

Uncle Rob paid for the flights

A commonly cited data point on the family’s wealth is their Christmas trip to Paris.

Flying 15 people to Paris is expensive, especially with the four adults flying first class, but Kevin’s parents don’t pay for the airplane tickets. Early in the film, Kate McCallister tells a police officer that her husband’s brother paid for the flights.

That brother is Uncle Rob. He is a minor figure in the first film, but the few mentions he does get suggest that he is loaded. He pays for the tickets, and he has an apartment in Paris that has a clear view of the Eiffel Tower and can somehow house 15 of his family members.

The movie is not about the money

After all, John Hughes and director Christopher Columbus created this heartwarming and comic film as entertainment for the audience and to uplift spirits for the holidays. It did, and still does.

🌈One viral TikTok theory suggests that the US is in a ‘silent depression’, but the latest economic data points to light at the end of the tunnel.

The U.S. economy has remained remarkably strong, but affordability is worse than it has ever been, some social media users say, even when compared to the Great Depression.

One of TikTok’s latest trends, coined the “silent depression,” aims to explain how key expenses such as housing, transportation, and food account for an increasing share of the average American’s take-home pay. It’s harder today to get by than it was during the worst economic period in this country’s history, according to some TikTokers.

But economists strongly disagree.

“Any notion from TikTok that life was better in 1923 than it is now is divorced from reality. Compared to 100 years ago, life expectancies are much longer, the quality of lives is much better, the opportunities to realize one’s potential are much greater, human rights are more widely respected, and access to information and education is widely expanded,” said Columbia Business School economics professor Brett House.

“To be sure, the economy is slowing and the job market is cooling, but we are not in a depression,” said Sung Won Sohn, professor of finance and economics at Loyola Marymount University and chief economist at SS Economics.

The unemployment rate declined to 3.7% in November, and the ratio of openings to available workers was 1.3, a far cry from the 25% unemployment rate in the 1930s.

However, there is no denying that lower-income families have been particularly hard hit. The lowest-paid workers spend more of their income on necessities such as food, rent, and gas, and all experienced higher-than-average inflation spikes.

“Inflation has been hitting the poor more than the rich, in terms of share of real income lost, because it has been relatively higher for categories that make up larger shares of household budgets,” Tomas Philipson, a professor of public policy studies at the University of Chicago and former acting chair of the White House Council of Economic Advisers said.

But relief may be on the way, as some of the latest economic prints indicate that inflation is cooling along with overall housing market conditions improving. The Consumer Confidence Index increased in December to 110.7, up from a downwardly revised 101.0 in November.

The Present Situation Index, based on consumers’ assessments of current business and labor market conditions, rose to 148.5 from 136.5 last month. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—jumped to 85.6 in December from 77.4 in November. This sharp increase brings expectations back to the levels of optimism last seen in July of this year.

“December’s increase in consumer confidence reflected more positive ratings of current business conditions and job availability, as well as less pessimistic views of business, labor market, and personal income prospects over the next six months,” said Dana Peterson, Chief Economist at The Conference Board.

At the same time, consumers’ Perceived Likelihood of a US Recession over the Next 12 Months abated in December to the lowest level seen this year, although two-thirds still perceive a downturn is possible in 2024.

Being a McCauley I love this post!

Happy Holidays to you and Uttam - and thanks for the great writings! (Love your big muffin 🧁!)

I remember reading the book Factfulness and there was a quiz about the trends of the world , and most of my friends and families were too pessimistic about the world around us.

No doubt the lower income got hit harder and things did get tough when inflation soared, but at the same time, the availability and access to technology have given us lots of options . A quick search on the internet can now give you ideas where to save money and where to take up side hustles; still lots of opportunities out there if we try!