Nvidia’s earnings created a paradox for the AI boom/bust debate

Nvidia's stock has entered bear market as earnings beat & guidance were lackluster, with uncertainties around Blackwell, AI spending & competition lurking. But does that change its long-term thesis?

Nvidia is officially in bear territory as it lost more than $300B in market cap since its Q2 earnings last week. The thing though is its earnings report was not at all terrible. Far from it. Revenue grew 122% YoY to $26.3B, while operating income expanded 174% with a margin improvement of 1200 basis points to 62%. This was driven by strength in demand for its Hopper GPU and Spectrum-X Ethernet networking solution as the AI capex cycle shows no signs of slowing down.

Why the selloff then? You see, Nvidia became an undue victim of its own success. Over the last several quarters, Nvidia had been consistently beating quarterly its revenue and earnings estimates by a huge margin. While that has made its CEO Jensen Huang the official rockstar of AI and Wall Street, the truth is that the magnitude of its revenue and earnings beats have been shrinking, with the latest surprise of 4.5% and 5.7%, respectively. Not what the Nvidia “watch party” folks were expecting.

On top of that: Its quarterly revenue growth showed initial signs of peaking, and estimates for Q3 suggest just an 8% sequential growth rate, far lower than its prior quarters. To make matters worse, its operating margin is expected to shrink further in the next quarter.

But at the big picture level: Things don’t look as bad. For the full year FY25, revenue is still expected to grow 124% to $124.8B and 38% next year. While operating margin is indeed expected to slow down in Q3, let’s just admit that maintaining a above 60% GAAP operating margin for four straight quarters is no easy task. However, there are shadows lurking in the background that Nvidia simply cannot escape from.

There is some level of uncertainty around its Blackwell line of chips, where shipments have been delayed by a quarter.

Investors are growing increasingly weary about the ROI (or lack thereof) on AI capex spend, with Gartner projecting that at least 30% of all GenAI projects are likely to be scrapped by 2025.

Finally, competitive pressures are intensifying very slowly, and it’s something to keep an eye on.

On the topic of Blackwell: Nvidia’s champion Huang said numerous times on the earnings call that he expects Blackwell to ship by Q4 generating several billions in revenue, making it clear that this is a supply-constrained product (because of design issues it had earlier) with demand expected to outpace supply in FY26. Furthermore, what is interesting is that Nvidia continues to significantly ramp up its purchase commitments with suppliers and manufacturers, which is very bullish in our opinion.

A “buy the dip” moment? Perhaps, but there are some caveats. Read on to find out more and discover our price target for the company.

🎥Let’s set the stage.

There is a solid reason why Nvidia’s NVDA 0.00%↑ quarterly earnings reports have become one of the most widely read earnings reports in the world.

Every time CEO & founder of Nvidia, Jensen Huang, would chair the quarterly earnings calls to talk about the performance of his accelerated computing chip company, experts and analysts would be wowed by the company’s performance. Sales would at least double, if not quadruple, every quarter for the last 12 months, and Huang would not have to put any effort into selling the results due to the grandiosity of the earnings reports that spoke for themselves.

The scale of Nvidia’s results also positioned the company to hold an almost 98% market share of the accelerated computing market because every company that had anything to do with GenAI was rushing to buy Nvidia’s chips.

Unfortunately, Nvidia’s second-quarter earnings report barely crossed investors' sky-high expectations, despite revenue continuing to soar 2x, leading to a further disturbance in the yin and the yang between AI optimists and pessimists.

Nvidia Became An Undue Victim Of Its Own Success

By now, every nook and cranny of Wall Street has gotten accustomed to Nvidia’s meteoric rise in semiconductor sales thanks to the elevated hyper-demand for Nvidia’s accelerated semiconductor chips, or GPUs, that are key to unlocking performance while training today’s AI models.

It wasn’t that revenue grew 122% in Nvidia's Q2 to a new quarterly record high of $30B. Neither was it the near-quadrupling of its operating income growing to $18.6B. What popped the AI bubble debate for many experts and AI watchers was the fact that for the first time ever in as many quarters as one could remember, Nvidia reported growth rates that showed initial signs of slowing down, which many market experts took as a sign of demand sobering up for Nvidia’s chips.

