2025 Halftime: AI Trade To Outpace Tariffs & Tensions

Our Quarterly Investor Letter & H2 Outlook

At The Pragmatic Optimist, we help hundreds of investors navigate the evolving AI innovation landscape, identify rock-solid businesses with strong growth trajectories and operational grit, and make long-term investments in the space with proven alpha generating returns.

Become a paid subscriber today

How It Started & How It’s Going

When we had last published our Macro outlook last quarter, President Trump had just announced the most draconian tariff measures on Liberation Day, which had plummeted the stock market and the economy into chaos.

The prevalent narrative at that time was that the Trump administration was trying to orchestrate an economic slowdown so it could refinance itself at lower rates and thus begin to cut the federal deficit, which currently stands at -6.3% of GDP, a level matched only, mind you, by the deficit during World War II, the 2005 Great Financial Crisis, and the 2020 Coronavirus Pandemic.

With many investors turning bearish at the time, we, however, insisted our readers and investors not bail on the AI trade and use the pessimism as an opportunity to dollar cost average into key winners in the AI ecosystem.

During the quarter, we published the following research reports as we navigated the evolving AI landscape.

Research Posts Published During the Last 3 Months

TSMC: A Winner That Takes All, Despite Tariffs: Staring at the top of the AI infrastructure stack, we started the quarter by initiating our “buy” rating on TSMC TSM 0.00%↑ as the company reported a 35% YoY revenue surge during the quarter, hardly a stumble given the tariff uncertainty at the time. With its 3 nm chips accounting for 22% of wafer revenue (up from 9% a year ago) powering Nvidia’s NVDA 0.00%↑ Blackwell GPUs, the company not only expanded its capital expenditure plans but also guided for its AI revenue to grow in the mid-40% range over the next five years.

ASML’s Q1 Report: A Preview of Tariff Turbulences Yet to Come: Despite initiating our “buy” rating on TSMC, we remained cautious with ASML ASML 0.00%↑, especially given the geopolitical climate at the time and China being a major customer of the company. Particularly, with management providing wider guidance than usual, we believed it was a quiet admission that things could swing either way. However, since then, we have upgraded our rating on the stock (available on the AI Stock Rec Tracker) as we saw growing progress of constructive trade talks with China.

Hyperscalers Had A Goldilocks Quarter: This was followed by all four hyperscalers sticking to their full-year capex guidance, which many investors thought they would pull back amid tariff uncertainty. At the beginning of the year, we had identified Microsoft MSFT 0.00%↑ to be the best-positioned hyperscaler in 2025. While that has played out per expectation as the Azure cloud shows no signs of slowdown, we also rated “buy” on both Amazon AMZN 0.00%↑ and Google GOOG 0.00%↑.

Palantir Q1: The AI Moat No One Understands: Next up, we covered Palantir PLTR 0.00%↑, where its Commercial business silenced all doubters with accelerating AIP adoption across enterprises. While we claimed that Palantir looked a lot like Nvidia in 2022, as we entered the second wave of the AI Revolution of mass AI deployment across enterprises, we believed that the price at which the stock traded (at the time of publication) made it hard to justify for new investors to start a position.

Semi Stocks Had Their Biggest Month This Year: Then came the month of May, which saw several bullish announcements that included the Middle East region becoming the new hot market for America’s semiconductor companies and Nvidia (during the Computex event) opening up access to its NVLink protocol by releasing NVLink Fusion, allowing hyperscalers to use their customer accelerators in the rack to talk to Nvidia’s CPUs.

CoreWeave & Nebius Bet on Nvidia’s GPUs & Won Big: Meanwhile, a new breed of companies that rents out GPUs like digital real estate, otherwise known as “neoclouds,” saw meteoric rises in their stock prices during the quarter. This is the case as the conversation around hyperscaler capex dollars moved from the volume of dollars spent to the efficiency of capital investments.

