Friday 5: Who thinks a US recession is coming? Millennials & GenZ's pick up Gig work, Ethereum struggles with user retention & more...

A survey & a visual to gauge the probability of a US recession, a Bank of America report to show how millennials & GenZ's are picking up gig work once again, 2 consumer spending trends & more...

At a Glance

📉 Will the US get hit with a recession in 2024? On one hand, the Fed shares a bright outlook for the economy and on the other hand, more than 50% of all consumers and CEOs of businesses are preparing for a recession.

👩🏻💻 Gig work is again picking up as wage growth moderates. Millennials and Gen Z’s are increasingly picking up extra gigs to shield themselves against the rising cost of living. Read below to find out how well do the different types of gig work pay.

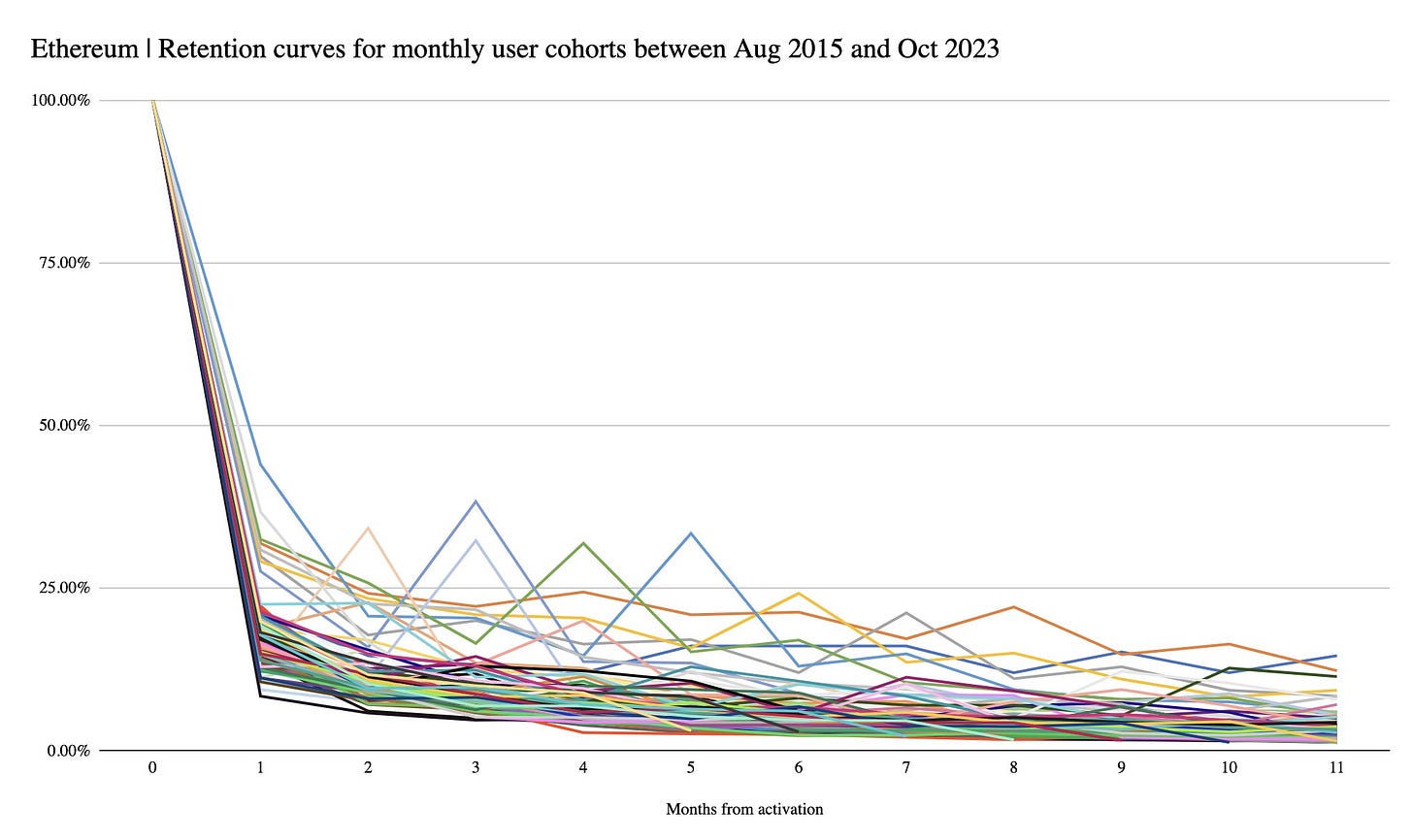

🌐 Did you know that only 7% of users who first interact with Ethereum will continue to do so after a year? Higher “gas” fees, security concerns and rising competition could be contributing factors dampening user engagement.

