Monday Macro: 5 stories that will shape the US economy & the stock market in 2024

Is the worst of inflation behind us? Will labor market cool from current levels? Will corporate earnings meet expectations? When will the Fed pivot? How will elections affect S&P 500 returns?

Welcome back to The Pragmatic Optimist.

First of all, I would like to wish all my readers a prosperous 2024. I hope you all had a wonderful holiday season with your loved ones and I wish you all health, happiness and fulfillment in 2024. ✨✨✨

««Monday Macro- The 2-minute version»»

These are the 5 stories that will shape the US economy and the stock market in 2024.

Inflation: Are we deflating or disinflating?

While we have made substantial progress on normalizing inflation from 5.5% in 2022 to 3.2% in November 2023, there is uncertainty as to how big of an impact, holiday spending would have on inflation, as overall sales rose by 3.1% as per Mastercard data.

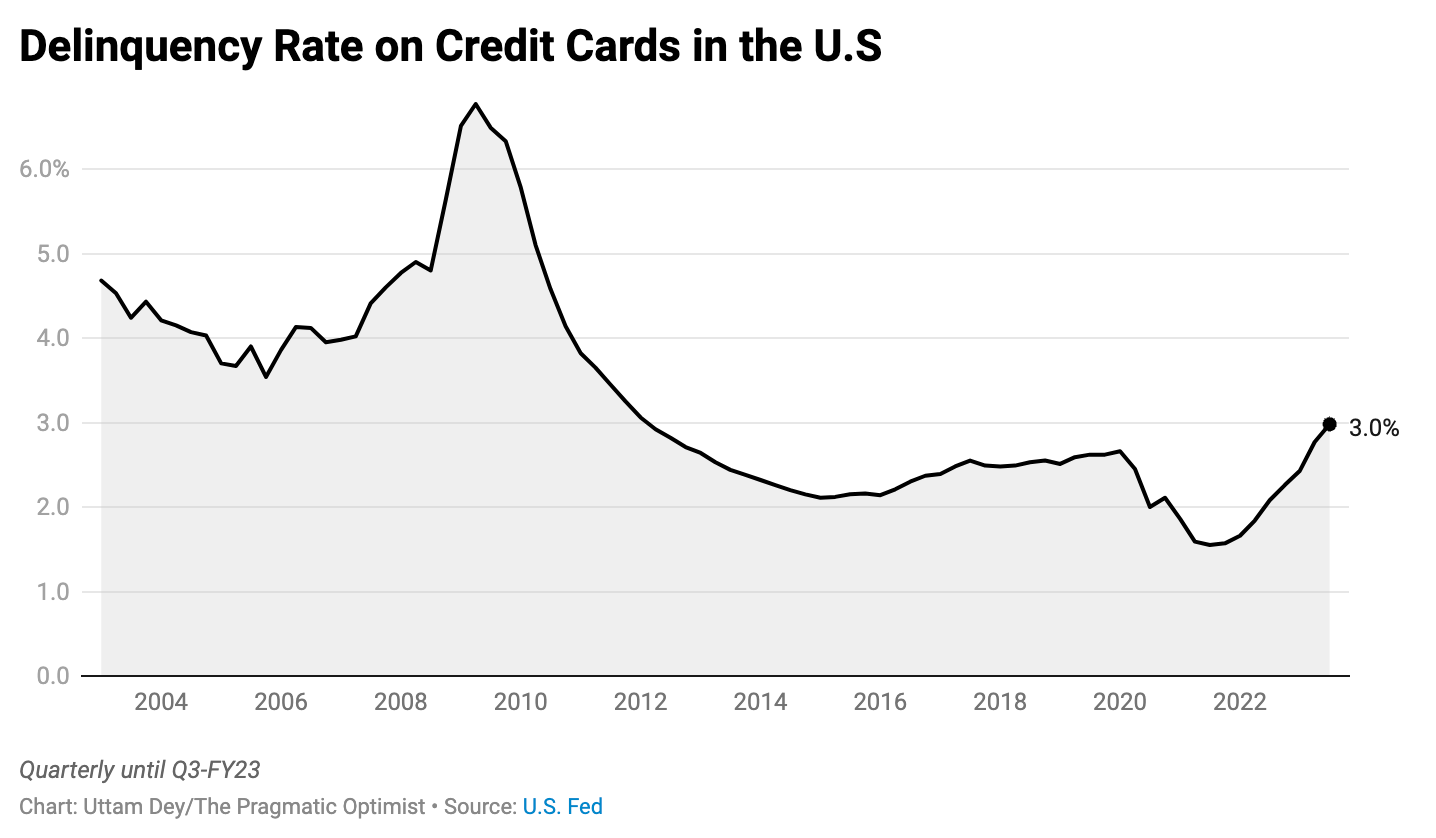

Meanwhile, consumer credit balance has reached an all time high, with delinquencies slowly picking up.

