Will retail earnings beat estimates? Are we in a bear bubble? Ron Barron's top 6 stocks

S&P 500 may rally to 4600 by the end of 2023. Will Walmart outshine its peers once again? Will Ron Baron's fund outperform indices once again in the coming decade?

««Tuesday Top 3 Picks- The 2-minute version»»

Pick 1: Is there a bear bubble in the S&P 500?

Overview: Tom Lee of Fundstrat thinks so. Meanwhile, Ed Yardeni of Yardeni Research believes that S&P 500 can rally to 4600 by year-end.

My take: If inflation, the 10Y US Treasury bond and earning estimates remain anchored, it is quite likely that we see a year end rally to at least 4600 from here on. You can check how I computed the estimated price target of S&P 500 based on “implied equity risk premium”.

Pick 2: Will consumer retail earnings surprise to the upside?

Outlook: Wall Street is pessimistic as data increasingly point to weak consumer traffic in stores, spending on electronics, appliances & furniture. Plus survey data point to fewer Americans who are looking to splurge big in the holidays season and higher number of consumers eagerly waiting for steep discounts.

My take: While Home Depot and Target are already pricing in revenue and earnings decline, they both sit at a precarious spot amidst weak housing demand, high mortgage rates and consumers who are cutting back on non-essential spending. Meanwhile, Walmart which has outperformed its peers has a lot of optimism going into the earnings call.

Pick 3: Did you know that Ron Baron’s Baron Partners Fund has outperformed returns on S&P500 and Nasdaq 100 since 2008?

Ron Baron’s secret sauces to success: Baron looks at competitive advantage, the quality of the management team and the valuation based on its own firm’s long term estimates to select companies to add to their portfolio. Baron takes a long-only approach and refuses to sell shares of companies he believes in.

His top 6 picks: Tesla, Arch Capital, Charles Schwab, Factset, MSCI & Guidewire.

1. Is there a bear bubble in the S&P 500? My take: A year end rally to 4600 is rationally possible.

According to Tom Lee: The only bubble in the stock market is in the pervasive bearish sentiment among investors, according to a Monday note from Fundstrat’s Tom Lee.

“The primary driver of cautiousness is the overall sense of gloom around a few factors,” Lee said, pointing to geopolitical risks, the rising federal debt pile, concerns of inflation staying above 3% and the current state of the commercial real estate market.

Tom Lee believes that there are reasons to be constructive in to year-end as economic momentum has slowed in a way that supports softer inflation. He also highlighted that positive seasonality in the last 2 months of the year, combined with continued bearish sentiment and positioning among investors should drive stocks higher into the end of 2023. Tom Lee has a year-end S&P 500 price target of 4825, representing potential upside of 10% from current levels.

According to Ed Yardeni: In the meantime, Ed Yardeni of Yardeni Research says that the “bond vigilantes'' have retreated, giving room for the S&P 500 to rally to 4600. He believes that the 10Y US Treasury bond yield at 4.5-4.6% will not crush the economy.

Going into 2024, Ed Yardeni believes that it will be a growth year where consumers continue to have employment gains and real wages increase driven by a surge in productivity.

According to The Pragmatic Optimist: I like to approach markets through the lens of risk premium. If I compute the “implied equity risk premium” of the S&P 500 based on its earnings growth expectation and expected 10Y bond yield, investors are earnings an additional premium of 4.6% to invest in the S&P 500 over the 10Y US Treasury bond. I can extend this to build a S&P 500 price target framework, which I have attached below.

When I overlay the S&P 500 price target framework onto the Economic Scenario Map, I have achieved the possible price targets for each economic scenarios.

If you are curious to learn more about equity risk premium and how to compute it to determine future S&P 500 price target, I had written about it in the post below.

Conclusion: My take is that if inflation, the 10Y US Treasury bond and earning estimates remain anchored, it is quite likely that we see a year end rally to at least 4600 from here on.

2. Will retail earnings surprise to the upside this week?

Walmart WMT 0.00%↑ , Target TGT 0.00%↑ and other retailers are set to report their earnings this week. But Wall Street is not optimistic.

Overview: Lower-income consumers have been hit hard by rising prices for basics. And those higher prices have made customers more selective when they spend on things they want rather than things they need.

What are analysts saying? UBS analysts in a research note on Thursday said that within the so-called softlines retail, that is, things like clothes, retailers were still cutting prices in an effort to clear items that shoppers don’t want.

