Friday5: CPI Inflation rose more than expected, Kellanova's Pop-Tarts turn 60, Pinterest predicts 2024 trends & more...

Plus, Lululemon, Abercrombie, Crocs and American Eagle Outfitters lift their sales outlook driven by robust holiday spending. Meanwhile, AI is likely the tech theme of the decade.

««Friday5- At a Glance»»

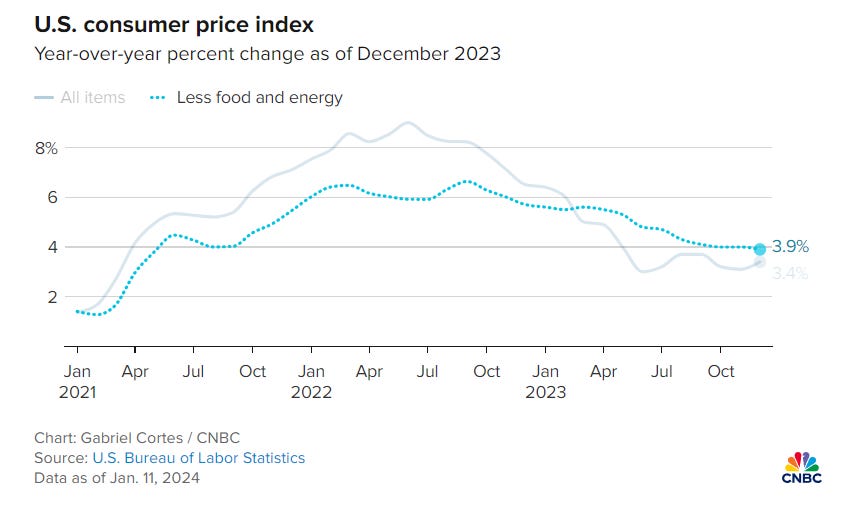

🛒Consumer prices rose more than expected, while US consumer inflation expectations fell to the lowest level since January 2021. Meanwhile, Fed funds futures are still pricing in 6 rate cuts, higher than what the Fed is guiding for.

📈Groovy weddings, jazz and grandpacore: Take a took at what Pinterest believes will be trendy in 2024.

🎂Kellanova’s Pop-Tarts turn 60 and its sales are still going strong. What’s your favorite pop-tart flavor?

🛍️While Lululemon, Abercrombie & others lift outlook on solid holiday sales, US consumers may be racking up credit card debt too quickly.

🤖Artificial Intelligence is likely the “tech theme of the decade”. It is expected to grow into a $225B market by 2027.

🛒Consumer prices rose more than expected, while US consumer inflation expectations fell to the lowest level since January 2021.

The consumer price index increased 0.3% for the month, higher than the 0.2% estimate at a time when most economists and policymakers see inflationary pressures easing. On a 12-month basis, the CPI closed 2023 up 3.4%. Economists surveyed by Dow Jones had been looking for a year-over-year reading of 3.2%. By comparison, the annual CPI gain in December 2022 was about 6.4%.

Much of the increase came due to rising shelter costs. The category rose 0.5% for the month and accounted for more than half the core CPI increase. On an annual basis, shelter costs increased 6.2%. Fed officials largely expect shelter costs to decline through the year as renewed leases reflect lower rents.

Despite the higher-than-expected inflation readings, futures traders continued to assign a strong possibility that the Fed would start cutting interest rates in March. The CME Group’s FedWatch gauge of futures pricing indicated about a 74% probability of a March reduction, slightly higher than where it stood Wednesday.

However, the probability also reflects a divide between the market and the Fed about the timing and extent of rate cuts in 2024. Markets expect six rate cuts this year; Fed projections point to just three.

Meanwhile, US consumers’ near-term inflation expectations declined in December to the lowest level since January 2021, according to a Federal Reserve Bank of New York survey released Monday.

Median year-ahead inflation expectations fell for a third month to 3.0%, down from 3.4% in November. Expectations for price growth at the three-year and five-year horizon also declined to 2.6% and 2.5%, respectively.

