Geopolitical tensions are driving venture capital funding into defense technology. Here’s 3 charts and insights you should know about.

Global government budget look to allocating a higher spend towards military in the coming decade. With geopolitical tensions on the rise, VC firms shift their focus towards defense tech.

«« The 2-minute Version»»

Did you know? Palmer Luckey who was leading the Virtual Reality startup Occulus VR, which was acquired by Facebook (Meta Platforms) went on to build Anduril, a defense tech startup, whose valuation has exploded 33x to $8.5B.

So what? We are at a point in time where we are starting to see a global trend where venture capital firms are increasingly investing in defense startups, a phenomenon that rarely took place before.

Tell me more:

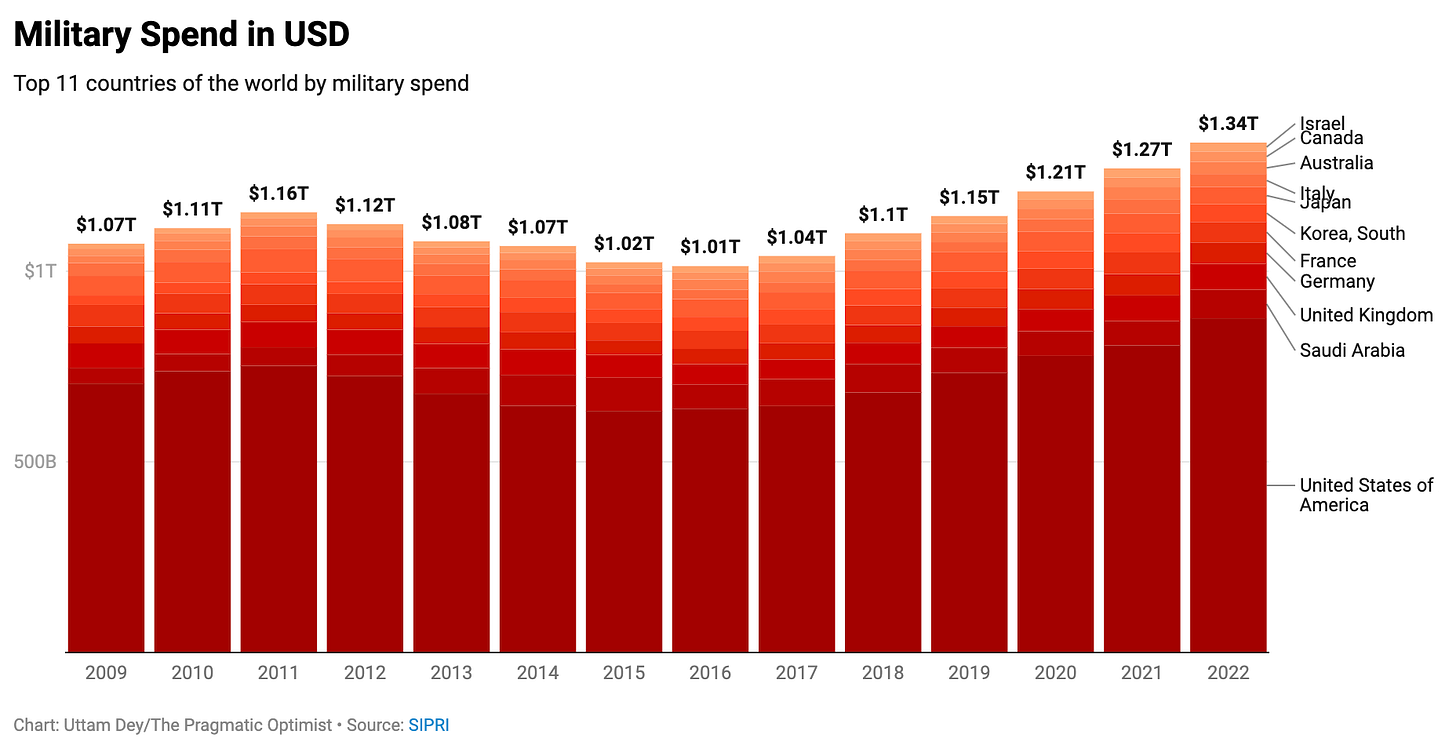

In 2022, global military spending rose by 3.7% to a record high of $2.24T according to data released by SIPRI. The figures mark the eighth consecutive year of global military spending growth.

Plus, after the Ukraine war broke out, USA’s dominance in military export has further increased, now accounting for 40% of the world’s global arms trade, up from 33%, just 5 years ago.