AI Networking Stole The Show In Q2-Part 1: We then followed up on our bullish call on Celestica CLS 0.00%↑ from March while providing our updated outlook on the growing rivalry between Broadcom AVGO 0.00%↑ and Marvell MRVL 0.00%↑ as the battle for custom silicon dominance heats up, along with Astera Labs ALAB 0.00%↑, the plucky underdog that stands to threaten the market dominance of both the incumbents.

Cybersecurity’s AI Arms Race Is Heating Up: We ended the quarter with our final post on cybersecurity, especially as the market is waking up to the fact that the second wave of the AI Revolution will be infinitely harder to secure as it will be autonomous. In this post, we framed the size of the highly fragmented cybersecurity landscape with players such as CrowdStrike CRWD 0.00%↑, Zscaler ZS 0.00%↑, and Cloudflare NET 0.00%↑ that are increasingly expanding their platform capabilities and forming strategic partnerships with each other to benefit from enterprise consolidation.

Launched The AI Stock Rec Tracker: Finally, in mid-quarter, we also launched the AI Stock Rec Tracker tool, which provides updated price targets, ratings, and performance since coverage across companies in the AI ecosystem, with the aim to help our readers and investors navigate the evolving innovation landscape with ease and take advantage of market asymmetries before the momentum crowd swoops in.

With the AI train showing no signs of slowdown, we witnessed one of the fastest recoveries in the S&P 500 last quarter, as recession odds, along with high-yield spreads, have plummeted as a result of progress made on trade deals with the US’s trading partners.

As stocks wrapped up the first half of 2025 at fresh all-time highs, let’s break down the performance of stocks we have covered in our publication since the beginning of the year.

In the chart below, you can see the returns by stock based on the date when the rating was published.

In other words, had you invested $1000 each time we publicly released a research report or a thread with a “buy” rating (between January and the end of June), you would have had a return of 17.5% so far. This is compared to the 5.85% YTD returns of the S&P 500, or an alpha of 3x plus 💸💸💸.

Note that we have issued a total of 35 “buy” ratings and 10 “hold” ratings from January to June, with 15 out of the 35 ratings that have generated a return of 20%+ since the time of coverage.

Plus, these 35 “buy” ratings have been issued across 26 unique companies in the AI ecosystem over the last six months, out of which we own 20 of them in our portfolio.

This brings us to the most pressing question: what lies ahead of us in H2 2025, particularly for the AI trade?

(FYI: Feel free to skip to the last section, "How to play the AI trade in H2” if you are here just for portfolio strategy 👇)

But before that…

Last month, we sent out a survey to all our subscribers asking for feedback on how to further improve The Pragmatic Optimist 2.0 publication to help you better navigate the AI investment landscape.

One of the most popular feature requests was Conviction Rating on stocks alongside our AI Stock Rec Tracker.

Well, you will be pleased to know that the Stock Scorecard is a feature that we had been working on for some time, and we will be launching it in 2 weeks time to all premium members so that you can drive your investment decisions and allocation sizing more confidently.

In the meantime, when it comes to the content roster, our readers also asked for coverage on cybersecurity, quantum computing, aerospace and defense tech, as well as adtech. During the quarter, we will be expanding our research in the above areas while continuing to provide timely updates on our existing coverage.

Finally, we plan on releasing our Portfolio by mid-August that will give investors live access to our trades and allocation sizes.

So, a lot of work on our plate and much to look forward to.

Thanks again for your support towards our publication, and with that said, let’s jump to our Q3 Macro and Portfolio Strategy update.

Consumer spending power will be put to the test in H2.

If there is one key takeaway from the last three months of navigating the markets from chaos to calm, it is that Wall Street is a forward-looking machine.

As we saw progress being made on trade negotiations in May, investors took many of the worst-case scenarios off the table.

In fact, President Trump has confirmed the extension of reciprocal tariff suspension period from July 9 to August 1, thus providing additional time to countries to finalize trade deals with the US.

