The curious case to include gold in your portfolio: Will gold prices reach new all time highs soon?

Gold's YTD Performance, Central Banks buying gold at record pace, the Investment Case for Gold & analyzing portfolios with gold as a defensive strategy

At a Glance

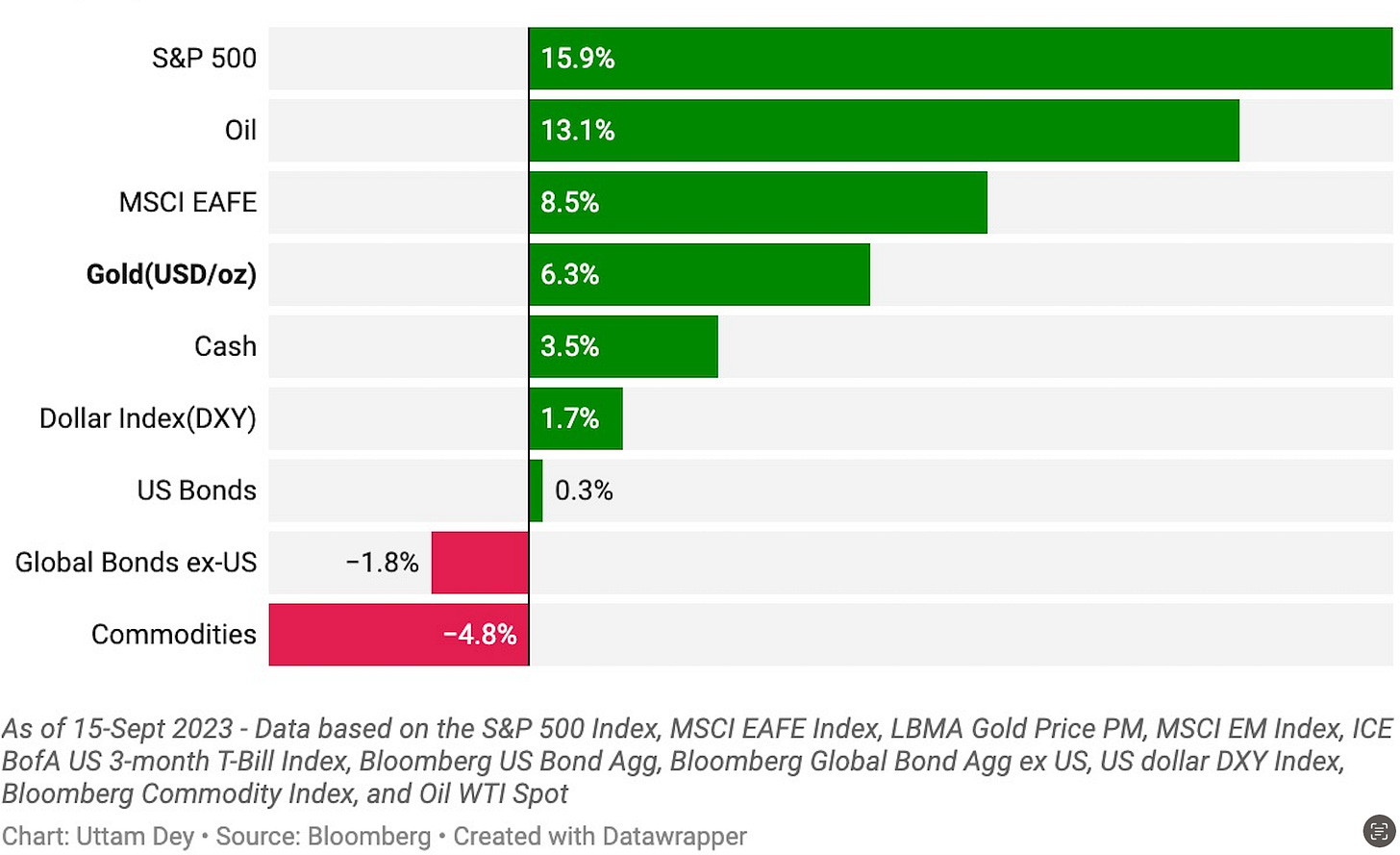

YTD Gold is up 7.4%, outperforming returns on the US Dollar, bonds and commodities.

H2 has not been kind to Gold so far, as yields and a strong US Dollar have once again taken center stage.

In the meantime, Central Banks bought gold at a blistering pace in Q1 2023. While Central Bank gold buying slowed in Q2, they are set to be net purchasers of gold once again this year led by Singapore, China, Turkey and India.

The investment thesis for Gold is strong if the Fed holds rates steady from here on, anticipating inflation to come down, while the economy grows at a slower pace. If the economy enters an official recession, gold will produce even stronger returns.

Have you ever wondered whether a portfolio that contains 10% allocation to gold indeed outperforms portfolios that don’t contain gold? Read below to find out!

Let’s establish the facts: Gold’s YTD Performance

YTD, Gold is up 7.4% to $1954/oz.

Gold has outperformed returns on cash, USD, bonds and commodities.

In H1 2023, gold increased by 5%, closing June at $1921/oz.

Behind gold’s performance in H1 was a combination of a relatively stable US dollar, interest rates and continued central bank demand.

H2, on the other hand has not started out positively for gold so far. Global gold ETFs saw another monthly outflow in August. Total AUM fell $3B, with the majority coming from US listed funds.

Higher yields and a stronger US dollar have taken center stage, which is weighing down on Gold’s performance.

Since July, US Dollar is up 2.1%. In the meantime, long maturity US Treasury bond yields have risen faster than shorter term US Treasury bond yields. In other words, yield curve is exhibiting a “bear steepening”. This is driven by renewed concerns of inflation rising from spike in oil prices.

