Friday5: Which inflation measure is correct? Bitcoin & Gold climb to new all-time highs, Wendy's dynamic pricing disaster

Plus, here are 3 charts that show the dominance of the US economy compared to the rest of the world. Universities are creating new AI-specific degrees, but is it worth it?

Welcome back everyone to another edition of the Friday5 (on Saturday Morning.)

In today’s post, we will talk about why the 2 most common inflation measures CPI and PCE are diverging more than usual, the fundamental drivers behind the recent surge in BTC and Gold’s price, Wendy’s media kerfuffle with surge pricing, the rise of AI-specific courses at universities and whether they are worth it and 3 charts that demonstrate America’s dominance compared to the rest of the world.

So, let’s get a coffee and a muffin on this bring spring morning and dive right in. ☕🧁

««Friday5- At a Glance»»

😕One Says 2.4%, and the other says 3.2%. Which inflation is correct?

🍔Wendy’s is going to start experimenting with dynamic pricing and people are really mad about it.

🚀Bitcoin and gold are two of the hottest assets on the market right now — just for very different reasons.

🗽“Don’t bet against America”- The dominance of the US economy & the stock market in 3 charts

🎓With all of the buzz surrounding artificial intelligence, more schools are now creating AI-specific degrees. But is it worth it?

😕One Says 2.4%, and the other says 3.2%. Which inflation is correct?

By one measure inflation is closing in on the Federal Reserve’s 2% target. By another measure, it is still far away. Whether, and how, that gap closes could be critical to the Fed’s plans this year.

The Labor Department’s monthly report on consumer prices, known as the consumer-price index or CPI, is generally thought of as “the” inflation report. It generates headlines, features in politicians’ speeches and moves markets.

But the Labor Department’s figures aren’t the Fed’s focus. Instead, the central bank bases its 2% inflation target on the inflation data that comes out with the Commerce Department’s monthly report on income and spending. That is known as the personal-consumption expenditures price index, or PCE.

PCE prices tend to run cooler than the CPI, and lately the gap between the two has been growing. For the month of January, the Commerce Department reported that overall consumer prices rose 0.3% month-over-month putting them up 2.4% from a year earlier. That compares with a 3.2% increase in CPI for February (released this week).

PCE prices excluding food and energy items—the “core” figure that policymakers and economists watch in an effort to better understand inflation’s underlying trend rose 2.8% in January from a year earlier. That compares with a 3.8% increase in core CPI for February.

While core PCE almost always runs cooler than the core CPI, the difference between the two has rarely been so wide. In the 60 years before the pandemic, their median gap was just 0.4 percentage point.

The biggest difference between the CPI and the PCE price indexes is their composition. The price weights for different items in the CPI depend on how much of their spending consumers say they devote to different items, based on annual surveys. The price weights in the PCE are based on what Commerce Department data suggest where money actually gets spent.

One place where price-weight differences have mattered a lot lately is housing. In the CPI, shelter costs for homeowners and renters account for about 34% of the index’s weight. They account for only about 15% of the PCE.

Most economists expect the shelter components for both the CPI and the PCE index to cool over the next year. For both renters and homeowners, shelter prices are derived from rents. These lag behind what is happening on newly signed leases, which are now rising much more slowly.

But because shelter costs count for so much more of the CPI’s weight than the PCE’s, if they moderate, they will cool CPI inflation more than PCE inflation. How that impact’s the Fed’s decisions on when to cut interest rates remains to be seen.

Meanwhile, here is a great perspective on how to assess the latest CPI report, especially when it comes to affordability. 👇

🍔Wendy’s is going to start experimenting with dynamic pricing and people are really mad about it.

Wendy's WEN 0.00%↑ has sparked some pretty understandable outrage after announcing it's going to start experimenting with dynamic pricing next year.

"Beginning as early as 2025, we will begin testing more enhanced features like dynamic pricing and daypart offerings along with AI-enabled menu changes and suggestive selling," Kirk Tanner, the CEO and president of Wendy's, said in the chain's Q4 earnings call.

The announcement, predictably, has not gone over well with lovers of square burgers, or the internet at large.

There's no doubt Wendy's could have done a better job with the rollout here. The talk on the earnings call comes off as some vague technobabble focused on maximizing profits, which makes sense given that executives were talking to investors. A better approach would have been for Wendy’s to position its messaging as a win for customers: "Come on in and get a discount on your favorite Wendy's sandwich when business is slow." That is not, however, the route it took, which is what's coming back to bite the chain.

Post the backlash, Wendy’s clarified what the company’s CEO meant in a recent call with analysts when he said the fast-food chain plans to roll out “dynamic pricing.”

