Your favorite social media app might ask you to pay up soon. Will you?

The face of social media is changing as we know it. Faced with slowing user growth, declining ad revenue and a saturated smartphone market, the industry is forced to rethink its business model.

At a Glance

With the entire industry’s model being threatened, many social media apps are pivoting away from their “free-forever” model and dabbling with “pay-to-play” models.

Apple’s privacy settings roll out allowed users to take control of their privacy, making it harder for social media companies to serve targeted ads, thus impacting their revenue model.

Further complicating the situation is the saturation in the smartphone sales market as well as slowing user growth across all social media platforms.

To make matters even worse, industry forecasts now indicate growth having topped off in social media ad spend.

Social media companies are facing a harsh environment with investors and employees asking hard questions while execs are left pondering the fundamentals of the business that got them to this point.

This post covers strategic pilot initiatives some companies have adopted and explores the success so far that the likes of Meta, TikTok, Snapchat and X(formerly Twitter) are making in pivoting away from the “free-forever” model while diversifying their revenue streams.

Why did the social media industry drop its “free-forever” promise?

“It’s free and always will be”.

That was the tagline on the Signup/Login Page for Facebook. Not anymore. Say “goodbye” to the era where you could set up your profile on social media platforms and use their services to the fullest for free.

As economic uncertainty grows, brands are slowing down their social media ad spend to conserve budgets. At the same time, the updates to Apple’s ad tracking is making it increasingly difficult for social media platforms to demonstrate return on advertisers’ investments.

As a result, social media companies are seeing a slowdown in their revenue growth. This is causing the latest shift where the industry is increasingly resorting to offer subscriptions to monetize their user base to offset the decline in revenue growth from ad spend.

But, will users actually pay up for the subscription service fees?

And if they use multiple social media platforms, will they be willing to pay subscription fees to all of them?

Finally, will subscription revenue meaningfully offset the declining ad revenues that social media companies are battling with?

Has social media ad spend plateaued in the US?

Social Media ad spend is projected to reach $85 billion by 2027 as seen in the chart below. That is 4x the ad spend from a decade ago in 2017.

So, why the doom and gloom?

If we look at the period between 2017-2021, social media spend in the US rose by an average of 31.1% every year.

In 2022, ad spend grew by 5.6%. In 2023, that number is supposed to grow by 8.52%.

This is far from the 30%+ growth rate we experienced until 2021.

The key takeaway is while the age of roaring social media ad spend is perhaps behind us, it still remains robust. But, for social media companies, that had seen stellar growth until 2021, such a slowdown in ad spend growth is bad news.

