Nvidia & Intel’s Ripple Effect On AI Chips

Impacts to Intel, Nvidia, AMD, Taiwan Semi, ASML and other semiconductor heavyweights

At The Pragmatic Optimist, we help hundreds of investors navigate the AI innovation landscape, identify businesses with strong growth trajectories and operational grit, and make long-term investments in the space with proven alpha generating returns. Winning calls: Celestica, Astera Labs, Credo, Micron, AppLovin, MongoDB and more.

Become a paid subscriber today

The relationship between Nvidia NVDA 0.00%↑ and INTC 0.00%↑ came full circle last week with the announcement of the $5B partnership between the two semiconductor neighbors from Santa Clara, CA.

In the early 2000s, Nvidia’s Jensen Huang would frequently voice his frustration about Intel’s arm-twisting tactics of allowing Nvidia’s GPUs to be used on Intel’s x86 architecture in the PC. At one point Huang almost termed its relationship with Intel as a zero-sum game, saying Nvidia could “only succeed where Intel is not.”

Fast forward to today, Nvidia has grown into this monstrous AI chip giant, while Intel is a shadow of the giant it once was, with the former now appearing to bail out the latter. Life does come full circle after all.

Obviously, this deal between Nvidia and Intel has meaningful direct implications for both parties, putting Intel in the same spot Nvidia once was.

But the implications of this deal also carry significance that has the ability to alter some of the competitive and supply chain threads in the broader semiconductor ecosystem.

While we break down the deal between Nvidia and Intel below, we also address the implications of this deal on partners and peers such as Advanced Micro Devices AMD 0.00%↑ , Taiwan Semiconductor TSM 0.00%↑, ASML Holdings ASML 0.00%↑, KLA Corp KLAC 0.00%↑ and Applied Materials AMAT 0.00%↑.

Note: Since our first "buy" rating on Nvidia, AMD, Taiwan Semiconductors, Intel, and ASML in 2025, it has averaged a return of 40% to date. This is 1.33x that of the YTD return of the Semiconductor ETF SMH. If we also add our returns from our first "buy" rating on Micron, Arista Networks, Credo, Astera Labs, and Broadcom in 2025, we have delivered an average return of 72.5% to date, or an alpha of 2.5x over the SMH ETF. You can find all our updated price targets, conviction scores, and ratings history on all these companies in the AI Stock Rec Tracker.Breaking Down the Nvidia/Intel Deal

At its core, the partnership appears to signal a joint collaboration between Nvidia and Intel on producing chips for both the data center and for PCs. The chips that Nvidia and Intel jointly produce will be designed for consumer applications as well as for enterprise and hyperscale workloads.

Also, as part of the deal, Nvidia will invest $5B in Intel, giving the ailing chip giant a much-needed cash boost.

The short version of our take on the deal is, Nvidia and Intel opening up their respective platforms to one another—Intel will build x86 SoCs (system-on-chips) that integrate NVIDIA RTX GPU chiplets to be deployed in PCs, while Nvidia will integrate Intel’s CPUs (all Intel CPUs are designed using Intel’s x86 architecture) to be deployed in AI data centers.

