Part 1: The Fed is broke. How is that possible?

How the modern financial system works, the mechanics of the central bank's balance sheet and how the Fed turned from being profitable to unprofitable to being broke

At a Glance

The Federal Reserve held interest rates steady at 5.25-5.5% last week during the FOMC meeting, while indicating that one more hike may be coming at the end of the year.

While the magnitude of the Fed’s tightening has brought down inflation from 5.4% to 4.2%, it has created some undesirable consequences for the Fed.

The once profitable Fed has turned unprofitable since September 2022. The pace of interest rate hikes and the composition of maturities of the assets and liabilities on the Fed’s balance sheet are to blame for the Fed’s operating loss.

While the Fed has $44B of tangible net equity on paper, the truth is muddier if you dig deeper into the details.

Turns out, that the Fed’s operating losses are captured as “deferred assets” thanks to accounting gimmicks, that help to prop up the assets in relation to the liabilities. In truth, the Fed is already broke.

This is the first time in modern history that the world’s largest central bank is not only operating at a loss, but also technically broke. Is the era of the world’s largest central bank’s independence coming to an end?

A recap of what happened at the Fed meeting last week

The Federal Reserve held interest rates steady at 5.25-5.5% , while also indicating it expects one more hike before the end of the year.

In addition to holding rates steady, the Fed is continuing to reduce its bond holdings, a process that has cut the central bank balance sheet by $815 billion since June 2022.

The Fed is broke: What to expect from this post?

The Fed embarked on one of the toughest tightening cycles in 2022 to combat inflation in the US. Core inflation rose to 5.4% in February 2022, the highest level in over 40 years. Since the tightening cycle began, core inflation has come down to 4.2%, a level that is still higher than the Fed’s long term target of 2.2%.

In its ongoing battle to restore price stability, the Fed has run into some predictable, though undesired consequences. The Fed is now operating at a financial loss and is technically at negative tangible equity (liabilities> assets) for the first time in modern history.

This post is broken into 2 parts. Today’s post is focused on Part 1. Part 2 will be released next week on Monday. I will explore the following areas in Part 1 and Part 2 respectively.

Part 1: The Fed is broke. How did this happen?

A primer on how the modern financial system works

What does it mean for a central bank (in this case the Fed) to go broke?

How exactly did the Fed go broke?

Part 2: The Fed is broke. Should we be worried?

What are the consequences of a Fed that is broke for the nation and its people?

What are the scope of actions that can be taken to remedy the situation?

How does the modern financial system work?

We usually think of a bank as a place where we take our money to deposit and the bank puts it in a giant vault. But that is not what happens in reality. Let me demonstrate.

Let’s say I go and deposit $10,000 into Bank ABC. As per the reserve ratio regulations, the bank only needs to keep 10% of my deposit amount in the vault. So, out of my $10,000 deposit, only $1000 is kept in the vault. Meanwhile, the bank can choose to invest or lend the remaining $9000 of my deposit to people and businesses who need a loan to buy things() and collect interest.

In the meantime, imagine there is a pastry shop “Le Gourmand” that makes the best croissants in the neighborhood. There are long lines everyday and the baker Fabien runs out of croissants by 9 am. He believes if he gets 2 more ovens, he will be able to bake more croissants every hour, sell them all out and make more revenue for his business.

So, Fabien from “Le Gourmand” approaches Bank ABC to ask for a loan to buy 2 ovens. And Bank ABC lends $9000 (out of the $10,000 that I deposited) to Le Gourmand at an interest rate of 10%. Now the bank will earn 10% on interest income from the loan (that it created using my deposit money) and in return will give me 4.3% interest on my savings account. The difference of 5.7% is Banks ABC’s net interest income, which goes to boost the bank’s profitability.

It doesn’t end there.

Le Gourmand then takes the $9000 (that it got from the bank loan which it created using my deposit money) and buys its ovens from HotOvens. The owner of HotOvens now has $9000 and it goes to Bank XYZ to deposit it.

Bank XYZ does exactly what Bank ABC had done with my $10,000 deposit. Bank XYZ only keeps 10% of $9000 (of HotOven’s deposit, which originated from my $10,000 deposit at Bank ABC) in the vault and loans out the remaining $8100 to a family who is buying a home.

Do you see what is happening here?

I started with $10,000 deposit in Bank ABC, and now it has multiplied across people and businesses, who need the money to buy real things (like an oven or a house). This process will repeat over and over again.

And if you model this out on a spreadsheet, you will see that my $10,000 would multiply 10x to create a total of $100,000 in the real economy. This is called the money multiplier effect and it depends on the reserve ratio (which is the amount that banks have to keep in their vaults, 10% in this case, vs. the amount they can lend/invest out).

This is how our modern financial system works and impacts the balance sheets of commercial banks in economies.

A bank’s balance sheet- what to look out for?