At the same time, a drastic drop in margins added more fuel to the fire that Nvidia would have probably been forced to claw back its aggressive pricing strategies that were responsible for such strong margins in the first place. The slowing growth coupled with shrinking margins that Nvidia showed in Q2 has put many of its watchers into a paradox.

Sure, the company is still doubling its revenue “as customers continue to accelerate their Hopper architecture purchases while gearing up to adopt Blackwell”, per Huang’s observation of Nvidia’s recent quarter. But relative to last year, when investors scored a bargain, the shine of that bargain is now paling in comparison.

And if the chart above wasn’t enough to put many investors in alert mode, this next chart certainly took care of the job.

The chart above is the percent magnitude by which Nvidia would beat the expectations of its revenue and earnings per share every quarter over the past 16 trailing quarters.

On average since October 2020, Nvidia would always be reporting quarterly numbers that would beat analysts’ revenue estimates by ~6% and earnings per share estimates by an even better 9%. The recent Q2 quarterly earnings report demonstrated a revenue surprise of just 4.5%, slightly under their longer-term average, while earnings surprise also came in lower than the average.

However, this was just one of the few problems that investors had to peruse through.

Probing Nvidia’s AI Bubble With Its Three Horsemen

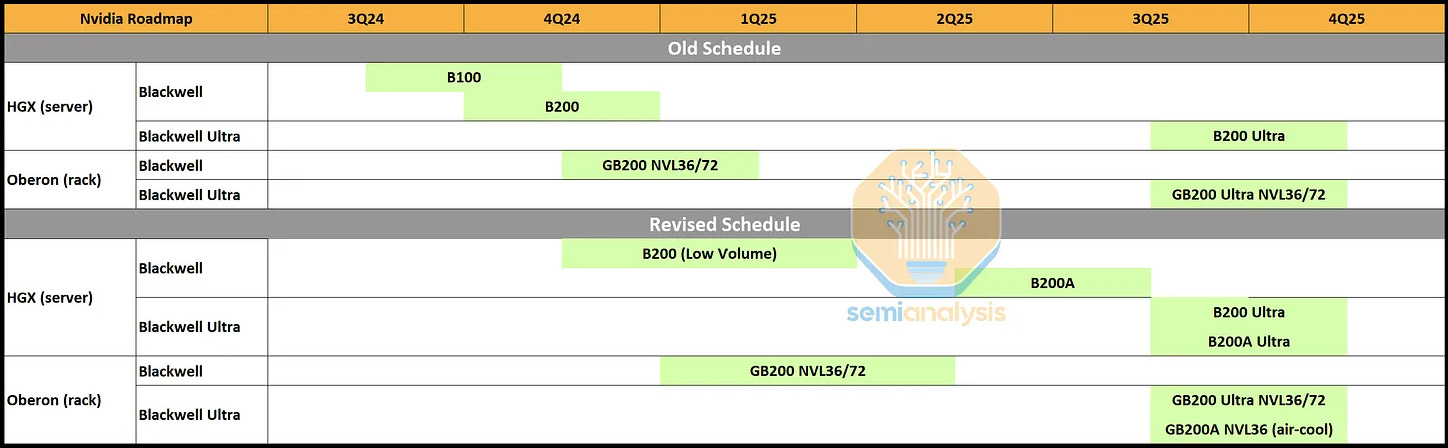

Layer on top of the suspected growth deceleration, Nvidia’s product delays about Blackwell, its next advanced platform of AI GPUs, and investors have a sharpening perspective of how growth could slow further in the coming quarter(s).

First, there are the shipment delays in Nvidia’s Blackwell chips line. For those that need a quick primer, Nvidia’s Blackwell line of chips represents a significant leap forward in AI infrastructure, integrating a powerful GPU with a full-stack system designed for building AI factories. It delivers 3-5x more AI throughput than its predecessor, Hopper.

Folks at

had done a deep dive last month where they noted that Blackwell’s chip packaging at TSMC TSM 0.00%↑ was being constrained by Nvidia’s design, thus impacting shipments of those chips. In that post, SemiAnalysis believes that, “This setback has impacted [Nvidia’s] production targets for Q3/Q4 2024 as well as the first half of next year. This affects Nvidia’s volume and revenue.”Due to these delays, Nvidia would be releasing the B200A chip to meet anticipated demand while also alleviating some of the packaging issues TSMC was having with Nvidia’s original Blackwell design.