“Our view is that the market underestimates the pressure on industry sales from US consumers’ decreasing ability and willingness to spend on apparel and footwear.”

“We expect sales trends to weaken over the course of Q4 2023. Plus, new October data increases our conviction that companies will experience more gross margin pressure than Wall Street’s forecasts, because it shows discounting increased on a year-over-year basis and inventory levels reached a new peak.”

Here’s some supporting data-driven evidence:

Consumer-traffic analytics firm Placer.ai found that consumer foot traffic fell in the third quarter in stores such Home Depot HD 0.00%↑, Target TGT 0.00%↑ , Walmart WMT 0.00%↑ and BJ’s BJ 0.00%↑.

Plus, October retail sales, excluding autos and gas fell by 0.08%, according to CNBC/NRF Retail monitor. The Retail Monitor is a joint product of CNBC and National Retail Federation based on 9B annual credit and debit card transactions. According to the data, consumer spending slowed in gas station sales, electronics and appliances, and furniture and home stores.

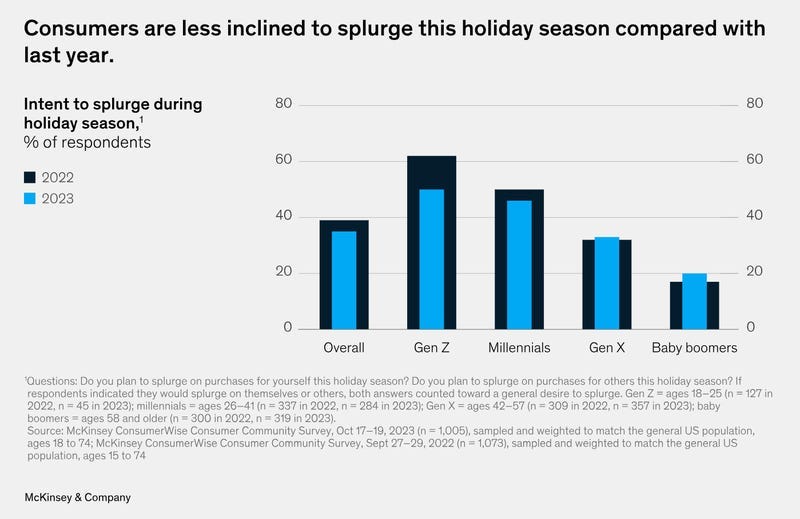

Adding further to the gloom, a McKinsey survey of 1000 US consumers found that just 35% surveyed plan to spend big this year, which is lower than 39% of people who said that they were willing to splurge ahead of the holidays in 2022.

A separate Morgan Stanley survey found that 69% of people are waiting for retailers to offer discounts before they start shopping. On average, consumers are looking for a discount of around 30%.

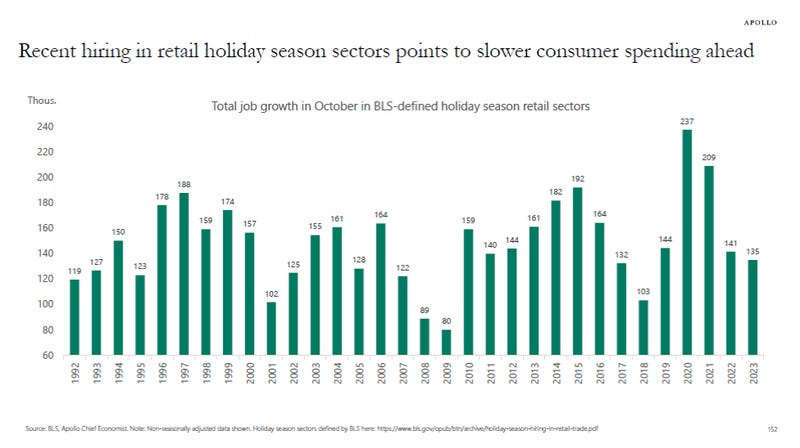

According to the Bureau of Labor Statistics, holiday hiring among retailers slumped to 135,000, the lowest level in about 5 years.

