Welcome back, everyone👋🏼

Today, we present to you our Q2 Monday Macro update.

This is a long one so bear with us. It might take you about half an hour to read through the whole post but we promise you it’ll be worth it.

We have all heard of Taper Tantrum. Let me introduce you to a new word I just added to The Pragmatic Optimist’s dictionary: Tariff Tantrum.

That’s right.

To what seemed like a pretty invincible bull market just a quarter ago, we are now facing one of the worst meltdowns in the S&P 500 since March 2020, as Trump’s draconian tariffs have caught investors by surprise, risking a recession.

Except, this will be a self-inflicted one.

You see, from the start, President Trump and his Treasury Secretary Scott Bessent made one thing quite clear: They wanted rates down.

In this case, tariffs, which are designed to reduce trade deficits, also slow down economic growth, as less foreign capital flows into the economy, thus pushing the 10Y Treasury yields down.

Yet, Powell is hesitant to ease monetary policy, despite the US economy showing signs of slowdown, as he fears that tariff-induced inflation through higher input costs could turn out to be more persistent.

Nevertheless, the future trajectory of the S&P 500 is now dependent on three main factors:

By how much will FY25 earnings guidance be revised downwards?

Will the labor market break?

Will the high-yield credit spreads spike higher from current levels?

You see, if there is one thing that Wall Street hates above all, it is called “uncertainty.” Right now, the air is full of it.

So, if you are feeling a bit suffocated and in need of some no-BS perspective, grab a coffee ☕ and a muffin 🧁 as we untangle the wave of moving parts to answer one big question (in 2 parts):

“1. Are we headed towards a bear market? And 2. What does that mean for AI?”

With the Q1 earnings season upon us, we will be watching carefully as to how CEOs across the AI ecosystem describe the performance of their businesses under the current environment and how they plan to navigate forward to protect their pricing power and cashflows.

This is not just about price multiples or technical levels anymore. It is now about paying careful attention to key operating metrics and overall sector trends that will help us reassess the investment thesis of companies moving forward.

Join us today as a premium member to gain the sharpest insights into select companies and sectors in the AI value chain through our supreme-quality deep dives and industry research that will help you gain perspectives, especially in turbulent times like these.

🎥Let’s set the stage

If misery loves company, the stock market threw quite a block party in Q1.

It didn't end there.

Tariffs and stagflation fears dominated the macro narrative in 2025, and it all culminated in a crescendo on “Liberation Day,” when President Trump announced the most draconian tariff measures, which plummeted the stock market and the economy into chaos.

In case you are curious about where the term “Liberation Day” comes from, it originated from President Trump’s March 21 post on his social media platform Truth Social, where he said the following:

“April 2nd is Liberation Day in America!!! For DECADES we have been ripped off and abused by every nation in the World, both friend and foe. Now it is finally time for the Good Ol’ USA to get some of that MONEY, and RESPECT, BACK.”

Unfortunately, the magnitude of the tariffs announced on Liberation Day was far worse than people were imagining. This triggered a massive tariff tantrum, wiping out over $6T in market cap over the last two trading sessions ending on April 4, the worst since March 2020, with the S&P 500 now losing close to 18% since its peak in February 2024.

With effective tax rates forecast to hit the highest levels since 1910 at 22%, the magnitude of the impact on the consumer and business demand landscape is now unknown.

Meanwhile, the US economy is already showing signs of slowdown, while the forecast for Q1 GDP has turned negative.

If you think that this calls for monetary policy easing, it’s not so simple either.

You see, while tariffs are fundamentally deflationary over a longer-term period, in the short term, they could create upward pressure on prices, especially as the cost of inputs rises, thus putting the Fed in a bit of a pickle.

While there are underlying motivations behind why the current administration is intentionally orchestrating an economic slowdown, the bigger question that we will try to answer in this post is the following:

“Is the bull market permanently on hold?”

But first, let’s take a few steps back and start with a quick summary of the tariff announcements made on Liberation Day that ultimately managed to create the meltdown that we are currently witnessing.

A quick summary of “Liberation Day” announcements

President Trump announced his “Liberation Day” plan for reciprocal tariffs on its trading partners on April 2.

The plan is twofold:

First, a 10% baseline tariff would apply to imports from all countries excluding Canada and Mexico (effective April 5) with some exclusions.

Second, most major trading partners, excluding Canada and Mexico, would face an additional tariff that equals half the ratio of the US bilateral trade deficit with the country divided by US imports from that country.

In other words, the effective tariff rate on all US imports will now rise from 2.5% in 2024 to 22% in 2025, the highest level seen since 1910.