Social Media App User Growth is also slowing

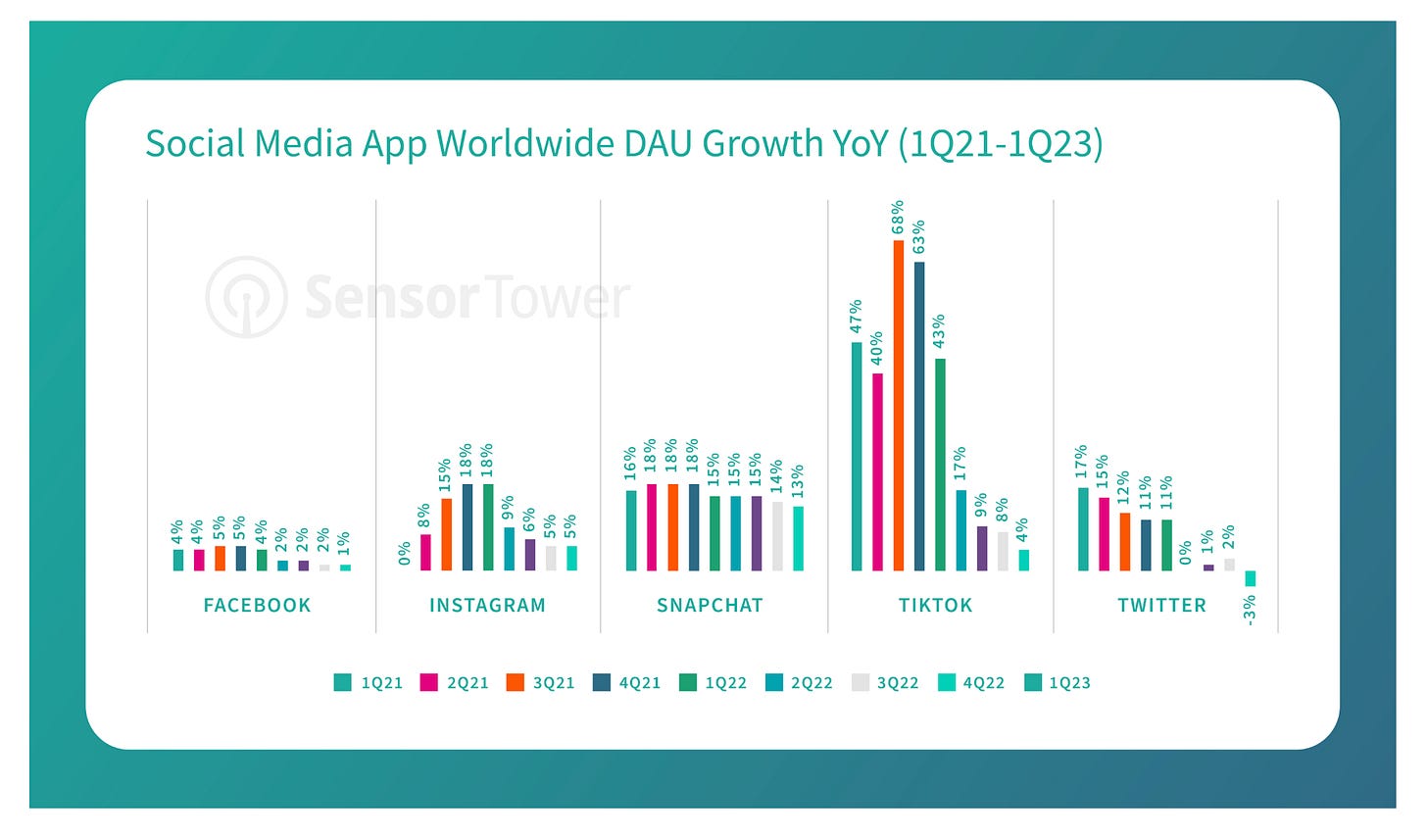

User growth on social media apps has also continued to decelerate from pandemic-fueled highs reached in 2020 and 2021.

Sensor Tower data indicates that Snapchat was the sole social media app to post double-digit YoY growth in users, with Daily Active Users (DAUs) accelerating by 13% YoY in 1Q23. The same quarter in 2022 was close, with 15% growth.

As the penetration of smartphone users reaches saturation and opportunities in prospective markets slows, there is an urgent need for social media companies to bolster user loyalty and increase user monetization via a combination of ads and subscription.

Comparing Social Media’s Subscription Plans & Features

In the table below, I have outlined the Cost, Availability and Features for Meta, Twitter, Reddit, Snap and Tumblr’s subscription offerings.

Except for Meta Verified, all other social media’s subscription plan is available worldwide, with Snap being the cheapest plan so far.

The Big Question: Why would someone pay to access their social app?

So far, most social media apps seem to be promoting verification and authentication as the two main advantages that users get in exchange for signing up for a monthly subscription plan. They argue that their subscription plans will help alleviate user concerns over bots or disinformation, at the same time protect free speech and facilitate an open flow of ideas while doubling down on privacy.

Elon Musk is convinced that subscription plans are the best foot forward towards providing users with an authentic user experience. Recently, in a sit down with Israel’s Prime Minister, he claimed that “the single most important reason to charging users a small monthly payment is to combat vast armies of bots”. He further elaborated that by charging everyone on the platform, bots would go out of business and eventually shut down since the cost of maintaining a bot increases.

