The AI Bubble Is Not Popping. At Least Not Yet.

Nvidia and the pack still have ways to go.

At The Pragmatic Optimist, we help hundreds of investors navigate the evolving AI innovation landscape, identify rock-solid businesses with strong growth trajectories and operational grit, and make long-term investments in the space with proven alpha generating returns.

Become a paid subscriber today

🎥 Let’s Set The Stage

There are 3 things OpenAI's Sam Altman has got a penchant for.

First, he's a tech visionary who single-handedly changed the course of technological innovation. OpenAI was just one of the many technological commercial establishments Altman pioneered to write a new chapter in the history of technology.

Second, he relishes having a go at the world’s richest man, Elon Musk. The two friends-turned-foes argue [a lot]. Their feuds on X cover a wide list of topics—politics, incorporation, and even who’s got more followers or who can deploy more GPUs.

And third, OpenAI’s Altman has a flair for attracting a ton of attention, given his position as one of the leading tech visionaries of the world.

So, when Altman reportedly made his feelings clear about the AI bubble 2 weeks ago, markets whipsawed in the days that followed.

Since our investment research at The Pragmatic Optimist is focused on the AI innovation landscape, we decided to write this post today, especially as fears of an “AI bubble” had suddenly crept back into markets post Sam Altman’s comments from last week.

In this post, we will discuss the state of the AI landscape at a high level, present our stance on the “AI bubble” debate, and outline our strategies of how we plan to generate alpha with the help of our robust framework that we developed using the AI Stock Rec Tracker.

Since our launch in early 2025, our winning calls have included Celestica, Astera Labs, AMD, Taiwan Semiconductor, AppLovin, and more, with our “buy” ratings returning an alpha of 2.5x over the S&P 500 YTD.

By becoming a premium member of The Pragmatic Optimist, you will get access to all our deep dives and the AI Stock Rec Tracker, where investors can easily navigate our stock recommendations across price targets, conviction scores, and ratings.

Getting Behind Sam’s AI Bubble Comments

When folks at The Verge asked Sam Altman, whether we were in an AI bubble, Altman’s response was:

“Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes.

Is AI the most important thing to happen in a very long time? My opinion is also yes.”

In the interview, Altman warned that some investors were likely to get “very burnt” as some of the hype unwinds. This week some of that hype appeared to be unwinding as darlings of this year’s AI trade—Palantir PLTR 0.00%↑ CoreWeave CRWV 0.00%↑ , Nebius NBIS 0.00%↑, Astera Labs ALAB 0.00%↑, etc.—took a hit.

