What is Google so afraid of?

As Google falls behind Microsoft in its AI innovation, it also sees decline in market share across all its products. With a renewed focus to drive cost efficiency, what does its next phase look like?

«The 2-minute version»

Ever since the launch of ChatGPT, Google seems to be caught in a sort of midlife crisis. What exactly is it so afraid of?

Falling behind? In the next innings of technological innovation, Microsoft is determined to be a winner. As Microsoft’s relationship with OpenAI became an overnight success, the company wasted no time in racing to integrate OpenAI’s ChatGPT into all of Microsoft’s products. Meanwhile, there is evidence pointing that Google is falling behind in its AI innovation as it called Code Red last year to bring Google’s founders Larry Page and Sergey Brin and help accelerate the company’s AI strategy.

To make matters more complicated: Google’s product adoption has been slowing across some of its flagship products such as Chrome, Google Search and Android OS.

Tough choices ahead: Last week, Google’s CEO, Sundar Pichai, underscored that the company was working towards ambitious goals in 2024 by investing in big priorities. Unfortunately, in order to create capacity for investment, Google’s employees are now in the line of fire, as the company has laid off 13K employees through 2023, with more role eliminations yet to come.

What’s next? The management has laid out a 7-point manifesto that outlines the company’s commitment to improve its velocity, efficiency, productivity and deliver durable cost savings in 2024, similar to Meta’ Year of Efficiency mandate in 2022. The company will be walking a very thin line between managing investor sentiment and employee morale while adopting a frugal approach to drive growth.

For most corporations, 2022 was the year of reckoning. Caught between supply chain constraints that showed no signs of easing and consumer demand, which was on thin ice, many corporations were forced to hunker down and prepare for a new world where inflation and high interest rates could very well be the new norm.

Silicon Valley’s growth-at-all-costs mantra did not seem to resonate anymore. Any company whose expenditures seemed exuberant was punished severely. But through 2023, the economy would continue to stay strong, inflation would show some more promise of receding, and innovation would steal the spotlight again in the form of AI and ChatGPT.

However, one company that has been wary of AI and ChatGPT is Google's parent company, Alphabet. Ever since the launch of ChatGPT, the search giant seems to be caught in a sort of midlife crisis warning against the rush to hastily adopt AI, fighting a proxy war for tech dominance while making “tough decisions” to lay off thousands of employees all at the same time.

AI is Google's next frontier no doubt. But there are consequences.

If this past year of AI has taught us anything, it is not that OpenAI is the hottest startup in a long time. In the battle for the next chapter of technological innovation, Microsoft MSFT 0.00%↑ is determined to be a winner. Microsoft’s Satya Nadella had already navigated the company in a new direction since 2014 by serving the enterprise with cloud computing infrastructure. But he still longed for the consumer technology reach that Google GOOG 0.00%↑ has. The Seattle-based company was the pioneer of personal computers, no doubt. But a series of missteps saw it slip up unprecedented opportunities that were eventually taken by Google’s Search or Apple's iPhone. By the end of 2022, Microsoft’s relationship with OpenAI became an overnight success, and the company wasted no time in racing to integrate OpenAI’s ChatGPT into all of Microsoft’s products.

A few months later, the world witnessed a rapid pace of announcements about their AI-based integrations from both the technology companies—Microsoft and OpenAI—leveraging their relationship to launch more AI-based products and features, while Google launched Bard, Search Generative Experience (SGE), and Gemini.

In a call with investors late last year, Google’s Chief Business Officer, Philipp Schindler, hinted at what Google might officially plan to do with its AI ambitions. He mentioned that Google had already begun testing new ad formats with SGE, while also adding that “it’s extremely important to us that advertisers still have the opportunity to reach potential customers along their search journeys.”

To most, it seemed like a no-brainer that Google would eventually find a way to embed its AI products with ads. But Schindler’s commentary was quite different from the measured words that had been trickling out of Googleplex all of last year. In February, the company’s executives called Code Red and asked Google’s founders, Larry Page and Sergey Brin, to step in and urgently help accelerate the company’s AI strategy . Later, in April 2023, when asked in a 60 Minutes interview about what keeps him up at night with regard to AI, Google’s CEO, Sundar Pichai, said, “We don’t have all the answers there yet, and the technology (AI) is moving too fast. So does that keep me up at night? Absolutely.”