“We said these (digital) menu boards would give us more flexibility to change the display of featured items. This was misconstrued in some media reports as an intent to raise prices when demand is highest at our restaurants. We have no plans to do that and would not raise prices when our customers are visiting us most. Any features we may test in the future would be designed to benefit our customers and restaurant crew members. Digital menu boards could allow us to change the menu offerings at different times of day and offer discounts and value offers to our customers more easily, particularly in the slower times of day.”

But the questions over what to call Wendy’s experiment – surge pricing? Dynamic pricing? Something else? underscore the PR problem around a pricing system that’s already been used for years in a range of industries, from ride-sharing to airlines to your local happy hour.

“Whoever called it surge pricing made the worst marketing mistake you can think of,” said Juan Castillo, assistant professor of economics at the University of Pennsylvania. “Surge pricing sent the message to everybody that this is mostly about increasing prices. That created a very negative reaction from the public.”

In a Capterra survey of US consumers, 52% of respondents said they thought dynamic pricing amounted to price gouging, and only 34% said they thought it benefited consumers. Nearly two-thirds said it made it more difficult to budget their restaurant spending, and one-third said they'd order less frequently from restaurants that implement the practice.

“As dynamic pricing and the use of AI moves into fast-food, companies risk confusing consumers and even losing customers,” Lindsay Owens, the executive director of the Groundwork Collaborative, a DC-based, progressive policy group, wrote in an email to CNN.

Although Wendy’s is now framing their dynamic pricing strategy as discounts during off-peak times instead of surge pricing during peak times, it has made an unforced error and has a real PR kerfuffle on its hands. Its communications around the matter have been deeply messy, and no matter what you call it, consumers are already wary of dynamic pricing, and they see the downsides more than the upsides.

🚀Bitcoin and gold are two of the hottest assets on the market right now — just for very different reasons.

Bitcoin and gold are moving in tandem right now, and both the digital currency and the precious metal hit new record highs last week.

Gold and what some call its digital equivalent are benefiting in different ways from an unusual macroeconomic environment where inflation and interest rates remain a top priority for the market.

"I think it's a coincidence, really. Gold attracts certain people, and bitcoin attracts other investors. Several factors have driven the two of them to new records, but it's really a quirk of the macro backdrop that they're both rising at the same time," Kathleen Brooks, research director at the online brokerage firm XTB said.

After a rough couple of years, bitcoin has kicked off 2024 on a tear. It was trading above $73,000 and is up almost 75% since January 1.

That surge has powered it past its previous high of about $69,000 set in November 2021 at the height of the last crypto bubble.

In January, the Securities and Exchange Commission (SEC) fired the starting gun on bitcoin's stellar rally by approving 11 spot ETFs, which allowed a flurry of institutional investors to pile into crypto for the first time.

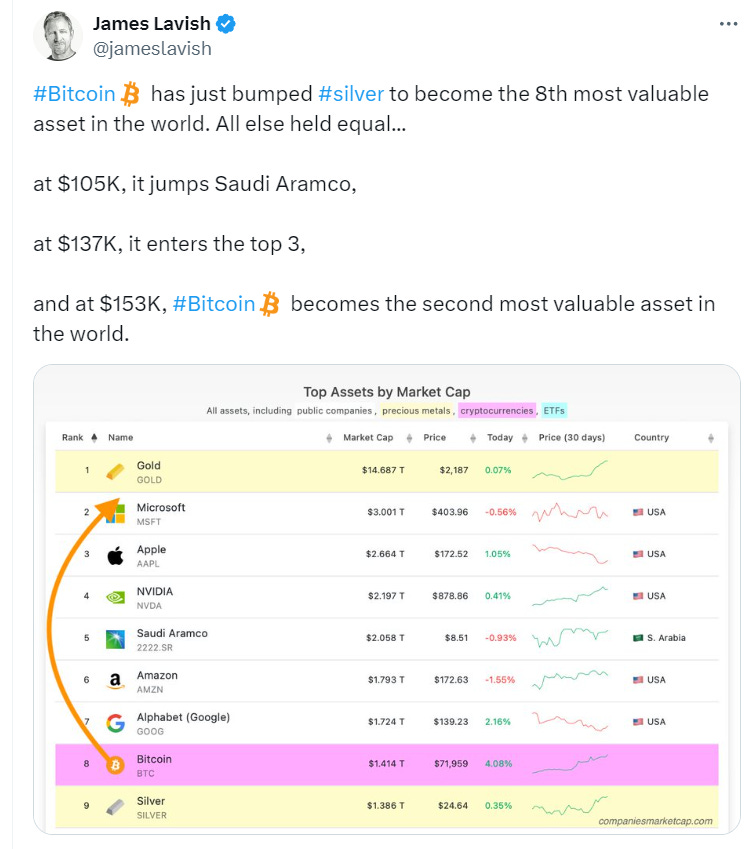

This has led BTC to become the 8th most valuable asset in the world, overtaking silver. 😮😮😮

More recently, investor excitement has been building about an upcoming "halving event" that's expected to take place in April. That will slash the reward for mining new blocks by half, which in the past has boosted bitcoin's price by making supply scarcer.