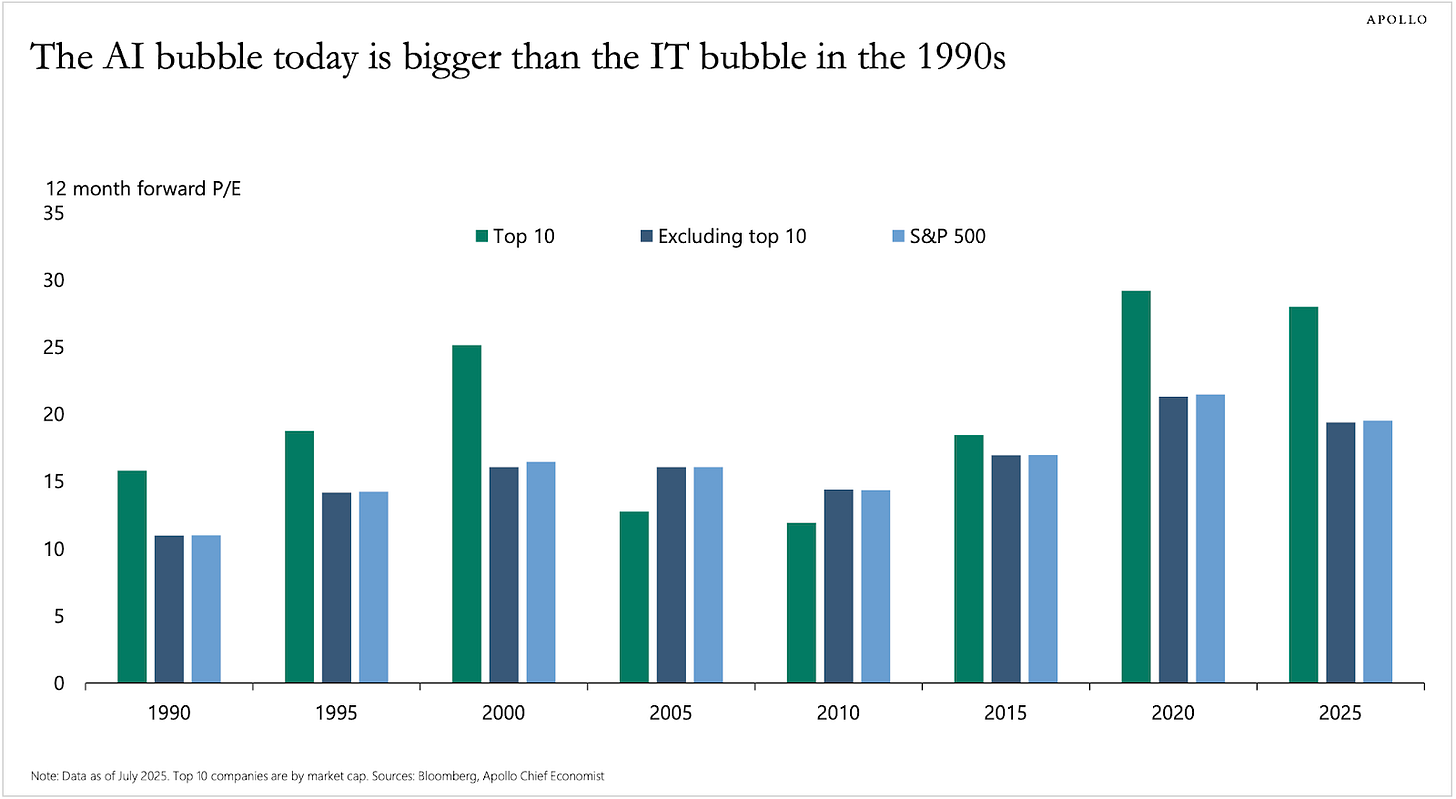

The consternation from Altman’s ‘AI bubble’ comments snowballed further as a couple of reports backed up the OpenAI founder’s talk about an AI bubble. An MIT report concluded that “95% of generative AI pilots at companies are failing,” while Apollo’s chief economist, Dr. Torsten Sløk, updated an old chart comparing the forward earnings multiples during the 1990s versus today.

While the chart above does portray the concern of an AI bubble given the expanding valuation premiums of the Top 10 companies, it is, though, only one side of the story.

Also note, this isn’t the first time AI bubble talk has crept into the tape. We had explained our views early last year and will reiterate our stance once again in this post.

But, before that, we believe it is important investors understand the events that transpired in the 1990’s leading up to the dot-com bubble bursting. Because almost every argument calling for the AI bubble refers back to the 1990s dot-com boom-and-bust.

The 90s Dot-com Bubble Shows the Way

In order to understand what Altman, Dr. Sløk & others were referring to when they pointed to the tech bubble, it made sense to look at a few milestones achieved in the 1990s leading up to the dot-com bubble that eventually burst at the end of that decade.