🍗 Americans love their chickens and an average person consumes twice the amount of chicken today than they did in the 1970s. Investors have spotted the trend and are generously rewarding restaurant chains, such as Wingstop that primarily sells chicken wings.

👜 Is the future of luxury retail less glittery? While Personal luxury retail sales in the US are projected to reach $125B by 2026, overall luxury spending is expected to keep slowing. This is because the category of “aspirational” shoppers have likely depleted their excess savings post pandemic.

📉 Will the US get hit with a recession in 2024?

For much of the last year, recession fears have been building up against a sharp rise in interest rates and market uncertainty. However, the US economy has continued to defy the bold recession prediction, thanks to a resilient labor market and analysts have started pushing out their time horizon for the anticipated recession. As we approach the end of 2023, the most anticipated recession has still not arrived.

The Fed continues to share a bright outlook for the economy, one that will continue to grow with a resilient labor market, despite higher interest rates. However, the yield curve remains inverted and an inverted yield curve is often a precursor to an impending recession. In fact, the yield curve spread between the 10Y and 3M Treasury bond would suggest that there is a 61% chance of a recession in the 12 months ahead.

Meanwhile, a survey of economists by Wolters Kluwer shows that approximately 48% of economists surveyed are calling for a recession in the next 12 months.

Across Main Street, consumers share a more cautious sentiment, with over 69% saying that a recession is likely in the next year, based on a Conference Board survey.

Yet corners of America’s C-suite have grown more positive. Goldman Sachs recently dropped its recession forecast to a 15% likelihood, while Bank of America gives it a 35-40% chance.

On the other hand, 84% of CEOs are preparing for a recession in the next 12-18 months, a drop from the 92% seen in Q2 2023.

So, on one hand, we have the Fed who doesn’t believe a recession would occur, while more than 50% of all consumers and CEOs of businesses are preparing for a recession.

👩🏻💻 Gig work is again picking up as wage growth moderates. Millennials and Gen Z’s are increasingly picking up extra gigs to shield themselves against the rising cost of living.