In the meantime, the much-feared tariff-induced inflation never took hold (at least not yet). At the same time, the “One Big Beautiful Bill,” that was passed last week is set to reportedly shower the US economy and corporate America with billions of dollars while simultaneously adding to the burgeoning fiscal debt burden.

However, the fragile spot at the moment is consumers who remain pessimistic about the future.

Coming out of the Q1 corporate earnings season, many companies noted that customers would not see broad-based price increases as companies would employ mitigation efforts, while others said tariff-induced price increases were unavoidable.

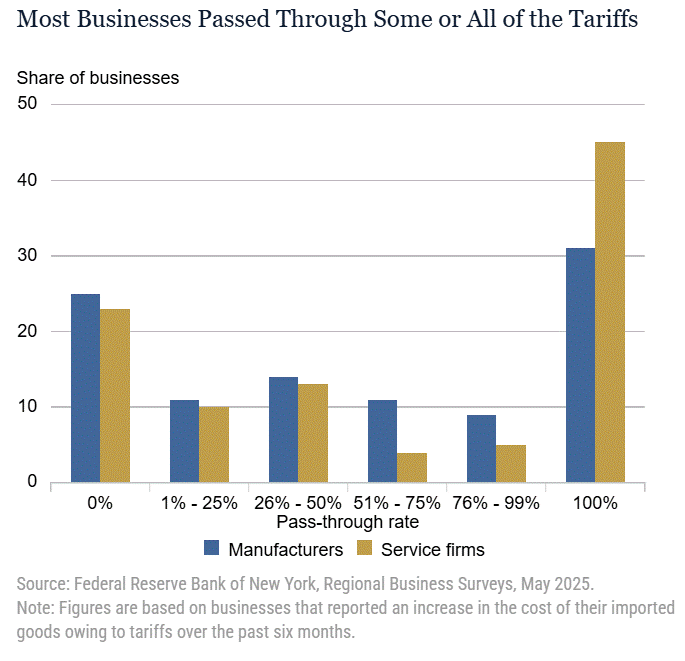

Enter the New York Fed, where a recent survey asked businesses how they were adjusting their operations in response to the administration’s new trade policies.

As one would expect, tariffs generally resulted in higher prices for consumers.

“About three-quarters of businesses facing tariff-induced cost increases in both the manufacturing and service sectors passed along at least some of these higher costs to their customers by raising prices.”

As businesses must adjust operations to protect margins and profitability, consumers are also quick to adapt to macroeconomic trends. At least, that’s what the post-Covid world has taught us.

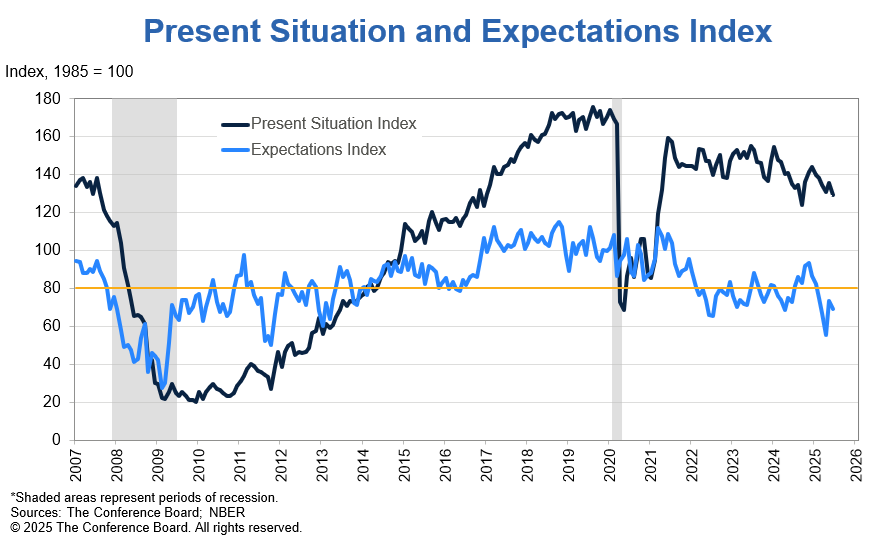

Last month, we saw US retail sales fall 0.9%, the largest decline since the start of the year, with seven of 13 categories posting drops. The decline could be attributed to consumer anxiety over tariffs and personal finances, with the consumer confidence index deteriorating for both the present situation and forward expectations in the month of June.