The mechanics of commercial banks stand at the heart of the modern financial system. A commercial bank has both assets and liabilities on its balance sheet. In order to remain solvent, the asset side must exceed the liability side. What do I mean by that?

For a typical bank, their liabilities mainly consist of deposits. Individuals or businesses deposit money at the bank, and those deposits (checking accounts, savings accounts, etc.) are considered liabilities for the bank. Today, banks are only required to keep 10% in reserves (in vaults).

On the other side of the ledger, banks have assets. These assets consist of various loans, securities, and cash that they hold at their central bank. As per US banking regulation, 90% of all deposits are used to lend out to people and businesses. This process creates new real economy money and based on the reserve ratio, this process can be accelerated or slowed down.

To use Bank of America as an example, they have $3.051T in assets and $2.778T in liabilities as of the end of 2022. Their assets exceed their liabilities, which means they have positive shareholder equity (which is a measure for solvency). A business that has positive shareholder equity means that it is solvent.

A business (in this case, Bank of America) that is solvent is financially capable of meeting their long-term debt and other financial obligations with their income producing assets.

The Fed’s balance sheet - demystified

A central bank (in this case, the Fed) has a similar balance sheet structure to a normal commercial bank, with assets and liabilities.

The Fed’s Balance Sheet: What are the Fed’s Assets

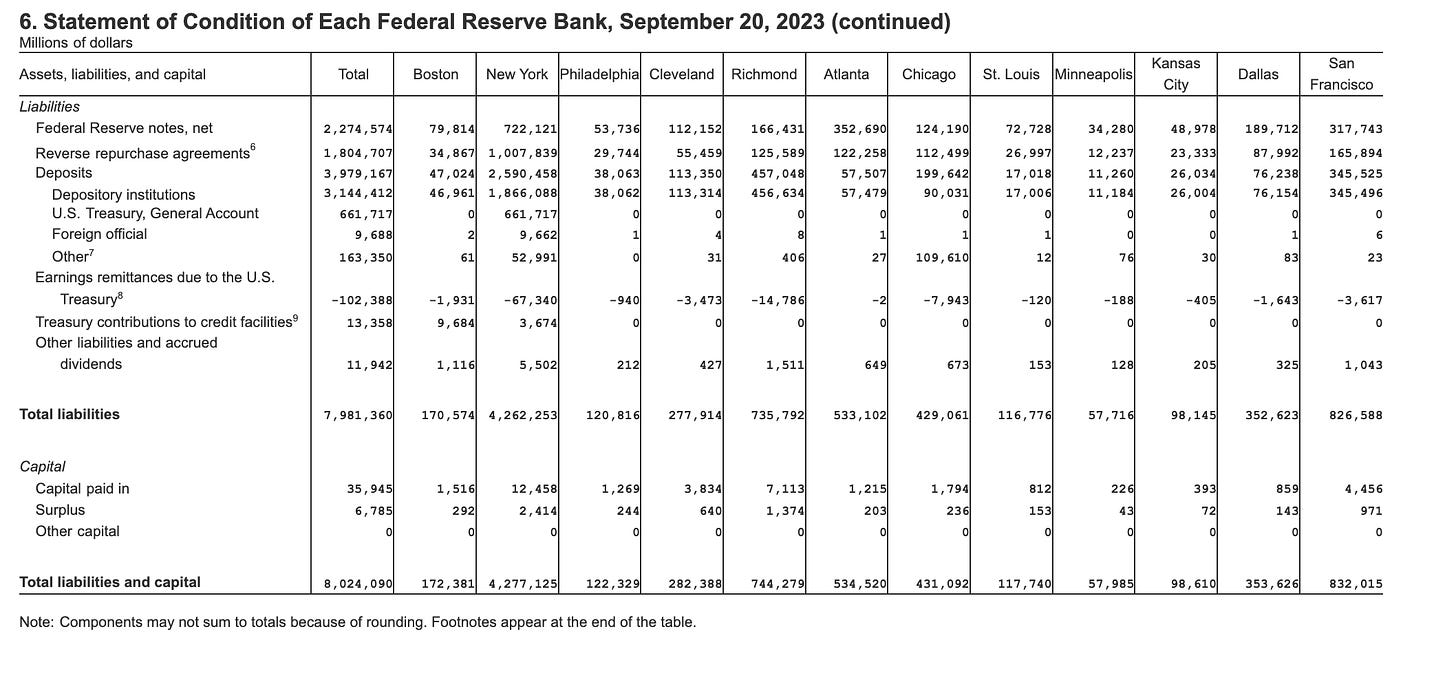

The Fed’s assets consist mainly of Treasuries (government bonds) and mortgage-backed securities. The total asset size stands at $8.024T, as of September 20, 2023.

The Fed’s Balance Sheet: What are the Fed’s Liabilities

Today, the Fed’s liability size stands at $7.98T and it consists mostly of commercial bank deposits, Treasury balance, currency (in circulation) and reverse repo operations.

