Streaming TV broke its promise. So, Consumers are fighting back.

After a decade of keeping its promise to keep content ad free, welcome to the new streaming norm: higher subscription prices, walled content, more ads. Are we peak streaming yet?

«The 2-minute version»

Is streaming still worth it? After years of refusing to push ads into the user’s viewing experience, rapidly rising costs and the effervescent need to protect profit margins have forced many streaming services as of late to rethink their strategies.

Let’s look at the big picture: At the turn of the decade, there were two things that happened setting the stage for streaming services to steal the show. First, the growing reach of the internet through laptops and smartphones enabled more viewers to watch content online. Second, users, most importantly millennials and Gen Z's, were growing tired of commercials on traditional linear TV models.

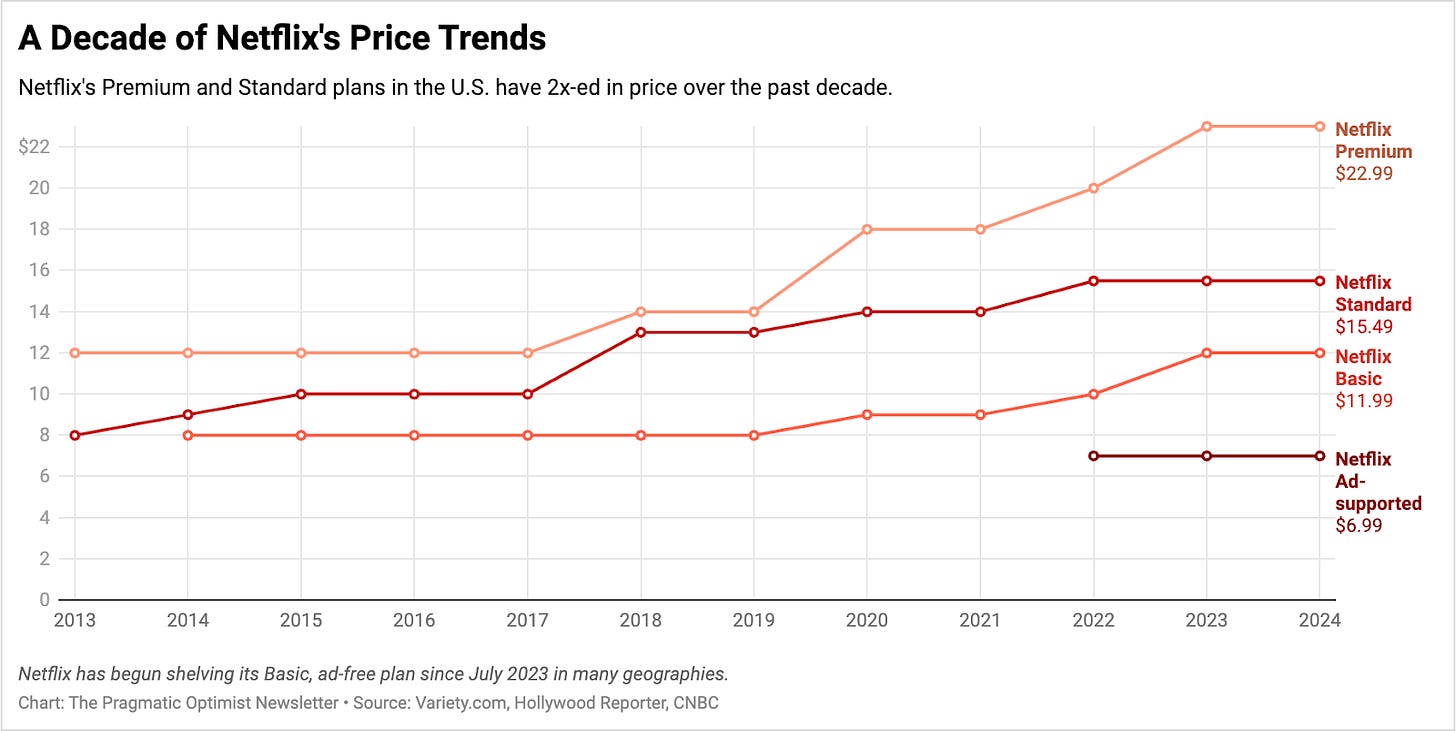

Voila! Enter streaming services, with the likes of Netflix, Hulu, and Disney promising ad-free, high-quality content at significantly cheaper prices compared to basic cable packages. With the first original series, House of Cards, commissioned by Netflix, came a gold rush for quality scripted shows. Between 2014 and 2016, Netflix had more than doubled its content spending budgets, and then in 2017 came the first price hike, where Netflix increased its Standard and Premium plans by 23% on average.

