Bitcoin & gold outperform the S&P 500, while investors remain under-allocated in gold. Is the investment thesis favoring bitcoin over gold?

With the US economy sending mixed signals, investors seek shelter in gold & bitcoin. While bitcoin has had a landslide victory YTD, both offer portfolio diversification and higher long term returns.

At a Glance

As the US economy swings back and forth from the “soft landing” to the “hard landing” narrative, investors search for opportunities to find shelter and protect their wealth from unknown outcomes.

During this economic cycle, investors have chosen to seek shelter in gold and bitcoin. The 10Y US Treasury bond which was previously a safe haven asset is currently out of favor as investors are unsure about the future path of inflation.

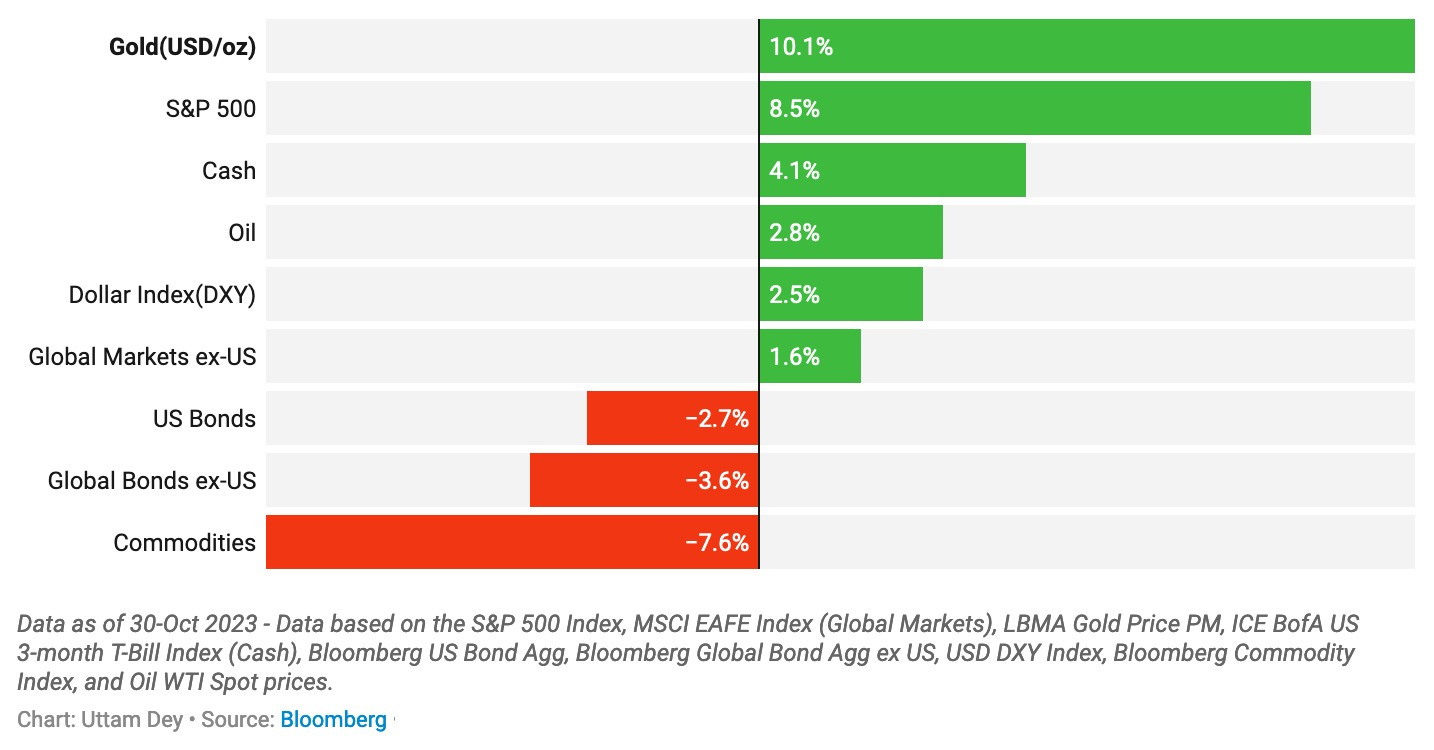

While gold and bitcoin have both outperformed the returns of S&P 500, bonds, cash, USD and commodities year-to-date, bitcoin has had a landslide victory.