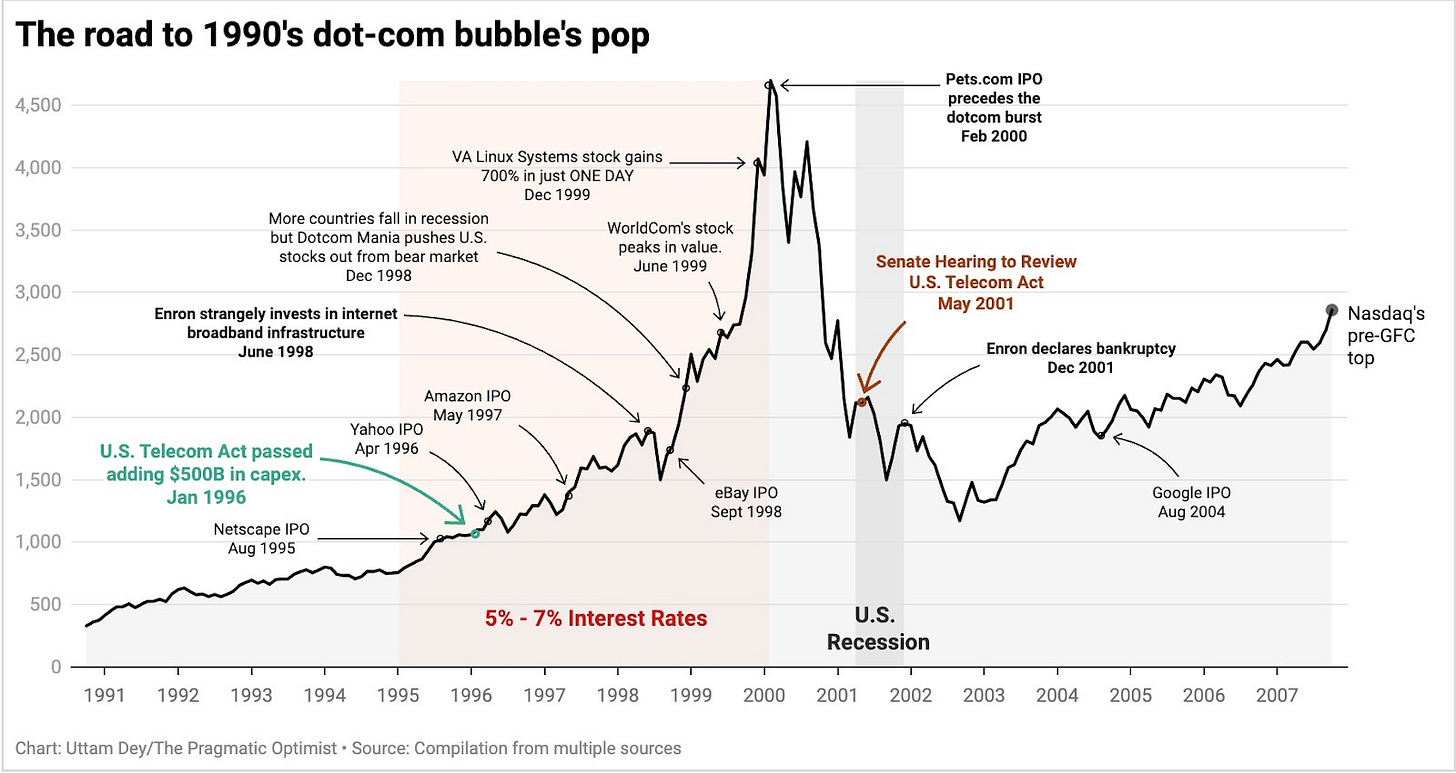

Here is the entire timeline of major events leading up to the dot-com bubble that eventually burst in February 2000, followed by the Senate Hearing in 2001. The timeline below is an exhaustive list of events, but it shows how the US Telecom Act was one of the catalysts that began a decades-long boom.

Netscape started the dot-com party as one of the first dot-com era companies to go public in 1995. This was really the ‘Big Bang’ of the internet era, ushering in a boom of IPOs that would eventually become overinflated in terms of market valuation. Along the way, there were some successful companies during those years that still exist in some shape or form today: Amazon AMZN 0.00%↑, eBay EBAY 0.00%↑, whatever is left of Yahoo, and others.

But looking at the chart above, a key driver of all this could be traced to the Telecommunications Act that was passed by the U.S. Congress in 1995.

According to testimony by a senior McKinsey executive to the U.S. FCC during a 2001 Senate hearing, the passing of the Telecommunications Act led to a huge surge in investments by corporations. Based on the McKinsey executive’s testimony, the business investments that the US saw between 1995 and 1999 doubled from $250B to $500B in just four years. All of this at a time when interest rates were rising and had reached almost 7% just before the dot-com bubble burst.

The story is quite similar to today’s AI investment frenzy.

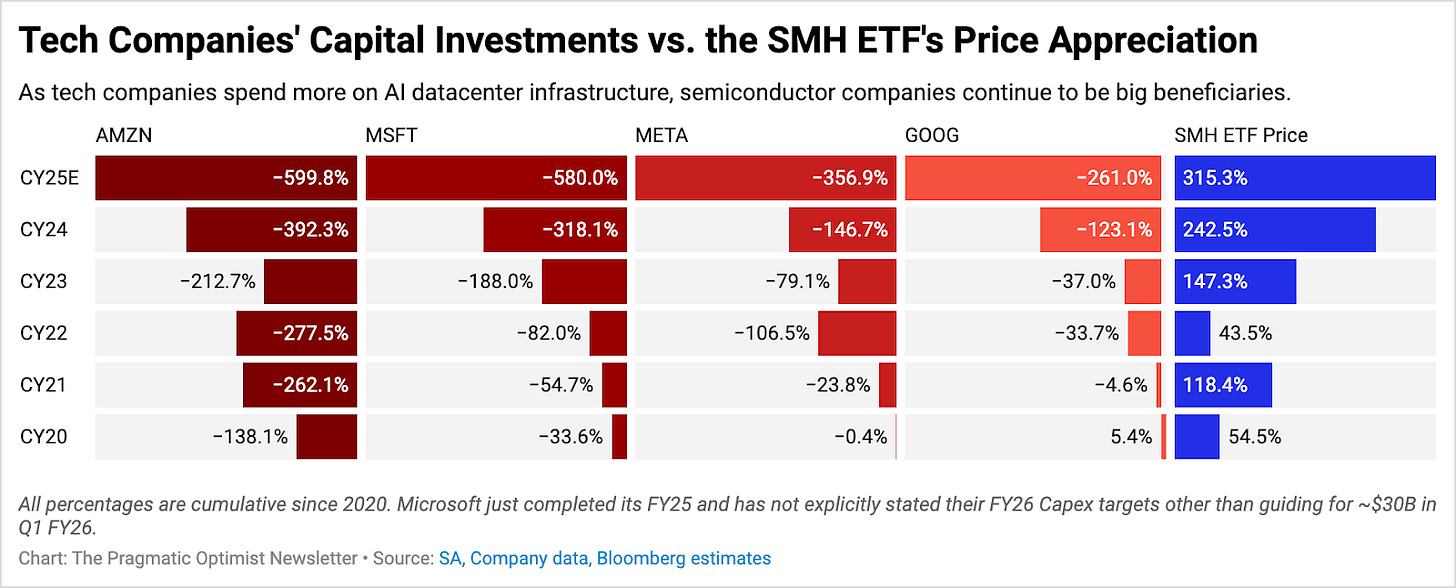

The CHIPS & Sciences Act that was passed in 2022 provided one of the regulatory tailwinds for companies to deploy large sums of capex dollars to scale their AI ambitions.