This raises the recession odds, with UBS estimating that the new tariff regime could amount to a $700B tax on US consumers, if the costs are fully passed through, equating to roughly 10% of annual retail sales and knocking off as much as 2% in US economic output.

Meanwhile, Goldman Sachs, which once expected GDP growth of 2.4% in 2025, with the unemployment rate at the end of the year around 4% and inflation close to normal at 2.4%, has now revised their GDP growth projection to below 1%, unemployment of 4.5%, and inflation of 3.5%.

Finally, JP Morgan rang the recession alarm for the back half of 2025, where the firm’s chief US economist, Michael Feroli, sees GDP contract by 1% in Q3 and by 0.5% in Q4, with the full year FY25 GDP down by 0.3%.

"The pinch from higher prices that we expect in coming months may hit harder than in the post-pandemic inflation spike, as nominal income growth has been moderating recently, as opposed to accelerating in the earlier episode. Moreover, in an environment of heightened uncertainty, consumers may be reluctant to dip too far into savings to finance spending growth."

The way we see it, it all boils down to one thing: the US wants to see rates down.

Why?

Let me explain in the next section.

Making (some) sense of it all

Since the inauguration on January 21, President Trump and his Treasury Secretary Scott Bessent have been trying to deflate the stock markets so that the bond market will rally and long-term interest rates, and by extension short-term interest rates, will decline.

But why manufacture a recession when the US economy was operating perfectly fine up until now?

Well, according to Treasury Secretary Scott Bessent, he claims that the “market and the economy have become addicted to excessive government spending.” Politics aside, what this marks is a profound ideological shift in American capitalism, where the current administration views short-term economic pain as an acceptable cost to detoxify, cleanse, and reset the economy towards its nationalist vision.

First, by getting long-term rates lower through an economic slowdown, the country can refinance itself at lower rates and thus begin to cut the deficit, which currently stands at -6.28%, a level matched only, mind you, by the deficit during World War II, the 2005 Great Financial Crisis, and the 2020 Coronavirus Pandemic.

If you remember, previous Treasury Secretary Janet Yellen had been famously notorious for draining out the reverse repo facility through its issuance of T-bills, a.k.a. short-term debt, to support domestic liquidity conditions amid the Fed’s quantitative tightening program that started in 2022.

However, given that T-bills mature more quickly than longer-dated bonds, lower 10Y Treasury yields would be hugely beneficial to help the US Treasury refinance the debt at favorable rates without causing a liquidity event.

Second, I believe that the rate obsession of the Trump administration is their realization that the trajectory of inflation will determine President Trump’s legacy like no other metric.

wrote an excellent post here, where he stated that Americans hate nothing with more passion than inflation, and I agree.He also argued that a low 10Y Treasury yield is indicative of low nominal GDP growth, translating into lower inflation in the US economy.

Unfortunately, this would mean that the US economy would have to shift from a high-growth/high-rate environment post-Covid from a public deficit binge to a low-growth/low-rate economy, similar to post-GFC, requiring substantial derating of the stock market, which we are currently witnessing.

Finally, with the draconian tariffs announced on Liberation Day, the US administration is determined to meaningfully reduce the US trade deficit. You see, the obsession with trade surpluses is partly ideological, where a trade surplus strategy enables politicians to keep inflation and unemployment in check, which cements political power.

However, in the case of the US, it has been a winner in international trade for many years. In fact, the famously large trade deficits have poured capital into the country, and the US has been able to leverage this capital into strong economic growth. As a result, they have outgrown the other G7 countries by a factor of two on a GDP/capita basis over the last 30 years. Plus, during this period of time, the US has seen its currency appreciate, while unemployment is close to its lowest level ever.

Of course, President Trump doesn’t agree to the above and believes that the US has been taken advantage of.

The truth is, the US is compensated very well for running such large trade deficits. In fact, this is what Fallacy Alarm said in his post below:

“If an alien looked down on us, it would be utterly confused with how much passion we are fighting over who can be the bigger servant to the other. Persistent trade imbalances make one person work for another. You would obviously want to be on the receiving end of that deal. Combined with a strong currency and low unemployment, a trade deficit means you are winning in international trade.”

As of now, the new US trade policy will impair the above mechanism. The US economy will grow slower because less capital will be pouring into the country. Input costs will rise because sourcing them from abroad will be more expensive. As for inflation, we may see a momentary spike; however, it will likely not be sustained, while corporate profits will come under pressure.

Plus,

wrote this post, which pins down two basic misunderstandings of Trump’s view of trade deficits.“The first is a simple accounting error. Trump’s advisors looked at the equation for GDP and noted that imports get subtracted from GDP. They didn’t understand that this is because imports also get added to consumption and investment, so you have to subtract them at the end in order to remove them from the number. The truth is that imports don’t affect GDP one way or another.”

