“Don’t bet against America”- Will this statement hold true in this decade?

How the US became the center of the new world order, the evolution of credit and innovation cycles over the past 80 years and where we stand today?

Welcome back everyone to another edition of The Monday Macro.

Something I have been thinking about lately, is the idea of American Dynamism, a concept that embodies the spirit of innovation, progress and resilience that drives the United States forward.

We are quite familiar with Warren Buffet’s infamous statement “Don’t bet against America”. At the same time, the largest venture capital firm Andreessen Horowitz is actively investing in founders and companies that support the national interest. And since the $53B Chips and Manufacturing Act has been passed, we have seen an exponential growth in capital spending in AI.

There are a lot of things to be excited about.

However, there is no denying that the US is getting more and more divided. We are seeing that manifest across the divergences in monetary and fiscal policies, business performance across large and small businesses and growing wealth gaps between the haves and the have nots.

In order to determine whether this decade belongs to the US as the center of the world order, we have to first take a trip down the memory lane to see how the US world domination came to be and how the cycle has evolved over time to get to where we are today. That is Part 1 and what this post is about.

So, let’s grab a coffee and a muffin and dive right in. ☕🧁

Let’s set the stage!!!

The US Fed Chair Jerome Powell told lawmakers on the Senate Banking Committee on Thursday last week that mounting bad commercial real estate loans will likely cause some bank failures, but don’t pose a risk to the overall system.

At the same time, Powell remains convinced that the US economy is strong and in better condition than any other major world economy. This is what he had to say that illustrates his confidence: 👇🏼👇🏼👇🏼

“The economy is growing at a healthy, sustainable, solid, strong pace. We’re doing the best of anybody. We’ve got the strongest growth and the lowest inflation of the advanced economies.”

He is not mistaken.

While the UK, Germany, China and Japan have tipped into recession, the US economy continues to outperform, despite interest rates at an all-time high in this decade. This makes you wonder, what is so special about the US economy, that is allowing it to remain resilient for so long? And an even more important question; how long will this exceptionalism last?

But first, a quick history lesson. 👇🏼👇🏼👇🏼

A new world order begins. This time, with the US at the center.

The year was 1945. The deadliest war ever fought had just ended. During the war, an estimated 40-75M lives were lost, which was roughly 3% of the world’s population and it cost close to $4-7T in current dollars in lost productivity.

Despite the sheer magnitude of devastation, the US came out a big winner on a relative basis, because the country had sold and lent a lot before and during the war. Plus all of the fighting took place off the US territory, so the US wasn’t physically damaged and US deaths were comparatively low in relation to most other major nations.

What followed afterwards was that the winning powers- the US, Britain and the Soviet Union sat down to create the new world order, which included carving up the world into geographic areas of control and establishing new money and credit systems.

Those countries in the US camp, which consisted of 44 countries, gathered in Bretton Wood, New Hampshire to make a monetary system that put the dollar and gold at the center of it. The Soviet Union also created its own monetary system built around its currency, the ruble, which was a much less significant monetary system.

The Bretton Woods Agreement put the dollar in the position of being the world’s leading reserve currency. This was logical because the US was the richest and the most powerful country by far at that time. It had earned its dominance via large exports and by the end of the war, it had amassed the greatest gold savings ever.

Take a look at the chart below that illustrates how the US had an outsized share in global exports, compared to the UK, China and Russia.

But exports are only half the net-income picture. It is exports minus import spending that makes the net income of a country. The next chart shows US exports of goods and services minus US imports of goods and services since 1900. As shown, the US sold more than it bought until around 1970.

So, following a brief post-war recession, a new cycle began with the new monetary system, where the US economy and markets would be very strong for many years to come.

Between 1945 and 1947, 20M people were released from the armed forces. At the same time, pent-up demand fueled a consumer spending surge. Cheap mortgages were also available for veterans, which led to a housing boom. Demand for labor grew as profit making activities returned. Exports were very strong. Simultaneously, stocks were cheap because those that went through the 1930’s Great Depression and war years were risk-averse, so they preferred a safe income stream to a risky one.

This set of conditions created a multi-decade prosperity and bull market in stocks that reinforced New York’s dominance as the world’s financial center, bringing in more investment and further strengthening the dollar as a reserve currency.