An old estimate by McKinsey suggested that the CHIPS & Sciences Act would help infuse at least $280B in the semiconductor and related technologies space, the same industry of which Nvidia NVDA 0.00%↑ & other semiconductor peers are part of. Meanwhile, recent estimates by Goldman Sachs suggest capital expenditures for AI data centers can cross $1.15T in the next two years.

Companies like Tesla TSLA 0.00%↑, Oracle ORCL 0.00%↑, neoclouds like CoreWeave have joined the hyperscalers in plowing more capex dollars into procuring chips and networking components needed for the data center, which still faces capacity constraints till today.

So far, these large companies are locked in a race to expand their computing capacity, similar to the business investments made in the early to mid-90s. This is creating almost inelastic demand dynamics, leading to surging valuation multiples for some of the AI beneficiaries that Dr. Sløk pointed out in his forward PE chart in the previous section.

But here’s why we believe that the AI bubble, despite having some similarities, is still fundamentally different from the dot-com bubble.

The AI Bubble Is Different From The Dot-com Era

Despite Dr. Slok’s chart showing elevated valuations for the Top 10 companies today vs. the dot-com era, we made the following observations that we would like to talk about.

First, of the top 10 companies by market capitalization today, eight are tech or communications behemoths. This contrasts with only five out of the 10 biggest companies that were tech firms back in 1999.

Second, the top 10 companies’ footprint in the S&P 500 is significantly higher today than it was in 1999, reflecting the fact that technology plays a much bigger role in the US economy today than it did at the turn of the millennium.

Third, if we just take Nasdaq into account, it is currently trading at 28.5x forward earnings, compared with the dot-com peak of over 70x.

In fact, we believe that today’s top megacap tech companies trade at more balanced forward price-to-earnings multiples, as there has been a shift away from ‘growth at all costs’ to ‘growing profitably,’ especially with interest rates elevated since 2022. On top of that, these industry giants have incredibly strong balance sheets, with historic levels of cash flows that are driving their AI investments.

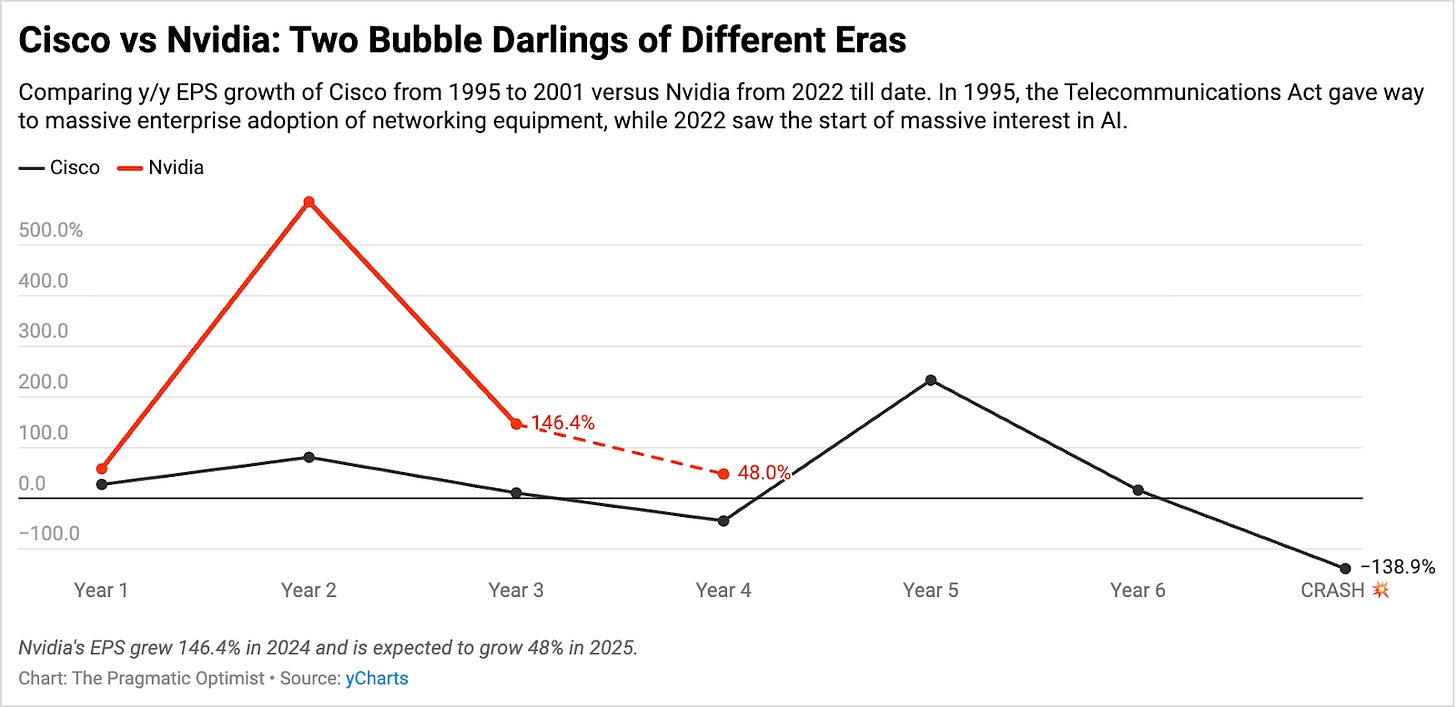

Particularly, if you pay attention to the semiconductor companies, earnings growth has been surging.