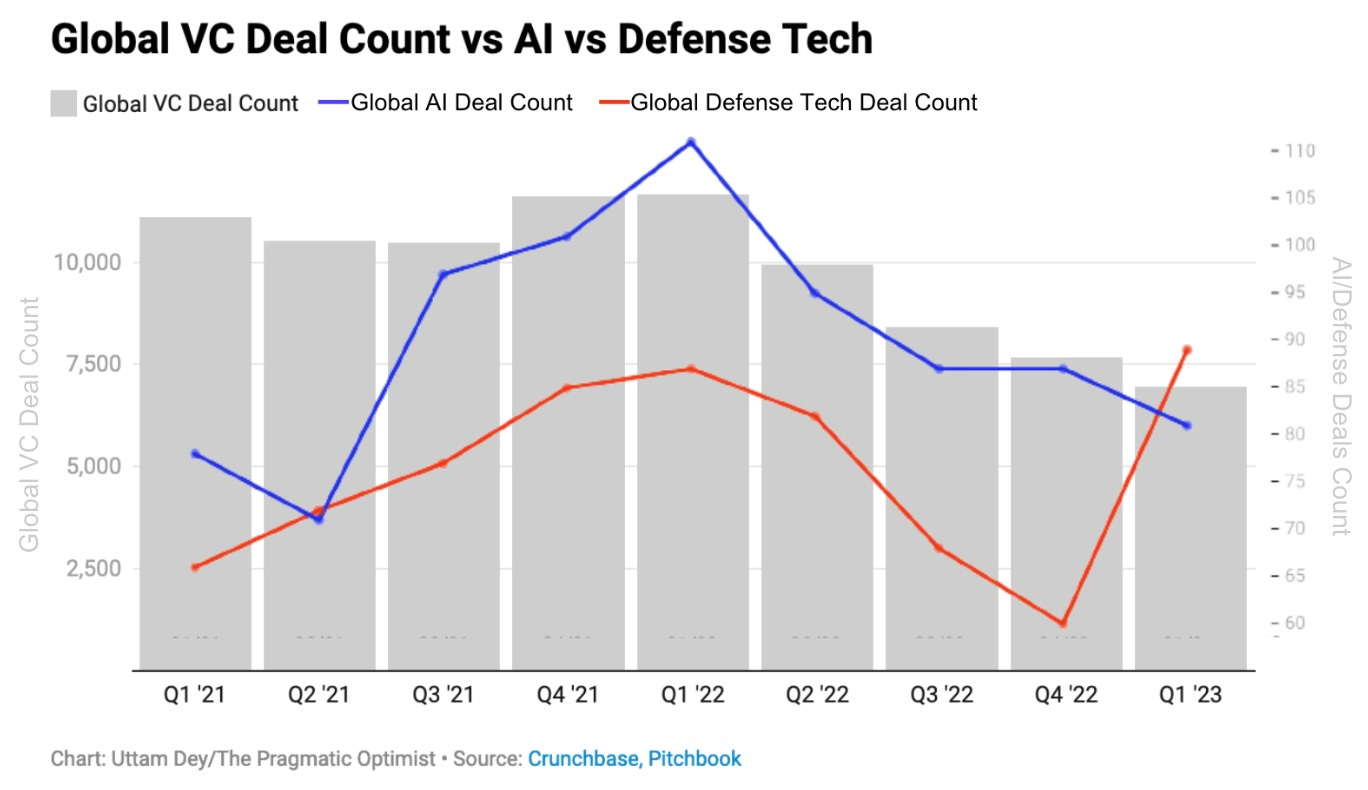

As a result, there is a renewed sense of enthusiasm in the venture capital deal activity in Defense Tech. Though global VC deal is down overall, deal activity in defense tech is on the rise.

Tailwinds include: Apart from rising geopolitical tensions, defense and security industry is considered to be recession proof, as opposed to Software-as-a Service (SaaS). In addition to that, Department of Homeland Security set up their own investment arm, In-Q-Tel to invest in cutting edge defense technology for the first time ever.

Looking forward: Stay tuned for Part 2 of the post where we dive into specific companies and technology trends that are fueling the defense industry, as well as actionable plans for portfolio allocation.

Until 2016, Palmer Luckey was one of Silicon Valley’s hottest, rising stars. Luckey was leading the revolution in Virtual Reality with his VR headset startup Occulus VR which was acquired by Facebook (now known as Meta Platforms) for $2B. Two years later, Facebook and Luckey abruptly decided to part ways given their irreparable political differences.

Within a year, Luckey founded Anduril, a defense tech startup, thus completely pivoting away from mainstream tech which had become popular at the time. Anduril would go on to become one of Silicon Valley’s most controversial start ups especially as its mission was to create autonomous drones for warfare.