The easing in Americans’ inflation views reflected a pullback in the expected price changes for food and rent.

However, expected year-ahead earnings growth slowed at the same time, falling to the lowest level since April 2021. The decline was driven by respondents with a high school diploma or less, the New York Fed said. People earning less than $50,000 expect 1% income growth, while those earning $100,000 or more expect 3%.

Despite the pullback in expected earnings growth, respondents were more upbeat about the jobs market. The perceived probability of losing one’s job fell, and more consumers anticipate the unemployment rate will be lower one year from now.

A larger share of respondents also expect looser credit conditions in the coming year.

In recent days, several policymakers have avoided committing to easier monetary policy. New York Fed President John Williams said Wednesday that inflation has clearly abated from its more than 40-year peak in mid-2022 and is making solid progress. But he gave no clues as to when he thinks rate cuts will be appropriate and insisted that the “restrictive” policy is likely to stay in place for some time.

Other officials, such as Fed Governor Michelle Bowman and Dallas Fed President Lorie Logan, also expressed skepticism and said they wouldn’t hesitate to hike should inflation turn higher.

📈Groovy weddings, jazz and grandpacore: Let’s take a took at what Pinterest believes will be trendy in 2024

Grab your cardigans, take out your boxing gloves and get your disco on — 2024 has loads of new trends in store, according to a Pinterest predictions report.

Pinterest, which has 482M users, analyzes billions of searches on its website and uses machine-learning-backed predictive methodologies to identify patterns and predict the trends in its annual report.

"Over the past four years, 80% of our predicted trends came true," the image-sharing and social media site said.

💒Groovy weddings

1970s-inspired nuptials will likely take the wedding industry by storm next year, Pinterest predicts.

"From disco decor to bohemian bachelorette, boomers and millennials are behind this retro-inspired return to the dance floor," the report states.

Searches for "Groovy wedding" rose 170%, and "Retro wedding theme" searches were up 80%.

🎺Jazz revival among millennials and Gen Z

Millennials and Gen Zers will trade in their electronic beats for more retro tunes, including vintage jazz.

Jazz-inspired outfits, dimly lit venues and lo-fi looks will be on the rise along with the tunes, according to Pinterest search trends.

🎀Bows on bows on bows

Bows have already flooded TikTok this winter, popping up on everything from Christmas trees to holiday hairdos.

Millennials and Gen Z will likely continue to adorn their outfits, shoes, hair, and jewelry with the accessory.

🧥"Eclectic Grandpa"

Gen Z and boomers will embrace "grandpacore" fashion in 2024, aka "grandpa style", searches for which were up 60%. Think chic cardigans—and go raid grandpa's wardrobe.

Customized clothing will also be trendy, as "customized denim jacket" searches were up a whopping 355%.

🏸Smitten with badminton & Knockout Workouts

Gen Z and millennials are searching for everything from "badminton outfits" to "playing badminton aesthetics."

Meanwhile, searches for mixed martial arts training and shadow boxing workouts were also on the rise.

"This year, millennials and Gen Z will go all in on combat sports like karate, kickboxing, and jiu jitsu as their daily dose of 'me' time," the report predicts.

🎂Pop-Tarts turn 60 and its sales are still going strong

Here are some of the first things that US consumers think about when they hear the word Pop-Tarts:

“Yummy”

“The pantry at my nana’s house”

“My childhood and being very happy”

“Nostalgic”

For 60 years, this toaster pastry has dominated the breakfast market, and is showing no signs of slowing down. In 2022, the product brought nearly $1B in US sales, up 8.7% from the prior year.

Here’s a quick story about Kellanova’s Pop-Tarts: 👇🏼👇🏼

In early 1960, Kellogg’s had come to Keebler, the cookie and cracker company, which was based out of Michigan to ask that Keebler to make a breakfast snack for the cereal giant. At that time, American society was focused on convenience and breakfast was becoming an afterthought.