“Trump’s second misunderstanding is based on the idea that imports will be replaced 1-for-1 by domestic production — i.e., if you stop America from importing a washing machine, an American company will make one more washing machine instead. That’s certainly one possible outcome, but it’s not the only one. American consumers could just go without one washing machine, making everyone poorer.”

Not to mention, by making imported components more expensive, Trump’s tariffs are weakening US manufacturers — that’s why auto workers and steelworkers in the US are being laid off right now, and why measures of manufacturing activity and sentiment are all heading down.

In case you are wondering why bury the short-term US bull case just at the moment where it became a no-brainer, you have to look past the short-term noise to understand what the long-term underlying motivations are.

✅ See, if a recession hits now, the timing of the recovery could just perfectly align with the 2028 election cycle. And guess who will take credit for it?

✅ Second, a recession would force the Federal Reserve to aggressively cut interest rates and possibly restart QE (Quantitative Easing), potentially boosting real estate and financial markets after an initial downturn. Think of a post-GFC-like environment.

✅ Third, an economic downturn would provide the necessary justification for the administration to push through the $4.5T in tax cuts, thus freeing up capital necessary to stimulate the economy.

✅ Finally, the US administration deliberately rewiring America’s relationships with the world through tariffs and de-globalization converges with the emergence of highly capable AI systems that can perform increasingly complicated cognitive tasks better than humans. This is hugely hypothetical, but it is possible that an orchestrated recession indeed forces companies to restructure their supply chains, rethink labor costs, accelerate automation, and create room for AI.

Can the productivity gains promised by AI help offset the economic drag from deglobalization? Possible, but then again the growing probability of CHIPS Act getting killed may undercut American leadership in AI hardware, given that advanced semiconductors are critical to training and running large-scale AI models. So. It is murky.

But for now, the US economy has already started to display initial signs of a slowdown (which I will discuss in the next section), which has already sent the 10Y Treasury bond yields lower from 4.8% at the beginning of the year to 3.98%.

The first signs of slowdown are already here.

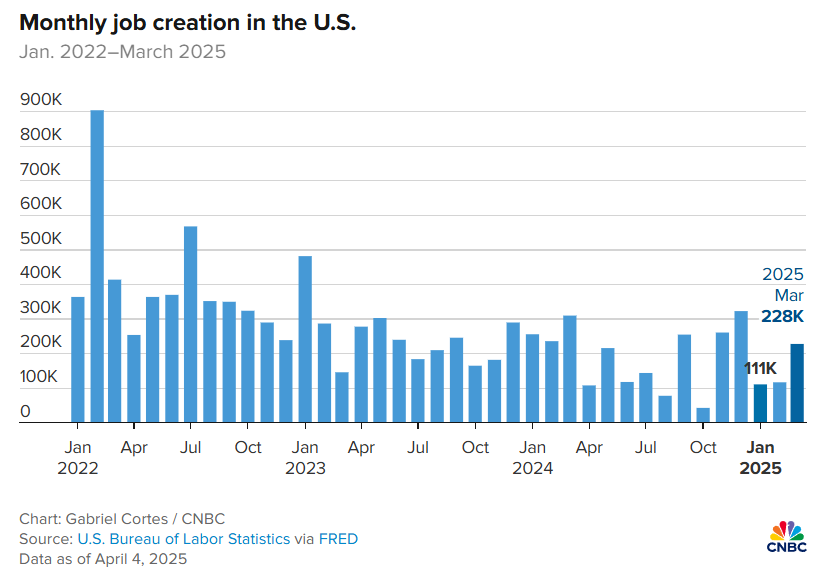

Starting with the state of the labor market, the US economy continued to add jobs in March, growing non-farm payrolls by 228,000, better than the Dow Jones estimate of 140,000, according to the Bureau of Labor Statistics. However, it wasn’t enough to ease fears of an immediate softening in the US labor market, as the data is backward-looking and doesn’t say anything about how employers might fare over the coming months, especially under the current tariff environment.

Plus, the US unemployment rate has been creeping up higher, as can be seen below, ending the month at 4.2%, higher than the 4.1% estimates, while the annual growth rate of 3.8% for average hourly earnings now stands at the lowest level since July 2024.

In the meantime, retail sales continued to remain in positive territory, growing 0.2%, despite how pessimistic consumers have become lately pertaining to the future state of the US economy.