My commentary on a select 3 stocks in consumer retail:

Home Depot HD 0.00%↑ is pricing in an earnings and revenue decline of (11%) and (4%) respectively, on a year-over-year basis for the coming quarter. The company is still expected to grow its revenue by 1.9% in 2024 and its earnings by 5%. Home Depot sits in a precarious spot as a tight supply of available homes, higher prices and mortgage rates continue to raise questions about homebuyer demand. It will be important to understand how the management is optimizing its cost structure in the current environment and presents its outlook on the housing industry going into 2024, which will determine its financial projections and the future of the stock.

Target TGT 0.00%↑ reports Wednesday and it also sits in a precarious position as more-expensive essentials are leaving consumers with less room to spend outside the grocery station. The company is pricing in an earnings and revenue decline of (4)% in the current quarter. While the company is projecting flat revenue growth in 2024, it expects an earnings growth of 17% on a year-over-year basis. In other words, the company is optimistic that it will be able to bring its cost structure under better control, especially as it closes a record number of under-performing stores in the US this year.

Walmart WMT 0.00%↑ , on the other hand, has fared better in 2023 and the stock is up 18% YTD. Walmart sells more groceries, and the company has attracted both higher-income and lower-income shoppers seeking cheaper options. This is one of the few retail companies that are expected to grow their revenues and earnings in the current quarter on a year-over-year basis. The company projects revenue growth of 3.4% and earnings growth of 9.5% in 2024. Since Walmart has managed to outshine its peer in consumer retail, investors have bid up the stock as well. Walmart will have to continue to delight on the top and bottom line in order to retain its current valuation.

3. The Baron Partners Fund has outperformed the S&P 500 and the Nasdaq 100 over 15 years. Now, they are betting on these 6 stocks.

Overview: The Baron’s Partners Fund is up 486% over the last 15-year period. During the same time, the S&P 500 is up 201% and Nasdaq Composite is up 419%.

The secret sauce of success: Ron Baron, who founded Baron Funds in 1982, says that he has found success over the years by taking a long-only approach and refusing to sell shares of companies he believes in.

Concentration: The fund has 85% of its money in just 10 stocks, and the other 15% in another 10.

Diversification: The fund ensures that the few stocks are spread across various industries, which behave differently depending on the economic environment.

This means their selection process is crucial. Michael Baron, son of Ron Baron co-manages Barons Partners Fund and shared 3 things that they look for in companies when trying to assess if they have a path for sustainable growth.

Competitive Advantage: Why can’t others do what they are doing?

Management team: “We are betting on people. We need to know who the management team is, what motivates them, what’s their vision, where they have been successful in the past, and where they have failed in the past,” Baron said.

Valuation: Baron doesn’t always give credence to traditional measures like shorter-term price-to-earnings ratio. The team aims to value a company based on the firm’s own long-term earnings estimates.

Here are the 6 stocks that Baron Partners Fund is betting on at the moment:

Tesla TSLA 0.00%↑ : When it comes to competitive advantage, Baron pointed to Tesla’s expanding charging station network. Baron also believes in the company’s ability to continue scaling up production and thinks that the auto industry is at a “tipping point” of adopting EVs. On a number of traditional measures, Tesla is considered to have a very high valuation. However, Baron believes that the stock is undervalued over the long-term given the breath of its potential revenue streams.

Arch Capital ACGL 0.00%↑ : Arch Capital is an insurance company. Baron said that their prices continue to rise, and they should benefit from high interest rates. Arch Capital has a fairly low 12 month Forward PE (price-to-earnings) ratio.

Charles Schwab SCHW 0.00%↑ : Similar to Arch Capital, the firm should benefit from higher interest rates. However, Schwab is down big this year, amid fears surrounding bank failures. It dropped 30% in a matter of days in March and is down 34% YTD (year-to-date). But Baron says he is confident that the firm will survive the pressure.

Factset FDS 0.00%↑ & MSCI MSCI 0.00%↑ : These 2 financial services firms provide data and analysis products. According to Barron, both companies are entering new areas of growth in terms of providing more products and services, which should improve their average revenue per user.

Guidewire GWRE 0.00%↑ : Guidewire is a software company for insurance firms and according to Baron, their profit margins and revenue should increase as they have invested in cloud technology.

However, the fund is down (28)% since 2022, underperforming the S&P 500 and the Nasdaq 100. Do you think the fund will find its footing and outperform the indices in the coming decade?

Always hard to predict market movement, even more by a specific date. But if we are really in a bull market, we should test all-time highs at 4,800 in coming months. That would be my target, but 4,600 will be a key resistance on the way!

Amazing insight! Thank you