The combination of higher yields and a stronger US dollar do not bode well for gold, because, when interest rates rise, bonds and other fixed-income investments become more attractive. Therefore, money flows out of gold into higher-yielding investments (such as bonds and money market funds).

The investment case for gold is strong, but risks remain

The investment case for gold is directly related to the path of inflation, interest rates and economic growth.

👇🏼Here are the possible economic scenarios may play out for the US and what that would mean for gold’s investment case:

✅ Scenario: The Status Quo | Investment Thesis for Gold: Strong

In this scenario, we expect monetary policy to remain at current levels, where the Fed Funds Rate = 5.25-5.5%. This would be a reflection of higher than long term average inflation rate and strong labor market.

The US Economic growth would be slow, but positive.

In this scenario, the yield on the longer maturity bonds will drop as a reflection of investors’ expectation of weak long term growth for the US and declining inflation. Such a behavior in the yield curve is often a sign of an impending recession.

Should this scenario play out, gold will see upside from current levels and the investment thesis for gold is strong.

❌ Scenario: Higher for Longer | Investment Thesis for Gold: Negative

In this scenario, we expect monetary policy to rise from current levels. This would be a result of inflation picking up once again from current levels.

The US Economy could still grow, but very slowly.

In this scenario, the yield on the longer maturity bonds will rise as the yields on the shorter maturity rises as well. This is known as “bear steepening”, which we have witnessed since July 2023.

Such a scenario will not bode well for the investment thesis for gold.

❌ Scenario: Productivity Acceleration | Investment Thesis for Gold: Medium

In this scenario, we expect inflation to drastically decline from current levels, yet not cause a recession. The short term maturity will drop in this scenario to reflect rate cuts. The longer maturity bond yield would fall too, but slower.

The US Economy would technically avoid a recession, but uncertainty will remain high, until the US economy is officially in growth mode.

Once the US Economy skips the recession and enters growth mode under an environment of low interest rates and inflation, the investment case for gold will be medium.

✅ Scenario: A Deflationary Recession | Investment Thesis for Gold: Strong

In this scenario, we expect inflation to drastically drop from current levels, and the economy tips into a recession. This could be driven by significant increase in defaults following tighter conditions or other unintended consequences of the high-rate environment.

During such periods, interest rates are slashed by the Fed, volatility rises and a flight to safe and high quality assets like gold.

✅ Scenario: Stagflationary Recession | Investment Thesis for Gold: Strong

A stagflationary recession will be a tricky environment for the Fed. In this scenario, inflation remains high, and yet the economy slips into a recession. This could be driven by supply side constraints such as spike in oil prices.

The longer maturity bond yield would fall in this scenario causing a deeper inversion in the yield curve.

Structurally, a stagflationary recession has terrible consequences for an economy. Once again, in such environments, investors place their path in the gold over other asset classes.

Central Banks continue to pile into gold- what is the big picture?

In the meantime, Central bank gold buying made a blistering start to 2023. Central bank gold buying in H1 reached a first-half record of 387t. While Central Bank buying slowed in Q2, they are set to be net purchasers of gold once again this year.

Four central banks accounted for the majority of reported purchasing during Q1. The Monetary Authority of Singapore (MAS) was the largest single buyer during the quarter, followed by The People’s Bank of China (PBoC), Turkey and The Reserve Bank of India.

➡️ But, why are central banks buying gold at a record pace?

One of gold’s primary role for central banks is to diversify their reserves. Central banks are responsible for their nations’ currencies, which are subject to swings in value depending of the perceived strength or weakness of the underlying economy.

In times of economic turmoil, interest rates are often cut and governments increase their deficit spending. These actions increase the money supply, which puts downward pressure on currencies and risk future spikes in inflation.

Typically, gold will act as a natural hedge against inflation during these times, as gold is a finite physical commodity.

Furthermore, gold has an inverse relationship with the US dollar, which means that if the US dollar dips in value, the price of gold rises. This enables central banks holding gold to protect their reserves to stabilize their currency during times of market volatility.

As gold carries no credit or counterparty risks, it makes it one of the safest reserve assets worldwide, alongside government bonds.

My take: If central banks are buying gold to protect their currencies in the event of an economic turmoil in the near future, it builds the case for an impending economic slowdown or recession. The recession dialogue has been going on in the market for quite some time, yet, the US economy has only come to surprise on the upside. However, we may be at a turning point, where the lagging effects of monetary policy finally start to take shape and create the next downturn for which central banks are possibly preparing for.

Gold helps improve defensive strategies with improved returns, reduced volatility and drawdown

Let’s face it. Today’s market environment is not straightforward. It requires a deep, framework driven approach to objectively identify key economic trends to form distinct economic scenarios, in order to drive your investment strategy with confidence.

As investors assess the impact of restrictive monetary policy and the possibility of a recession, they often dial up defensive strategies in their asset allocation.

For example, a common approach is to rotate part of equity exposure into defensive sectors to limit losses during a significant market drawdown.

To illustrate this, the team at Gold.org compares two hypothetical defensive strategies.

Strategy 1: 20% of the equity allocation is invested in defensive sectors

Strategy 2: 10% of equity allocation is invested in defensive sectors and 10% in gold

The analysis shows that, over the past 25 years, Strategy 2 that includes 10% gold in portfolio would see highest annualized returns, reduced volatility and drawdown.

Let’s do a quick polling!

Thanks for reading!! If you found today’s piece insightful, please do not forget to leave a comment and share with your network. See you all on Thursday.

Amrita 👋🏽

Good stuff. Not sure tho if Im buying gold just cuz the Feds are buying...

Great coverage, thank you! Keep it rocking!