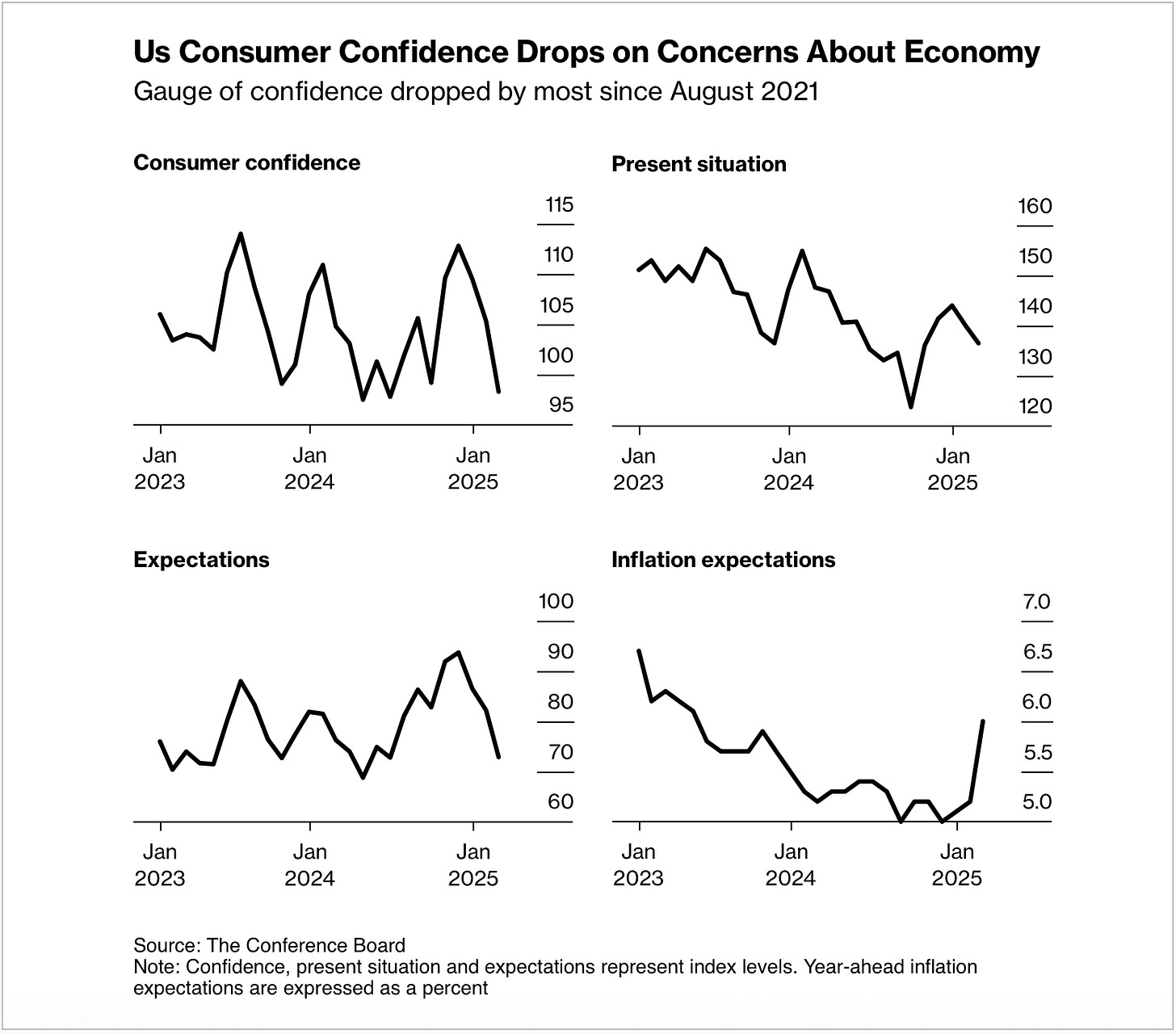

Speaking about the state of US consumer pessimism, consumer confidence declined for a fourth consecutive month in March, falling below the relatively narrow range that had prevailed since 2022, while consumers’ pessimism about future business conditions deepened, confidence about future employment prospects fell to a 12-year low, consumers were especially gloomy, and optimism about future income largely vanished, suggesting worries about the economy and labor market have started to spread into consumers’ assessment of their personal situations.

When we turn our attention to the production side of the economy, things don’t look too rosy either, with ISM Manufacturing contracting by 1.3 percentage points on a month-on-month basis to 49, with New Orders, Production, and Employment Index declining, while the Price Index surged 7 percentage points to 69.4%, stoking stagflationary fears.

Meanwhile, the NFIB Small Business Optimism Index also fell 2.1 points in February to 100.7, where small business owners expecting better business conditions in the next six months dropped and the percent viewing the current period as a good time to expand fell.