Let’s take the earnings year-over-year growth of Nvidia one of the darlings of the AI boom today, versus the earnings growth rates of Cisco CSCO 0.00%↑ during the 1990s. Nvidia robustly outpaces Cisco in earnings growth, which is why it makes sense that it has a higher forward PE today than Cisco did in the 1990s. This is true for most semiconductor companies that are big beneficiaries of the AI investments being made today.

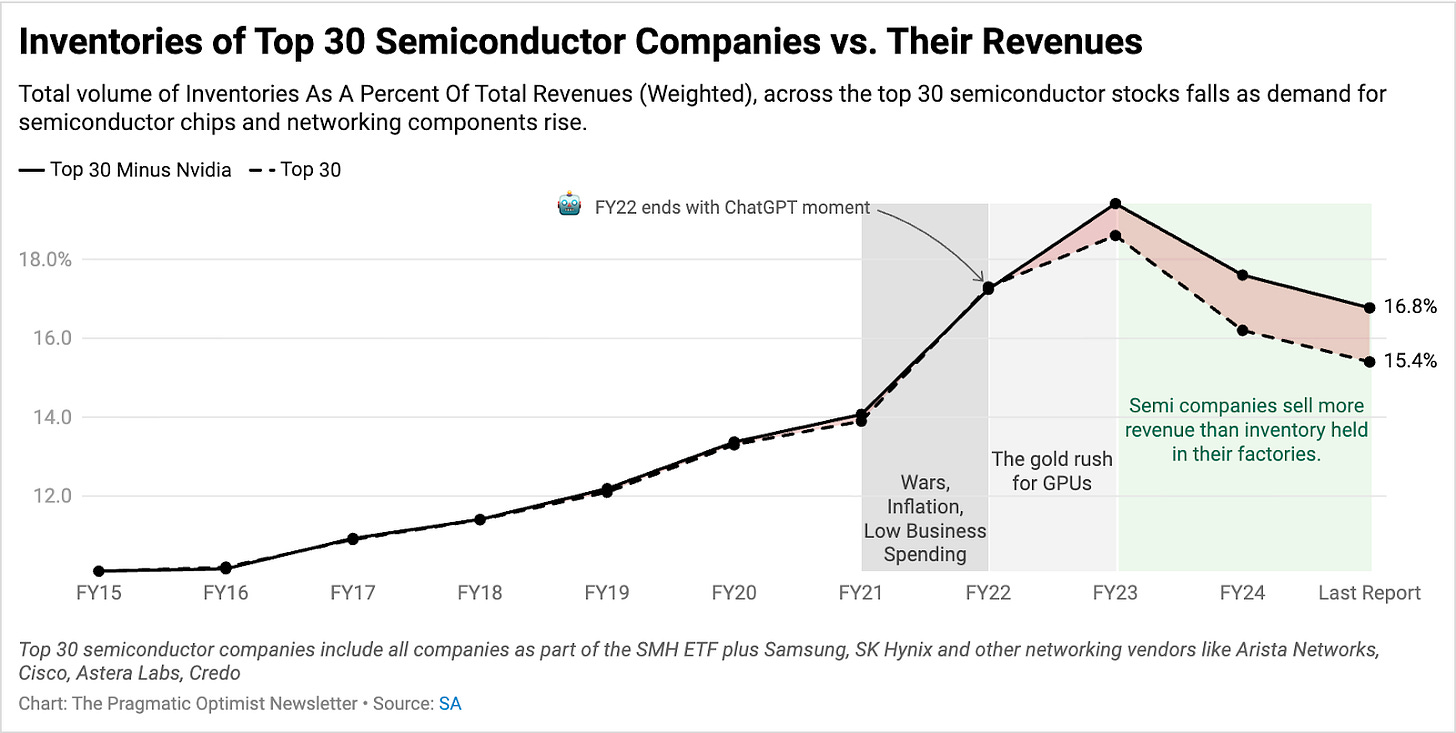

Moreover, semiconductor companies are selling into high-demand environments, as seen by the declining dollar volume of inventories these companies hold in their factories versus the sales of their semiconductor products, as can be seen below.

What the above chart also explains is why hyperscalers and data centers continue to face capacity constraints while the backlog of AI workloads grows, leading them to raise their capex projections compared to previous guidance.

Note that in the most recent quarterly earnings, these cloud titans posted another quarter of 25% growth in the cloud, now accelerating for 7 straight quarters, driven by the surging demand for their GenAI products.

Our analysis shows that enterprise AI spending is actually accelerating this year versus the anecdotal evidence about an AI bubble circulating in the markets as of last week, seen in the section below.

Inference TAM Is About To Explode.