While the labor market conditions remain resilient thus far, let me be very clear about one thing. That is, households’ spending power will be put to the test in H2 2025, especially after the full brunt of higher tariffs passes through to the prices of consumer goods on store shelves.

Implications for the labor market as the cost of intelligence goes to zero

When it comes to The Pragmatic Optimist, we rarely sugarcoat stuff. We say things as we see them.

Just like we said, consumer spending power will be put to the test in H2 2025 (in the earlier section).

We have one more observation that we would like to talk about.

That is, the implication to the labor market is that we see the cost of intelligence drop, ushering in the era of the agentic workforce.

Let me explain.

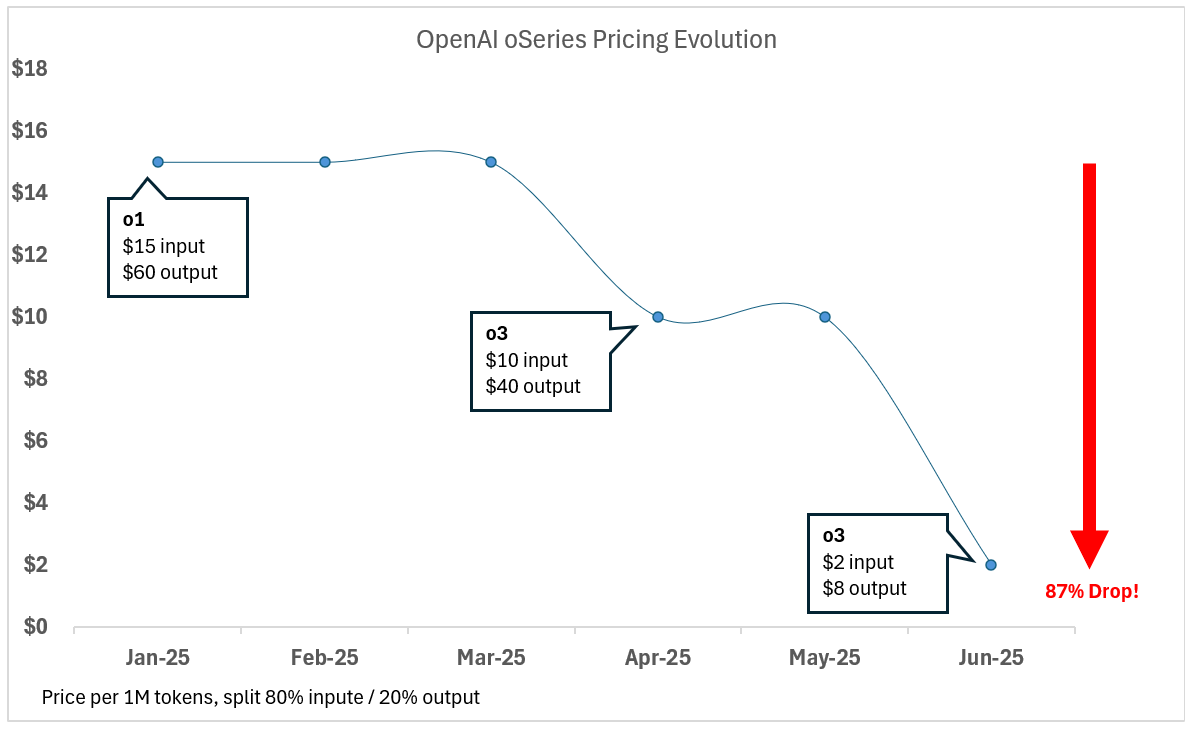

First, take a look at the graph below, and you can see how quickly the cost of tokens (i.e., intelligence) has dropped.