These investments drove improvements in education and led to the invention of fabulous technologies, such as Apollo 11’s moon landing which showcased American technological prowess and inspired generations, setting the stage for future space exploration and scientific advancements

It’s not always been a smooth ride. But it’s about relative strength. Let me explain.

Over the last 80 years of world domination, the US economy has gone through numerous cycles of booms and busts.

Think about the prosperous era of 1945 into the 50’s which was driven by productive debt growth that ultimately led to a weakening of the fundamentals in the 1960’s when the US trade balance started to worsen. Ultimately, the Bretton Woods monetary system broke down when President Nixon broke the US’s pledge to allow holders of paper dollars to turn them in for gold.

This led to an inflationary and troubled 1970’s as the world moved to an unanchored fiat monetary system and the dollar fell in value against gold and other currencies. There was a massive acceleration of money and credit, inflation, oil and commodity prices that drove interest rates up and caused a run into hard assets like real estate and gold for most of the decade between 1971 to 1981.

In order to establish price stability, Volcker announced that he would constrain money growth at 5.5% (M1). Following one of the most bone-crushing monetary tightening cycles that led to astronomical volumes of deflationary debt restructuring by non-American debtors, inflation rates fell leading to the excellent performance in stocks, bonds and other assets in the 1980’s.

Since the early 1990’s, we have been through three economic cycles that brought us to where we are now. These include the one that peaked in the 2000 dot-com bubble that led to the recession that followed, followed by the one that peaked in the 2007 bubble that led to the 2008 global financial crisis, and finally the one that peaked in 2019 just before the 2020 pandemic-triggered downturn.

Yet, 80 years later, the S&P 500 has consistently outperformed the rest of the world. Take a look at the chart below that illustrates what I am talking about.

The best possible explanation of such outperformance, despite multiple short-term credit booms and busts is tied to the concept of a nation’s “relative standing” in wealth and power that Ray Dalio talks about in his book, “The Principles of Dealing with the Changing World Order”.

Dalio believes a nation’s relative strength is composed of the following factors: 1) education 📚, 2) competitiveness 🏆, 3) innovation and technology 🤖, 4) economic output 📈, 5) share of world trade 🚢, 6) military strength 🥷, 7) financial center strength 🏦 and 8) reserve currency status 💵.

The chart below shows the relative strength of 11 leading empires over the last 500 years.

While you can see that the US has declined in relative strength during the course of its world domination when it comes to the quality of education, competitiveness and share of world trade, it still leads the rest of the world when it comes to its robust pace of technological innovation, which is driving strength in its financial markets, ultimately ensuring the reserve status of the US dollar as well as its military prowess.

Think about it 🤔🤔🤔

🖥️Since the late 1960’s-early 1970’s, we have seen the birth of microprocessors that reshaped modern life by revolutionizing computing and empowering the development of personal computers, smartphones and countless other electronic devices.

🛜This was followed by the internet that profoundly transformed global communication, information sharing and commerce, which ushered in

📱the “mobile” era with the iPhone that redefined communication and software interaction and inspired numerous consumer and enterprise products.

🤖Today, we sit at the cusp of another innovation cycle, powered by Generative AI that looks to bring down the marginal cost of creation to zero and will penetrate across numerous industries and redefine the future of productivity.

