An inverted yield curve has always preceded a recession. Is this time different?

The yield curve has been on a rollercoaster ride over the last 3 years. While the latest inflation print point to higher for longer rates, the prophecy may turn to be self-fulfilling once again.

Welcome back everyone to another edition of The Monday Macro.

As the US celebrated President’s Day and Canada celebrated Family Day yesterday, I decided to send this post out on Tuesday this week.

In the last Monday Macro post, I had conducted a poll asking you to recommend a macro topic that you would want me to write about. The most popular topics were the yield curve and emerging markets. (If you have more suggestions, please leave them in the comments below).

So, in today’s post, we will talk about the yield curve and its prophecy of successfully predicting recessions since 1950.

As always, we will start with the basics and then dive into deeper details to understand how to interpret the transformation of the yield curve to understand the future direction of macroeconomic conditions and most importantly answer the most pressing question: Is the prophecy going to come true or is this time different?

So, let’s grab a coffee and a muffin and dive right in. ☕🧁

««Monday Macro- The 2-minute version»»

Overview: Inflation unexpectedly reaccelerated in January. And then, retail sales declined more than expected. This is leading to a very interesting phenomena in the yield curve, where we are seeing a steepening in the 6M-2YR part of the yield curve reflecting “higher for longer” sentiment, while the 2YR-10YR is further inverting which indicates slower growth and inflation ahead.

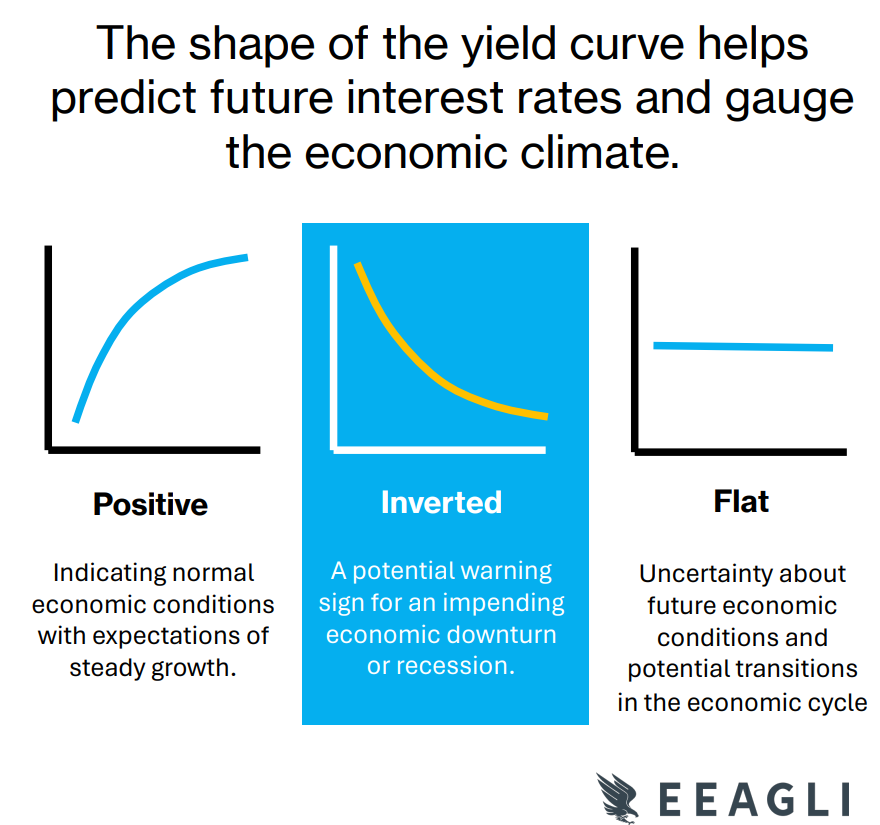

Why it matters? You see, a yield curve is basically a graph that plots the interest rates on US government bonds with different maturing dates and essentially, the shape of the yield curve helps us understand the current state of borrowing conditions and the market's future expectation of growth and inflation. Generally, a “positive” yield curve reflects steady economic growth prospects, while an “inverted” yield curve reflects the opposite.

Plus: Historically, an inverted yield curve has always preceded a recession every single time since the 1950’s, making it Wall Street’s favorite indicators to predict future recessions. We can thank Cam Harvey, a professor at Duke University for that.

So, where is the recession? While the yield curve had the sharpest inversion in over 40 years, a recession has not arrived. In fact, the yield curve started “bear steepening” in Q3 2023 after the US economy proved to be far more resilient than expected.

Is this time different? The large divergence between monetary and fiscal policy is disproportionately holding certain parts of the economy stronger than others, thus making it very hard for the Fed to cut rates as “core services” inflation continue to remain elevated.