The chart above shows the evolution of the o-series of models (o1 and o3) pricing from the beginning of the year to today. As you can see, in just a few months the pricing has dropped 87%.

This is taking place as each GPU generation nearly doubles performance every 18 months, as AI systems become much more energy-efficient, thanks to ongoing improvements in hardware and efficiency, which could lead to a 2000-fold increase in compute availability by 2030.

The point is that as we see the cost of tokens plummet, the marginal cost of creation goes to zero.

Think about it: GPT2 in 2019 had an 80% accuracy in counting to 10, GPT3 in 2020 had an 80% accuracy in summing three-digit numbers, and GPT4 in 2023 passed the California Bar exam. Each 100x increase in compute has unlocked dramatically new capabilities.

But what about jobs in the age of AI?

There are many CEOs, some of very large public companies, who have commented on what AI means for their headcount plans.

For instance, Microsoft has announced that it is laying off 4% of its workforce, while Google is offering buyouts to more workers. Meanwhile, Meta has been tightening performance standards for employees, while Andy Jassy, CEO of Amazon, put it this way.

“It’s hard to know exactly where this nets out over time, but in the next few years, we expect that this will reduce our total corporate workforce as we get efficiency gains from using AI extensively across the company.”

You see, for the first time, workers don’t need to be human for a growing number of enterprise workflows. AI agents can book meetings, run ad campaigns, and build software.

While an agentic workforce could mean expanding profit margins for corporations, it could also lead to short-term job displacement from AI, which could be massive, leading to a contracting economy.

On the other hand, the optimistic view is that creative destruction will destroy some jobs but create orders of magnitude more, leading to a massively expanding economy. While I’m not entirely sure what new jobs will be created, I will admit the following.

That is, human brains aren’t particularly good at understanding exponential improvements, and no generation of humans has experienced the pace of change that we’re seeing today.

The world will look a lot different in 2030.

But that doesn’t take away from the fact that fiscal deficits are ballooning higher, and it could eventually lead to a crack in the bond market, especially if forward economic growth fails to materialize soon enough. Here’s what I mean by that (next section).

Then, there is the fiscal deficit, which continues to balloon higher.

After months of negotiations, a new tax and spending bill called “One Big Beautiful Bill” was approved by Congress and signed into law by President Trump on July 4th.

The White House stated that it “will unleash robust, real economic growth and restore fiscal sanity in America” by bringing the deficit to 3.2% of GDP by 2034, as opposed to 6.2% under current law.

However, the Congressional Budget Office estimates that this new tax and spending bill will add $3.4T to the national debt over the next decade. And remember, this is against the backdrop of a federal debt that already exceeds 120% of GDP, standing at $36.2T, or an equivalent of $106,000 per American.

Add to that the potential inflationary pressures from tariffs, and the Federal Reserve is taking a cautious approach to monetary policy, where it expects at most two additional rate cuts for the remainder of 2025.

However, here’s the important thing.

If significantly higher economic growth doesn’t materialize quickly, the bond market could revolt and demand significantly higher yields to finance the US government.

In a recent interview, leading bond investor Jeff Gundlach suggested a rate of about 6% on 10-year Treasuries as a tipping point (at the time, the 10-year yield was around 4.5%).

On top of that, the FOMC’s latest projections suggest that the economy will grow at a slower rate of 1.4% (compared to its previous forecast of 1.7%), along with higher inflation estimates of 3.0% (up from 2.7% earlier) in 2025.

However, equity investors currently exhibit zero concern about debt and deficits, while the S&P 500 is now trading at a steep forward price-to-earnings multiple of 23.

Investors show little regard for valuation or macroeconomic headwinds.

From chaos to calm, the markets found their footing in Q2, as the economy remained strong, trade deals showed progress, and corporate earnings remained resilient.

Looking forward to H2, investors have many reasons to be optimistic.