A promise meant to last a lifetime? Not necessarily: Netflix’s co-founder and former CEO, Reed Hastings, had been vocal against ads on the platform, going on record multiple times to advocate against ads on the platform. However, in 2022, he finally backtracked on his stance and launched an ad-supported plan after the stock fell at least 70% from peak to trough as subscriber count stalled and profit margins shrank. Mind you, this is after they had already doubled their prices on most of their plans over the last decade.

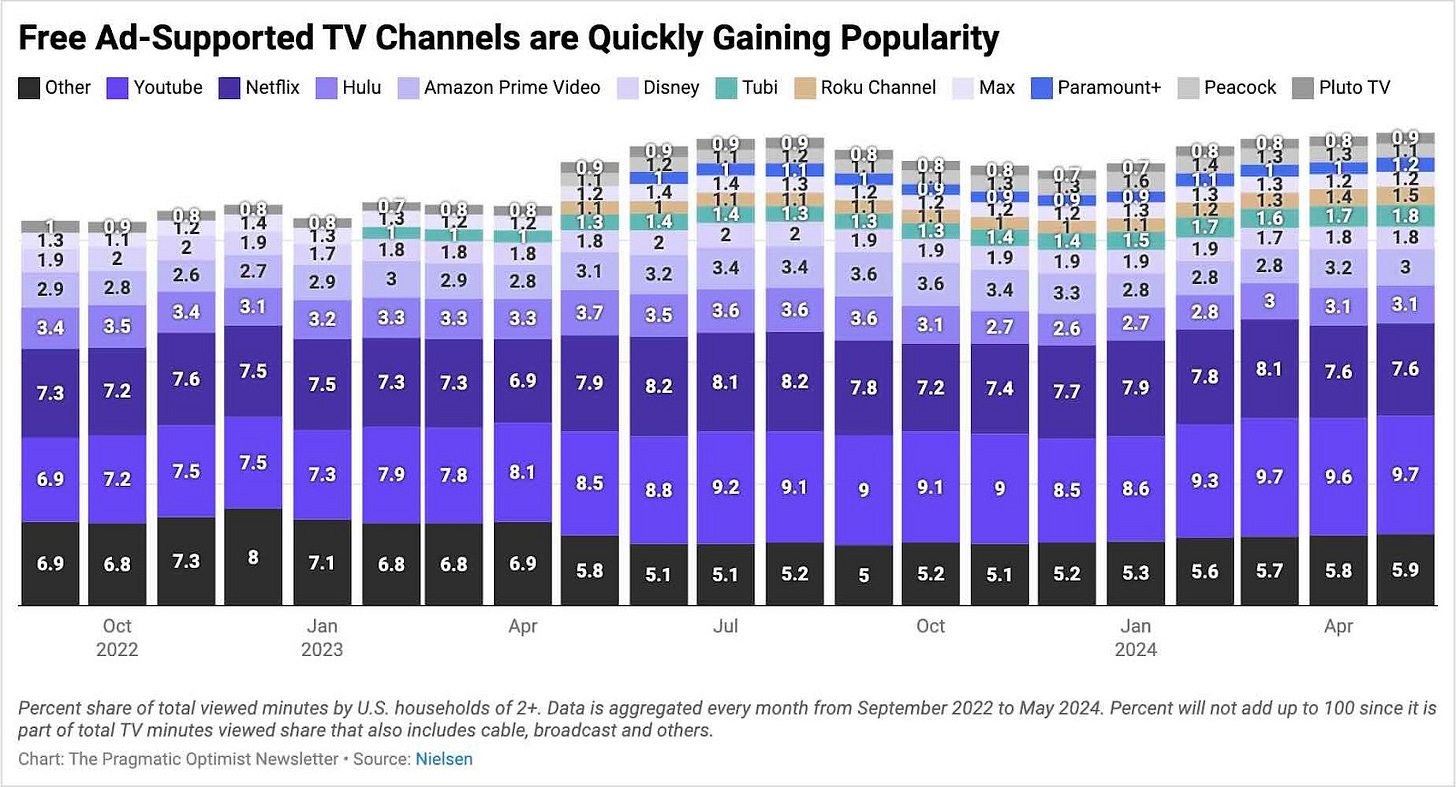

Peak streaming?...At least, not yet: While many streaming users have tightened up their budgets over the last year by reducing their number of subscriptions, Nielsen’s May 2024 Report of The Gauge showcases that the streaming share of total TV viewers reached an all-time high of 38.8%. There might be a reason for that.