Meanwhile, Google’s product adoption has been slowing.

Yes, the concerns about AI are real. But Google’s campaign to deploy AI responsibly could also threaten its dominance in technology. Could the tables have turned, putting Google in a position to catch up? Was AI a genuine threat to its overall Search & Ads business?

At the moment, it's too early to say how ChatGPT and AI will impact Google Search. But some early commentary from SEO (Search Engine Optimization) experts is starting to show why Google’s executives were right to issue Code Red last year. According to this SEO expert, Google’s search algorithm has been unable to keep up with the ferocious speed at which AI models learn and adapt, allowing unscrupulous sites to blatantly fill Google’s search results with plagiaristic redundancy.

Coincidentally, behavioral changes in online consumption patterns have also started to gradually shift the balance of user traffic away from the eponymous Google Search. According to this study, nearly a third of U.S. adults under the age of 30 regularly get their news from TikTok. Moreover, podcasts and newsletter platforms such as Substack are favorites among young audiences as an alternative source of news. A study by Insider Intelligence showed 66% of Gen Z podcast listeners use podcasts to stay updated on the latest current events.

The culmination of issues that AI could pose to Google’s search, together with the shifts in online information consumption, could have gotten Google executives extremely worried. These developments could probably explain why Google’s market share in Search has been stagnating at the 92% level for the last five years as can be seen in the left chart below.

To further complicate matters, fewer mobile phones with Android Operating Systems (OS) have been selling over the past 5 years, according to Statcounter, as seen in the right chart above. While the market share for other OS mobile phones largely remained stagnant after the pandemic, Apple’s iOS-powered iPhones gained significant market share in the same time period at the expense of Google’s Android, which saw its share fall by 5% over a five-year period. This looks consistent with recent news that Apple overtook Samsung as the world’s largest smartphone seller. Last month, we also looked at how Google’s Chrome was losing popularity among users as the preferred internet browser.

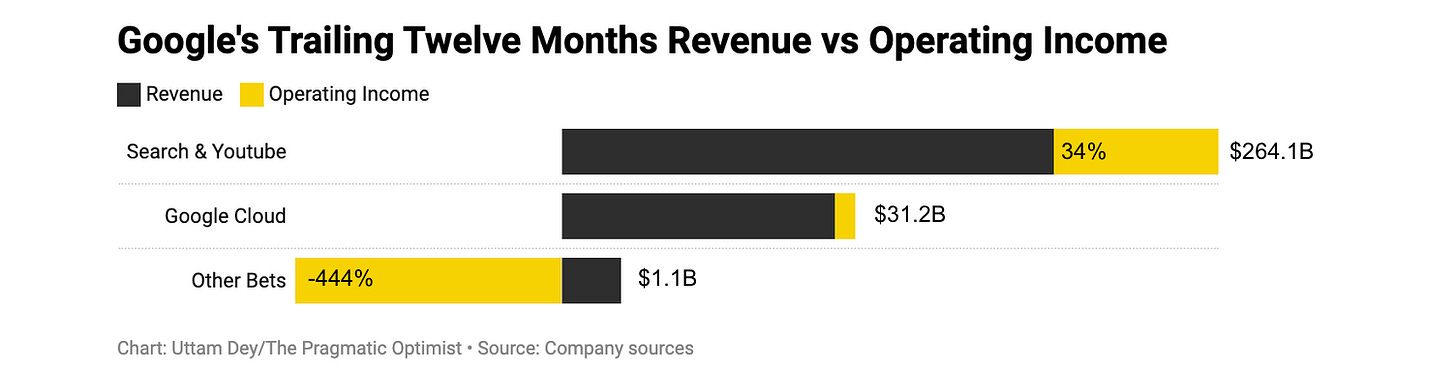

So far, it looks like just two products over the history of Google’s product suite have been meaningful enough to have their own separate line items in Google’s financial statements: Search & Youtube and Google Cloud. The rest are still grouped together in the Other Bets category, which till now has been losing boatloads of money for the Mountain View company.