In the latest earnings call, Nvidia’s Huang told investors that they had resolved those design challenges and now “expect to ship several billion dollars of Blackwell revenue by the end of the year.”

When asked about Blackwell’s delays again at an interview later on Bloomberg, Huang expressed some dismay during the interview at the question, but still reaffirming Blackwell’s revised plans to ship by the end of this year. However, investors might still expect to be on the sidelines until Nvidia demonstrates some uptick in Blackwell-originated revenues from Q4 onwards.

Second, the rising sentiment about the AI bubble bursting is complicating the outlook for the broader industry within which Nvidia operates. Many skeptics have called for the bubble to burst next year, and some have even pulled in their forecasts for the AI bubble to burst this year itself.

On the other hand, Gartner does not appear to think so yet because they recently revised the data center spending to grow sharply up 24% y/y this year alone, up from 10% y/y that they initially expected, citing “ravenous demand” from GenAI. But, at the same time, Gartner also threw some caution, saying that nearly one of every three GenAI projects will be scrapped due to “poor data quality, inadequate risk controls, escalating costs, or unclear business value.”

Meanwhile, Goldman Sachs expects AI spending to contract for the next 1-2 quarters before picking up again through next year and sees AI adoption rates broadening out as well.

The immediate outcome is not fully clear yet in the AI bubble debate since technology firms are still going strong with their AI data center investments, which include updated semiconductor chips from Nvidia.

Third is the rising peer pressure from its competitors that has also forced Nvidia’s hand to do some damage control and issue quick fixes to its Blackwell design that were talked about earlier.

In our inaugural deep dive on Nvidia this year, we explained how Nvidia dominated the data center GPU market, holding a 98% share of the target market it operated in. Over the past few months, AMD 0.00%↑ AMD has made massive strides in positioning its GPUs and data center products & services closer to the capabilities that Nvidia offers, making at least 3 strategic acquisitions this year alone.

Then there is also the custom AI chip market that threatens to perch over Nvidia’s GPU dominance. Leading players such as Broadcom AVGO 0.00%↑ and Celestica CLS 0.00%↑ are some examples of companies that cater to the custom AI chip market. Plus, Marvell MRVL 0.00%↑ also already reported robust earnings results last week, with their data center revenue nearly doubling year on year due to growing demand from custom AI chips.

had recently shared a tweet with the following note from a director at Qualcomm QCOM 0.00%↑ that presents a fairly credible bear case for Nvidia. The premise is that with a dominant player like Nvidia, they have the power to charge whatever ASP (Average Selling Price) they want for their GPUs. While hyperscalers are dependent on Nvidia for now, it only makes sense that they start building out their own vertical stack given the resources they have at hand to gain better control and protect their margins. Although this will take time, the truth is the move to internal silicon has already started, as per the excerpt below.All these factors will weigh on Nvidia’s outlook in the near term, with investors questioning every aspect of its valuation multiple if the stock continues its upward trajectory. We will discuss valuation in a later section, but there is also a fourth horseman that is expected to chart the course for Nvidia more accurately than the other horsemen.

Important Announcement before we move on…

As The Pragmatic Optimist closes in on its one-year anniversary 🎉🎉🎉, we will be introducing paid tiers with exclusive content and perks in the coming months. So, if you have been following and enjoying our work, please consider upgrading to an annual membership of $80, before prices go up.

Oh and here’s one more thing. 👇🏼👇🏼👇🏼

For all existing and new annual members, you will forever be able to lock in your $80 subscription amount with no further increases ever. Even if inflation starts climbing higher again.

Thanks again for all your support and let’s get back to the post.