On top of that: Rising risk from corporate refinancing and possible debt defaults (hint: commercial real estate), coupled with an emptying barrel of reverse repos at the Fed, as well as rising consumer credit card debt will continue to put downward pressure on longer-term yields, further inverting the yield curve.

Prophecies, often self-fulfilling? The longer rates remain high, the more difficult it gets for the Fed to pull a “soft landing” where the yield curve “bull steepens” without causing a recession, hence rendering the prophecy true.

Let’s set the stage!!!

Inflation unexpectedly re-accelerated in January.

The January Core CPI print in the US rose 0.4% month-on-month, vs. an expectation of 0.3%. On one hand, while durable and non-durable goods continue to deflate (prices are declining month-on-month), the stickiest part of the inflation basket, which is core services re-accelerated once again.

This isn’t good news.

While both durable and non-durable goods inflation had spiked during the pandemic as supply chains were constrained, they resumed their deflationary trend (resembling pre-pandemic conditions), as soon as supply chain conditions eased, allowing for more production capacity to sufficiently meet demand.

On the other hand, Shelter (a.k.a Housing) inflation, which represents 40% of the core CPI basket is still elevated. While I expect to see a disinflationary impact to the overall Housing component in core CPI as rent of primary residence continues to normalize, this seems to be a slow process.

But, ultimately, the Fed will only declare victory against inflation when they see sufficient evidence of moderation in the “services excluding shelter” component of the CPI basket. Unfortunately, prices of core services in the US, excluding shelter prices, re-accelerated from 0.2% to 0.9% month-on-month.

At the same time, retail sales tumbled 0.8% in January, much more than expected reigniting doubts about the resilience of the US consumer. Remember, US consumer spending accounts for roughly 70% of US GDP.

The higher than expected inflation print is forcing bond investors in the US to push out their expectations for the Fed to cut rates in the 2024 calendar. This is leading to a very interesting phenomena in the yield curve, where we are seeing a steepening in the 6M-2YR part of the yield curve reflecting “higher for longer” sentiment, while the 2YR-10YR is further inverting which indicates slower growth and inflation ahead.

What do I mean by that? And why should you care?

Assuming, you took the red pill, let’s dive right in. 👇🏼👇🏼

*if you don’t know the reference of the blue and the red pill, please stop everything you are doing and go watch The Matrix. That is far important than this post and your life will never be the same again.*

Introducing the Yield Curve- The basics

A yield curve is a graph (line) that plots the interest rates on US government bonds with different maturing dates.

FYI: Those of you who are pros, you can skip this section and move onto the next one. For those, who need a quick recap, you are in the right spot.

The shape of the yield curve helps us understand the current state of borrowing conditions and the market's future expectation of growth and inflation.

A positive yield curve is where longer duration bonds have a higher yield compared to shorter duration bonds.

The higher interest rate on the longer maturity bonds reflects steady growth prospects for the economy, where inflation is growing but well-anchored within the desired range.

As a result, investors demand higher term premiums on longer duration bonds to protect themselves from interest rate risk associated with time.

An inverted yield curve is where longer duration bonds have a lower yield compared to shorter duration bonds.

The lower interest rates on the longer duration bonds reflects slower economic growth prospects in the future along with a declining trend in inflation.

As a result, investors are more comfortable settling for lower term premiums because interest rate risk is perceived to be lower than current levels as the economy is expected to slow.

➡️Remember, the value of a bond yield (in this case, the US Treasury bond) is a reflection of the interaction of the following components:

Economic growth expectations

Inflation expectations

Term premium

If the economy is expected to grow from current levels, the yield curve is positive with higher term premiums to compensate for interest rate risk, associated with growing inflation. If the economy is expected to slow down from its current levels, the yield curve is inverted with lower term premiums as growth and inflation are expected to decline.

Makes sense?

The yield curve has been on a rollercoaster ride…I’m not joking

So, now that you understand the basics of a yield curve, let’s take a look at the transformation of the yield curve since 2021.

James Eagle, Founder of Eagli, has created this superb animation to visualize the transformation, that I have linked below, so press play, and you will know that I am not joking about the “rollercoaster” reference.

To summarize some of the key points in the journey of the yield curve so far:

Early 2021: The yield curve steepened in February 2021, driven by optimism as pandemic-related fears faded with vaccine rollouts and massive economic stimulus continued to boost spending.

2022: The Federal Reserve's interest rate hikes, starting from near zero, flattened the yield curve. Investors expected these measures to slow inflation and the economy, accepting lower returns on long-term debt.

2022-2023: Late 2022 saw the yield curve's deepest inversion since 1981, with short-term yields topping long-term ones, hinting at a potential recession.

Late 2023 to now: The US economy's resilience, marked by a strong labor market and moderating inflation, led to a re-steepening of the yield curve. To clarify, the yield curve is still inverted. It is just that the depth of the inversion has narrowed.