It appears 2023's market share figures could have been the last straw to break the search giant’s back.

Google’s employees are now in the line of fire.

In an organization-wide memo last week, Google’s CEO, Sundar Pichai, underscored that the company was working towards “ambitious goals” in 2024 by investing in “big priorities." The memo also mentioned, “The reality is that to create the capacity for this investment, we have to make tough choices.”

So far, those “tough choices” have included layoffs and reorganizations in many of Google’s business units, including hardware, ad sales, search, shopping, and YouTube. According to data compiled by layoffs.fyi, Google has laid off about 13k employees, or about 6.7% of its workforce, through 2023. But Pichai’s memo went on to further warn that more layoffs would be coming as the company continued to make “specific resource allocation decisions throughout the year (2024)” with “role eliminations” yet to come.

In light of the uncertain impact of AI on Google’s products, combined with the perceived slowdown in some of Google’s most used products and changing online user behavior, cutting back on employee salaries is conservative corporate strategy at its best. With these insights at hand, Google’s management will be tasked with walking a very thin line: managing investor sentiment and employee morale while adopting a frugal approach to investing in its “big priorities” and work towards its “ambitious goals.”

Much like META 0.00%↑ Meta’s Year of Efficiency mandate in 2022, Google wants to demonstrate that it will work towards improving “company velocity, efficiency, productivity and deliver durable cost savings," as it pointed out in its recently launched 7-point manifesto for 2024. Therefore, to immediately solve issues such as efficiency and productivity, Google has turned to a common corporate panacea: the Revenue per Employee metric. Simply put, it is a ratio that roughly measures how much money each employee generates for the company.

While companies such as Apple AAPL 0.00%↑ and Microsoft demonstrated more prudence in hiring employees over a four-year period, the rest of the companies in the left chart doubled their workforce on average over the same time period. Most of these companies that doubled their workforce had severe problems proving how productive their employees were, i.e., how much revenue each employee was accountable for on average.

Besides, with the perceived productivity boosts that AI delivers to the organization or to the general economy, Google executives may already be bracing for a barrage of questions on productivity this year. All of this at a time when the company is working on big priorities.

I worked at Google from 2015-2023 and noticed a calamitous change in culture over that period of time. Employees can no longer speak freely (most importantly, in confronting leadership, as epitomized at once-famous TGIF meetings). This culture of accountability and radical anti-hierarchy was a check on the inevitable decline into BS-heavy corporate comms. Sundar killed this emblem of managerial accountability in late 2019. What's left is a risk-averse, feudal empire spanning hundreds (low thousands?) of directors and VPs fearful of losing their multi-million-dollar comp and equity awards for capably and dutifully managing their sprawling serfdoms. These serfdoms so often come into conflict with one another (despite having to coordinate on new product launches) that innovative, disruptive work often never ships. And even if you get past that coordination problem, if it could do *anything* to put the core search ad business at risk, it's seen as not worth it for the company. So to answer your question, I think it's part classic innovators dillemma, and part managerial paralysis.

My view is that the “big efficiencies from AI” are largely a mirage. This is not unique to Google. All the big companies need to tread a fine line between feeding investors what they want to hear (AI hype about productivity force multipliers), yet also face the reality that AI is severely lagging in delivering those productivity gains except in extremely menial jobs (largely NOT in big tech: copywriters, low level graphic design), is extremely expensive to train models, differentiate custom models (because proprietary data is harder to find and privacy regulations do exist), not to mention the extremely high hardware costs and the lagging of primary research innovation in AI.

In short, we’re in the buzzword trap, big tech needs to say “me too, look at me I’m leading the way” but there’s no easy path to unique differentiation, no proven business model, and therefore no quick path to revenue. Metaverse 2.0

Also, much of the primary research was done by Google scientists with the psychological safety of the zirp years that they wouldn’t be laid off. Short term thinking leads employees to busy work and metrics hacking, not deep R&D innovation.