On the other hand, Gold's early 2024 run has been more subtle — but that's a given when you're dealing with an asset that investors tend to see as a "safe haven" defined by its low volatility.

The precious metal dipped slightly on Tuesday but is still up about 4.5% year-to-date at $2,162 per ounce. That's above the previous record high of about $2,140 reached in December.

“It has been the quietest and the most confusing rally,” said Nicky Shiels, precious metals analyst at MKS Pamp, a Swiss Gold refinery and trading house. “What took it from $2000 last month to above $2150 is the head-scratching part.”

The current rally kicked off when US manufacturing data at the beginning of the month showed a larger than expected contraction, strengthening investors’ conviction that the US Fed could start to cut rates in June.

Meanwhile, central banks from countries including China, Turkey, and India have all been on a gold-buying spree in recent months, helping to squeeze its price higher.

"Gold is very much driven by central banks, without question or doubt. They feel uncomfortable with the fact that they've got too much in the way of dollars in their portfolios. There aren't many other alternatives, but gold is one of them." Marc Ostwald, chief economist for ADM Investor Services International said.

🗽“Don’t bet against America”- The dominance of the US economy & the stock market in 3 charts

The dominance of the American economy and its markets has been an enduring theme.

The stunning resilience in recent months has led Wall Street to pull back on its recession calls, while America's CEOs have become more optimistic for the year ahead. The S&P 500 is up about 7.5% since January 1, investor sentiment is surging, and markets are pricing in multiple interest rate cuts from the Federal Reserve in the middle of 2024.

From macroeconomic to sector trends, the 3 charts below illustrate America's dominant position as an economic powerhouse.

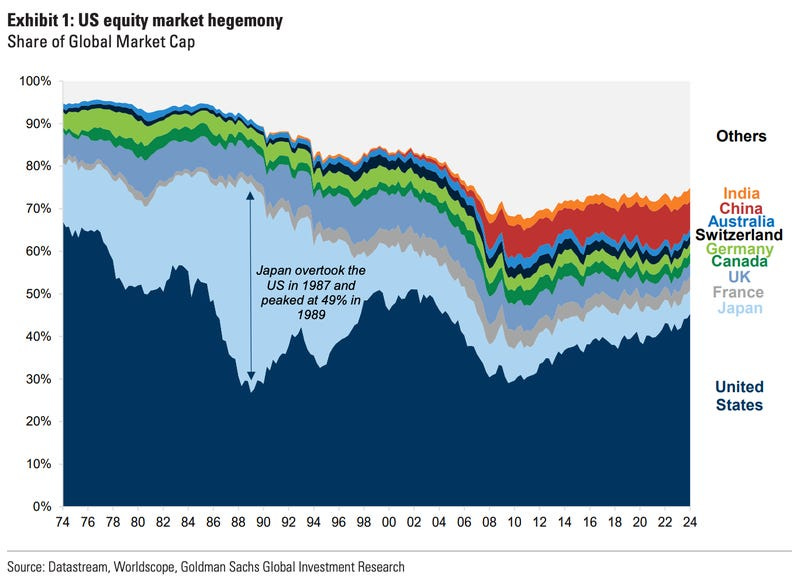

➡️The biggest slice of the global pie

The longer-term rise in the relative size of the US equity market has reflected the dominance of the US economy. Nonetheless, it is interesting that the US equity market's domination of the world market has accelerated dramatically in recent years, particularly since the global financial crisis.

The US now accounts for a roughly 50% share of the global equity market, according to Goldman Sachs.

It is interesting to note however that the share is lower than what it saw in the 1970s. More than four decades ago, the biggest individual American stocks included Exxon, Mobil XOM 0.00%↑, Ford F 0.00%↑ , General Electric GE 0.00%↑, and IBM IBM 0.00%↑ , a far different makeup than the batch of Magnificent Seven stocks today.