Simultaneously, the 6-month expectations of business investment in capital goods, according to the survey conducted by the New York Federal Reserve, have suddenly fallen to their lowest level since the pandemic, declining to levels that have been recessionary at other times. Not even during the sharp slowdown of 2022 did this survey enter negative territory.

And there is still more.

Plus, the Q1 GDP forecast has already turned south.

Latest projections for Real Q1 GDP point to a contraction of -2.8%. Now, remember, this is still just a potential, but we're running out of time to fix it and bring the figure back to positive territory.

This means that we are likely to endure a negative GDP reading for Q1. If we also see a negative GDP reading for Q2, we are officially in recession.

But fearmongering aside, which, trust me, tends to sell very well, let’s dig into what is actually pushing Real GDP into negative territory.

You see, GDP has several components, and one of them is "net exports," which is a simple figure of our imports less our exports. This is also called the "trade balance." Domestically, ours is rather large and is, therefore, a typical drag on our GDP.

As you can see, this trend began to accelerate in January 2025, and by GDPNow's metrics, is still accelerating. What is usually a small drag to the downside has now become so large that it pulls the entire GDP figure down.

See this chart, where before the shift on Feb. 26th, net exports pulled down the metrics by less than 100 basis points. Since then, it's pulled GDP down by several hundred basis points.

So, why are net exports so high all of a sudden?

One word: Tariffs, or at least the anticipation of them, which is now quickly becoming a reality.

This has resulted in significant market volatility, but most importantly, it has caused demand for imports to rise dramatically in the short term. This is due to many importers trying to "front-run" the tariffs, or buy as many surplus goods as they can now to avoid paying the duties on them later.

At the same time, Lyn Alden also made a valid point that the recent tariff uncertainty has resulted in an abnormally large spike of gold imports to the United States.

“A typical month might see $1-2 billion in gold imports, but in December it was $10 billion and in January it was $30 billion. These numbers are reported with a bit of a lag. Investors are likely protecting themselves around the margins in the event that gold they own overseas gets tariffed.

This won't have a large impact on GDP because most of that gold is not about economic activity. We can think of it more like a capital repatriation flow. But it does distort certain economic metrics that don't separate it out from other types of imports.”

The way we see it, we are living in a headline-driven market, where this is likely to continue to be a noisy data period, both for investors and businesses.

Powell just can’t catch a break.

Speaking of having to make sense of the noisy data, the latest of Trump’s tariffs just made the job of the Federal Reserve that much more difficult.

Remember that the Fed has a dual mandate that includes ensuring

price stability, and

maximum employment.

Today, amid all the tariff chaos, we have witnessed the Trade Policy Uncertainty Index spike at the highest level seen in this century, making spending, investment, hiring, and transport decisions harder.

Indeed, unclear trade policy has already terrified American consumers, where forward inflation expectations have risen dramatically in the University of Michigan’s national survey, with long-run expectations jumping to the highest levels in more than 30 years, leading to consumers trying to make large purchases before tariffs go into place, as

pointed out in his post here.From a monetary policy standpoint, many Fed policymakers have emphasized in recent days that they want to keep rates where they are for some time as they digest the impact of Trump’s policies. Some said they are still worried about inflation and not sure if the impact on prices will be temporary or not.

This is despite the fact that Trump has turned up the pressure on Powell, calling on him to lower rates.

"This would be a PERFECT time for Fed Chairman Jerome Powell to cut Interest Rates. He is always ‘late,’ but he could now change his image, and quickly. "CUT INTEREST RATES, JEROME, AND STOP PLAYING POLITICS!"

In response, Powell made it clear that the Fed isn’t in a hurry to take any action, as the tariff-induced inflation could turn out to be more persistent.

Meanwhile, if we take a quick glance at the Fed’s projections in its March 2025 meeting, we can see that it has revised its expectation for Real GDP to grow slower than what it had expected in December 2024, while simultaneously revising its guidance for Core PCE inflation and Unemployment Rate higher, as can be seen below.

This brings us to perhaps the most awaited question that everyone is trying to find an answer to: Are we headed towards a bear market?

What will signal the onset of a bear market, if there is one?

Did you know that recession-betting odds from Kalshi have skyrocketed higher in the last few days?

I’m not joking. Here, take a look.

But in order for a recession to take place, there has to be growing uncertainty around whether companies will meet their earnings projections, followed by an actual 7% or more downward revision in forward earnings estimates.

In this case, how exactly does the tariff-induced macro disruption translate into earnings risk for companies?