Today, users increasingly face the prospect of paying up to access their favorite social networks that they had become accustomed to using for free.

That begs the following fundamental questions:

What will users expect from Twitter, Facebook, Instagram, and Snapchat in the newly reconstructed social media ecosystem that is anchored by subscription fees?

How do users perceive the quality of the features and the price-points of the subscription plans?

How likely are users to opt-in for the new subscription services from Twitter, Facebook, Instagram, and Snapchat?

In a recent study by HBR, respondents were surveyed (on Facebook, Twitter, Instagram and Snapchat) across dimensions of users’ expectations, perception of app value and their likelihood of becoming a paid subscriber in the future. The survey scored the users on a scale of 1-10 (1 being the lowest and 10 being the highest). Here’s what they found:

When asked to rate the subscription plans of their favorite social media apps, respondents indicated they would receive the most perceived value from Twitter(score=7.37) and Snapchat’s(7.38) plans had they subscribed.

Interestingly, college-educated, conservative, younger male, and high-income users were some of the types of respondents that perceived the most value out of the subscription plans.

When asked about the likelihood to subscribe to their social platforms, Snapchat (score=7.27) and Instagram(7.21) users showed the most propensity to subscribe to services, followed closely by Facebook(7.16) and Twitter(7.14).

Here too, college-educated users & conservatives showed the highest likelihood to subscribe.

The same survey pointed out that Snapchat’s user base is primarily college-educated between the age group of 18-29 while Twitter’s user base is generally college educated between the ages of 35-65. On the other hand, Instagram boasts a user base primarily of influencers, artists and lifestyle brands while everyones’ mother, father, aunt and uncle seem to be on Facebook.

The responses in the HBR survey is just one of the examples that encapsulates every social media exec’s reason to be optimistic about charging users a small monthly gate-fee to access its platform.

Will these business model pivots work?

Still early days, but it appears social media companies are starting to see some traction in this pivot. In a call with investors this July, Snapchat CEO Evan Spiegel announced that its Snapchat+ subscription service has reached 4 million paid subscribers in its first year since launching. Granted, this number represents a paltry 1% of its 397Mn Daily active Users but the revenue collected from these paying subscribers buoyed Snapchat’s YoY revenue by 4%. Still, he tried to set expectations with the investors on the call that he isn’t expecting subscription fees to completely replace ad revenue yet.

The results don’t seem to be very different at X (Formerly Twitter). Outside experts estimate that only about 300,000 daily active users subscribed to Twitter Blue as of January this year. Twitter last publicly reported having more than 230 million users.

The much larger, Meta could have 12 million subscriber within about a year, Bank of America said in a note, potentially generating additional revenue of $1.7 billion.

The Bottom Line

Social Media companies need a selling point. They no longer will be able to completely rely on ad revenue as their primary source of income. It is clear that the path to the industry’s success will lie in diversifying their revenue streams.

Subscriptions may be one solution but user adoption risks remain. Some like, Elon Musk, are aware and are heavily testing newer ways to bring revenue. Musk’s own Twitter is looking at ways to charge developers to access its Twitter API.

While much is still to be known, I will leave you with the following thought:

Something to ponder upon: Will the social platform with the most users (Meta) be the best at the subscription game? Or the one where users enjoy spending most of the time (TikTok)? Or perhaps the platform that is used more for work than play (Twitter)?

Let’s do some quick polling!!

I hope you enjoyed the post. Please let me know your thoughts or feedback in the comments section below. In the meantime, I would be very grateful if you choose to further support me by sharing the post with your network.

I’ll see you all tomorrow.

Amrita

The best financial advice I was ever given was the old cliché my mom warn me about, “ Nothing is free”

Thank you!

When something is free, you are the product ... love that saying and I might be willing to pay if the platform ads value and fits my ways ... no platform will ever be perfect, but some might deserve a payment.