Since then, Anduril’s valuation has exploded by 33x to $8.5B, rewarding all of Anduril’s early backers such as Peter Thiel’s Founders Fund.

More importantly, Anduril’s valuation multiple is symbolic of a global trend where we see Venture Capital firms increasingly allocating investment funds towards defense technology startups, a phenomenon that rarely took place before.

Global Military Spending are Hitting Records

Defense is usually not hot property in the world of venture capital investments.

But the war in Ukraine changed the reality of how investors viewed this sector from a myriad of perspectives. Leading from the front, we saw a renewed shift in the government budgets that allocated more future capital towards defense and national security projects.

In 2022, global military spending rose by 3.7% to a record high of $2.24T according to data released by SIPRI. The figures mark the eighth consecutive year of global military spending growth.

“The continuous rise in global military expenditure in recent years is a sign that we are living in an increasingly insecure world,” said Nan Tian, a senior researcher at SIPRI.

The U.S. remained by far the world’s biggest military spender last year, with its $877B outlay, accounting for 39% of the global total. A big chunk of the 0.7% YoY increase in the US military spending is attributed to the military aid given to Ukraine.

Military spending in Europe rose at the fastest rate since the end of the Cold War some 30 years ago, SIPRI said, up 13% to $345B. The combined military expenditure of countries in Asia and Oceania was $575B, up 2.7% from last year and 45% from a decade ago. Many countries in these regions don’t have the capacity to build the required military infrastructure by themselves so they look to countries like the USA & France to import defense equipment from them.

Global Export Orders of Military equipment is also rising

Last year, Japan set out plans to increase its military capability in response to what it sees as a threat from China and North Korea. Tokyo said that by fiscal 2027, it would spend about 2% of its GDP on defense, up from about 1% now, making it the world’s third largest military spender, in terms of military imports.

Rising military spending has created record order books for weapons makers, though some companies are wrestling with labor and supply-chain issues as they work to capitalize on demand. Today, the market share of military exports are dominated by a few countries.

Take a look at the following chart which shows the share of the largest exporters of military capital to the world and how it has changed between 2013 and 2022.

Note that after the Ukraine war, USA’s dominance has further increased, now accounting for 40% of the world’s global arms trade, up from 33%, just 5 years ago. The U.S. provided more than half of the weapons purchased by 13 of the top 17 arms importers, with Saudi Arabia, Japan and Australia buying the most from the U.S.

Venture Capital firms world over are going to war (with their deals, of course)

As USA’s market share is rising in the world of global arms exports, VC’s have compelling reasons to turn their investment focus back onto American soil. A flurry of executive orders limiting US investment in critical technologies is further restricting investment avenues for many venture funds in the US. Moreover, rising geopolitical tension and risk of economic sanctions have led to investment funds re-evaluating the defense tech space.

This chart below reflects the renewed sense of enthusiasm that is building in VC deal activity in Defense Tech. Plus, Defense Tech Investments were one of the few industries to buck the trend in declining VC Deals getting completed this year.

In addition, companies focused on defense and security are considered recession-proof.

With the global economy drifting toward a possible recession, future revenues of SaaS startups are increasingly coming under pressure as many corporate customers cut back their software spending.

By contrast, security-focused tech companies are gaining favor as the Pentagon continues to retool its modern arsenal with satellite imagery, data analytics, artificial intelligence, space tech, cybersecurity and robotics. Moreover, Pentagon and CIA are looking to bolster their technologies with the agile approach that Silicon Valley brings to the table.

In fact, Department of Homeland Security set up their own investment arm, In-Q-Tel to invest in cutting edge defense technology for the first time ever. In-Q-Tel was one of the earliest backers in Palantir $PLTR.

Looking Forward

There is no doubt that defense spending budgets are set to rise in this decade. With Venture Capital firms and Hedge Funds starting to take notice of this, big money is set to flow in this industry through startups and publicly listed defense stocks.

In the next edition, we talk about emerging technology trends amongst players in the defense industry and what you, as an investor can do to position your investment portfolio for the next decade to take advantage of this growing secular force.

Here is Part 2 of this post:

Kinda F*cked up, how we(not me) went from "Just wear a mask, even if it saves just one life" to chanting "WAR, WAR, WAR!" in a jiffy.

One wonders how venture capsters square war mongering with “ESG”. Answer…follow the money…

ITA iShares Aeronautical and Defense ETF is one way to go if you want to avoid the minefield that is private equity. Personally I’m on the look out for a Peace and Goodwill ETF. Any sensible suggestions?