Let’s start on the revenue growth front, where companies that derive most or all of their revenues domestically will benefit, and companies that are dependent on foreign sales will be hurt by tariff wars.

To assess how that exposure varies across sectors, here’s a chart from

, where he mapped out the percentage of revenues in each sector that companies in the S&P 500 get from foreign markets.Collectively, about 28% of the revenues in 2023 of the companies in the S&P 500 came from foreign markets, but technology companies are the most exposed (with 59% of revenues coming from outside the country) and utilities the least exposed (just 2%) to foreign revenue exposure.

Meanwhile, on the profitability front, a company that gets all of its revenues from the domestic market can still be exposed to trade wars if its production or supply chains are set up in other countries. Not to mention that US small businesses are highly dependent on imports, as can be seen below, which would translate to higher input costs under the current tariff environment.

So far, analysts have lowered their estimates for earnings per share by 4.2% for Q1, higher than the 10-year average downward revision of 3.2%.

At the sector level, ten sectors witnessed a decrease in their EPS estimate for Q1 2025, led by the Materials (-17.6%) and Consumer Discretionary (-10.4%) sectors. On the other hand, the Utilities (+0.1%) sector was the only sector that recorded an increase in its EPS estimate for Q1 2025 during this period, as can be seen below.

Meanwhile, analysts have also lowered their EPS estimates for the full year FY 2025 by 1.6% (to $269.67 from $274.12) during this same period, with the sector-level breakdown as shown below.

This has simultaneously led to equity risk premium (additional premium that investors ) ticking up higher since the start of March. The ERP calculation below has been done by Aswath Damodaran up until March 14. Since then, ERP has spiked even higher to close to 5.2%.

You see, a rising ERP coincides with growing uncertainty around future earnings growth, inflation, and general sentiment expectations.

This in turn contracts the so-called price-to-earnings multiple, which now stands at 18.8 based on consensus estimates for FY25 earnings, compared to a peak of 22.5 post-election, as can be seen below.

Meanwhile, Goldman Sachs recently published its downwardly revised forecast for this year, with a range of multiples attached.

The way we see it, the path that the equity risk premium takes for the rest of the year will be the key driver in whether equities level off, continue to decline, or make a comeback.

If equity risk premiums continue to march upwards, driven by increased uncertainty and the potential for trade wars, stock prices will drop and price multiples will contract, even if the economy escapes a recession, and adding a recession, with the damage it will create to expected earnings, will only make it worse.

But, I have to be honest.

I don’t know where things are headed next. If you know where things are heading, then you probably don’t know what you are talking about.

The truth is there is no tariff playbook. I mean, look at Savita Subramanian, Chief Investment Officer at BofA, who currently estimates that the impact of tariffs could drag S&P 500 earnings per share by a range of 5% on the low side to 32% on the higher side.

That’s a wide range. And even she acknowledges that it’s derived from an “oversimplified scenario analysis.”

So, if you are asking whether the downside is fully priced in at the moment, I will tell you this much.

The current trend of earnings growth per share for the S&P 500 is still very optimistic, especially if the economy slows down further, or worse, if we enter a recession. This does increase the odds of further derating in the stock market.

Plus, I cannot stress enough how much the market detests uncertainty, and until we get clarity on where nations find the equilibrium with the newly imposed tariffs and the potential impact on companies’ earnings, we can expect to remain in The Grind, where the S&P 500 index is likely to remain range-bound between 4800 and 5600.

On the other hand, should we see earnings estimates slashed further down by 7% or more, with credit spreads widening and labor market conditions worsening, it will likely trigger a recession alarm, where markets break down below 4800-4500 levels and head lower, possibly in the 3000 levels, depending on the magnitude of the damage and the speed at which help comes.

So, does this mean that the bull case cannot make a comeback?

Of course, it can.

Remember, bull markets are often created at the deepest troughs of pessimism. In fact, the latest bull market that commenced in October 2022, leading the S&P 500 73% higher, was born on the day when the US saw its worst inflation print in this century. That was the day uncertainty peaked and pessimism bottomed.

In our Q1 update, we highlighted that there was a path for the S&P 500 to continue higher to 6500, as earnings breadth was projected to expand beyond the Magnificent 7 into the 493 companies in the index. While I had outlined the risks to my thesis, which included potential headwinds from Trump’s policy objectives of lower taxes, higher tariffs and reduced immigration, I reiterated that it’s a bull market until proven otherwise.

Will the magnitude of the tariff quake finally break the bull market?

That remains to be seen.

For now, until we see evidence of sentiment bottoming out with positive catalysts developing, we recommend using sellable rallies to raise cash and practice maximum caution.

