From Goldilocks to Hard Landing- The economic whiplash begins

The Fed Dilemma is back again. Does the Fed cut to stimulate a weakening economy but exacerbate the yen trade by causing a massive selloff in stocks? Or does it hold its ground?

Welcome back to the first Monday Macro of August 2024.

For a while, I had been writing on the macro side of AI, but today we will do a classic, old-fashioned Macro Deep Dive.

Well, part of the reason is because we kind of have an “all hands on” situation with the Fed’s soft-landing narrative suddenly coming under threat with weak economic reports and the “yen carry trade” that is wrecking havoc in financial markets around the globe.

So, it is time to grab your coffee ☕ and a muffin 🧁 , put your “pragmatic” cap 👒 on and get ready to peel this onion 🧅 one layer a time to understand what’s really going on.

«The 2-minute version»

Last week, the US economy achieved a series of milestones. First, its public debt just surpassed $35T. Then, the Sahm rule, which is one of the best recession predictors, got triggered. Finally, the US 10Y Treasury bond fell to its lowest YTD level at 3.79%.

It didn’t end there: Yesterday morning, the VIX, which is the market’s fear gauge, broke above 65 for the first time since March 2020. And then, Japan’s stock market posted its biggest two-day drop in history.

The “soft landing” is now suddenly under question: With Real GDP beating Q2 estimates and consumers spending robustly, everyone was convinced that the Fed was going to pull a “soft landing," a.k.a., slow down the economy just enough without causing a recession. Unfortunately, the recent PMI and labor reports have put the soft landing narrative under threat. Plus, companies such as Amazon, Wayfair, Visa, McDonald's, and more are indicating that the US consumer is probably starting to falter a little.

The “yen carry trade” has also decided to join the party: To make the Fed’s life slightly more difficult. Basically, as the Japanese yen (JPY) strengthens with the Bank of Japan (BOJ) raising interest rates, traders across the globe are being forced to unwind their trade positions. You see, traders had been borrowing JPY at lower interest rates, converting them to USD, and using the proceeds to buy US stocks. Now that they must pay a higher interest rate for JPY, they are selling their US stocks to pay back their loans. In this event, the Fed really cannot print its way out of it.

So, is the Fed late once again? After a prolonged inversion of the 2-10Y US Treasury yield curve, it is now finally reversing. This is usually a sign that the Fed has done enough damage. Meanwhile, the bond market is pricing in 5+ cuts over the next 3 meetings, and market experts such as Claudia Sahm, Jeffrey Gundlach, and Jeremy Siegel are going on air to urge the Fed to implement an emergency cut. But I don’t think that will actually help.

Let’s not turn all doomy: You see, the dramatic shift in rate-cut pricing is partially driven by fundamentals (weak economic data) but more by panic. Plus, cutting rates might actually exacerbate the selloff from the “yen carry trade." In the meantime, let’s not forget that we are not in a recession. What we are seeing is an economic slowdown, and given the low private sector debt (thanks to the 2020 fiscal bazooka), there might actually be a way to safely dodge the recession bullet. I am not saying that will happen, but there is always room to be pragmatically optimistic.

🎥Let’s set the stage.

Last week, we hit several milestones. I am not talking about The Pragmatic Optimist newsletter (that’s for another time). These are milestones for the US economy.

The US federal debt just hit $35T.

The Sahm Rule got triggered. (FYI: The Sahm rule signals a recession when the three-month moving average of the US unemployment rate rises by 0.5 percentage points or more relative to its low during the previous 12 months.)

The 10Y US Treasury fell to 3.79%, its lowest level YTD.

I was going to stop at that, but then, this morning, Mr. Market was like, “Hold my beer, here, let me give you two more milestones to put in your Monday Macro newsletter." So, here they are.

The Volatility Index, or VIX (a.k.a, market’s fear gauge) broke above 65, the highest level since March 2020.

Japan’s stock market posted its biggest two-day drop in history.