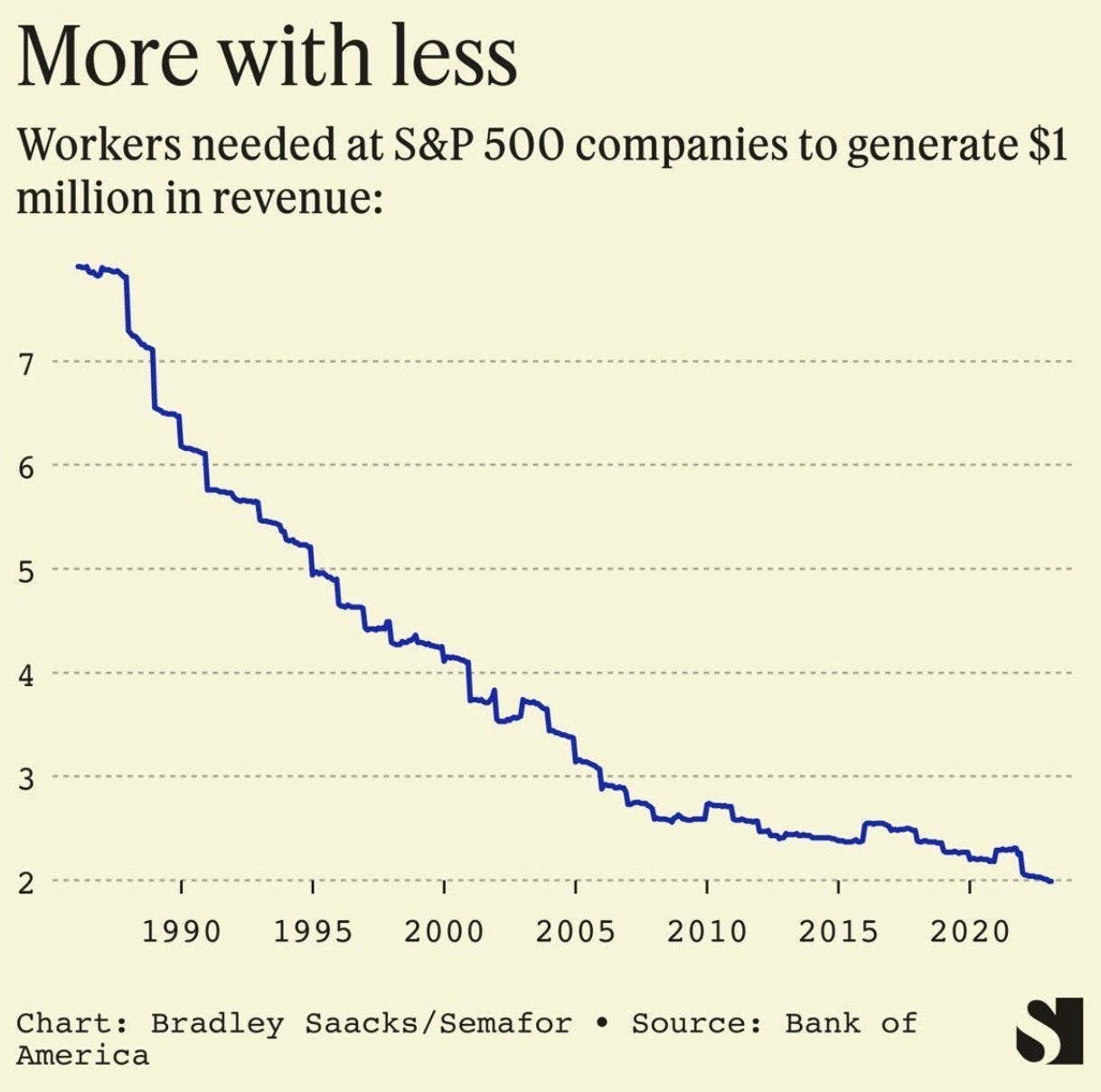

The point is, no matter the numerous short term credit boom and bust that the US economy endured over the last 80 years, we saw a tremendous growth in technological innovation that led to a productivity boom as can be seen below, which allowed us to gain access to cheaper goods and services, improve our living standards and live longer.

Remember that human productivity is the most important force in causing the world’s total wealth, power and living standards to rise over time.

However, a nation’s capacity to endure future credit booms and busts is dependent on how efficiently it gains in relative strength compared to other nations and the effectiveness with which it can drive desired outcomes using the right combination of monetary and fiscal policies.

This brings us to the latest cycle that we are in. 👇🏼👇🏼👇🏼

We entered a new economic cycle in 2020 post the Covid bust. How are things shaping up?

Since the pandemic, we have seen one of the fastest expansions of the US Fed’s balance sheet as it monetized government debt to extend $2.2T of fiscal stimulus at a time when the US (and global) economy shut down post Covid.

As a result, we saw one of the fastest recoveries in the US economy, although it came at the cost of one of the highest inflation rates since the 1970s. The Fed initially mistook it for "transitory," only to come back at it with full vengeance with the most aggressive tightening cycles, where it has raised interest rates 11 times over the last 2 years to 5.25–5.5% and reduced the size of its balance sheet.

However despite the magnitude of tightening, the US economy has managed to avoid a recession thus far, given a resilient US consumer amidst a strong labor market, robust corporate balance sheets (true for mostly large companies) and favorable liquidity conditions.

Moving forward, I believe that these tailwinds will turn into headwinds, the longer interest rates remain at elevated levels, thus increasing the probability of the US economy slowing down from its current levels.

So, what does this all mean?