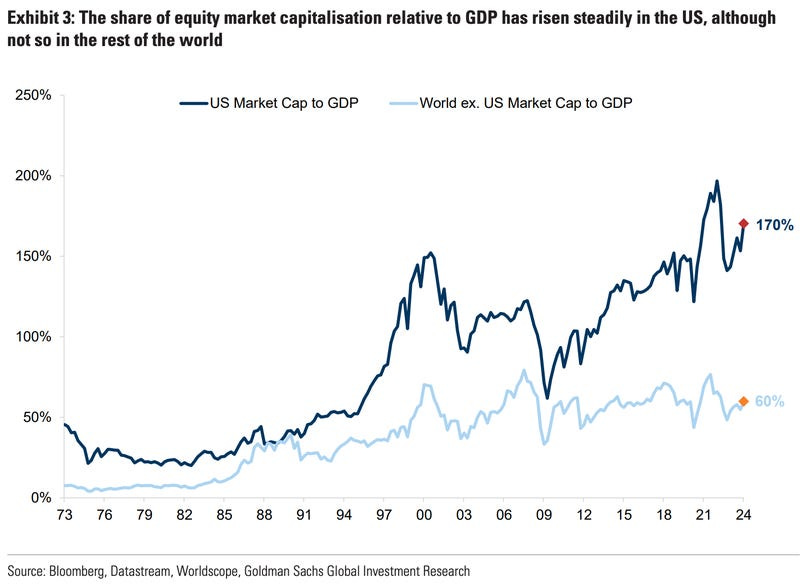

➡️Market cap relative to GDP

It's true that the US economy has been the largest global economy over the last 80 years, but Goldman Sachs highlighted how its share of equity market capitalization relative to GDP has also outpaced rival countries for many years.

The US's market cap to GDP share hovers at about 170%, while the figure for the rest of the world not including the US is at about 60%.

➡️The growth factor

The strength of the American stock market can be traced largely to its high volume of growth names. In Goldman's view, the US has benefited from a "growth" factor relative to the rest of the world.

"Put another way, the US stock market has more exposure to faster growing industries than the rest of the world, and less exposure to slow growing companies," Goldman strategists said.

The large number of growth names in the US has led to investors reinvesting in US stocks at a higher rate than in most other markets. This has also led to higher liquidity in US markets, which helps reduce the risk premium.

I am working on a 2-part series, for my Monday Macro and I published this piece last Monday, where I dive into the concept of the American Dynamism and whether the next decade will continue to see American domination in the world order.

🎓With all of the buzz surrounding artificial intelligence, more schools are now creating AI-specific degrees. But is it worth it?

The University of Pennsylvania recently announced that its B.S.E. in Artificial Intelligence program will begin in fall 2024. Carnegie Mellon introduced a program well before gen AI was a buzzword, in fall 2018, and MIT’s program began in fall 2022. Purdue University offers an AI undergraduate major, while many colleges and universities offer AI classes within their computer science department, even if there’s not a dedicated major.

The rise of AI-specific degree programs comes as companies are short on talent for this fast-developing field. Half of the highest-paid skills in technology are AI-specific, according to the employment website Indeed.com.

Yet some students may wonder if they even need a degree at all, given how fast the market is changing and the fact that more employers have expressed a willingness to hire workers without degrees if they have the appropriate, job-required skills.

It’s important to note that recent research suggests the practice of hiring people without degrees has fallen short, however, and research from the Ladders career site shows that a degree is still required for the highest paying jobs, a list that includes software engineers.

Even so, several providers including Dataquest and Coursera, offer certificate programs for learners to build skills quickly. These programs may be appropriate for students who lack the time and resources to complete a four-year program, or already have a degree and are looking to upskill.

Ultimately, it’s important for students to think critically about the curriculum for the program they are considering, how it’s different from a standard computer science curriculum, the likely career trajectory for graduates of the program and economic outcomes for graduates.

“If you’re an architect, you don’t want a degree in hammers. You want to understand hammers, you want to understand zoning and you want to understand how to build a house that helps a family come alive. The same is true in AI,” said Nichol Bradford, artificial intelligence and human intelligence executive-in-residence with SHRM, an organization for human resources professionals.

“When it comes to employment, some employers may look more favorably upon an AI-specific degree versus a plain-vanilla computer science degree”, said David Leighton, chief executive at WITI, an organization for technology-minded professionals.

On the other hand, no one really knows right now what the value of such a degree will be in a few years. Given the uncertainty, some professionals said students can’t go wrong with a traditional computer science degree or an AI-specific one, provided the fundamentals are covered.

That’s all for today, folks.

What are your thoughts on the CPI and PCE diverging? Do you think the Fed is doing the right thing by delaying its rate cuts?

Do you think dynamic pricing for fast-food chains or restaurants make sense?

BTC or Gold, which of the two are you more bullish on?

I'm bullish on both, Bitcoin and Gold.

The Wendy’s kerfuffle shows how important it is for brand messaging to be consistent with brand promise (fast food presumably value/$) and to not just know the customer but LISTEN to their messaging from the customers’ POV! Social media means any announcements such as at shareholder meetings are marketing messages that will reach the consumer.