Oracle & Nebius Are Breaking AI Expectations

Plus updates to CoreWeave and a Secret AI Networking Beneficiary

At The Pragmatic Optimist, we help hundreds of investors navigate the AI innovation landscape, identify businesses with strong growth trajectories and operational grit, and make long-term investments in the space with proven alpha generating returns. Winning calls: Celestica, Astera Labs, Credo, AppLovin, MongoDB and more

Become a paid subscriber today

One thing is for certain from these past few weeks: even if there is an AI bubble, it's far from popping.

Broadcom AVGO 0.00%↑ and Credo’s CRDO 0.00%↑ stellar ERs from last week should have poured cold water on the AI bubble theory, but explosive forward-looking updates from Oracle ORCL 0.00%↑ and Nebius NBIS 0.00%↑ in these last 2 days should have doused any remaining brushfires about AI pessimism that ironically started with a certain exclusive dinner involving a certain Mr. Altman in San Francisco.

In this post, we break down Oracle’s Q1 ER below as well as the massive tailwind that Nebius gets from its mammoth ~$19B deal with Microsoft MSFT 0.00%↑. We also explain how CoreWeave CRWV 0.00%↑, a partner to Oracle and peer to Nebius, benefits from the resilient capex spending.

As a bonus to our subscribers, we are upgrading our price target on an AI Networking peer that we recently turned bullish on. We believe this AI networking beneficiary is a direct & meaningful beneficiary of Oracle’s superb Q1 report.

Please note that you can find all our price targets, conviction scores, and rating history on all stocks under coverage in our AI Stock Rec Tracker.

Oracle Q1 ER: How Guidance Changes The Game

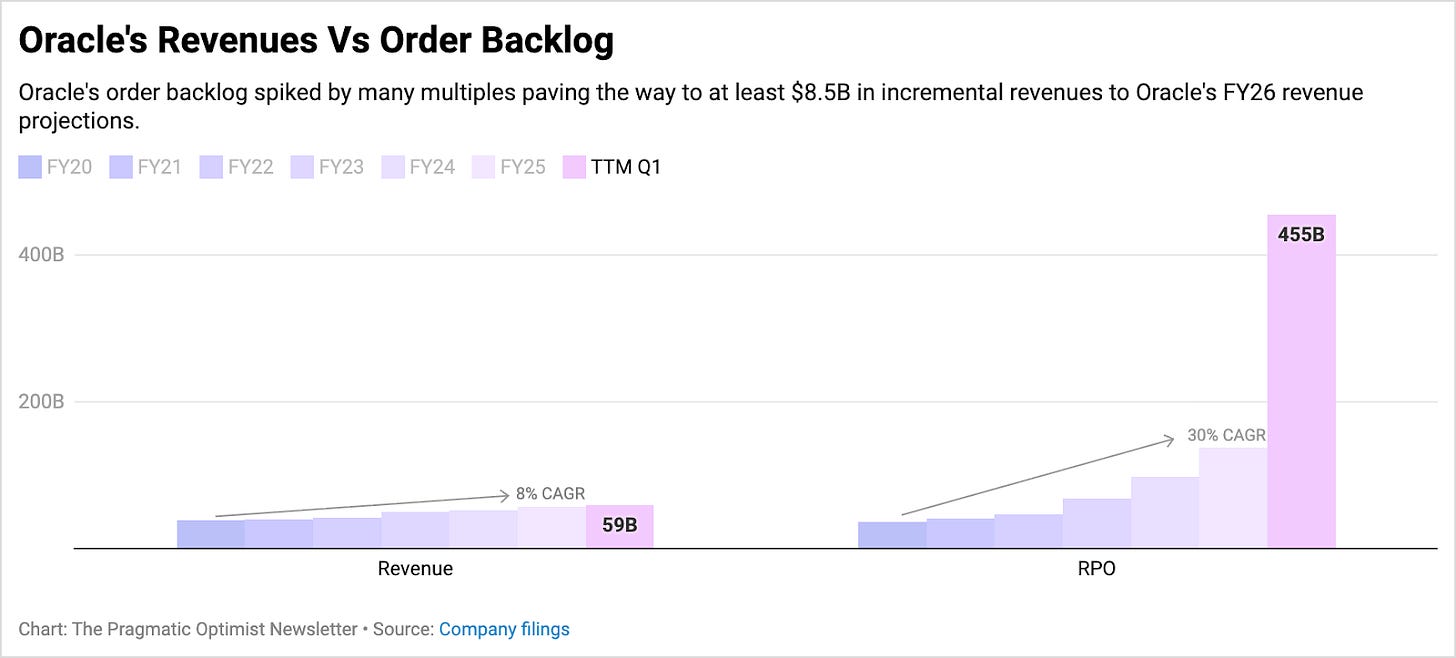

The stark reality of Oracle’s Q1 report is that the hyperscaler actually missed top-line and bottom-line estimates. Q1 revenues accelerated by 12.3% YoY to $14.9B but missed analysts’ estimates by $110M, while Q1 earnings of $1.47 per share also missed the mark by 1 cent.

But what flipped the script entirely for Oracle was their order backlog (remaining performance obligations, or RPO) that skyrocketed by 230% sequentially almost closing in on half a trillion dollars!

Oracle revealed that the reason for the sharp uptick was that the company signed four different multibillion-dollar contracts with three different customers in the past quarter. We think OpenAI was definitely one of the new contracts that they won after we observed the revised capex projections from OpenAI in our post at the start of the week. xAI was the other customer who may have significantly ramped up compute requirements with Oracle.

Oracle’s Q1 FY26 backlog growth was the sharpest pickup ever recorded in its business, and management believes it won’t end there. Oracle’s Larry Ellison & team “expect to sign up several additional multi-billion-dollar customers, and RPO is likely to exceed half a trillion dollars” over the next few months, as noted in the conference call yesterday.

In our strong opinion, Oracle has been extremely forward-looking in quietly