While gold generally performs well when interest rates have peaked, a portfolio allocation to gold and/or bitcoin has historically produced higher returns, compared to a traditional 60-40 portfolio.

In the meantime, while bitcoin has similar characteristics to gold, it also has added benefits of divisibility and transparency built into its design, that gold does not offer. This could garner even more adoption among retail and institutional investors, as they may choose to allocate a larger portion of their funds to bitcoin over gold.

Inflation in the US remains at elevated levels at 3.7%, despite the Fed raising interest rates at the highest level and at the fastest pace in over 40 years. The longer the Fed keeps interest rates at higher levels, the greater the probability that liquidity dries up faster in the financial markets, triggering a credit event that would ultimately lead to a recession.

Plus, there are emerging signs that suggest that consumer spending may be slowing moving forward in the US economy, as CEOs of some of the largest companies in the S&P 500 revise down their earnings forecast for the remainder of the year. However, in all of this, the labor market has managed to remain exceptionally resilient.

The complexity of the current environment has thus given rise to 2 contradictory and popular economic narratives which are driving a lot of debate in the financial markets. On one hand, the supporters of the more optimistic “soft landing” narrative believe that the Fed should stop hiking rates and possibly start to lower rates in order to fuel the next stage of economic expansion. On the other hand, proponents of the “hard landing” narrative understand that the Fed needs to keep rates higher for longer to quell inflation, but insist that this would ultimately lead to a recession.

During such confusing times, investors usually flee to safe assets such as the US Treasury bond and gold to protect their wealth. However, during this economic cycle, the 10Y US Treasury bond TLT 0.00%↑ has faced one of the toughest sell offs in history, down -17% YTD, driven by investors who are anticipating higher inflation and interest rates for longer. Instead, investors have resorted to gold and bitcoin to hedge their wealth against a possible recession or a stagflation in this economic cycle. In fact, bitcoin has outperformed all asset classes year-to-date, defying earlier objections that the asset class would see drawdowns as interest rates rise.

In this post, we will take a look at the investment case for gold and bitcoin across different economic scenarios. I will also demonstrate how a portfolio allocation to gold and bitcoin can help diversify risk and drive higher adjusted returns over a long period of time. Finally, we will take a look at some of the possible reasons why bitcoin is outperforming gold in this cycle.

Investors are under-allocated in gold despite gold up 10% YTD, outperforming the S&P 500 & other asset classes.

YTD, Gold is up 10% to $2001/oz.

In H1 2023, gold rose 5%, closing June at $1921/oz. Behind gold’s outperformance in H1 was a combination of a relatively stable US dollar, interest rates and continued demand from central banks.

H2, on the other hand, did not start out positively for gold, as higher yields and a stronger US dollar took center stage. However, the dynamics have rapidly shifted since the beginning of October 2023, as we saw gold bounce up 10% during the month, despite 10Y bond yields anchored at elevated levels.

Despite the strength in gold, it remains severely under-allocated in portfolios. In fact 71% of advisors have little to no exposure to gold. The chart below from Bank of America shows that investment portfolios have yet to take steps to boost their gold exposure.

In an earlier post, I had built a scenario analysis, to demonstrate the investment case for gold across different economic scenarios. In the scenario map below, you can see that the investment case for gold is strong as long as the 10Y US Treasury bond yield remains anchored or declines from current levels. This indicates that gold would outperform in an event of a deflationary recession or a stagflation.

Here is my scenario analysis framework that I use to make my decisions for adding Gold and Bitcoin: