AI Networking Stole The Show In Q2 - Part 1

Also, the battle for XPUs is heating up. Plus, our updated price targets for Broadcom, Marvell and Astera Labs

At The Pragmatic Optimist, we help investors navigate the evolving AI innovation landscape, identify rock-solid businesses with strong growth trajectories and operational grit, and make long-term investments in the space with a high probability of success.

Become a paid subscriber today

«The 2-minute version»

In early March we published a deep dive on the AI Networking market, followed by our coverage and “buy” rating in Celestica, which we believed was the best positioned to benefit from capex primetime. So far, the AI Networking complex has outperformed with Celestica leading the pack.

This two-part post is an update to our March deep dive on AI Networking.

💰The Networking Gold Rush Is Real: AI networking and connectivity products are experiencing explosive growth as hyperscalers shift focus from raw compute power to efficiency, with the market expected to exceed $50B annually and Ethernet technology rapidly displacing Nvidia's InfiniBand as the new popular networking standard in scale-out networks at the data center. Plus shipments of XPUs are expected to cross GPU shipments for the first time by CY29.

🏢Battle For Custom Silicon Dominance Heats Up: Rivalry between the industry’s two largest incumbents, Broadcom and Marvell, is getting fierce. Both companies are growing their networking revenues in strong double digits, but just one incumbent is protecting its share in the custom silicon market. Then, new kids like Astera Labs, the plucky underdog with big dreams, are flipping the script with their own unique approach to the custom silicon market, threatening Broadcom & Marvell’s incumbent dominance.

📈Will Broadcom Raise The Bar Today? Broadcom has reportedly been scoring wins for XPU design programs that extend beyond the traditional cohort of hyperscaler customers. Will Broadcom’s Hock Tan upgrade his FY27 addressable market opportunity of ~$75B in the Q2 Earnings report to be released today after markets close? We publish our outlook on Broadcom with price targets for the company as well as Marvell and Astera Labs.

We have added updated price targets and respective ratings on Broadcom, Marvell and Astera Labs on our AI Stock Tracker that all premium members have access to.

🎥Let’s Set The Stage

There are two takeaways from the evolving conversation around AI capex that most of our readers will be quite familiar with by now.

First, AI capex is still on track to grow at a near-50% this fiscal year, led by the four largest hyperscalers. Second, while AI capex growth rates are still elevated, every hyperscaler is looking to become more efficient in how they spend their capex dollars. While some have resorted to extending the shelf life of their GPUs, others are doubling down on building their own XPUs.

But all hyperscalers seem to be in broad consensus on one area of the data center spend: Networking & Connectivity products & solutions.

Companies that provide AI Connectivity products and solutions have turned out to be one of the biggest beneficiaries of AI capex so far this year, and the market performance has shown how undervalued some of these companies were at the heart of DeepSeek concerns that started in January this year.

The past month has seen many companies in the AI Connectivity space announce path-breaking earnings reports, which have further strengthened the outlook.

This is a 2-part series of posts, with today’s post being the first part, which will focus on the rivalry between Broadcom AVGO 0.00%↑, Marvell MRVL 0.00%↑, and Astera Labs ALAB 0.00%↑. Part 2 will be published in a few weeks, which will focus on the competition between pure-play AI networking companies such as Celestica CLS 0.00%↑, Arista Networks ANET 0.00%↑, Credo CRDO 0.00%↑, and Cisco CSCO 0.00%↑.

The AI Connectivity Market Marches On

In March this year, AI stocks and broader markets were left reeling from the one-two punch delivered by DeepSeek concerns on AI capex, followed by Trump’s tariff threats.

Our opinion on the DeepSeek concerns (at the time) was that it would only force hyperscalers to become more efficient with their AI capex. In the meantime, we were particularly bullish on AI Networking & Connectivity, as we believed it would become a new beneficiary cohort of AI capex as the focus of capex dollars turned towards efficiency.

So, we issued an industry overview of the entire AI Connectivity landscape, in March this year and followed it up with a deep dive on Celestica, one of our top conviction picks and a stock that we continue to hold.

Over the past month, many players, such as Astera Labs, Marvell, and most recently Credo, have announced their earnings reports, which confirmed path-breaking growth potentials in their outlooks.

Plus, Nvidia NVDA 0.00%↑ also announced that they are opening up their connectivity ecosystem with the announcement of NVLink Fusion at last month’s Computex 2025, which we covered in detail in a previous post.

The only remaining piece to the AI Connectivity industry outlook is Broadcom’s Q2 FY25 earnings report, which should be announced after market close today.

For now, industry reports show the AI Connectivity market is still going strong. We’ll start at a high level and then go deeper down into the outlook on products & solutions.

A few months ago, the 650 Group published this report that showed that capex dollars on networking infrastructure in the data center are poised to “exceed $50B a year in spending” from this year as AI capex grows from a little over $200B last year to $1T over the next few years.

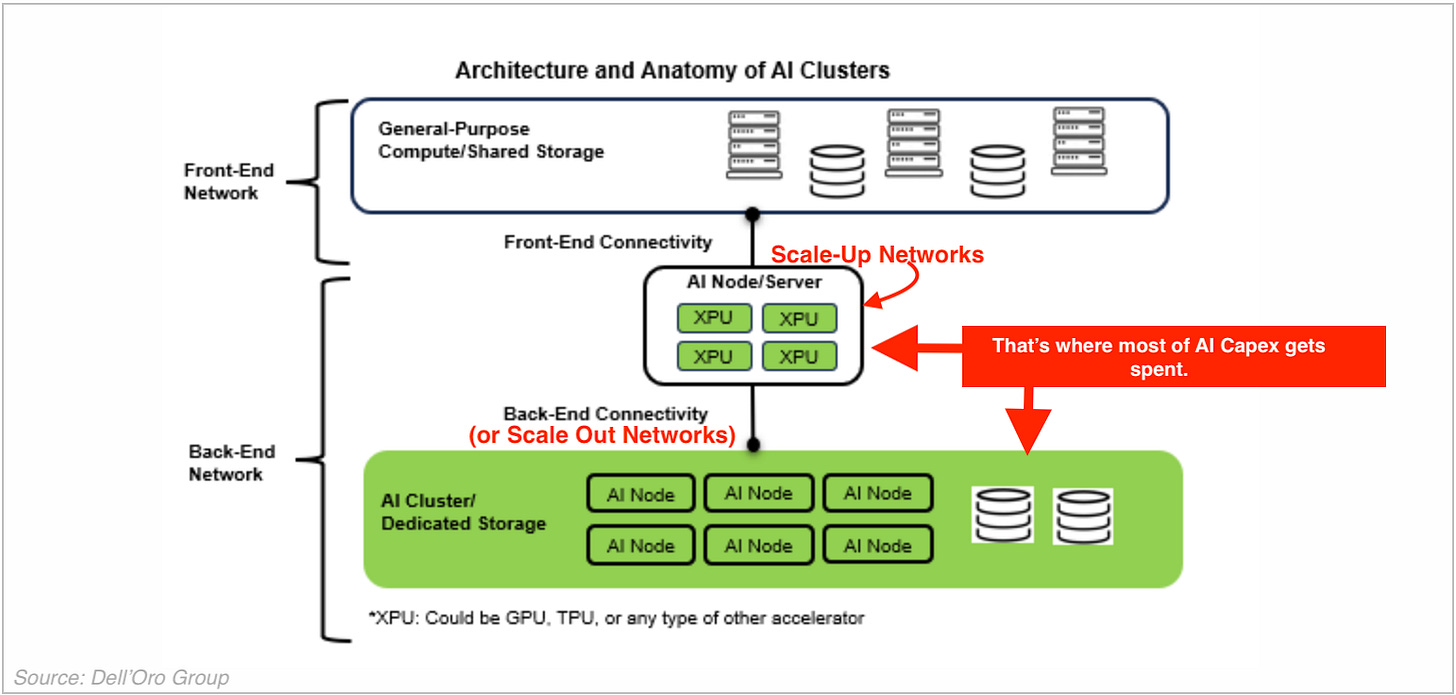

Scale-up and scale-out network architectures are still two areas of AI Connectivity which are driving demand for XPUs & networking infrastructure. Both scale-up and scale-out networks are estimated to grow at a 2x pace this year alone, but scale-out is growing much faster.

Nvidia’s InfiniBand was the primary choice of networking fabric technology used in prior scale-out architectures, but the advancements in Ethernet technology have quickly catapulted Ethernet as the new de facto standard of networking products to be used in scale-out architectures. 2025 should see a record volume of 800 Gb Ethernet-based solutions being deployed in the data center while the industry gets ready to deploy 1.6 Tb networking solutions early next year.

Another research firm, the Dell’Oro Group, believes the switching market for scale-out networks (also called backend networks) is expected to grow by a CAGR of 35.7% over the next five years to a TAM of $29B. Of this, the top four U.S. hyperscalers alone will account for a spend of $14.6B.

So, networking vendors like Celestica, Broadcom & Cisco that are currently engaging and winning contracts with hyperscalers and other clients on Ethernet switches, routers, and adapters are enjoying robust growth ramps in their revenue bases.

Dell’Oro also believes Ethernet will eventually hold a 64% share in the backend networks (a.k.a. scale-out) while Nvidia’s InfiniBand will drop to a 36% share. Until last year, InfiniBand had a majority share.

Outside of Ethernet, the Accelerator Interconnect solutions which are usually built on the PCIe standard, are also going strong. New kid on the block Astera Labs believes the PCIe switch market for data center interconnect is a ~$5B dollar market opportunity and recently launched their custom silicon products for this market. But by doing so, Astera Labs will now directly compete with industry incumbents Broadcom and Marvell, and after evaluating Marvell’s recent earnings report, we think the competition is fierce due to the large volumes of capex dollars being thrown into the AI Connectivity market.

Meanwhile, other smaller product markets, such as retimers (~$1.5B opportunity) and AEC cables ($1-2B opportunity), continue to be rapidly growing markets within the realm of AI Connectivity and Networking solutions.

In the section below we will delve into our growth outlook for Broadcom, Marvell, and Astera Labs, the growing competition between the three, and the resulting casualty from that competition.

Since Broadcom and Marvell also generate a meaningful share of their revenues from XPUs, we will also put our market estimates on the XPU market and how that impacts Broadcom and Marvell. This will be followed by updated price targets and valuations for all three names.