Kellogg's, which had a cereal empire at that time, wanted to expand its reach further and was challenged with adding new products in other categories. The two companies collaborated on the product, with Keebler as the manufacturer and Kellogg’s as the marketer.

Pop-Tarts were initially released in Cleveland, in 1964 with four flavors of blueberry, strawberry, apple-currant and brown sugar cinnamon. Bill Post, who helped develop Pop-Tarts in the 1960's says, “We didn’t realize that this thing was going to go as well as it did. It went beyond any expectations we had. They wanted 10,000 cases of each flavor. But it was such a success that we made 45,000 cases of each flavor,” he said. “The production was not enough. They ran out.”

The shortage was just a taste of the success yet to come. The snack went mainstream the following year when it hit shelves nationwide. Frosted pop-tarts, America’s favorite kind, arrived in 1967.

As of 2023, pop-tarts are sold in more than 20 standard flavors, along with periodically released limited edition versions.

In October 2023, Kellogg’s split into 2 independent public companies; Kellanova K 0.00%↑ for snacks and W.K. Kellogg’s KLG 0.00%↑ for its American cereal division. Snacking brought $7.5B, or 60% of all sales for the company in 2022. Analysts say that pop-tarts' uniqueness has been the key to its success and may help Kellanova become in its own words “the world’s best-performing snacks led powerhouse.”

“The big surprise about pop-tarts is how steady the growth has been over time. There really haven’t been any copycats that have had any success. There is a very small subset of brands like this that consumers used when they were young and continue to use when they are teens and even keep using when they are adults,” Robert Moskow, Managing Director of TD Cowen said.

Now, Pop-Tarts is a part of Kellanova’s push to tackle emerging markets, like Mexico and Brazil, which accounted for 30% of 2022’s net sales. Kellanova generates half of its revenue from outside of the US & Canada and in Q3 2023, it posted net sales growth of 17% in Europe and Latin America.

🤔What’s your favorite flavor of Pop-Tarts?

🛍️While Lululemon, Abercrombie & others lift outlook on solid holiday sales, US consumers may be racking up credit card debt too quickly.

Lululemon LULU 0.00%↑ , Abercrombie & Fitch ANF 0.00%↑ and American Eagle Outfitters AEO 0.00%↑ raised their sales outlooks on Monday on the back of a strong holiday quarter, bucking fears of consumer weakness amid stubbornly high inflation and elevated interest rates.

The upgrades come after what had been a more cautious tone in the retail industry. Nike said in December that it was looking for as much as $2B in cost savings amid a weaker sales outlook in China and around the world. Also in December, Meghan Frank, chief financial officer of Lululemon, said the company was pleased with Thanksgiving sales but wanted to be “prudent with the planning” for the remainder of the quarter, where guidance trailed Wall Street estimates.

Shoppers got a hand with their holiday season shopping from discounts and buy now, pay later plans, which helped generate record online sales, according to the latest Adobe Analytics report.

Lululemon said it now expects net revenue of $3.17B to $3.19B for Q4 FY23, up from a previous range that topped out at $3.17B. This would represent a 15% growth in revenue from the prior year.

As per Wedbush analyst Tom Nikic, this might not be the last raise. Shoppers are making Lululemon purchases at full price, according to Nikic, boosting gross margins even amid a highly promotional retail environment.

Abercrombie also raised its Q4 and full-year sales outlook and said better-than-expected holiday sales will help it reach its 2025 financial targets ahead of schedule. Meanwhile, American Eagle now expects Q4 revenue to rise in the low-double digits, up from a high-single digit increase previously.

Likewise, Crocs CROX 0.00%↑ on Monday said that it expects record 2023 revenue after a “successful holiday season” that resulted in market share gains for both its namesake and HeyDude brands. Preliminary 2024 guidance is for revenue growth of 3% to 5%.

💳Meanwhile, Americans are increasingly leaning on their credit cards.