The way that Ray Dalio explains a cycle of rising and declining nations and their reserve currencies is that it begins with a new order order that usually comes after a war, in which

➡️there is an environment of peace, prosperity and productivity in which debt growth is allocated productively to produce incomes that are greater than debt service, so most debts get paid back, equities do well and the society gets rich, which leads to

➡️ excessive debt growth to finance speculation and over-consumption, which results in incomes being inadequate to service the debt, which results in

➡️ central banks lowering interest rates, which produces greater wealth gaps and more over-indebtedness, until

➡️ over-indebtedness becomes so large, which

➡️produces severe economic downturns with large wealth gaps that lead to internal conflict and leads to

➡️lots of debt monetization (printing of money through QE), debt restructuring, that

➡️create financial, economic and political vulnerabilities for the leading nation relative to other nations that lead to wars and produce the new world order.

As per Dalio, the US is roughly 75% through the cycle +/-10%.

The evidence presents itself, when we look at federal deficit relative to GDP. In fact it was during 2016-2017, when the federal deficit as a % GDP started to rise during an economic expansion.

As unusual as it it is, this is quite typical for a late stage cycle economy, especially, when the government’s interest expense continues to grow the more it borrows to service its debts, as is the case in the US, where it is expected to top defense and Medicare spend in 2024.

This phenomenon makes policy making extremely tricky. Take the Fed’s interest rate tool for example, which is designed to quell inflation that is caused by a surge in bank lending, not by fiscal deficit. In fact, raising interest rates to quell a fiscal-driven inflation will have negative outcomes for inflation, as the government would need to borrow more at higher rates to service their debt, which creates a vicious cycle.

At the same time, the gap between the haves and the have-nots is widening more than ever before, leading to internal friction in values. Here is a statistic that is going to blow your mind. It is the top 50% of US income households that hold 94% of assets , while the bottom 50% of US income households have just 6% in assets, yet carry 50% of total US household debt. As a result, despite the higher interest rates, the top 50% of US income households are actually better off, especially given the fat interest income they are earning on their assets.