Here is a quick overview of what the Fed’s liabilities represent:

🏦 Commercial bank deposits aka “reserves”: Just like individuals and businesses deposit cash at a commercial bank, bank deposit their cash at the Federal Reserve. Commercial bank reserves stand at $3.14T. The Fed pays interest on the reserves at a rate similar to the Fed funds rate.

⚖️ Treasury Balance: The U.S. Treasury Department maintains a cash account at the Federal Reserve, and this represents the checking account of the federal government. Currently the Treasury Balance stands at $0.67T.

💸 Currency in Circulation: At $2.3T, it represents the amount of printed notes and coins in circulation. This figure won’t fall unless you physically destroy all the notes and coins.

🔁 Reverse Repo: Repurchase agreements (repos) and reverse repos are used for short-term lending and borrowing, often overnight, for banks looking to fulfill their reserve requirements. From a practical perspective, a reverse repo agreement is similar to taking out a short-term loan, with the underlying assets serving as collateral. Today, the Reverse Repo stands at $1.4T.

The Fed’s Balance Sheet: A quick summary

Fed’s asset size= $8.024T

Fed’s liability size = $7.98T

This means the Fed’s equity stands at roughly $44B.

In other words, if the Fed reduces the asset size by a little over $44B, the Fed’s assets will become lower than the Fed’s liabilities.

At the rate at which the Fed is shrinking its balance sheet, we are now just over 1 month away before the Fed’s tangible equity drops below 0 on paper.

How did the once profitable Fed turn “unprofitable”?

The Fed was profitable up until September 2022.

In fact, in 2021, the Federal Reserve earned $100+ billion in net interest income. Some of it went to pay for operating expenses and some of it was paid out as a dividend to the shareholders of the Fed (which are the commercial banks). The majority of the profit was handed to the U.S. Treasury. By law, that’s how it works, and the Federal Reserve is a source of profit for the U.S. federal government.

However, the once profitable Fed turned unprofitable once it started to raise interest rates at an accelerating pace in 2022. It turned unprofitable because the assets and liabilities on the Fed’s balance sheet have different maturity periods.

Most of the Fed’s assets are long duration, which means that most of the US Treasuries and Mortgage backed securities are locked in at lower fixed interest rates which don’t adjust upwards as interest rates rise.

On the other hand, the Fed’s liabilities which are bank reserves and reverse repos are short duration assets, which means their interest rates quickly adjust to the market rate.

So the Fed pays out a higher interest rate very quickly on its liabilities, as they reset almost daily. The Fed pays for these liabilities with the assets it owns, which are mostly long duration US Treasuries.

Today, the Fed is paying more on its liabilities than it earns on its assets. Therefore, its net interest income is negative.

In other words, the Fed is operating at a loss.

From an Unprofitable Fed to a Broke Fed

When the Federal Reserve operates at a loss, it doesn’t send a remittance to the Treasury. They take a note of how much they lost, and if they become profitable at a later point in time, they get to pay back their cumulative losses with those profits, before they would return to sending remittances to the Treasury.

Normally, when the Fed’s net income is positive, the amount of money that would be remitted to the US Treasury Department is listed as a liability.

However, when the Fed is operating at a loss, the liability becomes negative. And what is a negative liability? An asset!

Enter Accounting Gimmicks!!!

The Fed’s cumulative losses become negative liabilities, and are referred to as “deferred assets”. These deferred assets represent the total amount of money that the Fed gets to pay themselves back before starting to send remittances to the US Treasury.

Today, the Fed’s asset size = $8.024T and liability side = $7.98T . But if you look carefully, deferred assets = $102B

So, while the Fed still has positive tangible equity of $44B on paper, the deferred asset is already greater than $44B. This means, all accounting gimmicks aside, if we take out “deferred assets”, the Fed has technically a negative equity of -$58B already.

The deferred asset here is simply serving to prop up the assets at a higher level than liabilities on paper.

Closing Thoughts!!!

With interest rates at high levels, and the composition of maturity periods of assets and liabilities on the Fed’s balance sheet, the situation is likely to get worse.

I want to take a moment to pause here and highlight the gravity of the situation.

The world’s largest central bank the Fed is operating at a loss today.

The Fed, while still solvent on paper (thanks to accounting gimmicks) is technically already broke with negative equity of -$58B as of September 20, 2023

This is happening for the first time in modern history. Is the era of the world’s largest central bank’s independence finally coming to an end?

In Part 2 of this series, I talk about the consequences to a nation and its people when the central bank (in this case, the Fed) becomes broke and the actionable remedies that can be taken to avert such a situation and protect your financial well-being. You can read that below:

If you enjoyed today’s post, please like it below and feel free to share your feedback.

Have a great week!!

Amrita 👋🏼👋🏼

Spectacular! Question for you- IYO why cant the Feds just use reverse repo and control for new loan growth vs controlling front facing rates and hurt Americans who already own mortgages?

A brilliant and enlightening analysis, Amrita.