Now, over the last few months (or more), you may have been hearing terms like “bear steepening”, “bull flattening” and such, more often, especially when experts come on CNBC and other news channels to talk about the yield curve and its impact on the stock market.

Turns out, they are pretty important concepts to understand the direction of the macroeconomic environment.

So, in the next section, we will take it a notch higher to understand *in simple English* what these terms actually mean. So the next time you are watching the finance segment on CNBC, you are on top of your game. Or even better, you can now confidently explain these concepts to your non-finance friends and how it connects together to better understand the macroeconomic environment.

Are you ready?

Taking a notch higher to dive into some yield curve technicalities

There are 4 main yield curve dynamics that you need to know of. These dynamics display the “transformation” of the yield curve throughout the economic cycle.

Bull Flattening: A yield curve “bull flattens” when the front-end yields remain more or less anchored, but long duration yields decline, leading to a flatter curve, as can be seen below.

Example: Think 2016, when the Fed funds rate was already at close to 0%, but the long-end yields declined, reflecting weak global growth.

Bull Steepening: This occurs when the front-end yields drop faster than longer-end yields, leading to a steeper curve. This phenomenon can take place when a yield curve is positive or inverted. Let me explain.

When the yield curve is positive, it reflects increasing nominal economic growth. In this environment, should the Fed cut interest rates to support economic growth, the yield curve “bull steepens” as easy monetary policy at the front-end will likely heat up nominal growth resulting in higher long-end yields.

Example: Think late 2020 or early 2021, when the Fed pinned interest rates at 0%, and added accommodation via QE (Quantitative Easing) reflected investor optimism for faster economic growth ahead.

On the other hand, when the yield curve is inverted, the yield curve can also bull-steepen. In this case, the story will be different as bull-steepening will likely take place to reflect an immediate slowdown in economic growth, thus putting pressures on the Fed to cut interest rates.

Example: From here onwards, if we start to see weak economic data in the form of weak consumer spending, corporate earnings, etc., along with declining inflation, this will give enough reason to the Fed to cut interest rates faster. This will cause front-end yields to fall faster than longer-end yields, causing the depth of the inversion in the curve to narrow and possibly turn into positive territory.

Bear Flattening: A yield curve “bear flattens” when short-term rates are raised, possibly to cool down a heating economy. Meanwhile, the longer-end yields stay anchored, as they anticipate that the rise in interest rates at the front-end is likely to dampen growth into the future.

Example: 2022 was the year of bear flattening, when the Fed started hiking interest rates to fight one of the toughest inflation periods in this century.

Bear Steepening: This takes place when longer-end yields rise faster than the front-end yields. This too can take place when the yield curve is positive or inverted. If the yield curve is already positive, a bear steepening could indicate that the economy is heating up faster than anticipated signaling the Fed to start reigning in growth by raising interest rates (front-end) to manage price-stability. The higher yields at the longer-end reflect the higher term premiums that investors demand to hold long duration bonds.

Example: During Q3 2023, the yield curve started bear-steepening, when the Fed projected to keep interest rates anchored for longer than expected as the US economy continued to demonstrate its resilience marked by strong consumer spending, labor market and corporate earnings. This drove bond investors to aggressively sell off longer duration bonds, demanding higher premium, narrowing the inversion between the 2YR-10YR (part of the yield curve) from -77 basis points (b.p.) to -20 b.p.

So, if the inverted yield curve is steepening once again, does it mean that we have averted a recession? Let’s find out.

An inverted yield curve has always preceded a recession. Is the prophecy going to come true or “is this time different”?

The yield curve has had the sharpest inversion in over 40 years. Yet, there is no recession.

Cam Harvey, a professor at Duke University and the director of research at Research Affiliates had first revealed in 1986, that an inverted yield curve had successfully predicted the past seven recessions since 1950.

According to Harvey’s model, when yields on the 3M Treasury bills stay higher than those on the 10YR bond for three months, it triggers an official inversion, where a recession is likely to follow. The indicator has preceded each of the last eight recessions and has not produced any false positives.

So, where exactly is the recession? 🤔🤔🤔

Starting Q3 2023, we saw the yield curve start to “bear steepen”, with long-term rates rising faster than short-term rates. This was driven by a stronger than expected labor market, increasing consumer confidence and robust consumer spending. Not to mention the favorable liquidity condition, where the government issued shorter duration debt to take advantage of excess liquidity parked in the Reverse Repo Facility at the Fed, thereby not harming the bank reserves.

Plus, the number of economists predicting a recession has fallen from 63% in October 2022 to 39% in January 2024 as per Wall Street Journal survey of economists.

But here’s the thing.