Does that mean that the AI investment landscape is dead?

⏰⏰We will be releasing our AI Stock Tracker to paid members next week that will contain our updated price targets under the current derating environment across all the AI stocks that we have covered on The Pragmatic Optimist as well as on Seeking Alpha over the last month.

Get access to our AI Stock Tracker by becoming a paid member today. Plus, you will also unlock 9-12 supreme quality industry research on the AI investment landscape, with focus on specific companies, especially as we enter one of the most crucial earnings season this week.

Is it time to bail on AI Investing?

Not so fast.

Especially, if you have existing positions, we would recommend taking a long-view and ride through the pain.

At least, that’s what we are doing.

But first, there is no sugarcoating the fact that FY2025 has been brutal for tech, with XLK XLK 0.00%↑ down over 16% YTD, hugely the S&P 500 as well as other sectors.

In the meantime, Microsoft MSFT 0.00%↑ has slowed down and paused several data center projects around the globe, as per a Bloomberg report, while Nvidia NVDA 0.00%↑, which has been one of the biggest beneficiaries of the AI trade was downgraded to Hold from Buy at HSBC last week as the investment firm said it sees “limited” pricing power for GPUs going forward until several long-term bets start to emerge.

What is further concerning is that long-term AI bull, Dan Ives from Wedbush also released the following note last week warning of “dark days ahead” from “tariff economic Armageddon”.

“From the Dot.com bubble and burst to the financial crisis to Europe debt crisis to COVID-19 lows in March 2020...but never have we (or others that have covered the markets for 50 years) seen a self-inflicted debacle of epic proportions like the Trump tariff slate over the last 36 hours,” analysts led by Dan Ives wrote in a note to clients.”

That is right.

The year seemingly started with a bang, with the announcement of the $500B AI Infrastructure investment called The Stargate Project, which was shortly followed by the launch of DeepSeek’s R1 reasoning model. Meanwhile, Big Tech also confirmed to grow their capital expenditure by 46% YoY to $317B to support the growing demand for AI workloads.

Soon after, we saw Google GOOG 0.00%↑ expanding its Gemini 2.0 family with new, cost-effective models and enormous context windows, enabling cheaper yet larger-scale tasks. OpenAI also shared its roadmap toward GPT4.5 and GPT5, aiming for a future where AI “just works” across tasks without the user needing specialized knowledge.

What I am trying to say is that we have entered a really interesting point in the AI Platform shift, where we would ideally see an explosion of companies building with AI as lower cost and more efficient models would create helpful economics for developing and adopting sophisticated applications across use cases.

I believe

had put it quite aptly in his post saying that while the infrastructure landscape is fairly well laid out today, the application landscape is a world of possibility.He also shared the following revenue figures by AI category:

Semiconductor Ecosystem: ~$160B

Data Center Infrastructure: Very roughly ~$115B (assuming half the costs of AI data centers are GPUs; according to Coreweave’s S1, 46% of their purchases went to Nvidia.)

Cloud Revenue: ~$25B

Foundation Models & AI Applications: <$10B

This had many investors thinking that we were entering the golden age of tech investing as AI companies scale their revenues much faster than companies from prior cycles, such as the cloud.

Having said that, there was always the probability that even as AI companies surge, the technology’s productivity impact could falter due to adoption hurdles. Small firms—startups and agile players—adopt AI swiftly, using tools like ChatGPT or Cursor to enhance efficiency or innovate. Yet, their limited scale curbs broader economic influence. For instance, in the US, large firms with over 500 employees drive 70% of GDP.

However a recent analysis from METR Evaluations suggested that AI’s ability to sustain task execution is improving at a fast rate. According to the analysis, the length of tasks AI can autonomously complete is doubling every seven months and If this trend holds, by 2027, off-the-shelf AI could handle eight-hour workdays with a 50% success rate.

Plus, recent research from Fabrizio Dell’Acqua et al. showed that AI doesn’t just act like a tool, it functions like a teammate, where individuals working with AI performed as effectively as two-person teams and did so 12–17% faster.