Okay, I think I am done (for now, at least).

Now, sorry to sound like a party pooper, but, unfortunately, achieving these milestones is no cause for celebration. On the contrary, It means it is time to buckle your seatbelts and put your “pragmatic” cap on to peel this onion🧅 one layer at a time to understand what is truly going on.

We were headed for a “soft landing”, until recently.

At the end of last month, US Real GDP expanded at a 2.8% annualized rate in Q2. Consensus estimates were at 2.0%. So, you can say that was a fairly strong beat. The growth in GDP was led by strong consumer spending and inventory restocking, while capital expenditure and government spending also rose.

I will point out, though, that the growth of Real GDP in H1 2024 of 2.1% was much softer than the 4.1% growth in H2 2023. Simultaneously, the closely watched inflation gauge PCE (Personal Consumption Expenditure) price index also slowed to 2.6% from 3.4% in the previous quarter.

But this is exactly what the Fed has been trying to achieve for over two years, which is to bring economic growth back to its long-term trend while normalizing prices and avoiding a recession.

Plus, news and economic reports like these had everyone (almost) convinced that the US consumer is simply unbreakable. 👇🏼

“Americans are traveling at record levels: There are a record ~418,000 flights scheduled between the US and Europe from April to October 2024. This is 7% higher than last year's record and more than double the number registered in 2021. This has been driven by rising demand from US travelers due to the strong dollar. At the same time, the number of transatlantic routes offered by airlines jumped to the highest level since 2019. TSA checkpoint travel numbers at US airports are averaging a record of nearly ~3 million per day.- The Kobeissi Letter”

Here’s one more.

But it would only take a slightly more curious person (who likes to dig deeper or burn their eyes peeling into the next layer of this onion) to know that some things were not quite adding up. What do I mean by that? Let’s find out.

Let’s be honest, there were always some glaring loopholes.

While everyone (and markets specifically) was rejoicing about a projected soft landing, the US Consumer Confidence Index had declined to 100.3 points from 101.3, near its lowest level since 2021. In the same report, just 12.5% of US consumers expect better business conditions in the next 6 months, the lowest level since September 2011.

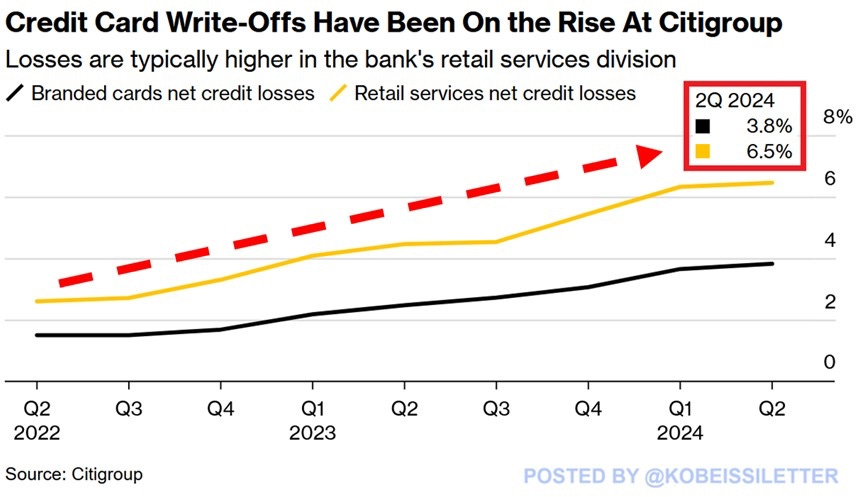

Meanwhile, despite “robust” consumer spending, credit card and auto loan delinquencies have been steadily rising. In fact, the percentage of net credit losses at the retail services division of Citibank C 0.00%↑ has more than doubled in just 2 years. Simultaneously, Wells Fargo WFC 0.00%↑ and JP Morgan JPM 0.00%↑ net charge-offs from their credit card businesses also jumped 60% in Q2 2024.

To add to that, the number of mentions of weak demand per US company during earnings calls remains highly elevated, with average mentions of soft demand tripling in just 2 years.

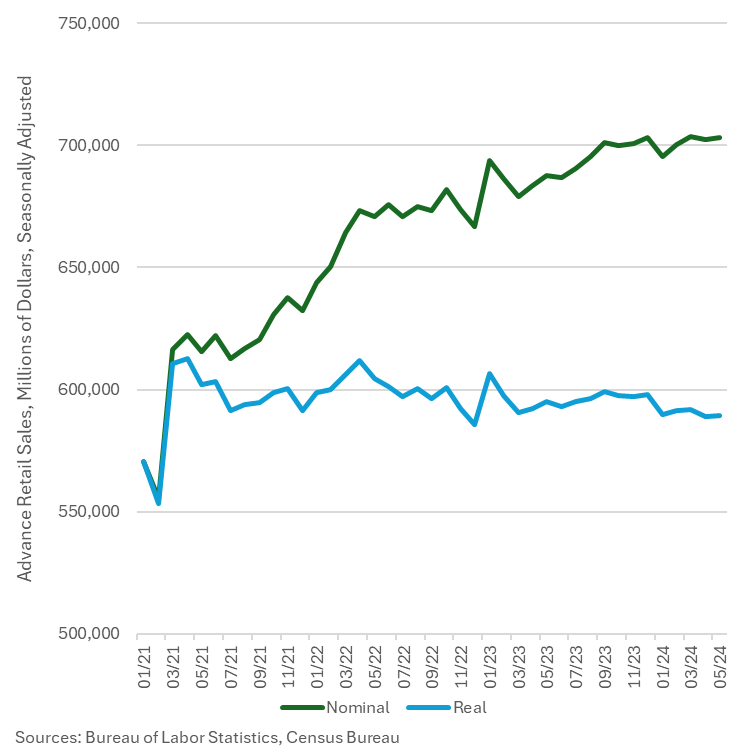

Part of it could be driven by the fact that the growth in retail sales (a proxy for consumer spending) is driven entirely by growth in prices, not more physical stuff actually being sold. In fact, if you look at the chart below, you will see that real retail sales have arguably been on a slight and somewhat erratic downtrend since early 2021.

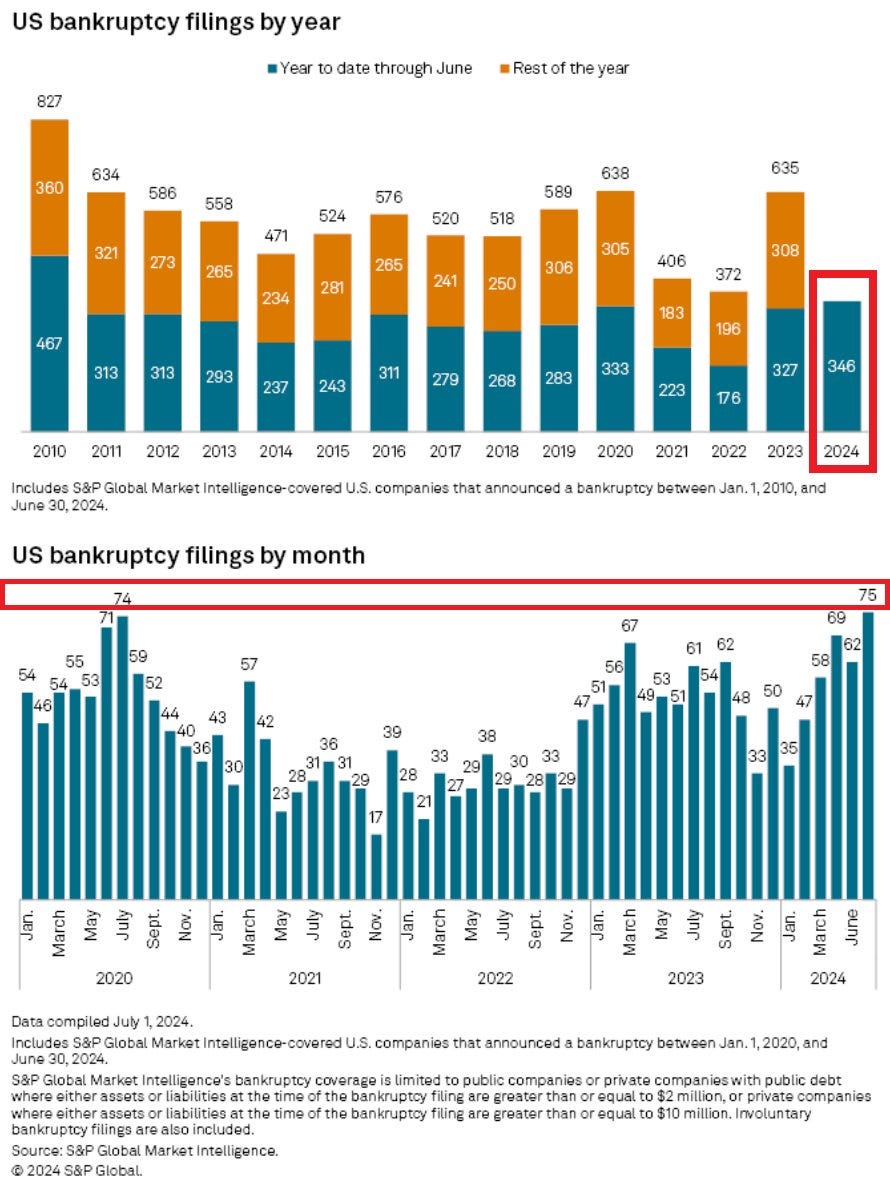

On the corporate side, US Bankruptcies are silently hitting the highest level in 14 years, with 346 bankruptcy filings in the US YTD, the most since 2010. In some of my earlier posts, I had written extensively about how the high interest rate environment has been a boon to larger companies, while weaker ones, especially those that are rated “junk,” had the shortest-ever maturity on their debt on average, which would mean that they faced more frequent refinancing at higher rates.

Now, with 44% of small-caps that are unprofitable and volatility (VIX) spiking over 200% to its peak at 65 (although it closed at 38 on August 5), we should see a spike in credit spreads, which could turn into an accelerating number of bankruptcies for the remainder of the year.

The truth is the US economy is indeed weakening

There’s no way to sugarcoat this.

So here I go.

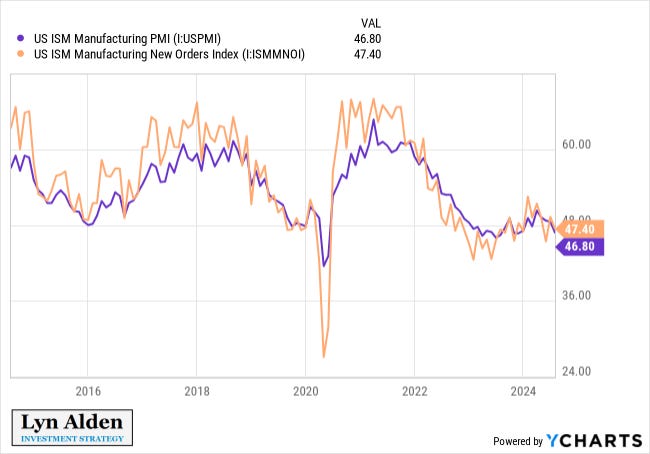

The PMI results came out last week, and they were bad across the board and below consensus estimates. But most importantly, it was the employment component in the ISM Manufacturing Report that caught my attention the most. If we leave out the GFC (2008 Financial Crisis) and the pandemic, this is the weakest the series has been in over 20 years.

And then came the labor market, and that did not make things any better. US job openings declined to 8.18M in June, down from 8.23M in May, near their lowest level since 2021. On a year-over-year basis, job openings fell 10.3%, marking the 23rd consecutive monthly decrease and the longest streak since GFC. The ratio of vacancies per unemployed worker that had once climbed to 2.0 at its peak in 2022 is now down to 1.20, the lowest since 2021.

Simultaneously, I would also like to share some of the commentary from the latest earnings report across companies, that validate that the once “unbreakable” US consumer may finally be faltering.

With Amazon AMZN 0.00%↑ missing its sales estimates in its quarterly report, Amazon CFO Brian Olsavsky said that shoppers were “cautious” and “looking for deals,” trading down to lower-priced items whenever possible. This helped boost Amazon’s lower-priced Everyday Essentials category, which includes non-perishable foods, health and personal care items. But those lower-priced items weighed on sales.

Meanwhile, Wayfair W 0.00%↑ CEO compared the drop in spending on home goods to the GFC. “Customers remain cautious in their spending on the home and our credit card data suggests that the category was down by nearly 25% from the peak we saw in the fourth quarter of 2021. This mirrors the magnitude of the peak to trough correction of the home furnishing space experienced during the great financial crisis.”

Here's what Chris Kempczinski, CEO of McDonald's MCD 0.00%↑ said from its latest call: “Beginning last year, we warned of a more discriminating consumer, particularly among lower-income households. And as this year progressed, those pressures have deepened and broadened. You're seeing that the consumer is eating at home more often, you're seeing more deal seeking from the consumer, and you're just seeing, I think, a trade down even within either units per transaction or within mix, all of those things for us are indicators that the consumer across a number of these markets is being very discriminating.”

Similarly, Visa’s V 0.00%↑ management also outlined the following, “In the U.S., while growth in the high spend consumer segment remained stable compared to prior quarters, we saw a slight moderation in the lower spend consumer segment.”

These are just a few examples, and there are many more.

What I am trying to say is that two years ago, the Fed vowed to bring down inflation without a large rise in unemployment. During this period of time, it undertook one of the harshest tightening cycles, and by the Fed's dual mandate standards, it has been able to cool the economy just enough.

So, now that the Fed has gotten what it wanted, what comes next? Will it be able to thread the needle between an economic slowdown and a recession?

But before we move on, we need to digress just a tiny bit to address the elephant 🐘 in the room. That is the “Yen carry trade," which has exacerbated the panic on Wall Street at the moment, and unfortunately, this has made the Fed’s job slightly more complicated once again.

***Enjoying the content so far? If yes, please consider supporting our work by buying us a coffee ☕ and a muffin 🧁 for $8/month or $80 annually and unlock 30 minutes of zoom call time to discuss a range of topics surrounding macroeconomics, technology and investing. Also, your support goes a long way to help us keep up the quality of our work and continue to delight you all.***

Why is everyone suddenly talking about the “Yen carry trade”?

Over the last three days, the S&P 500 has shed 6.8% in value. While weak economic data has certainly played a part, the bigger force at play is hedge funds unwinding the “yen carry trade” after the BOJ (Bank of Japan) raised its short term interest rates to 0.25%. What do I mean by that?

Here’s a brief explanation of how a currency “carry trade” works, and in this case, I take the example of the JPY/USD pair to demonstrate it:

Traders and hedge funds were borrowing Japanese yen (JPY) at low interest rates, converting them to USD, and using the proceeds to buy US stocks.

Now that the BOJ is raising interest rates, the JPY has strengthened significantly against the USD.

This puts traders in big 💩. Not only must they pay higher interest for the JPY they borrowed, but, they are now facing huge forex losses as well. The USD assets they are holding may not be enough to repay the JPY they have borrowed.

This is causing a huge unwind in these trade positions. Traders facing big losses and margin calls are selling their US stocks to raise USD, converting back to JPY, and paying back their loans.

The irony in all of this is that as hedge funds and traders are looking to settle their mismatched balance sheets by selling USD to raise JPY, it will cause a further surge in JPY (higher demand for the currency). Meanwhile, the selling pressure on US stocks can continue in the short term.

On that note, here’s an excellent video that I highly recommend you watch if you want a deeper understanding of this mechanism and to clear up your concepts on this matter. For those who are seasoned investors, traders, or market experts, you can skip it.

Is the Fed too late again?

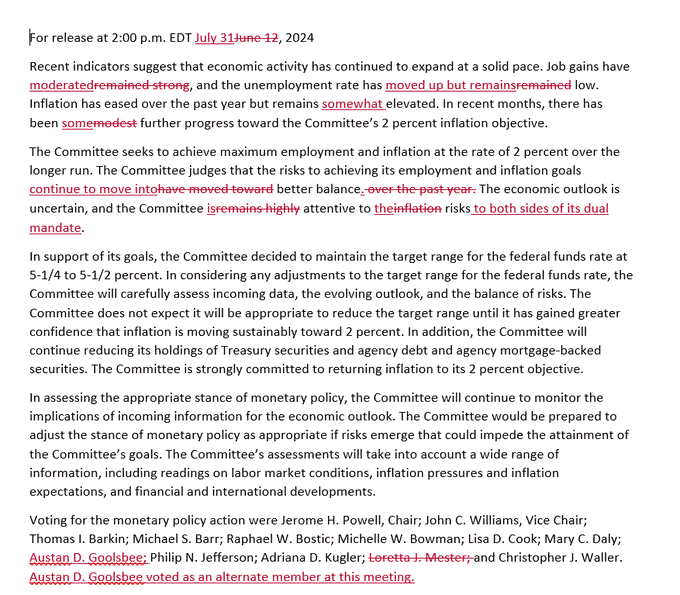

In its latest FOMC meeting, the Fed did not provide any explicit signal of a September rate cut, but there were meaningful changes made to the statement, as you can see below. Also note that the meeting took place before the latest round of PMI and labor reports came out.

Since then, there has been a dramatic shift in the target fed funds probabilities for the upcoming FOMC meetings, with the bond market pricing 5+ cuts over the next 3 meetings. In fact, there is a 60% chance of an emergency interest rate cut within one week.

Plus, after a prolonged inversion, the yield curve (2-10Y Treasury) is also finally reversing, which is also known as “bull steepening” (which I had written about here). The premise is that while a yield curve inversion is a “warning sign," the “un-inversion” usually marks that the Fed has done enough damage and that we will be forced to cut as the recession approaches. In this case, the short end of the yield curve tends to fall faster than the long end.

This morning

wrote this post, where he highlighted that a typical recession playbook follows a series of 6 steps, which are as follows:➡️ Step 1: The Central Bank raises rates aggressively

➡️ Step 2: Markets signal conditions are too tight: the yield curve inverts

➡️ Step 3: The curve stays inverted for 12-27 months

➡️ Step 4: The economy slows

➡️ Step 5: A late-cycle yield curve steepening happens

➡️ Step 6: Finally, a recession occurs

According to him, markets are pricing us close to step 6. Yet data shows we are still at step 4-5. I agree with him on this. The truth is that the sudden dramatic move in rate-cut pricing is partially driven by fundamentals but exacerbated by lot by panic.

Meanwhile, market experts have also been clamoring for the Fed to start cutting soon. This is what Claudia Sahm, the inventor of the Sahm Rule said on CNBC after the Fed concluded its meeting, urging the Fed to start cutting rates.

“What is it they’re looking for? The bar is getting set pretty high and that really doesn’t make a lot of sense. The Fed needs to start that process back gradually to normal, which means gradually reducing interest rates.”

“We don’t need a weak economy to get that last little bit out of inflation,” she said. “We do not have to be afraid of a good economy. If the inflation job is done, or we’re on that glide path, it’s OK, the Fed can start stepping aside.”

She is not alone. Even Jeffrey Gundlach, CEO of DoubleLine, thinks that the Fed is risking a recession by holding a hard line on rates. In fact, he thinks the consumer price index will be below 3% soon and that the Fed could end up slashing rates by 1.5 percentage points over the next year, a pace that’s more aggressive than the policymakers charted when they last updated the “dot plot” of individual projections.

“That’s exactly what I think because I’ve been at this game for over 40 years, and it seems to happen every single time. All the other underlying aspects of employment data are not improving. They’re deteriorating. And so once it starts to get to that upper level, where they have to start cutting rates, it is going to be more than they think.”

“If you have a positive real interest rate that’s even one and a half percent, that would suggest you have 150 basis points of room to cut rates without even thinking that you’re being excessive about it,” he said. “I think they should have cut today, quite frankly.”

This morning, Jeremy Siegel of Wharton University called on the Fed to make an emergency 75 basis point cut in the short-term Fed funds rate. Plus, he thinks that an emergency cut will not send the markets into a downward spiral. Here’s an excerpt of what he said on CNBC this morning.

“The fed funds rate right now should be somewhere between 3.5% and 4%. If they are going to be as slow on the way down as they were on the way up, which by the way was the first policy error in 50 years, then we’re not in for a good time with this economy.”

However, here is the tricky bit.

Won’t a Fed cut actually aggravate the problem created by the unwinding of the yen carry trade? 🤔

Precisely. See, like Alf said earlier, I think we are in the stage where we are seeing a weakening of the US economy. Not a recession.

So, while there is no mathematical way (that I know of) for me to deduce how much of the current pricing in rate cuts is driven by panic rather than fundamentals, there is no doubt that the recent events have put the Fed in a tough spot once again.

Does it cut rates to stimulate a weakening economy but exacerbate the yen trade by causing a massive selloff in stocks? (That sounds like a self-fulfilling prophecy to recession)

Or,

Does it hold its ground at the moment, allow the currency markets to sort themselves out, and then make a slightly more informed decision on how much to cut rates by? (By then, some of the panic will have likely abated too.)

There is a difference between a slowdown and a recession

With the Sahm Rule triggered and the yield curve on the verge of “de-inverting”, it is important to note that we are not in a recession yet.

Here are some data points for you. 👇🏼

Households are still sitting on record cash of close to $18T, up from $13T pre-Covid. Plus, household debt as a share of household net worth is hovering around lows not seen since the mid-1970s. The 2020 fiscal bazooka has probably played a huge role in this.

has written an awesome post on this topic, which you can check out, but here’s an excerpt from the post that I think is particularly important.

“The Global Financial Crisis is now finally fully digested. A new private sector debt cycle can start when policymakers and households choose to. I am not saying they will do so imminently. But they have the option to launch that anytime. There is great upside in this.”

Meanwhile, Layoffs remain depressed, and hiring remains firm. Employers laid off 1.5 million people in June. While challenging for all those affected, this figure represents just 0.9% of total employment and remains below pre-pandemic levels.

Furthermore, Hurricane Beryl has likely impacted July’s job report to a certain extent. Take a look at the initial claims for unemployment insurance in Texas.

Look, I am not saying that we are unlikely to have a recession. What I am saying is that what we are currently experiencing is a slowdown. In fact, Claudia Sahm herself pushed back against the plethora of doomsday narratives that gained traction after its triggering on Friday.

“I am not concerned that, at this moment, we are in a recession,” she told Fortune, adding that “no one should be in panic mode today, though it appears some might be.” This time really could be different. The Sahm Rule may not tell us what it’s told us in the past, because of these swings from labor shortages, with people dropping out of the labor force, to now having immigrants coming lately.”

While saying now is not the time to panic, Sahm also emphasized that recent trends in the labor market have looked weak, at best, and the triggering of her namesake rule is certainly cause for concern about what may lie ahead. After all, the Sahm Rule’s accuracy rate is 100%, going back to every recession since the early 1970s.

But will rate cuts even matter?

On Monday, Chicago Fed President Goolsbee said that if economic conditions start deteriorating, the Fed will “fix it”.

I have no doubt about it.

If economic conditions indeed worsen from current levels, the Fed will fire away with everything they got. They are indeed the masters of quantitative easing, except I am not too sure whether the market will respond in the way that it did back in 2020 when the Fed “printed” (technically, they create reserves) trillions in stimulus payments.

See, up until now, we have defied a recession due to the flood of monetary stimulus from the Inflation Reduction Act and the CHIPS ACT along with a surge in deficit spending, which supported economic growth. However, that expenditure surge has peaked and turned lower, but is currently not at recessionary levels by any means. Furthermore, domestic liquidity conditions have continued to trend sideways, with monetary supply M2 as a percentage of GDP remaining elevated, preventing economic activity from declining faster.

However, from here onwards, we would need to see a stabilization and improvement in unemployment if we have to dodge the recession bullet. That is because the US is a consumption based economy and technically consumers cannot consume without producing something first. Production must come first to generate the income needed for that consumption. It is the 101 economic flywheel that is the basis of any functional society in the world.

In that sense, interest rate cuts are designed to stimulate economic activity, as it will reduce the cost of borrowing, allowing businesses (outside of Magnificent 7) to start investing and creating new jobs, thus reinforcing the economic flywheel. So far, Powell’s tightening cycle has crushed cyclical and capital-intensive industries, while capital-light industries have been booming from enormous fiscal savings injections that are being amplified by rate hikes. Autos and Real Estate are some of the most prominent examples of industries that are at cyclical lows and should react strongly to rate cuts.

On the other hand, Lyn Alden believes that the US would be rather desensitized to falling interest rates this time and her rationale is if there is so much locked-in fixed rate debt (low rate mortgages for households, fixed long-term debt for large corporations), rate cuts will not matter unless mortgage rates reach a lower-low this cycle and her base case is “no”.

“Whenever mortgage rates drop to new lower-lows, homeowners have a big incentive to refinance their mortgage rates. Paying off a previous 6% mortgage with a new 4.5% mortgage can free up a lot of disposable income each month, and without increasing a homeowner’s overall debt load. And then, years later, paying off that 4.5% mortgage with a newer 3% mortgage can free up a lot of disposable income each month again. It’s basically a free lunch.”

“With the ongoing fiscal dominance condition of deficits equaling 6-7% of GDP or more, along with various trade tensions/tariffs, ongoing wars, and higher average oil prices, I think it’s unlikely that mortgage rates will reach a lower-low in this cycle. It’s not impossible that they could, but it’s not my base case. If we do not get a lower low in mortgage rates in this cycle, then there likely won’t be many mortgages on the market worth refinancing. The rather small number of people who took out high-rate mortgages in 2023 and 2024 would be able to refinance theirs, but that’s about it.”

This is a debate for a later post, especially when it comes to the whole US housing gridlock and how that may unravel in the coming months and years.

In my next post (next week), I plan to write on whether the wreckage in Magnificent 7 presents us a long-term buying opportunity. So, stay tuned for that.

I agree, how many times in the past 3 years has some “recession indicator” been triggered? Sure, this time may be different (eventually one indicator will proceed a recession, after all.)

If anyone could predict recessions with any accuracy, they would 1) Be unfathomably rich and 2) They wouldn’t tell you.

The biggest problem, in my opinion, is the debt levels. Few seem to be paying attention as the interest payments on US debt are growing into one of the largest line items of the budget, with no end game in sight. No solutions, not even any real proposals for how to deal with it.

Back with a vengeance and better than ever, as if that's possible. Excellent subject coverage and perfect sentence structure designed to convey meaty topics in easily consumable bite-size morsels of knowledge. Forever a fan!!