Labor Market: While Average hours worked continued to slow, however, Average hourly earnings remain stubbornly high.

Monetary Policy: To pivot or not to pivot?

While the Fed has indicated that it plans to cut rates 3 times in 2024 to bring its interest rates to 4.6%, the latest FOMC meeting notes did not provide any clarity as to when the rate cuts would commence.

Meanwhile, the labor market report on strong wage growth puts a damper on the Fed’s policy path, as they would remain cautious as to not react too soon.

Corporate earnings: All set to grow 10% YoY?

S&P 500 companies are expected to produce earnings growth rate of 10% in FY24. This is higher than the 8.4% average growth rate in earnings based on 10-year history.

While corporate margins have been steady and growing, thanks to companies who have streamlined operations, passed on higher costs to consumers, we have to monitor the level of stress developing in the credit market, especially for smaller and mid-size businesses as their interest payments on debt have ballooned.

S&P 500 and elections: Is it wise to go long based on its average returns during an election year?

As per Bank of America, average monthly returns for the S&P 500 during the Presidential cycle Year 4 show a lackluster January through May, a June through August summer rally, a September through October pre-election dip and a November through December post-election relief rally, with an average return of 7.5%.

Based on my analysis, while it is possible for the S&P 500 to reach new all-time highs on the back of soft-landing expectations, I believe we are in for “The Grind” where inflation continues to moderate but remains above 2.2-2.5% while earnings come in below expectation.

Before we get started on our first Monday Macro of 2024, I wanted to do 2 quick things:

I want to go down the memory lane to highlight some of the key moments from the Pragmatic Optimist in 2023, and

What all I have planned for The Pragmatic Optimist in 2024, and what you can expect as a reader moving forward.

Here it goes 🥁🥁🥁

➡️My 2023 StackUp- a recap of key moments from The Pragmatic Optimist in the year that went by

I wish Substack would do something similar to what Spotify does at the end of the year with its Spotify Unwrapped, where it highlights your key moments on the app during the year. But since it doesn’t have that funky feature (yet), here’s my attempt at my 2023 Substack StackUp (and yes, I just coined that term).

🎬September 6th: Created my substack account and sent my first post out.

💯 September 30th: Got up to 100 subscribers, and it felt like a momentous achievement.

⭐November 11th: Substack featured my newsletter, thanks to

, and . The post that got me the feature was this one below:📈November 12th: Reached 1000 subscribers. Might have done a few cartwheels to celebrate the moment.

🌱November 18th: Wrote this note out on how I grew my 1000 subscribers without any other social media following. To my surprise, my note received more love than I could have ever imagined.

🕥 During this period of time, I had a ton of fun, writing my Monday Macros where I talked about The Fed (and how it creates and destroys money), The US Labor Market & Consumer spending , US government debt, the state of the US housing market & my 2024 outlook for the US economy and the stock market.

🤝🏻 I also collaborated with

for my Thursday Deep Dives, covering a bunch of topics from online shopping, dating apps and more. The best performing post (engagement wise) was the one we wrote on how Google was losing market share with Chrome.🎯Needless to say, Friday5’s have always been a hit amongst all, thank you.

🥳December 20th: The Pragmatic Optimist reached 2000 subscribers.

Well…it’s been quite a ride 🎢.

But, this entire journey would not have been possible without your constant support and engagement on my posts. So, I am truly grateful to you all and for all the lovely conversations we have had on our posts and on Notes. 🙏🏼

So, looking ahead…

➡️My plan for 2024 and what you can expect:

The vision (or mission?) of The Pragmatic Optimist is to connect the dots in macroeconomics, investing and technological trends to help us all a) better understand the “big picture” and build perspectives with clarity, b) identify great businesses and c) improve our overall financial and mental well being in the process.

Until now, I have been writing The Pragmatic Optimist 3x a week under the following themes:

(Please note: the frequency of posts may change in the future, but I would notify you in advance).

Monday Macro: In 2024, I will continue to write my top-down macroeconomic analysis on the US economy. In addition, I will also add Emerging Markets as a sub-topic within Monday Macro starting next month.

Thursday Deep Dives: Provide ongoing research and commentary on trends in technology and culture and how it affects the broader society. In addition, I will add a stock report once a month that provides in-depth analysis of some of the companies that I hold and/or watching.

Friday5: Goes on as usual (for now).

2024 is also going to be the year where I am taking the plunge to developing The Pragmatic Optimist as a full-time job (call me crazy). Therefore, while I will be writing, I will also expand on other platforms as I aim to produce more short form video (and written content), so it is accessible to more people. I have also recently started contributing to Seeking Alpha and GuruFocus.

I intend to build The Pragmatic Optimist in public, so as I am figuring it out, I will also be sharing my learnings along the way. To all my readers, who have walked on this path before, I would love to hear your thoughts and any ideas you may have for me.

In the meantime, if you choose to support my work by buying me a coffee and a muffin, I would be immensely grateful. If you choose to pass, no worries at all. I intend to keep my content free for all and I will always value your support and engagement.

Now, on to the first Monday Macro of 2024!! 👇👇

1. Inflation- Are we deflating or disinflating?

As of the latest inflation print, Core PCE grew 0.1% in November from the previous month. On a YOY basis, Core inflation is still up 3.2%. But, since the Fed started hiking rates, core inflation has indeed dropped from its peak of 5.5% in March 2022 to 3.2% in November 2023. The Fed expects core inflation to moderate further in 2024 to 2.4%.

Meanwhile, if we look at the overall PCE index, including food and energy prices, it declined (0.1%) in November, which is the first decline since April 2020. Over the last 6 months, overall PCE (including food and energy) measured 1.9% on an annual basis, below the Fed’s 2024 target of 2.4%.

❓Given the progress thus far, one might ask: Is the war on inflation finally over?

Well, the state of consumer spending holds some clues to answering the above question. Consumer expenditures for November rose 0.2% from the month prior, while personal income increased 0.4%. Americans are increasingly willing to dish out money on services, which increased by 0.2%.

Meanwhile, 2023 was a record-breaking holiday season for e-commerce, as per Adobe, as price-sensitive consumers flocked to online stores in search of the best deals of the season.

Online spending rose 4.9% on a YoY basis to $222.1B from Nov. 1 to Dec. 31 this year, according to the latest data from Adobe Analytics.

At the same time, Mastercard released its own preliminary data, which found that overall holiday sales, which include both online and bricks-and-mortar sales, rose by 3.1% compared with the previous year. Online sales gained 6.3%, Mastercard said, while spending in stores increased by 2.2%.

“This holiday season, the consumer showed up, spending in a deliberate manner. The economic backdrop remains favorable with healthy job creation and easing inflation pressures, empowering consumers to seek the goods and experiences they value most,” said Michelle Meyer, chief economist, Mastercard Economics Institute.

Here is a quick breakdown of spending by category this holiday season as per Mastercard’s Spending Pulse data:

All of this is finally making Americans see that the economy is doing well, as the University of Michigan Index of Consumer Sentiment increased 13.7% MoM in December and 16.6% over the last 12 months, driven by a surge in expected business conditions. This spike brought consumer confidence levels back to July levels, though sentiment is still well below pre-pandemic levels. The report noted that sentiment improved across age, education, geography, income, and political identification.

While this could be an indication that the so-called “vibecession” (which refers to the disconnect between how the economy is doing and how people think the economy is doing) might be shrinking, there are 3 areas that I want to bring your attention to:

Credit card balances in the US increased by about 4.7% to $48B in Q3, pushing the total to $1.08T. One specific area of concern is the increasing popularity of “buy now, pay later” services, which typically allow consumers to pay for purchases in four installments, often with no fee unless a payment is missed. The debt is not reported to credit bureaus, meaning no one knows for sure how much is out there. Meanwhile, the delinquency on credit card debt is above pre-pandemic levels at 2.98% in Q3, as interest payments relative to personal disposable income have been on the rise.

Consumers have also drained a significant portion of their savings. As per the San Francisco Fed, there is still approximately $430B in excess savings that remain in the aggregate economy as of November 2023, after consumers have drawn out $1.7T out of $2.1T in excess savings accumulated during the pandemic. Should the recent pace of drawdowns persist, we should expect aggregate excess savings to be depleted by the first half of 2024.

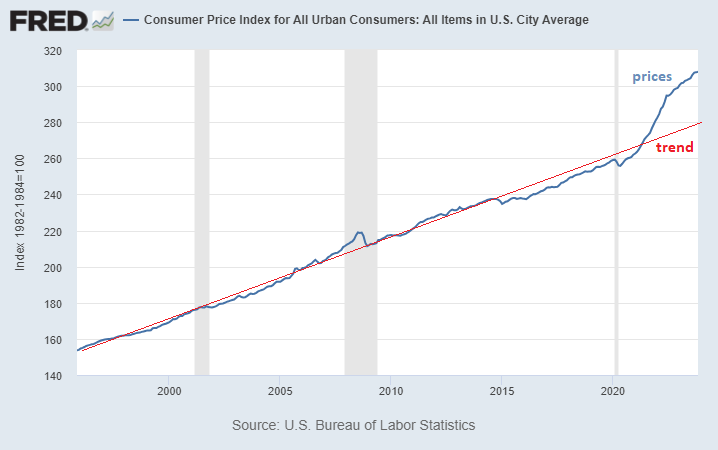

Finally, while inflation has indeed come down from its peak, prices in aggregate are structurally higher than the pre-stimulus trend. Unless inflation runs well below the Fed's target for a while, prices won't be returning to the prior trend. Digging one level deeper, the official CPI is up 19% since the start of 2020, whereas if it had grown within the target range of 2.2% over the last 4 years, then it would have been more like 8%. So, prices in aggregate rose more than 2x as quickly as they were targeted to do over this past four-year period.

Tying all the signals together, while inflation looks like it is on its way down, we know that inflation is well above the pre-Covid trend. At the same time, I would be curious to see the effect of holiday spending on overall inflation in the coming weeks. At the same time, I will be monitoring the overall health of the consumer as they take on an incrementally higher amount of debt while depleting their savings, in an environment where the labor market is expected to weaken from its current levels.

So, for now, are we deflating? Not yet. Are we disinflating? So far, yes. Is it possible, we reflate from here? An earlier Fed pivot can make that a possibility.

2. Labor market- While Average hours worked slows, average hourly earnings remain stubbornly high.

Last week, we saw that Job Openings nudged lower to 8.8M, about in line with the Dow Jones estimate and the lowest since March 2021. The ratio of job openings to available workers fell to 1.4, still elevated but down sharply from the 2 to 1 level that had been prevalent in 2022.

“Today’s JOLTS data is another signal that the Fed is delivering a soft landing. Today’s report is good news for American workers and the economy, but it also suggests to me that the Fed is unlikely to cut rates as aggressively in 2024, as markets currently indicate, given the risk of reigniting inflationary pressures,” said Ron temple, chief market strategist at Lazard.

Meanwhile, December’s jobs report showed employers added 216,000 positions for the month, while the unemployment rate held at 3.7%. Economists surveyed by Dow Jones had been looking for payrolls to increase by 170,000 and the unemployment rate to nudge higher to 3.8%. The report showed that inflationary pressures, despite receding elsewhere, are still prevalent in the labor market. Average hourly earnings rose 0.4% MoM and were up 4.1% on a YoY basis, both higher than the respective estimates of 0.3% and 3.9%, respectively. The average workweek edged lower to 34.3 hours.

“Today’s report speaks to the bumpy road ahead for the Fed’s journey back to 2% inflation. The decision of when to first cut policy rates remains one for the second half of the year in our view,” said Andrew Patterson, senior international economist at Vanguard.

“Jobs growth remains as resilient as ever, validating growing skepticism that the economy will be ready for policy rate cuts as early as March. Indeed, the recent run of labor market data generally points in one direction: strength,” said Seema Shah, chief global strategist at Principal Asset Management.

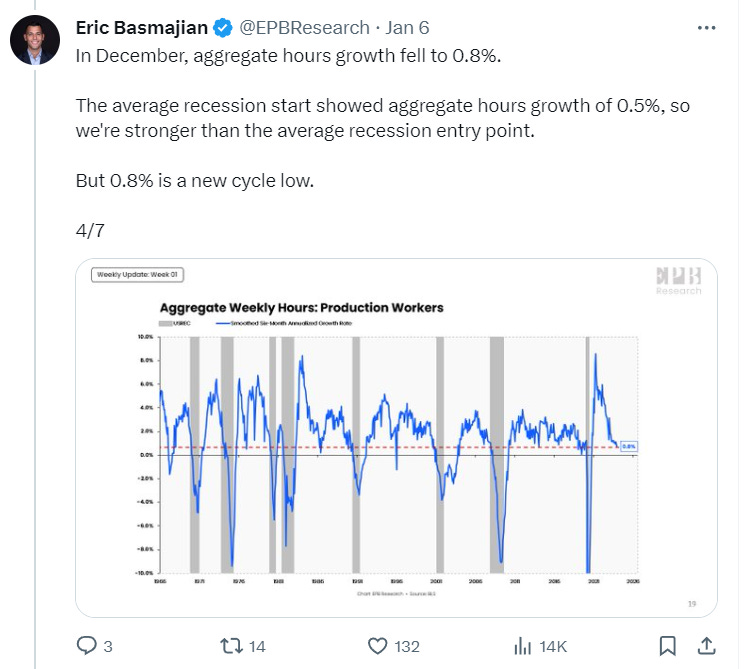

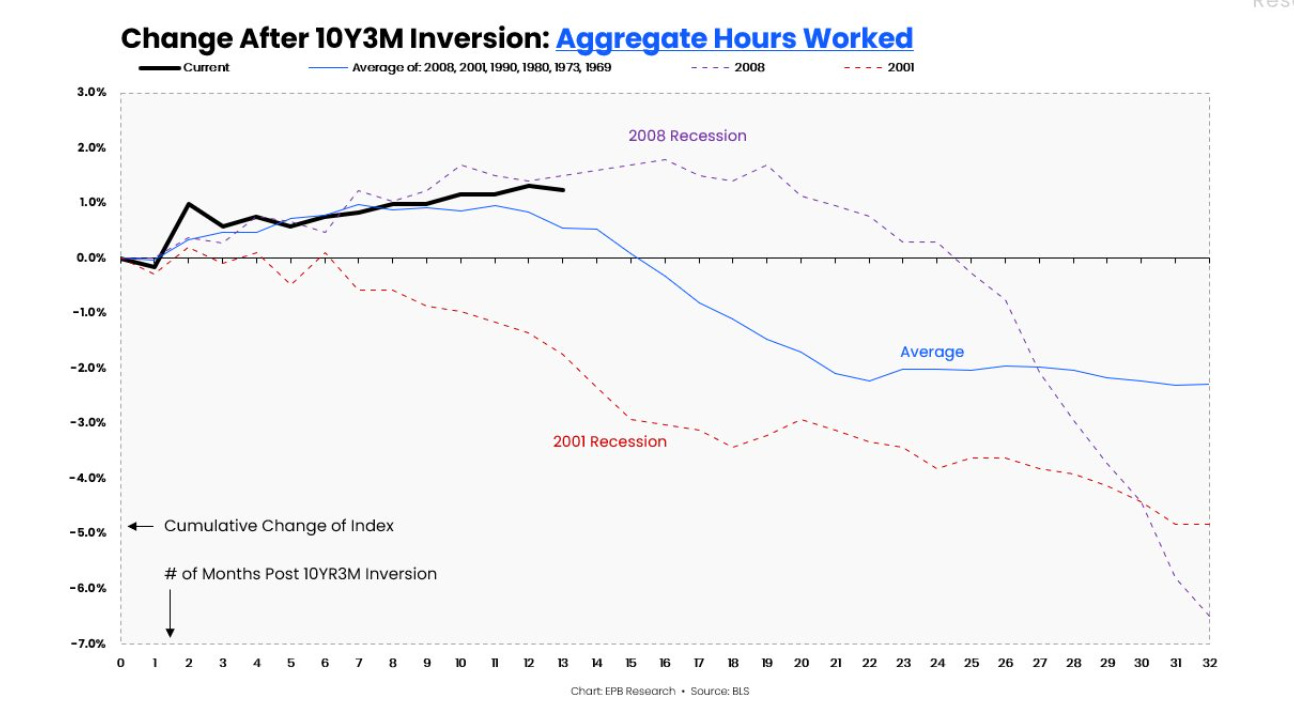

At the same time, Eric Basmajian had an insightful tweet in which he looked at the relationship between work hours and the possible start of a recession. In December, aggregate hours worked grew by 0.8%, which is trending lower. His research indicates that the average recession start showed aggregate hours growth of 0.5%, so that would mean that the US economy is still strong and away from the average recession entry point.

Another way to look at it would be how aggregate earnings have performed since the inversion of the 10Y3M yield curve. As per Eric’s research, compared to the average of all inversions, the longest lead time cycle was in 2008, and the shortest lead time cycle was in 2001.

Moving forward, the Fed has outlined that it expects the Unemployment rate in 2024 to inch up to 4.1%, which would mean that the labor market would have to weaken from current levels.

On one hand, while higher unemployment would mean that the Fed would pivot faster, which would ideally ignite the next phase of economic expansion, it is also possible that higher unemployment may tip the US economy into a recession as consumer health would exponentially deteriorate, leading to a sizable deleveraging. On the other hand, if the labor market stays at current levels without further softening, the Fed would not want to cut rates, as it may stoke another inflation burst, which is probably the Fed’s worst nightmare at this point.

3. Monetary policy: To pivot or not to pivot?

The Federal Reserve had outlined their projections for the US economy as follows, as per their December meeting:

In the Fed’s projections above, you can see that the Fed expects the economy to continue to grow modestly at 1.4%, slower than current levels. This will be accompanied by a slowdown in inflation to 2.4% as well as an uptick in unemployment levels to 4.1%. The Fed will orchestrate the above by cutting its interest rate three times, by 25 bp each, to 4.6% by the end of 2024.

However, as per the latest FOMC meetings released last week, there is a high level of uncertainty over when the rate cuts will actually take place.

“Participants generally stressed the importance of maintaining a careful and data-dependent approach to making monetary policy decisions and reaffirmed that it would be appropriate for policy to remain at a restrictive stance for some time until inflation was clearly moving down sustainably toward the Committee’s objective,” the minutes stated.

Meanwhile, as per the latest reading on the CME Fedwatch tool, which analyzes the probability of changes to the Fed rate and US monetary policy, as implied by the 30-day Fed funds futures pricing data, there is a 62.7% probability of a rate cut in March. By May 2024, the probability of at least one cut goes up to 91%.

However, contrary to the Fed’s guidance, the Fed Funds futures are pricing in over an 82% probability that the interest rate will be between 4 and 4.25 percent by 2024, which would require the Fed to cut rates 5 times instead of their projected 3 times.

4. Corporate earnings: Set to grow 10% YoY.

For FY23, S&P 500 companies are expected to report YoY growth in earnings of 0.8% and YoY growth in revenues of 2.3%. Meanwhile, analysts on Factset are projecting earnings growth of 11.8% and revenue growth of 5.5% for FY24. The average earnings growth rate over a 10-year period for the S&P 500 is 8.4%.

Meanwhile,

had laid out this chart below that outlines how corporate margins managed to stay resilient through 2023, despite many analysts who were convinced that rising rates and inflation would crush profit margins. During this period of time, we saw that most companies were able to successfully pass on the costs to the consumer while improving operating efficiencies. Moving forward, Wall Street believes corporate profits may continue to remain steady, which could help amplify earnings growth even if overall revenue grows at a slower rate.It is interesting to note how software companies, who were primarily focused on growing as quickly as possible in the last decade, shifted their focus to profitability and operating margin soon after the Fed started its hiking cycle in 2022. In fact, software executives and Wall Street analysts talked about profit more than twice as often in 2023 as they did in 2019, according to an analysis of transcripts of earnings calls, corporate events, and other presentations compiled by Bloomberg. By comparison, references to “growth” and “revenue” grew less than half as quickly across that period.

In fact, many companies that are high-quality borrowers locked in low interest rates around the pandemic, with bonds maturing further in the future. These companies were the winners at higher rates, as they saw their net interest payments decline, thus boosting their net profit margins.

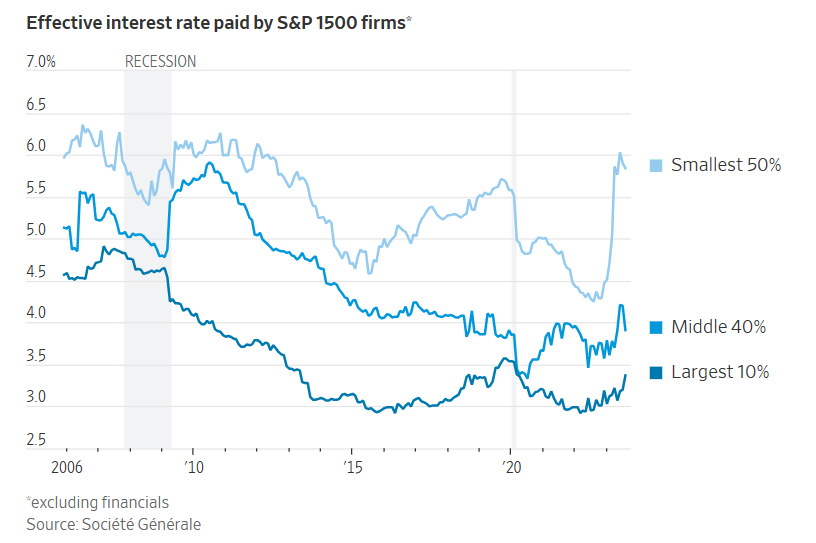

Moving forward, we have to be careful, as weaker companies that were unable to lock in low rates for very long or that chose to borrow using floating-rate bank loans may face real stress, if not distress, if interest rates continue to remain at current levels for a long time. Plus, if you look at the chart below, you can see that the rate paid by the smallest half of companies in the S&P 1500 index has risen to the highest in more than a decade, while those in the middle are roughly back at pre-pandemic levels.

5. S&P 500- Is it wise to go long based on its average returns during an election year?

2024 represents a crucial year for the stock market as the fourth year of the current presidential cycle gets underway. The fourth year of a presidential term is the second-strongest year for the stock market, with the S&P 500 historically posting solid median and average returns of 10.7% and 7.5%, respectively, according to data going back to 1928. Only the third year of a presidential term is stronger.

One idea behind the solid performance during the fourth year of the presidential cycle is that the incumbent president will try to give the economy one last boost via fiscal spending to increase their chances of getting re-elected.

While the stock market has historically delivered solid returns and a win ratio of 75% during the fourth year of a presidential cycle, the gains are rather choppy and don't happen until the second half of the year.

"Average monthly returns for the S&P 500 during Presidential Cycle Year 4 show a lackluster January through May, a June through August summer rally, a September through October pre-election dip and a November through December post-election relief rally," said Stephen Suttmeier, technical strategist of Bank of America.

The strongest month of the year tends to be August, delivering an average gain of just over 3% with a win ratio of 71%. Meanwhile, December is typically the month with the highest chance of gains, with a win ratio of 83% as uncertainty around the Presidential election subsides. Finally, May tends to be the weakest month of the year, with an average decline of 1.1%.

Tying this all together, I had laid out my S&P 500 target based on the possible economic scenarios that may play out in 2024. While I believe that the US stock market could reach new all-time highs based on the assumption that the US will engineer a soft landing, I believe that the longer-term picture for the US stock market puts us in “The Grind” for now, where I expect the overall economy to continue to slow under the current monetary policy regime, marked by weaker, more vulnerable households and corporations.

In this case, an earnings downside of any magnitude will cause a spike in the equity risk premium. As a result, I expect to see continued volatility in 2024. While I am not optimistic that we are heading into the Productivity Acceleration scenario next, I don’t believe we are headed into a severe recession either. Plus, I think inflation will further normalize from current levels. Given my set of beliefs and assumptions, I think we are in for “The Grind,” which is marked by slowing inflation and weaker than expected earnings growth. This will put the S&P 500 in a range of 4300–4500 until we get further clarity on the direction of inflation, the labor market, corporate earnings, and how that will impact monetary policy.

That’s all for today. Would love to hear your thoughts on the following:

Will holiday splurge create an uptick in inflation? Will that freak out the bond market and the Fed?

Is unemployment heading higher or lower from here?

Is the Fed Funds futures too optimistic on the number of rate cuts? Or just right?

Do you think the S&P 500 will perform at par with an election year average?

Loved reading the bit about your journey since starting the publication.

I am a big fan of your approach of connecting the dots across Macro, Investing and Tech. All made easy.

No wonder you saw such incredible growth in subscribers!

Good luck in going full time! I have tried many times to expand into short video format. I find it a difficult transition. What is your intended platform for this?