Altogether, credit card balances now total $1.08T, according to the latest quarterly report from the Federal Reserve Bank of New York.

“Over the past two years, Americans’ credit card balances have skyrocketed 40%,” said Ted Rossman, senior industry analyst at Bankrate.

“While Americans are managing their credit card debt pretty well, all things considered, we are seeing pockets of trouble at the household level,” Rossman said.

More cardholders are carrying debt from month to month and fewer are able to pay off their balances in full, according to a separate report by Bankrate.com.

The average credit card rate is now more than 20%, on average, an all-time high after rising at the steepest annual pace ever, in step with the Federal Reserve’s interest rate hike cycle.

“Most cardholders’ rates have risen five-and-a-quarter percentage points during that span as a result of the Fed’s rate hikes meant to combat inflation,” Rossman said. “It’s no wonder, then, that we’re seeing more people carrying more debt for longer periods of time.”

😮😮The minimum payment math is brutal: At 20.74%, if you made minimum payments toward the average credit card balance, which is $6,088, according to Transunion, it would take you more than 17 years to pay off the debt and cost you more than $9,072 in interest.

🤖Artificial Intelligence is likely the “tech theme of the decade”. It is expected to grow into a $225B market by 2027.

2024 will be the year AI solidifies its position as a dominant investing theme and tech stocks could surge by up to a third as a result, according to Wedbush.

"We believe tech stocks will be up 25% in 2024 with a Nasdaq 20k level our bull case scenario, as the Street is still significantly underestimating how quickly this AI monetization cycle is playing out," said Dan Ives of Wedbush.

The battle between Microsoft and Google parent Alphabet will likely intensify over the next 12 months, with both companies having launched AI-powered chatbots in 2023 , while fellow tech giants Apple, Amazon, Nvidia, and Meta Platforms will collectively invest billions of dollars in the field, Ives added.

Tech stocks surged in 2023 thanks to the massive explosion of interest in ChatGPT, which helped turn chipmaker Nvidia into a trillion-dollar company and helped the "Magnificent Seven" group rack up dominant returns.

In fact, the market cap of Magnificent 7 is now the same as the combined market cap of stock markets in the UK, Canada and Japan.

Ives isn't the only analyst betting that 2024 will be a big year for AI.

"AI will carry on being a dominant theme in 2024 and we're kind of only scratching the surface of it at the moment," Minerva Analysis founder Kathleen Brooks said last month.

Meanwhile, AI is expected to grow into a $225B market by 2027, as per UBS. That signals a near 152% compounded annual growth rate (CAGR) from current levels. The forecast is a 40% upside revision from UBS's earlier calls, which the researchers acknowledged may have been too conservative.

At the same time, stronger-than-expected demand will be a boost for AI software moving forward, fueling a 138% CAGR for the application sector.

"If the launch of the ChatGPT application is the iPhone moment for the AI industry, the recent rollouts of numerous applications like copilots and features like Turbo and vision from OpenAI in Q4 2023 mean the App Store moment for the AI industry has arrived, in our view," the report said.

Meanwhile, increased clarity around AI infrastructure spending will also contribute to tech's multi-year momentum, the note said. The segment is expected to grow from $25.8B in 2022 to $195B in 2027.

"This will likely make AI one of the fastest-growing and largest segments within global tech and arguably the 'tech theme of the decade,' as we don't see similar growth profiles elsewhere in tech," the report said.

That’s all for today, folks.

Where do you think inflation will trend in 2024?

What are some of the trends in 2024 that you are excited about?

Pop-Tarts- what’s your favorite flavor?

Do you think the market cap of AI will grow to $225B in the next 3 years, or is it too pessimistic? Or optimistic?

I don't know what the AI market will be like in three years, but I do know that most markets experience contractions after huge capital inflows. My estimate is that a few companies will survive and become the next Google or Facebook. The rest will die when the bubble bursts. It's hard to know when this will happen, but I'm certain this kind of growth isn't sustainable.

20% credit card debt rate is absolutely insane!