FAST channels may be a contributing factor: With subscription fatigue on the rise, users are flocking to FAST channels such as Roku Channel, Tubi, and even YouTube, where the viewer pays nothing for a content library that constantly evolves in exchange for ads.

FYI: Netflix is set to report second quarter results on Thursday (July 18) and analysts expect the streaming giant to continue to reap benefit from password sharing, while its ad-supported tier gains momentum. We will be covering the stock in depth next Tuesday, so stay tuned!!!

🎥Let’s set the stage…

For years, video streaming services promised to free us all from the shackles of the interruption overload and distraction deluge that TV advertisements are usually associated with.

And for a good part of the last decade, many streaming services, led by Netflix NFLX 0.00%↑, actually upheld that promise in all its entirety by refusing to push ads into the user’s viewing experience. In addition to binge-watching, the ad-free experience was critical in defining the online TV-viewing experiences for many of us that even adopted ‘Netflix and Chill’ into dating culture.

Unfortunately, rapidly rising costs and the effervescent need to protect profit margins have forced many streaming services to walk back on that promise as of late.

The Stage Was Set For Streaming Services To Steal The Show

For a long time, linear TV channels such as ABC, NBC, CBS, etc. worked in a certain way that scheduled TV programs at specific intervals during the day or week, which set the expectation for viewers to tune in at those times to watch their favorite TV shows. What viewers were given to expect, as a result of the scheduled grid, was a mix of programming that was distributed across TV channels and Live TV interlaced with ads between breaks.

But at the turn of the previous decade, two things happened: First, the internet not only penetrated a larger footprint, but there was also a large extent of personalization that seeped into viewers habits with more laptops and mobile phones being sold, allowing more viewers to watch content online.

Second, and more importantly, an increasing number of viewers, led by millennials and Gen Z's, were growing tired of the twenty minutes of commercials for each hour of Linear TV programming they watched, something Netflix’s co-founders famously called “managed dissatisfaction.” This led to a growing share of users in the last decade, led by younger users, to buy into streaming’s value proposition versus cable TV.