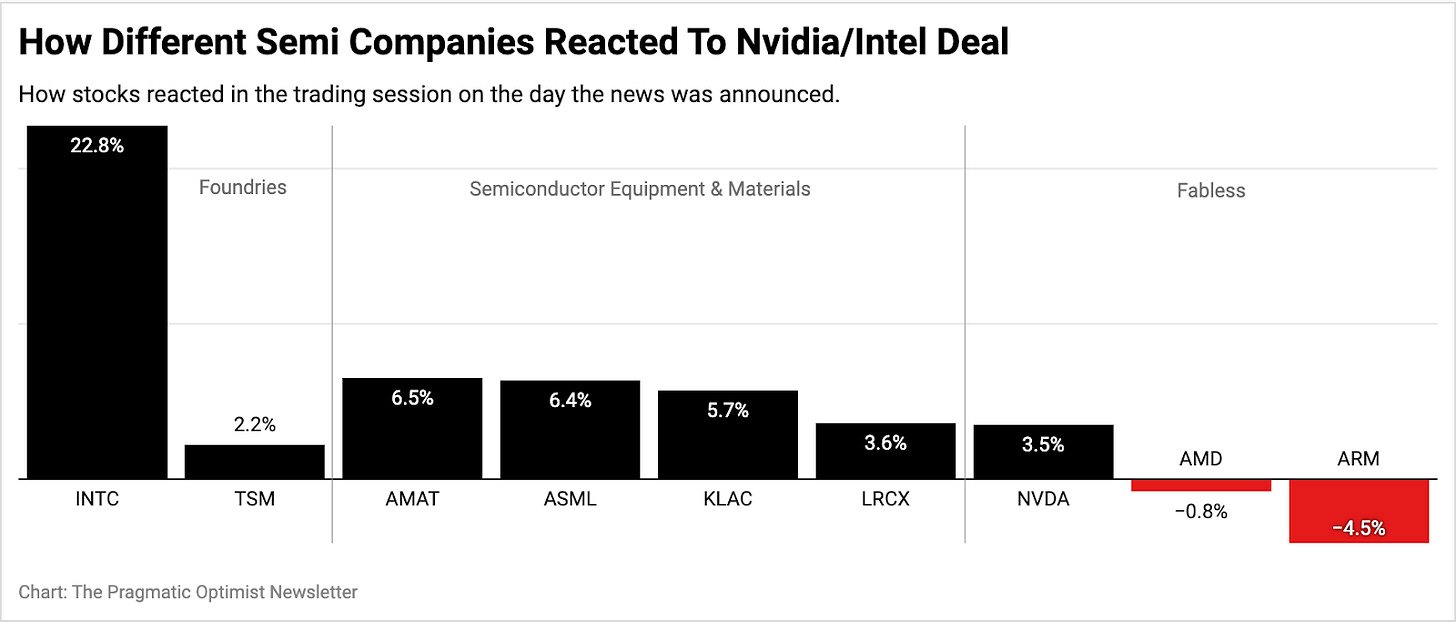

⚠️ If you’re wondering what an SoC is, it is a single chip board that contains all essential components of a computer, including CPU and GPU chiplets merged into one compact chip package. Apple’s M-series chips are the most popular SoCs that power iPhones, Macbooks, etc.Previously, we mentioned implications of the deal extending beyond the usual suspects, Nvidia and Intel. In the chart below, we show the market's response to certain semi stocks on the day the news was released.

Now that we’ve shown the market reactions to you, we’ll proceed with our analyses of how the Nvidia/Intel deal impacts Intel, Nvidia, and the semiconductor ecosystem and revise our price targets for the shares of these companies accordingly, below.

Intel Will Muscle Up Its Capital Abs

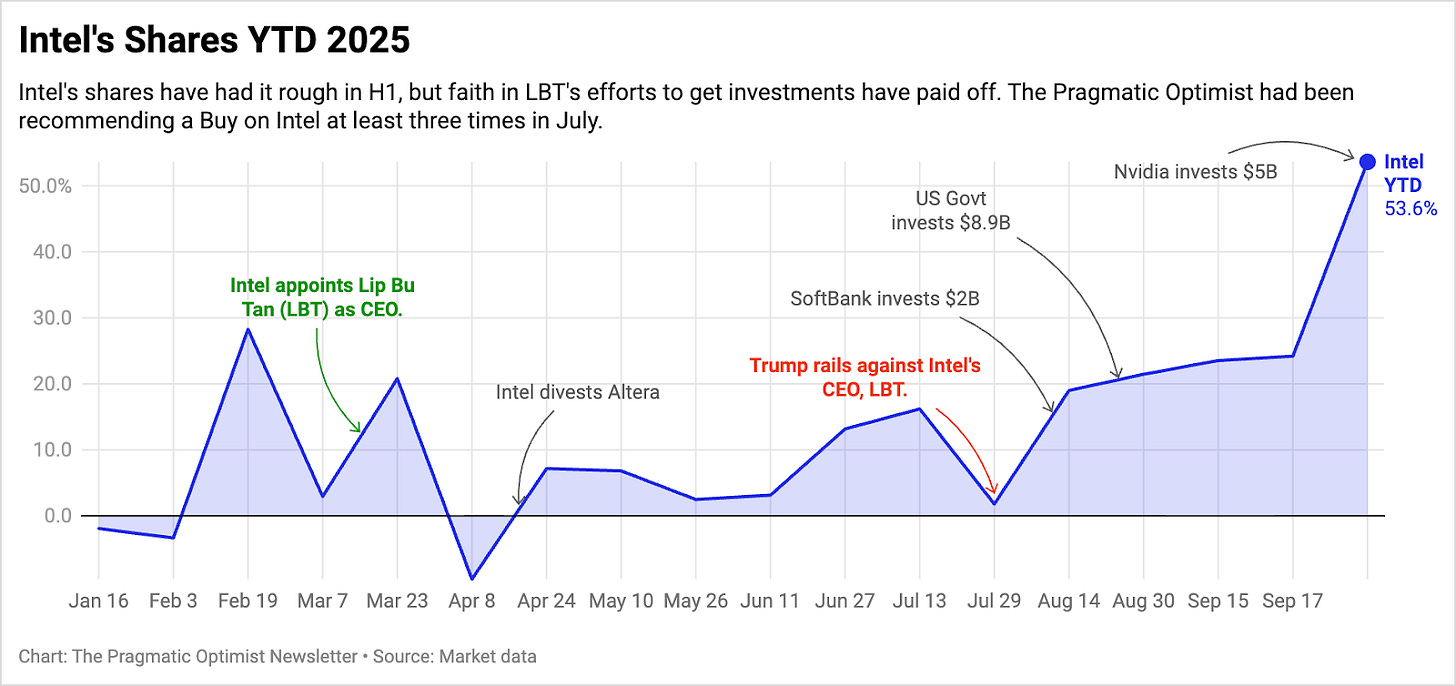

After Pat Gelsinger and Intel separated in December last year, Intel’s future was up in the air. Initially, even the appointment of LBT (Lip Bu Tan, a former Cadence Design CDNS 0.00%↑ executive and former Intel board member) did not do much to revive optimism in Intel’s shares.

LBT’s appointment as Intel’s CEO did, however, put a floor in Intel’s share price at ~$20 per share, a level that was thoroughly tested after President Trump railed against LBT last month.

However, through these months we believed the appointment of LBT was just what Intel needed and kept reiterating our “buy” ratings on Intel’s shares, with the latest one on July 27th.

Here’s why we believed in Intel’s new management and how we think the Nvidia deal impacts the price targets for Intel and Nvidia.