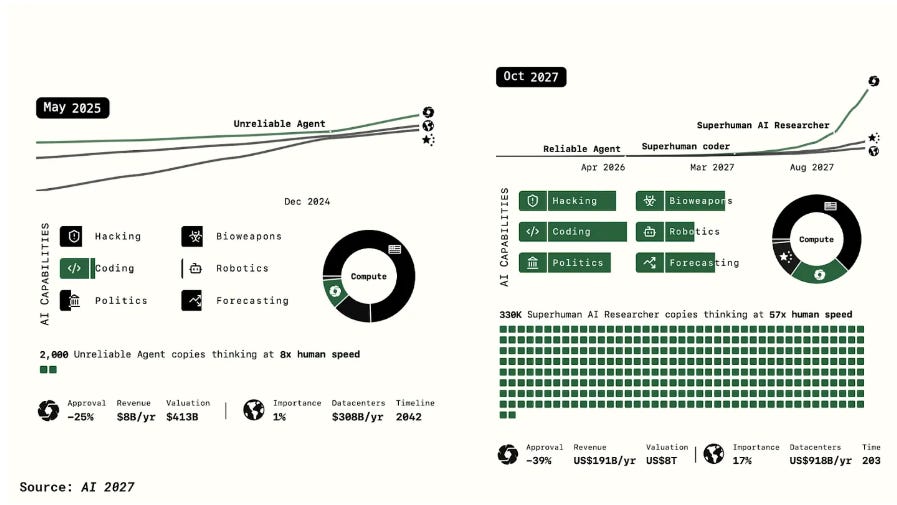

Finally, Daniel Kokotajlo and colleagues also painted a picture of how the next three years of AI development might unfold. They describe the emergence of successive generations of superhuman AI agents- from powerful code-generators to artificial researchers operating at 50x human speed would take place over the next three years in their AI 2027 report.

As we stepped into the age where AI agents empowered with autonomous reasoning and multi-step planning could fundamentally reshape entire industries, Jensen Huang, CEO of Nvidia, also confirmed in the company’s Q4 earnings call that the demand for compute is about to grow 100x higher than anticipated as we move beyond traditional pre-training scaling law to inference-time scaling.

However, there is one key assumption in all of this. It would require a unbroken pipeline of physical and economic inputs that include compute, power, capital, and institutional capacity to fuel the pace of AI innovation.

But what if those assumptions break down?

This is how

breaks down how the current tariffs imposed by the Trump administration could introduce friction at a delicate time by raising the cost of cutting-edge AI data centers by 15-17% or even more, thus slowing the pace of AI innovation, especially when we are in an AI arms race with China.“Taiwan, which produces the vast majority of advanced logic chips including Nvidia’s GPUs, now faces a 32% reciprocal tariff on many goods. South Korea, a key source of memory chips, sees 25%. While raw semiconductors themselves are strategically excluded, the equipment housing them — servers and accelerator modules assembled in Taiwan, China (34%), Mexico (10%+) or Vietnam (46%) — is not.

How significant is this?

Consider a simplified data centre cost breakdown: 50% for compute hardware, 15% for cooling systems, 15% for build-out (steel, racks, power) and 20% for land. Land isn’t directly hit, and raw chips and copper are excluded. But tariffs on imported compute hardware could increase that dominant 50% portion by nearly 25%. Cooling and structural materials—like steel—face tariffs too. Cumulatively, these measures could raise the total cost of a cutting-edge AI data center by 15–17% or more.

This friction hits at a delicate time. Executives and investors, many of whom built careers under globalisation doctrine, are confronting an unfamiliar world. The world economy may eventually settle into new regional blocs and bilateral pacts. But for now, uncertainty is real. Firms are revising assumptions, rethinking supply chains and pausing investment. There’s been action from the White House, but we haven’t seen the reaction of the bosses who will make the investments.”

On that note, I would conclude with the following points:

The self-inflicted harm on the AI landscape is truly unfortunate, especially at a time when we had likely entered the golden era of AI investing.

The current massacre in tech is driven by valuation contraction. Earnings estimates are yet to be revised downwards. Should companies along the AI ecosystem face larger-than-expected cuts to their forward earnings estimates, there could be further derating ahead.

Yet, tech CEOs are surprisingly quiet in all of this. So, it all boils down to how well management is able to communicate their plans around navigating the current landscape to protect their pricing power and cash flows in the upcoming earnings season.

Can tech earnings hold up better, given productivity tailwinds from AI and supply chain efficiencies? Possible. But appropriate risk management in investment portfolios is of utmost importance at the moment in order to come out in one piece once the storm settles. Here’s an example of how we have diversified our portfolio into long-term treasuries TLT 0.00%↑, Gold GLD 0.00%↑ and Defensives that include positions in Healthcare PFE 0.00%↑and Staples PEP 0.00%↑, as well as recession-resistant REITs OHI 0.00%↑ .

The AI bull case is on hold, but it ain’t over.

That’s all for today.

Wishing all of you patience, caution and perspective.

Amrita & Uttam

Thank you AMRITA, very hard work 🔥🏆💌👏🏻

An incredibly in depth piece with so much to mull over in these chaotic times. Thank you so much for taking the time guys, it’s given me lots of food for thought!