There is a Fourth Horseman, Of Course, That Holds The Key To Demand Outlook

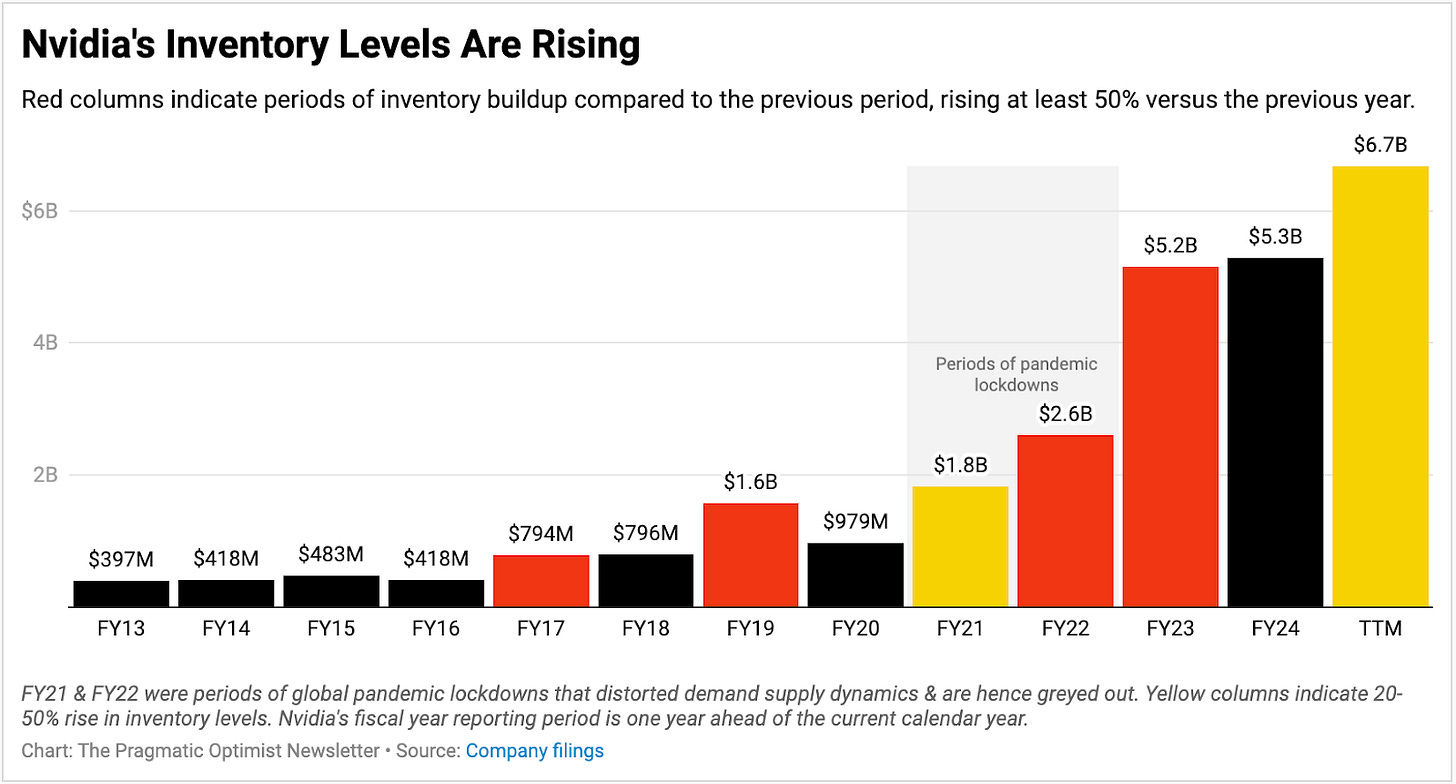

Nvidia’s inventory levels are one of the key indicators to understanding the potential for the imbalance between supply and demand for the company’s products. Lower levels of inventory relative to the previous year(s) indicate Nvidia selling into a higher demand environment, which has ideally helped the company price to market and thus increase its margins in the near term.

However, the converse is also true when demand starts to slack. In the chart that can be seen below, ignoring the years that were impacted by pandemic distortions, a buildup in inventory has almost always been a harbinger of the revenue deceleration and margin compression that were due to come.

The same can be seen in the first half of this year as well, where inventory has been quietly building up behind the scenes, which could potentially weigh on the company’s margins for a longer time period.

Part of the reason could be that customers, especially the hyperscalers, held off on ordering more Hopper chips in anticipation of the new Blackwell chips, which may have caused an inventory buildup. However, if there is a structural demand problem in the broader AI industry, that some AI skeptics point out, the implications of Nvidia’s inventory buildup could be far more severe.

For now, the best way to cross-validate Nvidia’s inventory levels is by observing the value of its term purchase commitments. Most chip manufacturers, such as Nvidia, enter into mid-to-long-term commitments with their manufacturers and component suppliers. For example, Nvidia pays a certain dollarized commitment to TSMC, one of its manufacturers, to reserve manufacturing capacity to produce and package its next generation of chips.

However, per the chart below, Nvidia continues to significantly ramp up its