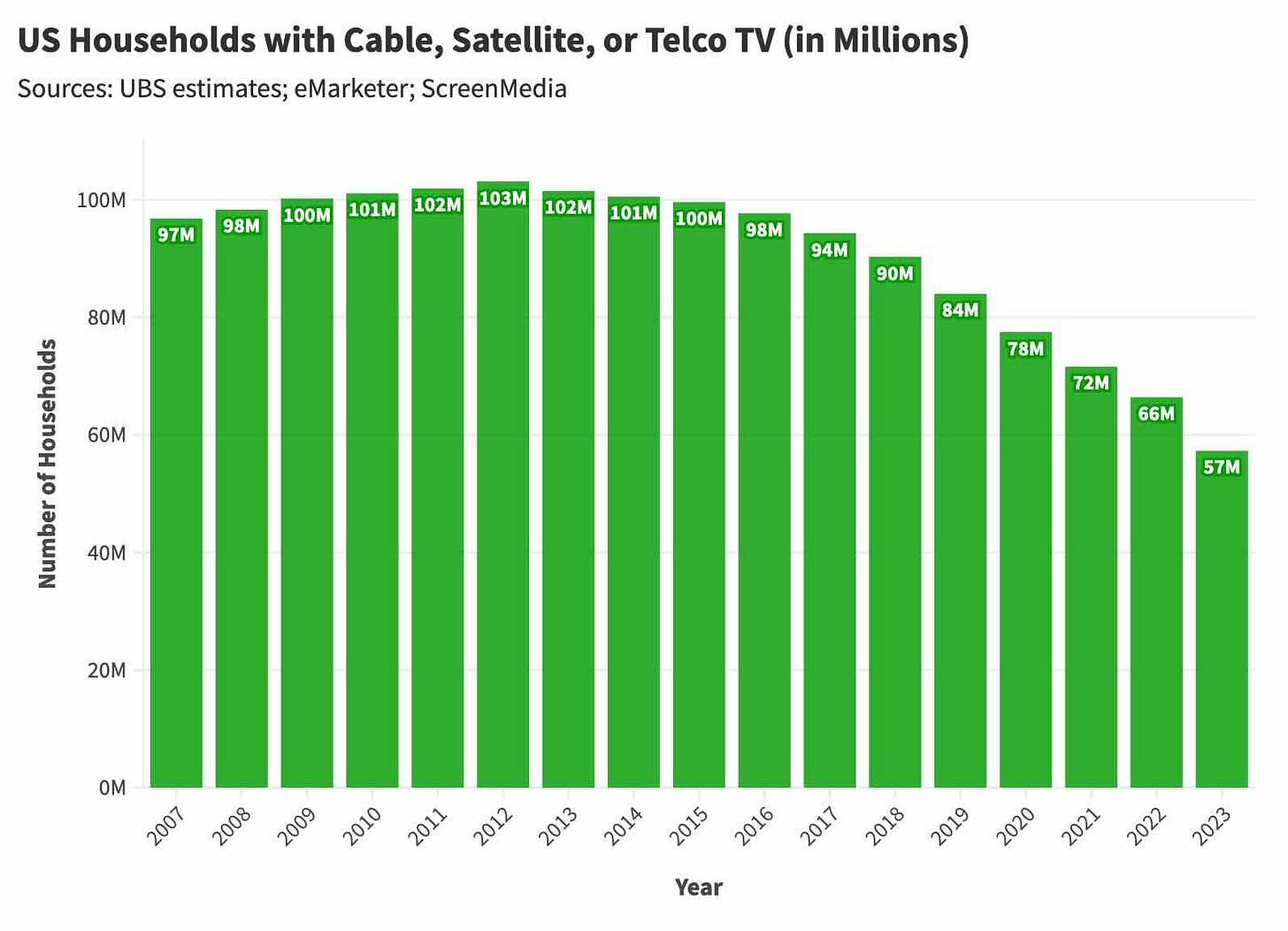

By 2015, 3 years after Cable TV had reached its peak penetration among U.S. households, Netflix and other streaming services had become hugely popular, draining television advertising revenues, which were heavily dependent on the TV ad golden goose.

So, per this old Cord Cutter calculator, if a user, in 2014, subscribed to streaming services from Netflix, HBO (now called Max), and Hulu Plus (now owned by Disney), along with online linear TV programming that included live sports from Sling TV, the user would end up paying $52 per month. This was 21% cheaper than average basic digital cable packages that cost ~$66 in 2014.

Apart from the price advantage, other benefits like on-demand content libraries (a.k.a. binge watching) and ad-free experiences made streaming a good deal for most people for most of the decade.

The New Streaming Norm: Higher Prices, Walled Content, More Ads

One of the other alternative benefits many users, especially millennials and Gen Z's, valued from streaming services like Netflix was the constant addition of high-quality original content to the content libraries of streaming networks. Most of it can be traced back to the first original series commissioned by Netflix, House of Cards, which heralded the beginning of a new era for the streaming giant and for TV. This accelerated a gold rush for quality scripted shows such as Transparent and The Handmaid’s Tale, leading to one Hollywood producer calling this period “Peak TV that hasn’t peaked yet.”

The competition became fierce by 2017 when Disney DIS 0.00%↑ decided it wanted a piece of the pie as well and announced it would be pulling its entire slate of Disney content from rival streaming services. By 2018, Netflix had an impressive roster of Hollywood producers as well as their own original TV shows and movies, showing no signs of stopping. Between 2014 and 2016, Netflix had more than doubled its content spending budgets, from $3.2 billion to $6.9 billion. By 2019, Netflix’s content spending had again more than doubled to $14.6 billion.

With streaming wars going underway, someone eventually had to pay the price of this all: the user.

In 2017, Netflix raised its prices in the U.S. for the first time for its Standard and Premium plans by 23% on average across these two plans. These price hikes continued well into the pandemic lockdowns as demand for on-demand video surged.

But at all times, Netflix refused to budge from its anti-ads stance, even if their streaming peers were folding one by one. On a conference call with investors in early 2019, Netflix’s then-CEO and co-founder, Reed Hastings, said this when someone revisited a question about ads on the Netflix platform at the time:

We don't collect anything [personal data]. We're really focused on just making our members happy. And we're not tied up with all that controversy around advertising. And again, if you wanted to succeed in online advertising, you can't just have a little data. To keep up with those giants, you've got to spend very heavily on that and track locations and all kinds of other things that we're not interested in doing. We want to be the safe respite where you can explore; you can get stimulated, have fun, enjoy, relax and have none of the controversy around exploiting users with advertising.

However, later in 2022, Netflix launched its first ever ad-tier. At the New York Times’ DealBook Summit, Hastings backtracked from his decades-long stance, calling the company’s reluctance to adopt advertising “wrong.” Hastings reasoned that Netflix’s new ad strategy was a “good tactic, because we get to offer consumers lower prices.” Hastings would later step down as CEO, two months after the Dealbook Summit.