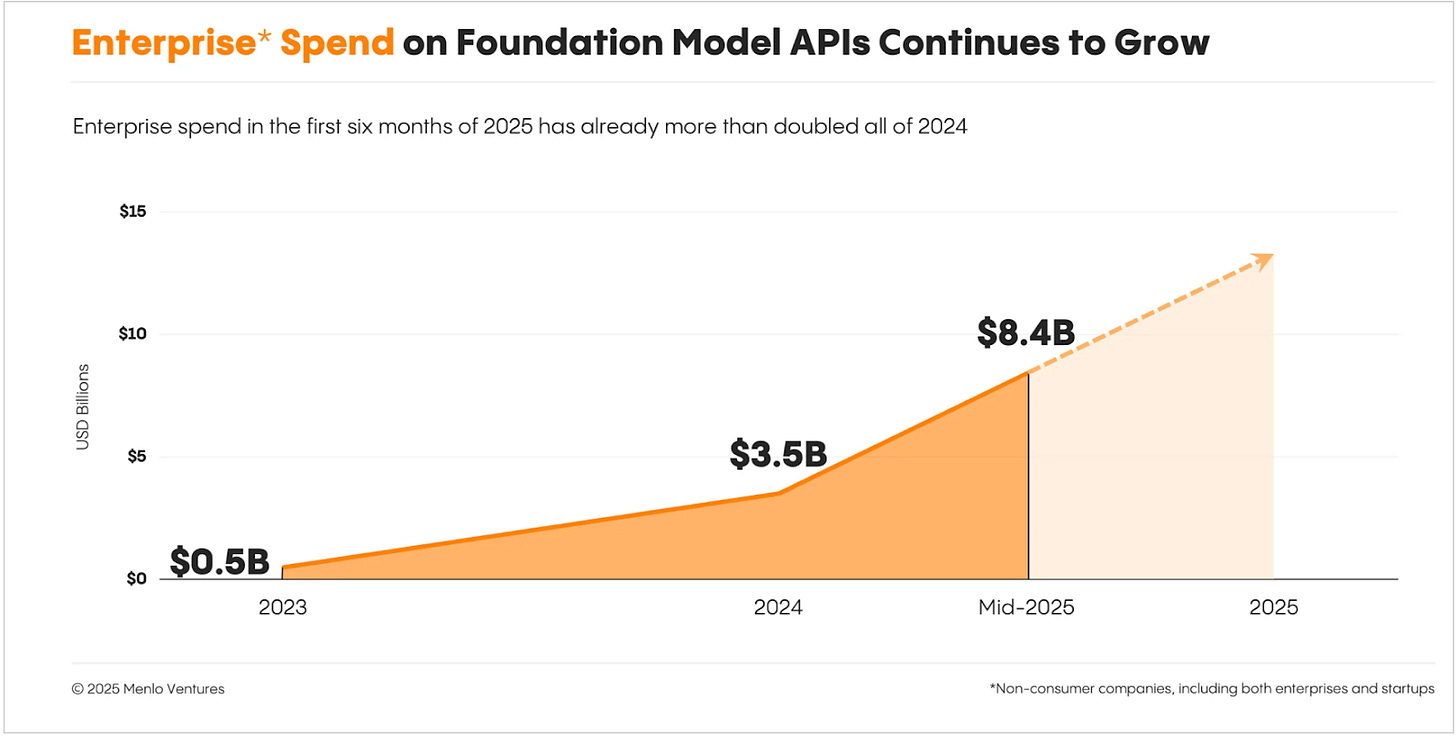

A recent report from Menlo Ventures showed that enterprise spending on AI models has already grown more than 2x to $8.4B midway through the year.

The surge in spending pushed Menlo Ventures to put out a mid-year update versus the annual update they publish in November every year. But the report also notes that enterprise spending for AI is rapidly shifting from training to inference.

Earlier this year, Nvidia’s CEO Jensen Huang had outlined that the demand for compute is about to grow 100x higher than anticipated with the proliferation of reasoning models, ushering in the Physical and Agentic AI era. This was also echoed by AMD’s AMD 0.00%↑ Lisa Su, where she noted that AI inference is at an inflection point, which will drive its total addressable market for AI products beyond $500B by 2028.

In other words, this isn’t just about training LLMs anymore.

It’s about every enterprise app going AI-native. In this cycle, every workflow, every vertical, and every user interface will need low-latency inference, secure data pipelines, and orchestration layers that simply don’t run on legacy infrastructure. It runs in the cloud, and it runs on clouds built for AI.

As a result, we don’t believe that AI capex will fall off a cliff just yet.

Sure, companies need to continue delivering earnings results at par or higher than expectations. So far, that has largely been the case, with companies reporting strong Q2 earnings this season.

Then, Why Did Sam Scare Investors?

We’re not entirely sure. Neither do we know the context of the dinner at which Altman voiced his opinions. But the timing of Altman’s views seems to strangely coincide with the venture capital market slowing in Q2.