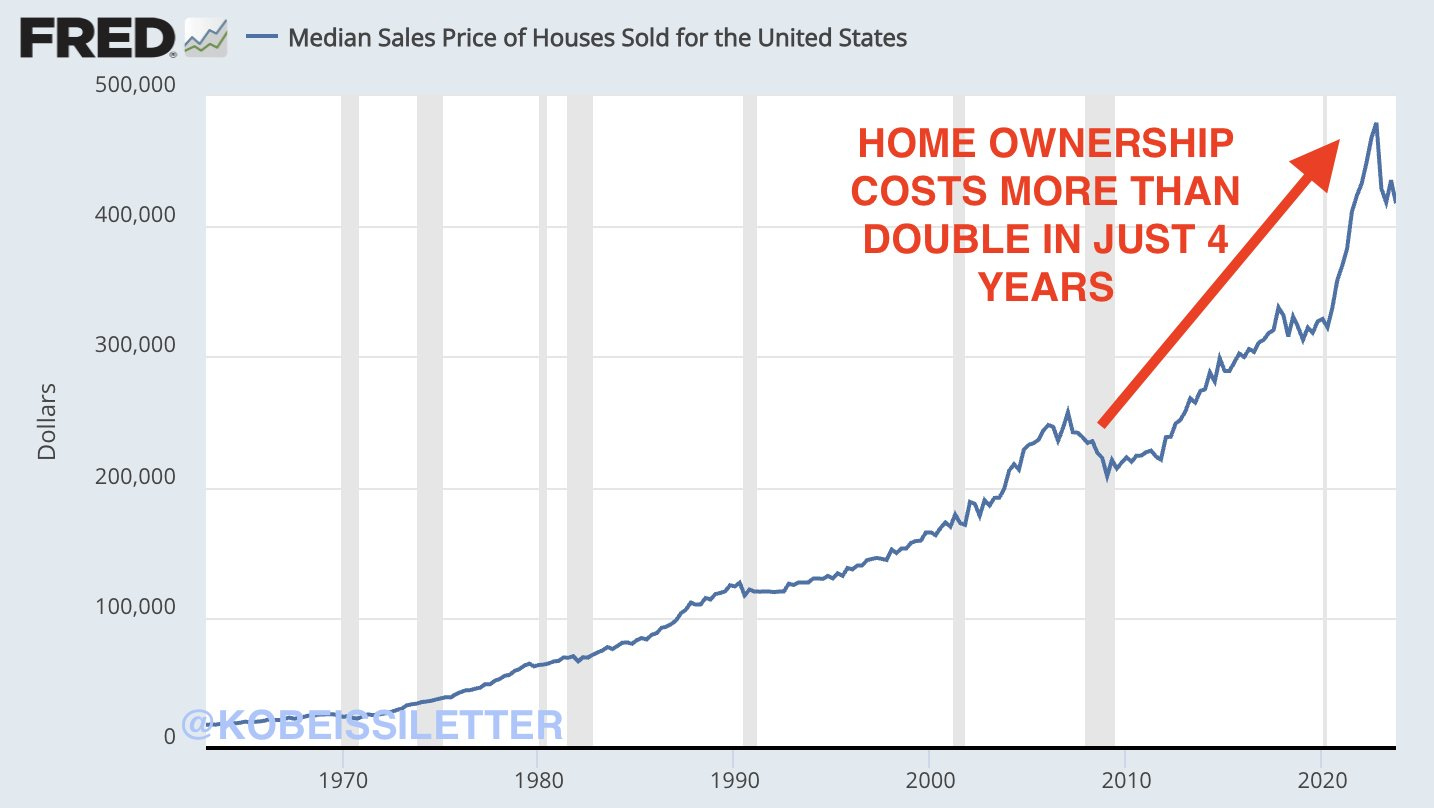

This divide between the haves and the have-nots is especially manifesting itself in housing affordability, where it is nearly impossible for the average American to buy a home today, with millennials and Gen Z’ers feeling the brunt of it.

It’s not just households, it is corporations as well. As the S&P 500 makes new all time high, the small-caps have underperformed. And there are reasons for it.

➡️47% of the Russell 2000 universe is saddled with floating rate debt, versus just 9% for the S&P 500.

➡️Small companies have a Net Debt/EBITDA ratio of 2.5x, compared with an average of just 1.3x for the S&P 500.

➡️Nearly, half the small cap universe is unprofitable 😨

Not to mention, the growing geopolitical tensions, especially between the US and China. In August 2023, Washington announced it would limit US investments in advanced technology in China, including AI, quantum computing and semiconductors, to protect national security and to prevent American money from being potentially used to fund the military.

In Q3 2023, venture capital deals in China involving a US investor totaled about $300M, compared with $2B the same period the previous year, according to PitchBook.

Simultaneously, Mexico and Canada eclipsed China to become America’s top trading partners last year, accounting for 15.7% and 15.3% respectively of US trade, compared to China’s 11.1% according to the latest US government data.

But is this reversible?

That’s what we will dive into in Part 2, now that we have the foundation of how it all started and where we are now. I think the most important question is how we adapt and change by asking ourselves and honestly answering some difficult questions.

For example, while the capitalist profit-making system allocates resources effectively, we now need to ask ourselves, “who is it optimizing these efficiencies for?” and “what should be done if the benefits are not broad-based?”, “will we modify capitalism so that it both increases the size of the pie by increasing productivity and divides it well?”

These questions will increasingly come to the forefront as I strongly believe that the US economy is at the cusp of a productivity boom, driven by AI, that will fundamentally challenge and change the status quo of work, entrepreneurship and the economics of profit-making.

So, stay tuned for Part 2!!!

That’s all for today, folks. Hope you found this post useful.

Please leave your thoughts in the comments section below.

Amrita 👋🏼👋🏼

This is really good content! Thanks for such helpful information. You explain these concepts in a way that is really easy for me to understand. Much appreciated!

Having recently read Michael Hudson book Super Imperialism it’s hard to be optimistic for USA. We are probably going to either have a civil war or Washington DC will be nuked. Government at all levels are 45 percent of USA economy now

My late father said “when I was a boy people were self reliant nowadays everyone has their hand in your pocket”. The culture of the country has changed. It’s become a rentier society dominated by FIRE sector which is great for Warren Buffet as is an insurance guy

Middle class is disappearing etc me have grifters in the corporate suites and in the government offices

Trillions are wasted every year by psychopaths in politics

Of course will keep importing people to extract from them for a generation or two.

Karl Polanyi the great socialist was correct the USA no longer has free land so those days are gone

It needs to invest in its citizens not just import people

That means universal healthcare and education

All USA will have is universal homelessness

lol