It wasn’t just Netflix. All streaming companies were raising their prices while launching different variations of ad-supported tiers at the same time. Even Amazon AMZN 0.00%↑ started charging customers an extra monthly fee of $3 for ad-free on top of the $139 Annual Prime Subscription while streaming companies also started cornering customers into paying up for sharing accounts. At the same time, cable bills had started to skyrocket, rising three times the cost of inflation, according to this report.

***Enjoying the content so far? If yes, please consider supporting our work by buying us a coffee ☕ and a muffin 🧁 for $8/month or $80 annually and unlock 30 minutes of zoom call time to discuss a range of topics surrounding macroeconomics, technology and investing. Also, your support goes a long way to help us keep up the quality of our work and continue to delight you all.***

Despite Its Broken Promises, Streaming Still Grows

Over the years, many streaming users ended up subscribing to ~3 streaming services to watch their favorite movies and TV shows. The walled garden of content offered by each streaming service is still used as a carrot to bait many viewers to jump over from rival streaming platforms. But with prices rising rapidly, many viewers experienced subscription fatigue, leading them to cut their subscriptions.

For example, data collected by this pricing research firm showed that on-demand streaming viewers across the world were tightening up their budgets, with users now subscribing for approximately 2 streaming services on average, down from 3 services a year earlier.

Viewers in the U.S. still subscribed to ~3 streaming services, above the global average number of subscriptions respondents indicated they paid for. At the same time, interestingly enough, more viewers than ever watched content on their streaming platforms.

According to Nielsen’s May 2024 Report of The Gauge™, the streaming share of total TV viewers reached an all-time high, with 38.8% of viewers watching TV via their streaming platforms, surpassing the share of cable TV viewers last year.

The Simple Reason Why Streaming Continues to Grow

An intriguing trend in Nielsen’s Gauge report was the emergence of a new brand of TV channels that a growing number of users are flocking to.

FAST or Free Ad-Supported Television channels, such as Roku Channel and Fox affiliate Tubi, had been steadily rising since the pandemic, but the share of viewing minutes on these FAST channels spiked by over 50% for many channels in the past 12 months.

The value proposition for FAST appears to be simple: one single viewing experience for the user that provides both linear and on-demand content, relying entirely on ads for monetization. The rise of FAST comes as most major streaming services have raised prices in the past two years, with Netflix still expected to follow through on yet another round of price hikes.

On a recent podcast, Tubi’s CEO, Anjali Sud, captioned the value proposition of Tubi in three sentences:

"We're not asking you to subscribe to an ad tier or a subscription tier. We're not trying to upsell you. The fragmentation and friction is reduced."

A growing number of TV viewers have found appeal with Tubi’s pitch, with expectations set beforehand that the viewer pays nothing for a content library that constantly evolves yet remains in demand in exchange for ads.

Alternatively, other users have continued to flock to YouTube as well, the free version of which loosely offers the same value proposition as many FAST channels. Except, much of the content is crowd-sourced by other users and entities on the platform. This could be the main reason why Youtube’s share in Streaming TV rose the most by almost 3% over the past twenty months, demonstrating gains similar to those of other FAST channels such as Roku and Tubi.

In addition, Youtube also globally launched its own line of games in May that can be played directly on YouTube, as if to increase the value proposition of what Youtube offers.

It’s not just YouTube. Netflix has made a big push into games as well in the past two years, coinciding with the round of price hikes on its platform. In addition, Netflix is also plowing into live programming, while Disney and Amazon are currently locked in a bidding war to get exclusive rights to the NBA.

Since the big bros in streaming cannot compete on price, there is a race to pack in as much live content as possible to justify the price hikes and infusion of ads into streaming networks. With the streaming market maturing, streaming companies are rushing to line up in front of one another to advocate the value of their streaming platform. Their job becomes a lot tougher in the age of the Discerning Customer who is not afraid to cut costs and trade down if brands don't give them enough value to justify those price hikes.

Before we go, we’ll leave you with an interesting discussion we came across on Reddit, especially the comments where the lines between streaming and cable TV are now blurring.

Great article! I’m going to share this with my wife. I have long felt it is no longer worth it and that we should go back to accumulating DVDs of our favorite shows and movies. Not glamorous by any means, but I hate being bombarded with adds and propaganda.

You know how highly I think of your work. This latest edition only re-enforces that high opinion. Excellent piece, as always!