When the yield curve “bear steepens”, longer-term yields rise and this has a large and rapid tightening effect on the real economy: 30-year mortgage rates rise, corporate borrowing rates climb across the curve causing financing to become tougher and negative mark-to-market effects are amplified (hint: more pain for regional banks). This is why in all three previous instances (September-November 2000, May-June 2007 and September-November 2018), rapid late-cycle bear steepening marked the end of the “this time is different” experiment and ended up causing severe distress to economies.

Plus, today, the Fed funds rate of 5.25-5.5% is significantly higher than the 6-month annualized Core PCE, meaning that the Fed’s monetary policy is restrictive at the moment with positive real rates. The last time, “real rates” (Fed funds rate- Core Inflation) were this high was back in 2007.

At the same time, the tailwinds that were helping the US economy avoid a recession all this time, are likely to turn headwinds in 2024. Let me elaborate.

On the household front: consumers that were once flush with cash have depleted their savings and increasingly tapped into credit card debt. With delinquencies on the rise and a labor market that is not as strong as it used to be, this will weigh down on consumer spending moving forward, like we saw with the decline in retail sales last week.

On the corporate front: While rising interest rates have been a boon to large corporations with strong balance sheets, smaller companies have not been so fortunate. 49% of the Russell 2000 universe is saddled with floating rate debt, vs. just 9% for the S&P 500. Small-cap companies also have a Net-debt to EBITDA ratio of 2.5, compared with 1.3 for the S&P 500. Finally, nearly half of the small cap universe is unprofitable. Add to the mix, the ticking bomb of commercial real estate, there is a growing probability of real stress, if not distress, in the leveraged credit market.

On the liquidity front: Up until now, the $2.5T of pent-up liquidity in the Fed’s Reverse Repo Facility played a pivotal role in absorbing new shorter-dated Treasury debt issuance, thus keeping bank reserves mostly intact. But what happens when the RRP barrel is empty?

Complicating matters further (to a certain extent) is the wider-than-normal divergence between loose fiscal policy (which is stimulating) and tight monetary policy (which slows things down) is contributing to wider-than-normal divergence between the performance of different economic sectors. In particular, it results in a wider-than-normal gap between sectors that are directly or indirectly on the receiving side of the deficits (for example: businesses that rely on spending from upper and upper-middle class spenders) vs. those that are the most sensitive to interest rates and thus are the most hurt by tight monetary policy (for example: commercial real estate). Not convinced? Take a look at the image below.

And then ironically, because public debt levels are so high, tight monetary policy actually contributes to looser fiscal policy by increasing the overall interest expense of the government, which goes to various entities in the economy and strengthens some of the sectors that are not sensitive to interest rates.

Last week, we saw the 6M-2YR part of the yield curve steepen by 14 b.p. This was driven by a higher than expected inflation print, which re-priced and re-shuffled the timing of the Fed’s interest rate cuts down the curve.

For context: The market was pricing in a 50% probability of the first interest rate cut in March 2024, a month back. Now, the probability has moved down to 8.5%. In other words, there is practically no chance of a rate cut taking place in March. In fact, the probability of the first rate cut taking place in May has also reduced severely from 83% a month ago to 33% now.

At the same time, we saw the 2YR-10YR part of the yield curve re-invert by (5) b.p. from -29 b.p. to -0.34 b.p., as retail sales came in lower than expected, foreshadowing a possible slowdown in consumer spending ahead.

Remember: the 2YR bond yields are very tied to short-term monetary policy decisions, so the Fed has a relatively strong control on that part of the curve. Meanwhile the 10YR bond yields can be thought of as the market-implied long term path for growth and inflation plus term premium.

Moving forward, the longer the divergence in monetary and fiscal policy keeps core services inflation from moderating at levels where the Fed declares a victory, the higher the chances of interest rates to remain where they are.

Last month, Cam Harvey told Business Insider that a recession is probable in 2024.

“The average lead time of inversions for the last four recessions has been 13 months, meaning a recession could be looming. Given the Fed’s actions of keeping rates too high for too long, I think the probability of a recession has greatly increased.”

Given the tightness of the financial conditions, I believe that we should start to see more weakness ahead in economic data prints, similar to what we saw with retail sales last week. This will once again cause the yield curve to invert further, squeezing financial conditions once again.

And by that time, if inflation has moderated per the Fed’s liking, the front-end of the yield curve will decline (bull steepening) indicating that the Fed cuts are on their way, leading to easier financial conditions. If the Fed is able to pull that off smoothly, without the US economy tipping into a recession, well then, this time will indeed be different. Else, the legacy of the prophecy continues.

That’s all for today, folks. Hope you found this post useful.

What do you think about the prophecy; will it come true or will this time be different?

Please leave your thoughts in the comments section below.

Amrita 👋🏼👋🏼

Very nice write up. I am sensing a little more pessimism creeping in. Welcome to the dark side. We’ve got cookies!

Thanks for the explanation of the yield curve! Many articles reference it clearly having no idea what it is.