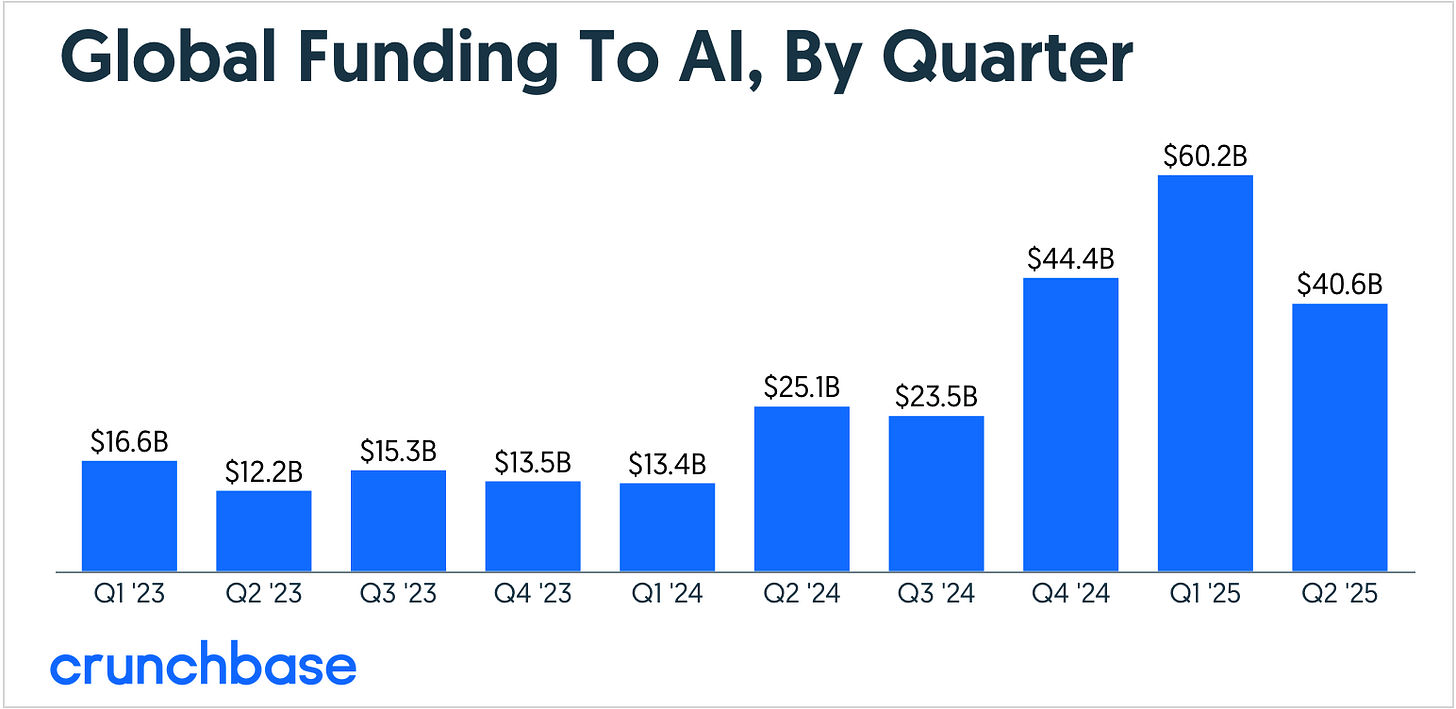

After two quarters of back-to-back blockbuster funding rounds, global funding to AI startups slowed drastically to $40.6B in Q2, up 62% YoY but down 33% sequentially per Crunchbase data.

Not only that, funding for AI startups also seemed to consolidate around popular, well-established AI startups, with late-stage funding seeing a pickup versus early-stage and seed funding slowing down. This type of behavior usually happens when the perception of risk grows on the horizon, very similar to how stock markets are again consolidating around the Top 10 stocks like the Mag 7, etc.