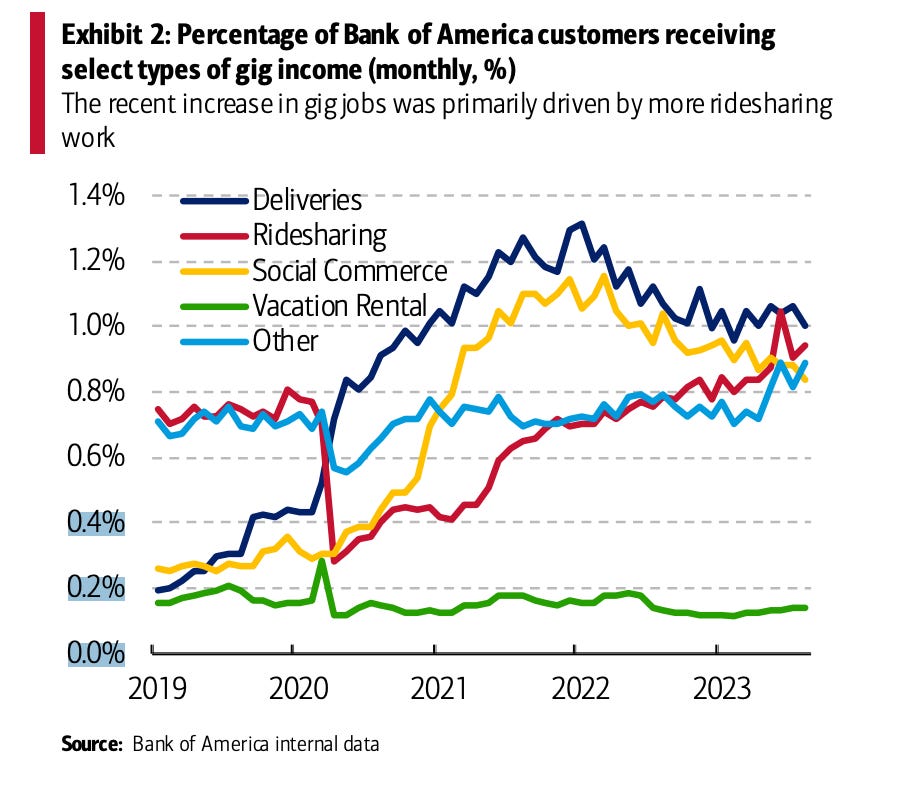

Earlier this year, Bank of America had conducted a study, where it found that workers were leaving the gig economy as a tight labor market and strong wage growth attracted them to traditional jobs. Now, 9 months later, things have shifted again.

With wage growth for traditional jobs moderating, the latest Bank of America’s consumer report sees an uptick in gig jobs over the past few months. Specifically, the percentage of Bank of America customers who received income from gig platforms through direct deposit or debit cards reached 3% in August 2023, up from 2.7% in April 2023.

As the chart below shows, the recent increase in gig work was primarily driven by more ridesharing work. Meanwhile, delivery jobs have stabilized since the start of the year and the number of customers engaging with social commerce marketplaces continue to decline.

While more people are performing ridesharing work full-time, average monthly ridesharing gig income has gone down slightly. The graph below shows the average monthly income by type of gig platform according to Bank of America’s internal data, and it suggests that the average pay for ridesharing gig jobs have been on a downward trend over the last year. That said, compared with the same month in 2019, average monthly pay for ridesharing gig jobs was still 14% higher in August 2023. Outside of ridesharing, two types of gig jobs have seen a noticeable rise in average monthly pay over the last year; vacation rental and deliveries.

The increase in gig job participation seems to be driven by younger generations, with millennials continuing to represent the biggest cohort.

As of August 2023, 4.3% of millennial customers received income from gig platforms. Next was GenZ, with 3.6% of customers seeing gig income inflows in August 2023.

According to data from the Federal Reserve, Baby Boomers hold the greatest wealth across generations at $73T in Q3 2022, eight times that of millennials. In addition to different wealth levels, younger generations are more exposed to the rising cost of living as they tend to move more frequently, either for work, to accommodate expanding families, or more broadly, as they seek more space as they age.

🌐 Ethereum is struggling with User Retention. Higher “gas” fees, security concerns and rising competition could be contributing factors to dampen user engagement.

Did you know that only 7% of users who first interact with Ethereum will continue to do so after a year? That is what the latest Token Terminal data shows. This statistic means that roughly 93% of new users will stop using the platform to transfer tokens or deploy smart contracts within a year.

Token Terminal, an analytics platform, posted a graph showing fast-falling interest over time on data collected between August 2015 and October 2023.

Ethereum first launched in July 2015. The ledger is the first to allow users to launch decentralized applications (dapps). These protocols are powered by smart contracts in a generally secure environment guided by globally distributed validators.

Ethereum is popular because of Ether (ETH), its native currency, now the 2nd most valuable coin after Bitcoin. Beyond this, the chain anchors decentralized finance (DeFi), non-fungible token (NFT) activities and others.

While billions of transactions are taking place on the platform every year, the network however is struggling with on-chain scalability. At peak, the blockchain can only process 15 transactions every second. Subsequently, transaction fees are relatively higher, since the demand for block space is also high. In fact, the fees associated with the Ethereum network are higher than the fees observed in competing networks, such as, Solana or TRON, which are more scalable.

Therefore, it is possible that high “gas” fees are contributing to a dampening of user engagement on the Ethereum platform. Furthermore, challenges related to user interfaces, hacks of protocols deploying on Ethereum and rising competition might also explain why users are giving up on Ethereum.

🍗 Americans love their chickens and an average person consumes twice the amount of chicken today than they did in the 1970s.

Americans eat way more chickens and actually, significantly fewer cows than they used to. Here’s a graph that shows the per capita meat consumption since 1960.