The technical setup remains constructive, with many charts showing the potential for breakouts, while sentiment and positioning remain accommodative to a FOMO catch-up trade.

Policy uncertainty is falling, which gives CEOs better visibility and confidence on a go-forward basis, not to mention that the “One Big Beautiful Bill” will be conducive for consumer spending as well as corporate investments to drive growth in infrastructure, defense, and construction sectors.

But, over the long run, nothing matters more to stock prices than earnings.

Q1 earnings season was strong, with a 79% beat rate and year-on-year growth at +13%.

Meanwhile, as we kick off Q2 earnings, consensus estimates per Factset imply that S&P 500 earnings growth will be +5.0% in Q2, which sounds healthy until you consider expectations were +9.4% on March 31. In other words, earnings estimates have been cut in half over the last three months.

The market will be relying on Tech and the Mag 7 to shoulder the burden once again. While the S&P 493 is expected to see earnings acceleration from -0.6% to +7.4%, that pales in comparison to the size and performance of the tech stalwarts at +36.1%.

However, the larger issue facing investors is centered on Q3 and Q4 earnings estimates, which could be prone to further cuts, considering the potential for tariffs to hit profit margins.

For the full year 2025, analysts are projecting S&P earnings per share to grow 9.0%-9.5% to $264.15, an impressive measure when compared against the broader economic growth projection.

I will point out that the current expected growth rate of earnings at 9.0-9.5% represents a 360 basis point downward revision since the beginning of the year.

What this means is that the S&P 500 is more “pricey” today than it was back in January, with a forward price-to-earnings multiple of 23.5.

Yet, industry analysts currently project a 7.5% increase in S&P 500 price over the next twelve months to 6694, while Goldman Sachs raised their return forecast over the next 3- and 12-month periods to 3% and 11%, indicating S&P 500 levels of 6400 and 6900 (previously 5900 and 6500), respectively.

The thing is that, unlike the deep trough of pessimism in April, investor sentiment is now back with a vengeance along with record-high household allocation to stocks, as retail investors show little regard for valuation or macroeconomic headwinds.

This tells me two things that are diametrically opposed to one another:

Investors are comfortable maintaining this level of stock ownership because they remain optimistic on the intermediate- to long-term prospects of the stock market and, by extension, the US economy.

Along with high valuations, full positioning doesn’t leave much room for future buying power beyond the margin. Any change in risk appetite, or a series of negative risks materializing, could leave the market susceptible to a leg lower.

What I am ultimately trying to convey is that the next leg up in the S&P 500 rally won’t be a straight line. But with the right measures of risk management in place, it could offer some extremely attractive investment opportunities in the AI landscape, which is what we will discuss next.

How to play the AI trade in H2?

In April, Oppenheimer research had said, “Against a noisy/tariff backdrop, we view AI as the best/safest growth vector.”

Throughout the quarter, we repeatedly used the above quote in our research notes as the AI train showed no signs of slowing down.

The way we see it, the AI economy will ultimately be defined by a few broad themes: 1) Who controls compute, 2) Who controls data, 3) Who controls deployment, and 4) Who governs security at scale.

The market is still obsessed with Mag 7, but the next wave of AI disruption will happen beneath the surface, at the silicon layer, the interconnect, the data plane, the agent layer, and the edge.

Our AI Stock Rec Tracker tool covers key companies that we own as well as on our watchlist across the AI ecosystem, where over 20 companies out of 42 are trading at discounts of over 10% to our estimated intrinsic value, with 6 of them offering potential upside exceeding 30%.

In the next two weeks, we will be releasing our Stock Scorecard feature that will provide investors with a scorecard of all stocks in our coverage based on a set of fundamental parameters. This will be followed by the launch of our Portfolio, giving investors live access to our trades and allocation sizes by mid-August.

In the meantime, we outline our AI investment strategy below 👇 across key market levels along with a list of high-conviction companies that we plan to add at current levels as well as if we see a sizable pullback.