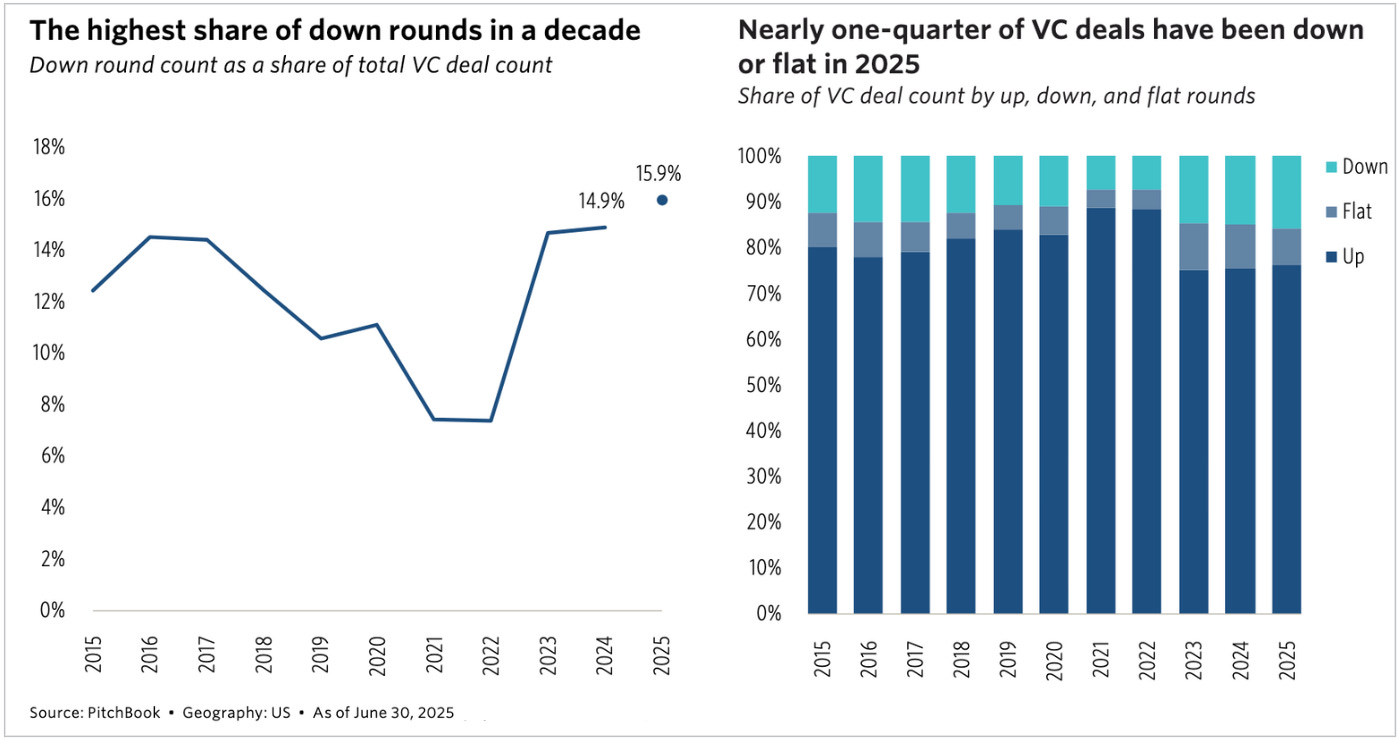

This was also echoed by Pitchbook data that showed that the top five deals accounted for 36.7% of total funding—more than double the 17.1% share in 2024. According to Pitchbook, “2025 is shaping up to be one of the most concentrated venture markets in the past decade.” Additionally, Pitchbook data also revealed that 15.9% of venture-backed deals in 2025 so far have been down rounds, marking a decade high.

In the startup world, down rounds typically imply that the startup scored funding at a valuation that was lower than the previous round, basically a discount, thus hitting its valuations.

So it's very possible that the current slowdown in the VC world allows startups to reset their valuations, which is healthy and necessary for the entire funding ecosystem to thrive in the long term.

In the meantime, we admit that there are also risks to the AI bubble from capex depreciation shrinking profit margins, especially if revenue growth fails to show up at the rate investors are expecting.

At the moment, Morgan Stanley estimates that revenue from GenAI could reach about $1.1T in 2028, a 20-fold jump from $45B in 2024. Over the long term, these estimates do provide a path for us to see strong potential returns from our investments in the AI space.

However, in the short term, one of the key things to watch out for is earnings strength. As long as companies can deliver top- and bottom-line beats, we believe that the AI investment landscape will remain on a strong footing.

At The Pragmatic Optimist, we have a robust framework driven by our deep dives and our AI Stock Rec Tracker offering that allows us to successfully navigate the evolving AI innovation landscape. Our framework enables us to identify rock-solid businesses with strong growth trajectories and operational grit and make long-term investments in the space with proven alpha-generating returns.

In the next section, we will briefly discuss how we plan to continue generating alpha in the AI investment landscape.

How Do We Plan To Generate Alpha in AI?

Since the beginning of the year, we have issued 87 “buy” ratings through August 15 across 43 unique stocks, out of which we own 28 of them in our portfolio.

Had you invested $1000 (or any sum for that matter) each time we issued a “buy” rating on a stock, you would have had a return of 23.5% so far, roughly 2.5x higher than the S&P 500 YTD.

Some of our winning calls include our bullish ratings on Celestica, Astera Labs, AMD, Taiwan Semiconductor, AppLovin, and more.

But, here’s the thing.

Aside from our deep-dive research, we also introduced our AI Stock Rec Tracker in mid-May and have been expanding its features since then.

The AI Stock Rec Tracker is a tool where we track the price targets, conviction scores, ratings, and thesis progression across all stocks under our coverage since the beginning of the year. This allows our premium members to easily navigate our stock recommendations with ease and confidence, while maximizing the likelihood of future outsized returns.

For the remainder of the year, we will continue to 👇

Invest in AI companies under our coverage with the highest Conviction Scores and potential upsides from current levels, as long as the underlying company and market fundamentals don’t change.

We will also launch a “Live Trade Alert” feature very soon in preparation for the launch of our Portfolio feature next month.

Next week, Nvidia, Snowflake SNOW 0.00%↑, CrowdStrike CRWD 0.00%↑, Veeva VEEV 0.00%↑, Marvell Technologies MRVL 0.00%↑, MongoDB MDB 0.00%↑, and Okta OKTA 0.00%↑ will report their earnings. While Nvidia will be a crucial one testing the strength of the AI trade, we will be providing earnings previews and reviews on all seven of these companies, out of which we own four of them in our portfolios.

That’s all for today.

Uttam & Amrita

The only thing not different about this bubble is people saying it's different this time.