As the chart shows, per capita beef consumption has significantly declined over the last few decades. Meanwhile, per capita chicken consumption has skyrocketed over the same period. In 1970, the average person ate around 50 pounds of chicken a year, today, it is more than 100.

From an environmental perspective, chicken farming does not produce as much greenhouse gas as beef farming. However, beef production is somewhat less industrialized than chicken farming. Many cows raised on a modern American farm get to spend some time outside, compared to most farmed animals.

Most chickens, on the other hand, spend every minute of their short lives in crowded, ammonia-filled indoor spaces, as we saw in an undercover investigation into a farm that supplies chicken to Costco.

However, this is not stopping consumers from buying more chicken than ever before. In fact, Wingstop, an American chain of restaurants that primarily sells chicken wings is seeing outsized demand amongst its consumer base. And investors, well aware of the customer purchasing patterns and Wingstop’s growing revenues, are generously rewarding the company’s stock, thus driving up its valuation.

We covered this topic yesterday, where we discussed how restaurants and fast-food chains are competing for customer loyalty by leveraging technology to streamline operations and boost their customers’ digital footprint.

How fast-food chains are using technology to drive customer loyalty and higher spend?

At a glance: The pandemic changed how consumers order food from their favorite restaurants. This ushered in a new age for the restaurant industry as it rapidly embraced technological innovation to create alternate channels for their customers to buy food from their restaurants. Curbside pickups and mobile app orders were some of the early innovations.

👜 Is the future of luxury retail less glittery?

2 weeks ago, LVMH (Moët Hennessy Louis Vuitton), the world’s largest luxury group, reported less-than-stellar results after years of lavish consumer spending on its iconic brands like Louis Vuitton and Dior. LVMH’s fashion and leather goods, its biggest category, saw sales grow 9%, well below the 20% growth it posted in the first half of the year. Sales for its wine and spirit brands like Hennessy and Moët took a 15% tumble.

While Personal luxury retail sales in the US are projected to reach $125B by 2026, overall luxury spending is expected to keep slowing.

High-end brands rely heavily on spending from China, where the economic rebound isn’t taking place at the desired pace. Last month, Chinese luxury spending at home and abroad was only 80% of 2019 levels, and experts think that a full recovery could take a while.

In the US, brands like Gucci’s Kering and Cartier parent Richemont said that aspirational shoppers have dried up their savings and are increasingly resorting to discount retailers. In Europe, wealthy shoppers who have splurged this summer have cut back too.

According to Deloitte’s Martin, American consumers are feeling the squeeze the most in the middle tier, where the “aspirational” lives. “If you’re choosing to buy food or gas or summer camp (places) for your kids or things that are going up as the economy changes, you probably don’t need that extra $500 bag.” Those who shop for $7,000 bags are less concerned, she adds.

Earlier this year, Kering and Ferragamo were among a slew of brands that made a clear distinction between their aspirational shoppers, who are spending less, and high-net-worth individuals (HNWIs), who have not altered their spending patterns.

While Aspirational luxury consumers are pulling back their spend, they still merit attention as more than 30% of them still plan to splurge, according to a study by McKinsey. In the meantime, brands are adjusting their strategies to target high-net-worth individuals (HNWIs) in order to ensure financial success amid a weakening US economy. They are also future-proofing their businesses by diversifying their strategies in order to tap Gen Z shoppers while retaining their already-loyal following.

That’s all for today. Have a great weekend everyone.

Amrita 👋🏽👋🏽

We are in a recession. The metrics have been altered over the years in order to hide the facts. Unemployment calculations have dubious metrics to hide true unemployment. The powers that be don't want us to know the truth because when we know we are in or approaching a recession, human behavior adapts accordingly. When families cut spending, economies are effected. John Williams has an excellent site where he compares the economic stats calculated today with how the stats were calculated prior to the changes. shadowstats.com

I also recommend the book I was required to read while at University studying Business. How To Lie With Statistics.

My personal opinion is the recession started 2 weeks ago. I am involved in an engineering business that supplies equipment to large companies mainly. Typically we feel economic changes prior to most and business activity has slowed considerably since the beginning of the month.